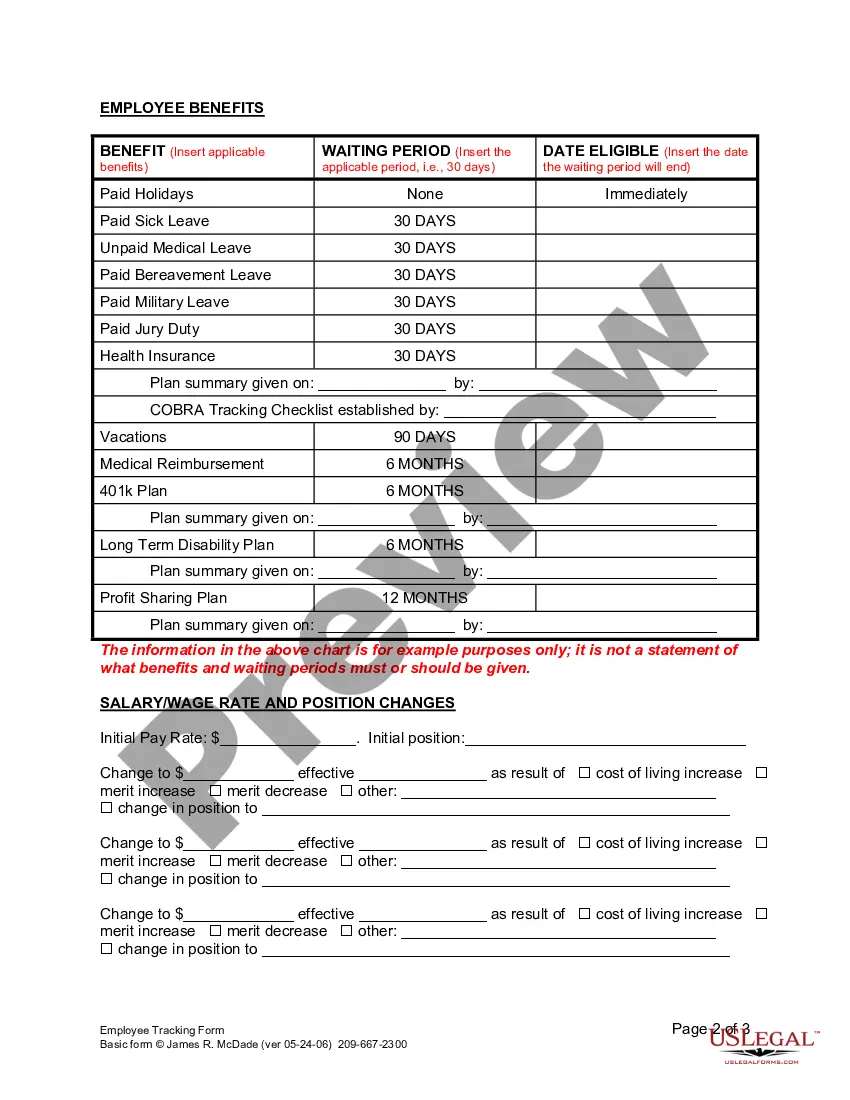

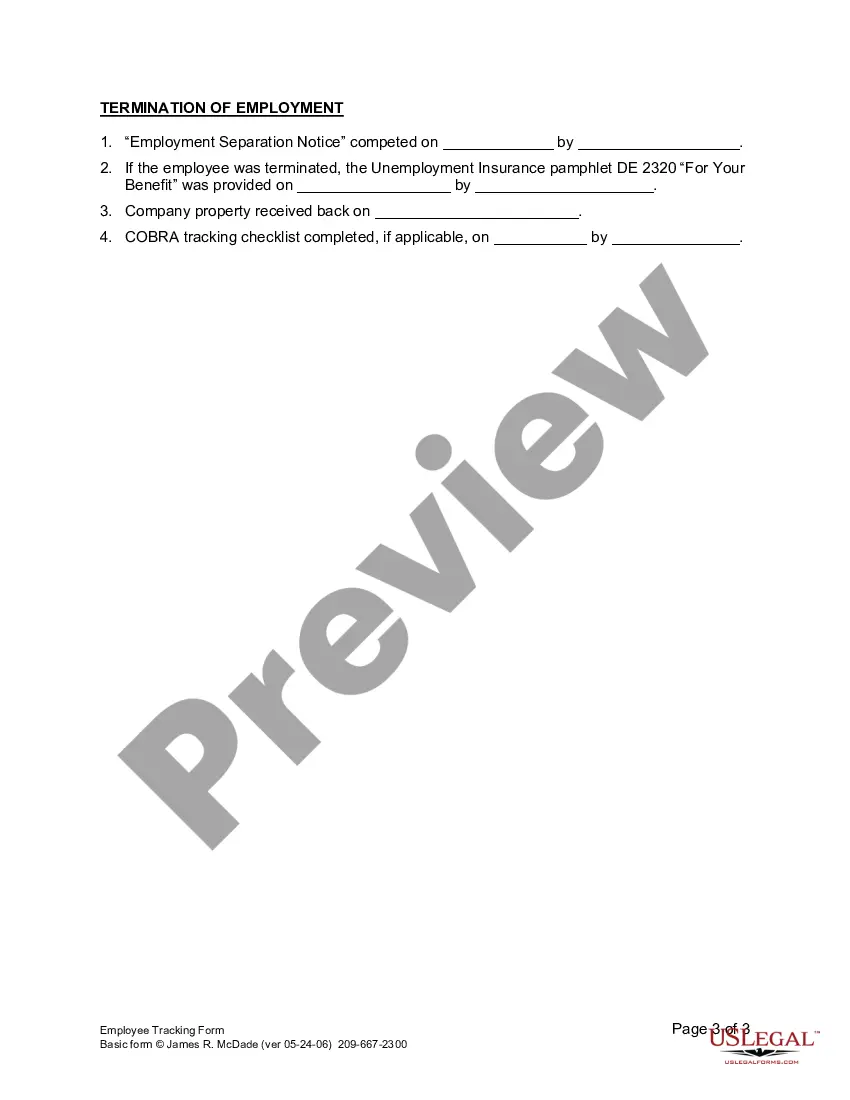

Employers use this form to track the completion of initial orientation and the qualifying for benefits of a new employee.

Employee Tracking Form Withdrawal

Instant download

Description Comp Employee Days

Free preview Employee Form Other