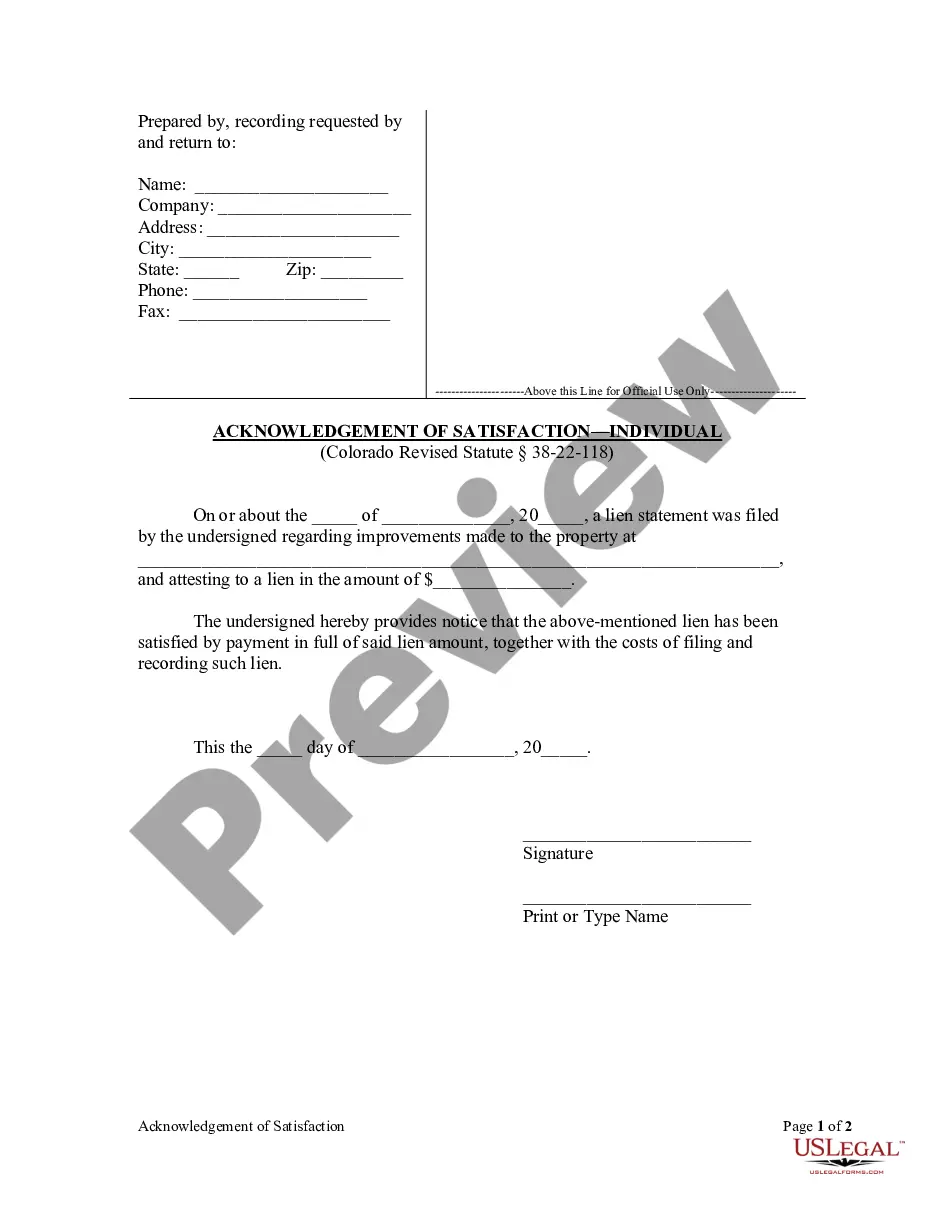

Pursuant to Colorado Revised Statute section 38-22-118, an individual who has previously filed a lien statement must file an Acknowledgment of Satisfaction after payment in full of the amount attested to in the lien statement, including the cost of filing and recording said lien. Failure to file this acknowledgment within ten (10) days of the request of the property owner to do so may result in a statutory penalty of $10.00 per day being assessed against the lien claimant.

Satisfaction Of Lien Form Withdrawal

Description

Form popularity

FAQ

A satisfaction of claim is a legal document that confirms that the obligations or claims against a debtor have been met fully. This document is essential for the debtor to ensure that creditors recognize the debt as satisfied. Knowing how to file this properly can aid in avoiding complications when addressing a satisfaction of lien form withdrawal.

A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. This means creditors can hold property as collateral for unpaid debts. Understanding liens is crucial, especially when managing or processing a satisfaction of lien form withdrawal.

The IRS withdrawal form is a document that allows you to formally withdraw a Notice of Federal Tax Lien. By completing this form, you can help clear your record and show potential creditors that you have resolved your tax issues. If you are dealing with multiple liens, considering a satisfaction of lien form withdrawal can be helpful.

To obtain a copy of a mechanic's lien in NYC, you need to visit the Office of the City Register. There, you can search for the lien by entering the property address or the name of the lien claimant. Additionally, you can request the lien electronically or by mail. Understanding how to navigate the process can simplify obtaining your satisfaction of lien form withdrawal.

Recovering your lien balance starts with ensuring that you have completed a Satisfaction of lien form withdrawal. After filing this form, monitor its status with the relevant authorities to confirm the lien's release. If the proper procedures have been followed, you should be able to recover your balance once the lien is lifted.

Lifting a lien from your account involves submitting a Satisfaction of lien form withdrawal to the relevant institution or governing body. Once this form is filed, and if approved, your funds will no longer be held under the lien, allowing you to access the 4k in question. It is advisable to verify any outstanding obligations that may affect the lifting of the lien.

To unlock your lien amount, you need to file a Satisfaction of lien form withdrawal with the appropriate authorities. This form indicates that the obligation tied to the lien has been satisfied, which allows you to access your funds. Make sure to provide any additional documentation that may be required to support your request.

The time it takes to remove a lien amount can vary depending on several factors, including the type of lien and the completion of necessary documentation. Typically, once you file a Satisfaction of lien form withdrawal, it can take anywhere from a few days to a few weeks for the lien to be officially released. It's essential to ensure you have submitted all required documents promptly to expedite the process.

A lien withdrawal refers to the process by which a lien claimant retracts the lien they filed. This usually occurs when the obligation is still pending, but the claimant decides to forgo the claim for various reasons, such as a settled agreement or dispute resolution. Handling this carefully is vital, and guidance from US Legal Forms on satisfaction of lien form withdrawal can simplify this process.

To have the IRS remove a lien, you need to follow specific procedures, which may include settling your tax debt or negotiating a payment plan. After the payment is made, you can request a withdrawal of the lien by filing the appropriate forms. This process can be complex, but resources like US Legal Forms provide templates that guide you through the satisfaction of lien form withdrawal.