Small estate form Equinix is a legal document that is used to simplify the estate administration process for small estates. It is designed to ensure a smooth and efficient transfer of assets from a deceased individual to their beneficiaries. Equinix is a trusted provider of financial and administrative solutions, and their small estate form streamlines the probate process by eliminating the need for a full probate application. This form is specifically tailored for smaller estates, those with a total value below a certain threshold, usually set by local laws. The Small estate form Equinix is recognized by many financial institutions, governmental bodies, and other relevant organizations. It enables the executor or personal representative of the estate to easily gather and present the necessary information required to distribute assets to the rightful heirs. Some common types of Small estate form Equinix include: 1. Small Estate Affidavit: This form is used when the deceased had no will or the will was not submitted for probate. It typically requires the personal representative to provide details about the deceased, their heirs, and the assets in the estate. 2. Summary Administration Form: This form is typically used in cases where the estate value is below a certain threshold set by applicable laws. It streamlines the probate process by bypassing certain administrative steps, making it faster and more cost-effective. 3. Release and Indemnification Agreement: In situations where the estate's assets are relatively simple and straightforward, this form may be used. It allows the heirs to release the personal representative from any liability in exchange for the distribution of their inheritances. 4. Waiver of Notice: This form is utilized when beneficiaries or interested parties voluntarily waive their right to receive formal notice about the probate proceedings. It expedites the distribution process by removing the need to notify all parties involved. These Small estate forms Equinix can vary depending on the jurisdiction and the specific requirements. It is essential to consult with legal professionals or estate administration specialists to ensure the correct form is used and all necessary information is provided accurately. Using Small estate form Equinix can greatly help simplify and expedite the administration of small estates, making the entire process less time-consuming and more efficient for all parties involved.

Small Estate Form Equiniti

Description

How to fill out Small Estate Form Equiniti?

It’s no secret that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare Small Estate Form Equiniti without having a specialized background. Putting together legal forms is a time-consuming venture requiring a specific education and skills. So why not leave the preparation of the Small Estate Form Equiniti to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and get the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

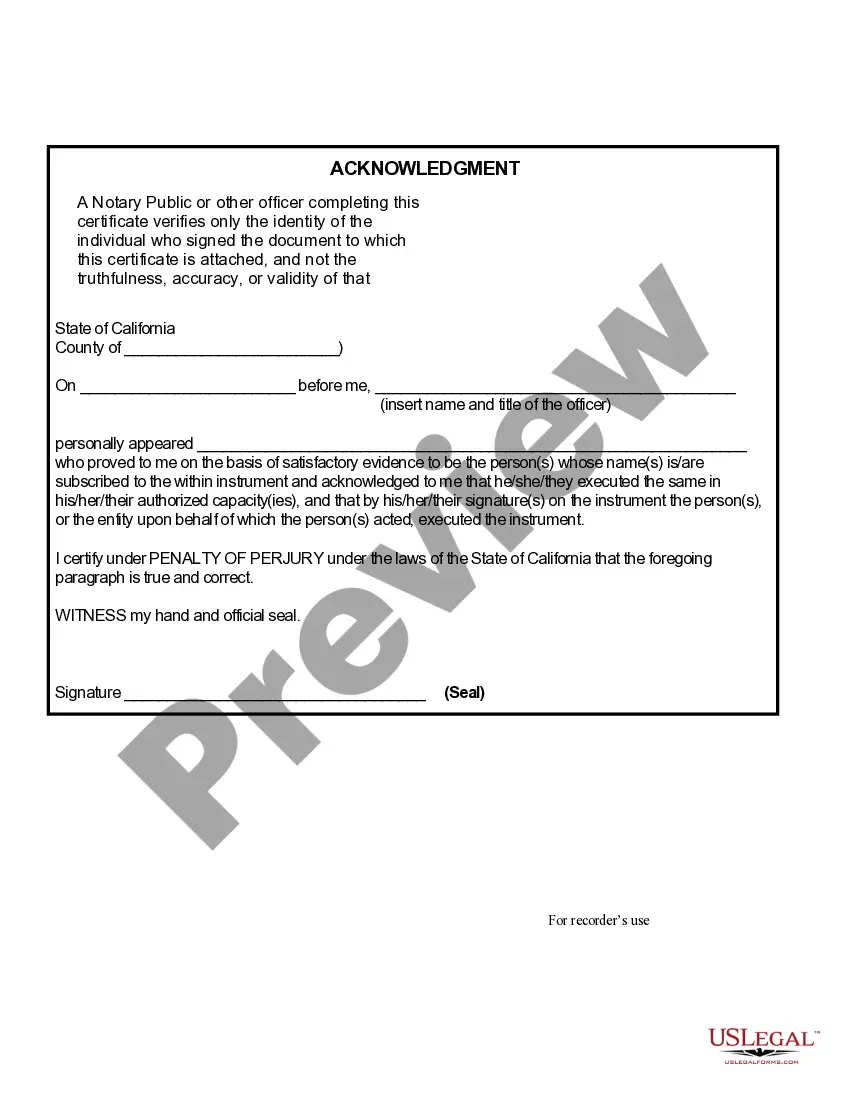

- Preview it (if this option available) and read the supporting description to figure out whether Small Estate Form Equiniti is what you’re searching for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription option to purchase the form.

- Pick Buy now. Once the payment is complete, you can get the Small Estate Form Equiniti, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Filling out the small estate affidavit requires you to gather important details about the deceased's assets, debts, and the individuals who will inherit these assets. The small estate form Equiniti provides a user-friendly template to guide you through this process. Make sure to enter accurate information and have the required signatures. This affidavit can greatly simplify the settlement process, allowing you to handle matters fairly and efficiently.

Transferring shares owned by a deceased individual involves gathering necessary documents like the death certificate and the small estate form Equiniti. This form assists in facilitating the transfer process without going through probate. You should reach out to the stockbroker or financial institution that holds the shares to follow their specific process. By using the small estate form Equiniti, you can complete the transfer efficiently, easing the burden on beneficiaries.

To transfer ownership of a stock after someone has passed away, you typically need to provide documentation such as a death certificate and the small estate form Equiniti. This form simplifies the process by allowing you to claim shares without the lengthy probate procedure. Ensure you contact Equiniti for specific instructions and any additional requirements. This approach often makes the transition smoother for heirs.

To transfer Equiniti shares when someone dies, you generally need to submit a small estate form Equiniti along with a copy of the death certificate and any required identification. This process helps beneficiaries claim their inheritance without the complications of probate. It's advisable to contact Equiniti directly or consult with a legal professional for specific steps and documentation needed. Properly navigating this can ensure that the transfer goes smoothly.

To obtain a small estate affidavit, you typically need to fill out a specific form provided by your state’s probate court or relevant authority. This document serves as proof of your claim to the deceased's assets without the need for lengthy probate. If you have Equiniti shares to manage, using the small estate form Equiniti can make the task easier. Make sure you have all relevant information about the estate to support your application.

A small estates declaration is a legal statement made to affirm the value of the deceased's assets, allowing for the transfer without full probate proceedings. It simplifies the process and can be filed more quickly than traditional probate forms. If you are handling shares with Equiniti, using the small estate form Equiniti may be a beneficial step for managing the estate effectively. Confirm all requirements are met to ensure a smooth process.

To obtain a copy of a small estate affidavit, you typically need to file a request with the appropriate court or department where the estate was settled. Some states may offer online services for this purpose. If you're dealing with Equiniti shares, utilizing the small estate form Equiniti can assist in this process as you gather necessary documentation. Always check local regulations to ensure proper steps are followed.

A small estate is typically an estate that falls below a specific financial threshold, which allows heirs to bypass the probate process. In contrast, a probate estate requires court intervention to settle debts and distribute assets. Using the small estate form Equiniti can help simplify the process for those eligible, easing the burden on families during a difficult time. Understanding this can aid in managing your loved one’s affairs more efficiently.

A small estate declaration form is a document that allows heirs to claim the deceased person's assets without the need for formal probate. This form simplifies the process and helps facilitate the transfer of property quickly. In the context of Equiniti, utilizing the small estate form Equiniti can streamline how you handle shares and other assets. Make sure to gather all necessary documentation before completing the form.

The small estate limit in Nevada is currently set at $100,000 for personal property. This means that if the total value of the estate falls below this threshold, heirs may not need to go through the lengthy probate process. Instead, you can use a small estate form Equiniti to expedite the transfer of assets. Always consult with an attorney for confirmation of the latest limits.