Conservation Easement Land In Trust

Description

How to fill out Conservation Easement Land In Trust?

How to locate professional legal documents that adhere to your state's regulations and draft the Conservation Easement Land In Trust without consulting an attorney? Numerous online services provide templates to address various legal situations and formalities. However, it may require some time to identify which of the accessible samples meet both your usage scenario and legal requirements.

US Legal Forms is a reliable platform that assists you in finding official documents drafted according to the latest updates in state law and helps you save on legal costs.

US Legal Forms is not merely a typical web directory. It comprises over 85,000 verified templates for an array of business and personal situations. All documents are classified by region and state to streamline your search process.

Visit our platform and create legal documents independently like a proficient legal professional!

- Furthermore, it integrates with comprehensive solutions for PDF editing and electronic signatures, enabling users with a Premium subscription to effortlessly complete their paperwork online.

- It demands minimal time and effort to obtain the necessary documentation.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Conservation Easement Land In Trust using the relevant button next to the file name.

- If you do not have an account with US Legal Forms, follow the instructions below.

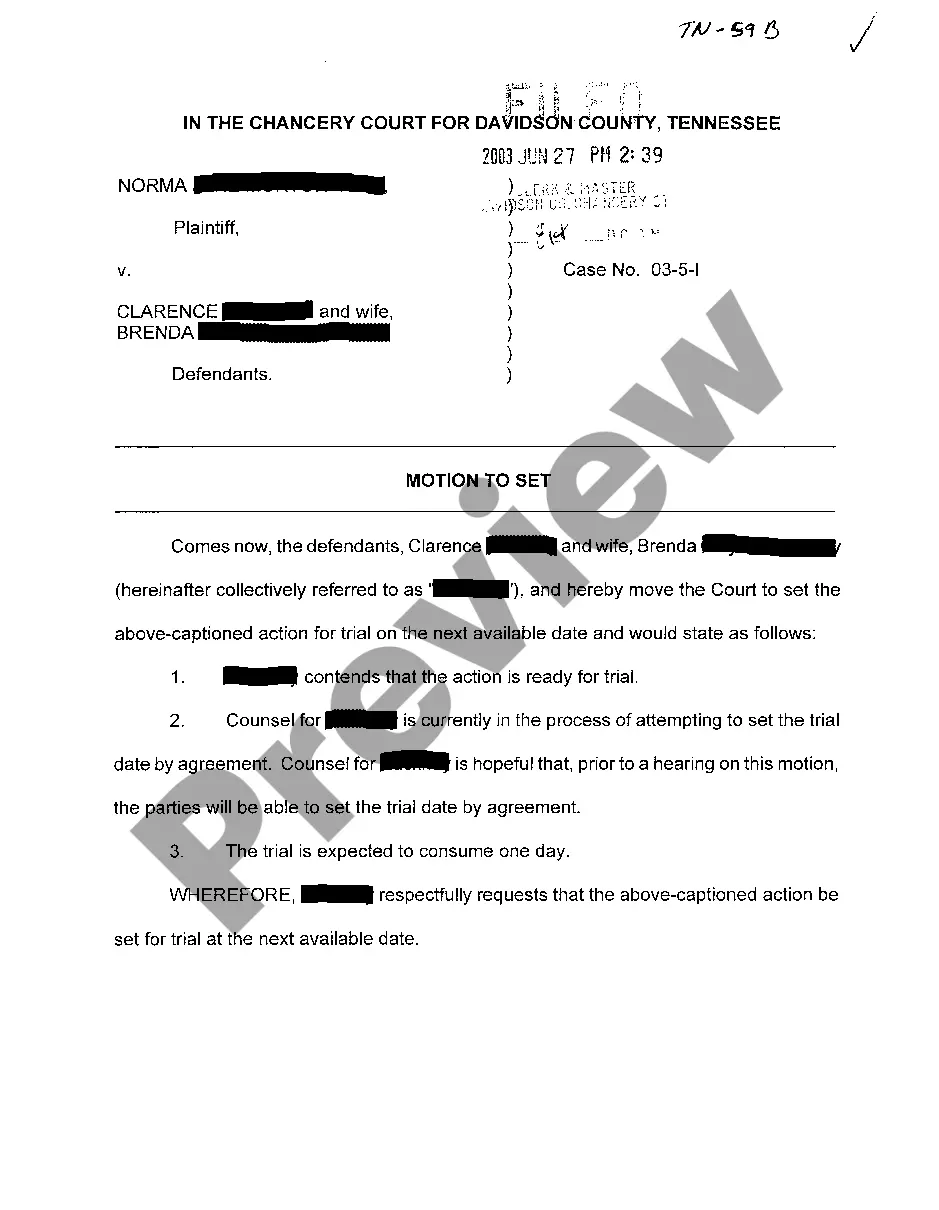

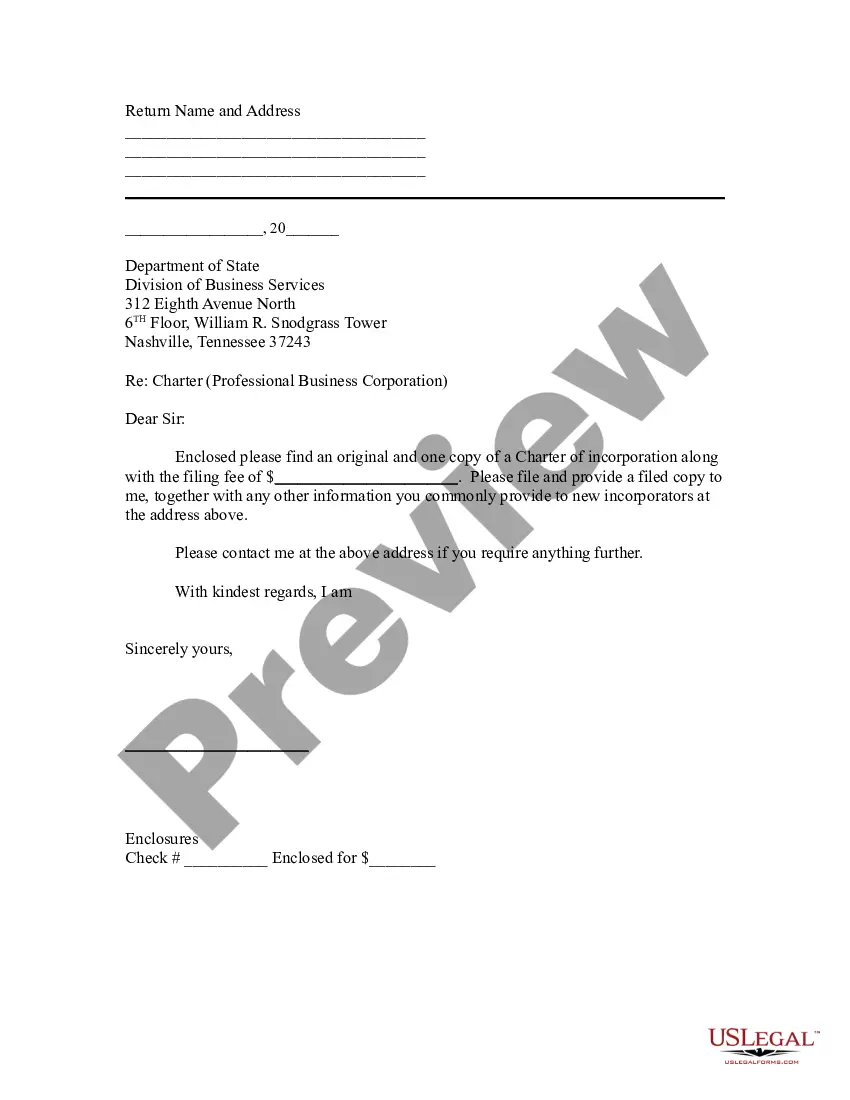

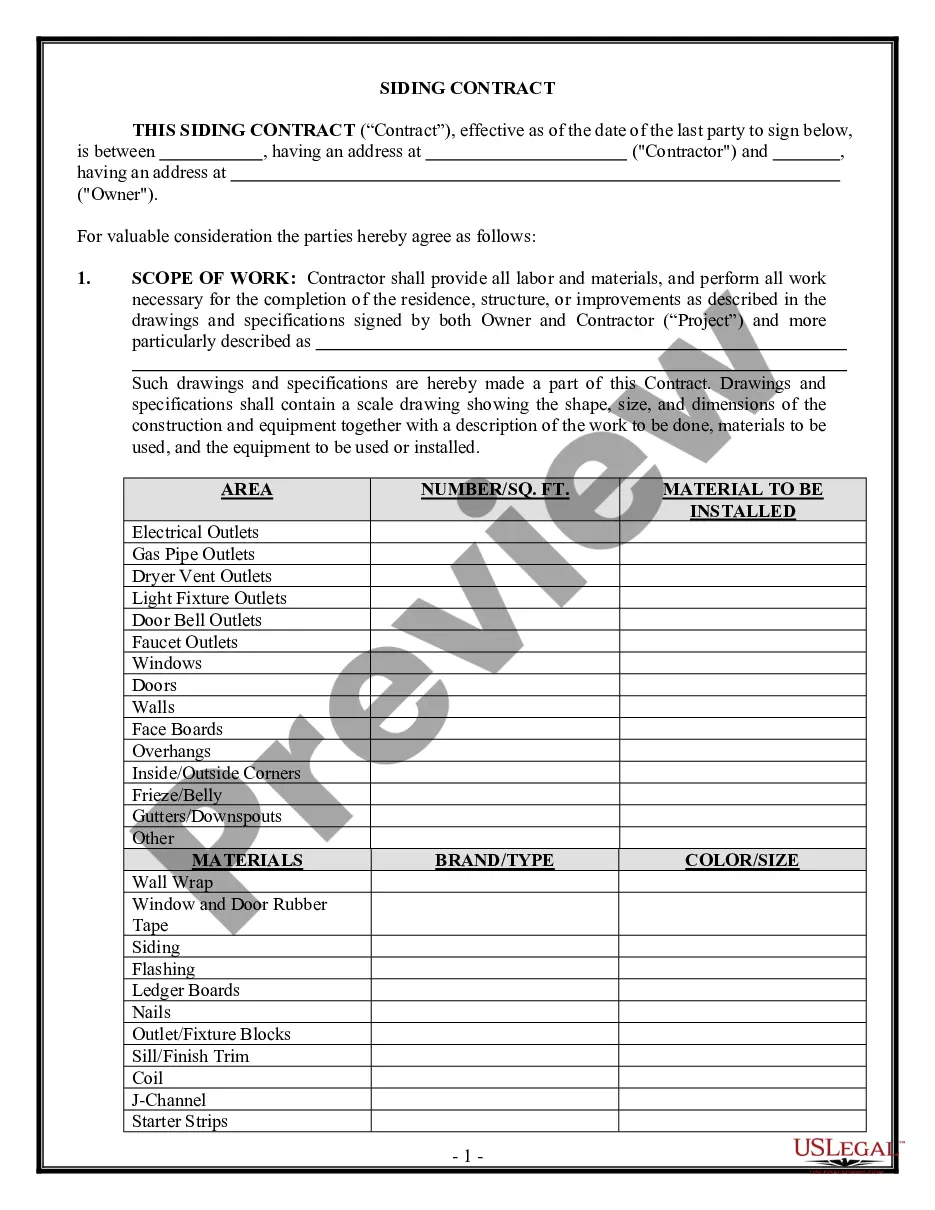

- Browse the webpage you've opened and confirm if the form meets your requirements.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Conservation easements are legal tools to help you protect the habitat on your land. While maintaining ownership, you make a commitment to conserve the natural integrity of the habitats agreed upon by you and DUC, by limiting the amount and type of development that can occur.

A land trust is a legal entity that takes ownership of, or authority over, a piece of property at the behest of the property owner. Land trusts are living trusts that allow for the management of property while alive.

A conservation easement is a voluntary legal agreement to preserve land in perpetuity (legal term meaning forever). A conservation easement is a deed but it does not transfer land ownership. Instead the deed spells out a landowner's commitments to protect the existing character of his property.

Cons:A conservation easement is typically perpetual.A future owner or your heirs may not have the same affinity for conservation as you do.The future value of the property will likely be diminished as a result of the restrictions of the easement.Not all land will qualify for a conservation easement.More items...?

A conservation easement that removes your land's development potential typically lowers its market valueand that means lower taxes for the landowner. That can significantly reduce estate taxes when you pass on your property to the next generation, making it easier to keep the land in the family and intact.