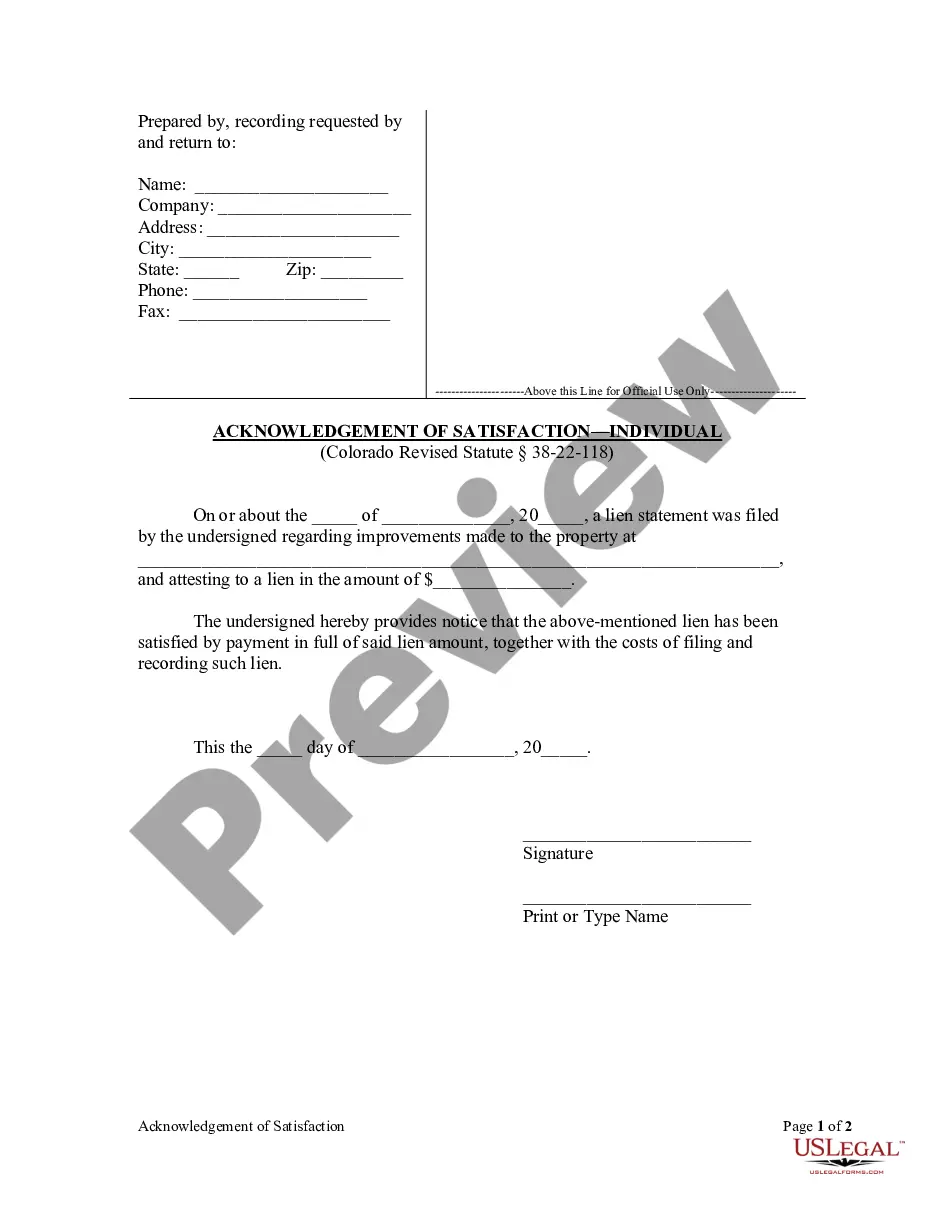

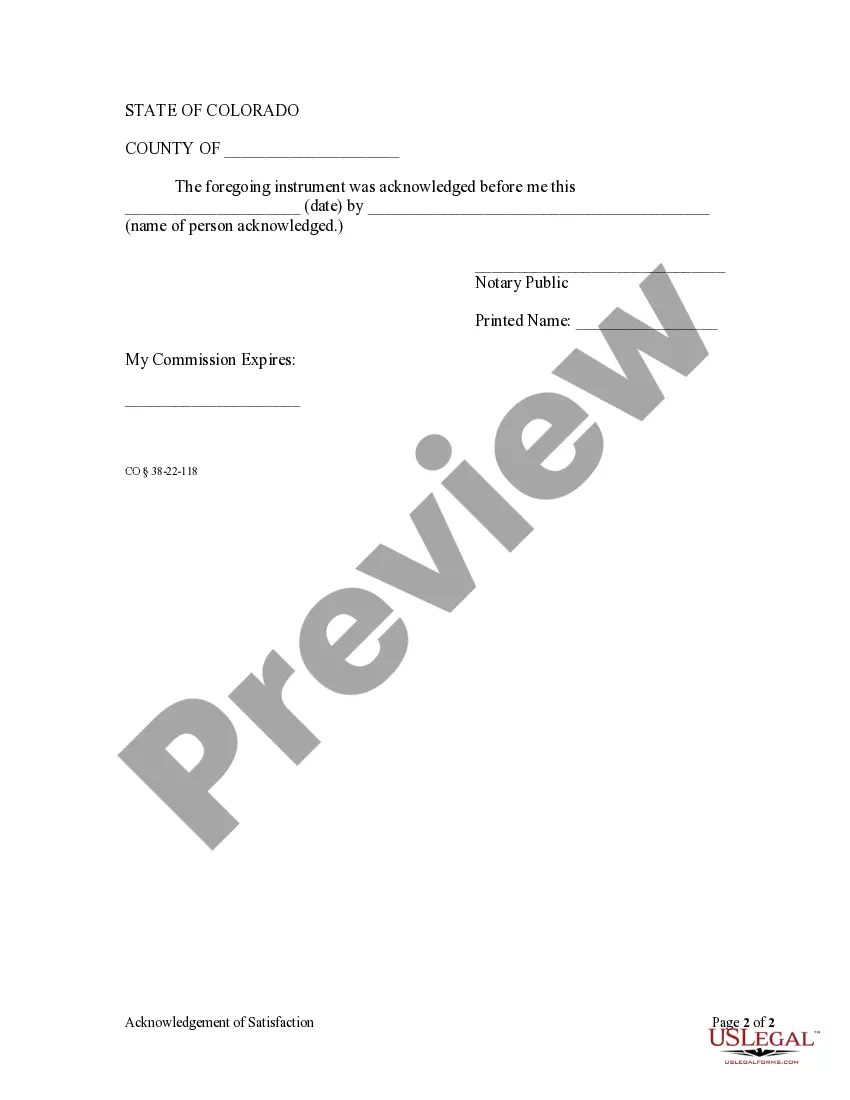

Pursuant to Colorado Revised Statute section 38-22-118, an individual who has previously filed a lien statement must file an Acknowledgment of Satisfaction after payment in full of the amount attested to in the lien statement, including the cost of filing and recording said lien. Failure to file this acknowledgment within ten (10) days of the request of the property owner to do so may result in a statutory penalty of $10.00 per day being assessed against the lien claimant.

Satisfaction Of Lien Form Without

Description

Form popularity

FAQ

Liens are subject to specific conditions, such as the existence of a debt or obligation, proper documentation, and adherence to legal requirements. Generally, the property involved must also be properly identified in the lien. If you are unsure about the requirements, using a satisfaction of lien form without expert help can simplify your journey.

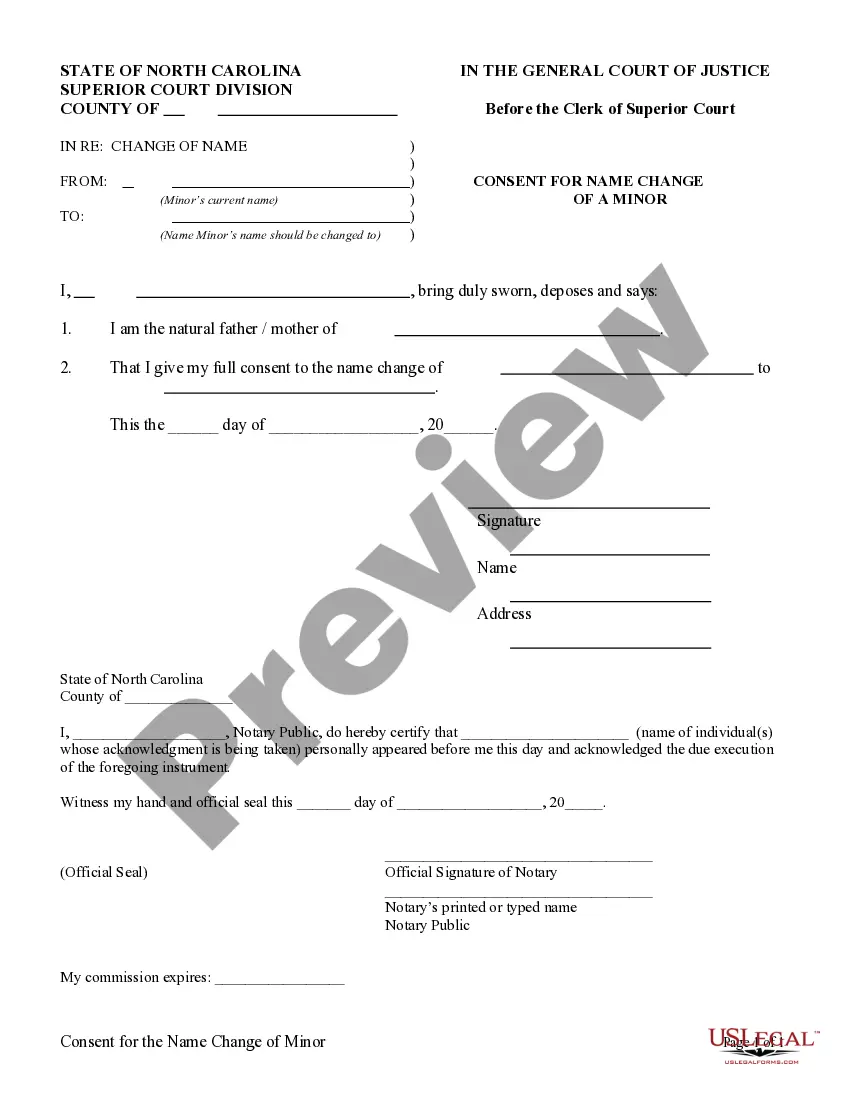

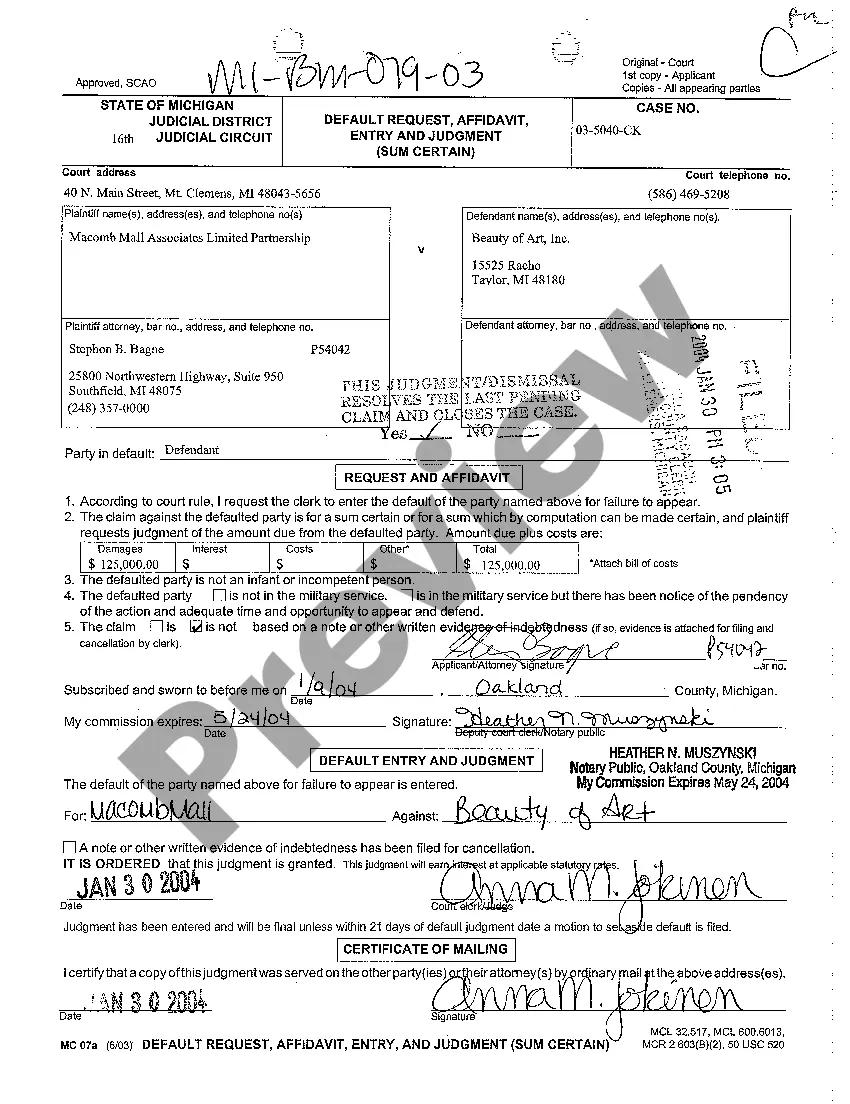

A satisfaction of lien is a legal document that confirms that a lien on a property has been fulfilled or released. It acts as proof that the debt or obligation linked to the lien has been satisfied. Once completed, this form is typically filed with the appropriate government office to update public records. If you need a satisfaction of lien form without the hassle, there are platforms that can provide you with easy access.

A release of lien without satisfaction refers to a document that indicates that a lien has been removed but does not confirm that the underlying obligation has been fully satisfied. This situation can occur when a debtor pays a portion of the debt but the creditor chooses to release the lien prior to full repayment. It’s essential to understand that this may leave a gap in your financial records. Using our Satisfaction of lien form without service can help clarify the status of your obligations.

A lien release form is an official document that indicates a lien has been satisfied and removed. This form often needs to be filed with local or state authorities to ensure that the lien's status is updated in public records. For those navigating the process, using a satisfaction of lien form without hassle is essential, and platforms like uslegalforms can simplify this task significantly.

A lien release is a document that confirms the removal of a lien from a property or asset after the borrower has fulfilled their debt obligation. This document serves as proof that the lender no longer has a legal claim to the borrower’s property. Having a lien release can improve your credit score and open up opportunities for future financial transactions.

A lien is a legal right or interest that a lender has in a borrower's property, granted until the debt obligation is satisfied. In simpler terms, it allows the lender to take possession of the property if the borrower fails to meet the repayment terms. Understanding the implications of a lien is essential, especially when dealing with a satisfaction of lien form without complications.

A lien in a bank account refers to the legal claim by a creditor to funds held in that account. This means that the creditor can take funds directly to satisfy outstanding debts. A bank lien may also restrict the account holder's access to those funds until the debt is resolved. Ensure you understand your rights and options regarding liens by consulting resources on USLegalForms.

A lien is a legal right or interest in someone else's property, typically used as security for a debt or obligation. Essentially, it means that the property is collateral for a financial commitment. When a lien is placed, the property cannot be sold or transferred without resolving the underlying debt. If you need assistance with understanding or managing liens, USLegalForms offers comprehensive guides and forms to support you.

Another word for lien is 'claim'. A lien indicates a legal right or interest that a creditor has in another's property, usually as security for a debt. Understanding this terminology helps clarify legal contexts around property rights and obligations. For more insights, you may refer to resources on USLegalForms regarding lien definitions and their implications.

To release a lien in Oregon, you must complete a Satisfaction of Lien Form. This form needs to be filed with the county recording office where the original lien was recorded. It signifies that the necessary obligations have been met, and the lien is no longer valid. Utilizing platforms like USLegalForms can help streamline the process, making it easier to prepare the required documentation.