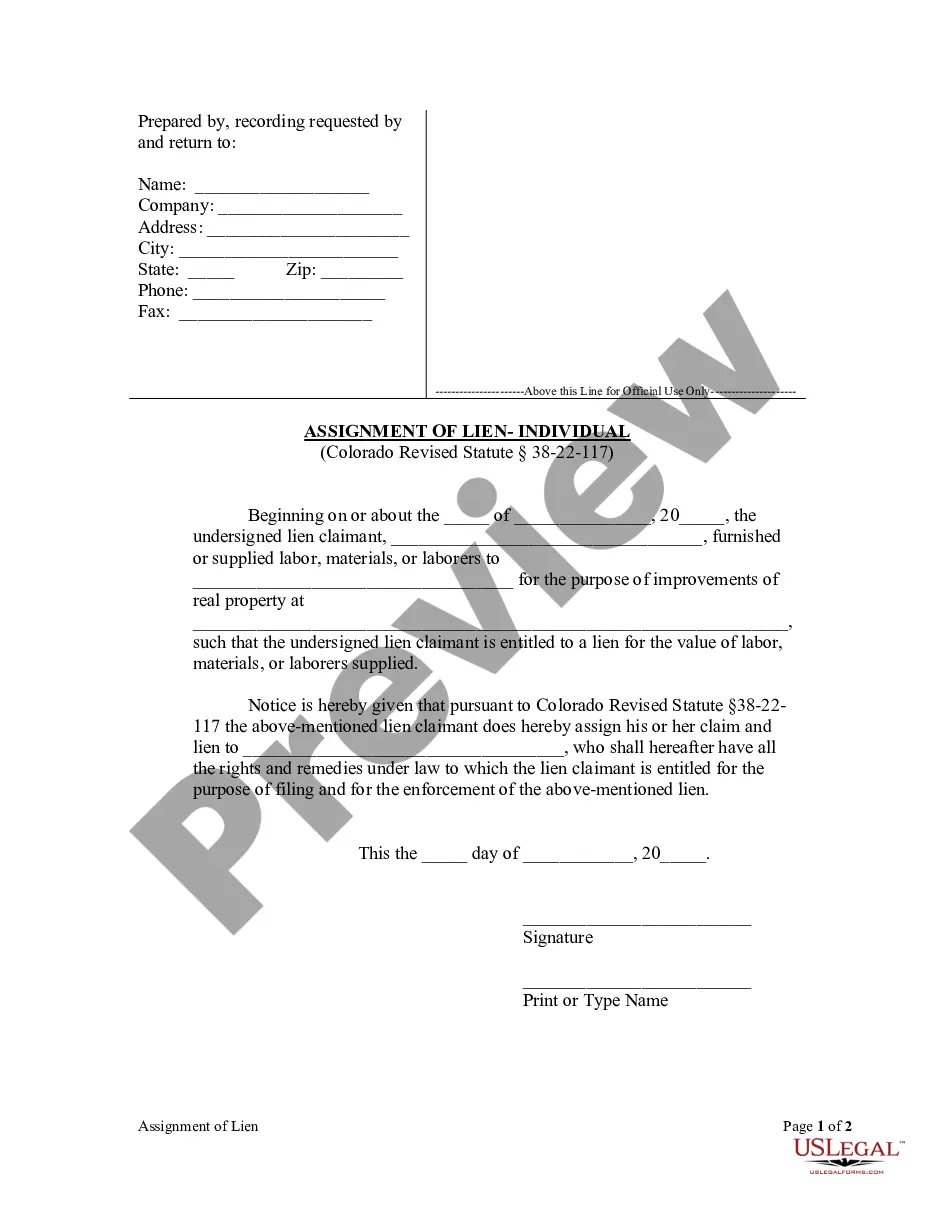

Colorado Revised Statute section 38-22-117 permits a lien claimant to assign his claim and lien to another party who will have all the rights and remedies of the assignor. This assignment may be made before or after the filing of a statement of lien.

Assignment Of Lien Withdrawal

Description

Form popularity

FAQ

The best way to remove a tax lien often involves an assignment of lien withdrawal. This process allows you to formally request the removal of the lien from your property records. You can initiate this by settling the debt with the IRS or relevant tax authority. Additionally, using platforms like US Legal Forms can guide you through the necessary steps and documentation required for a smooth assignment of lien withdrawal.

Another word for lien is ‘claim’ or ‘encumbrance.’ These synonyms reflect the same concept of holding a legal right over an asset until a debt is settled. Understanding related terms can provide clarity when working through the complexities of Assignment of lien withdrawal. Utilizing proper resources can further facilitate a smooth process when dealing with claims against your property.

A lien in a bank account occurs when a creditor establishes a claim against the funds within that account. This section of financial law often involves an Assignment of lien withdrawal process, wherein you may seek to release the funds from the creditor's claim. If a lien is placed on your bank account due to unpaid debts, addressing this issue promptly is crucial. Tools and resources, such as those offered by US Legal Forms, can assist you in navigating this process.

The term lien refers to a legal claim or right against assets that are typically used as collateral to satisfy a debt. In the context of Assignment of lien withdrawal, it implies the steps one must take to remove a lien against their property or assets. Liens can arise from various financial obligations and understanding this concept helps you manage your debts more effectively. It is always wise to consult legal resources for more detailed guidance on lien matters.

The IRS withdrawal form refers to the form used to request the release of a tax lien. When dealing with situations of Assignment of lien withdrawal, this form helps to ensure that the IRS formally cancels its claim against your property. Completing this form accurately is crucial to resolving any outstanding tax issues. You can find guidance on this process through platforms like US Legal Forms.

A lien is a legal claim or right against a property, typically used as security for a debt. It prevents the property owner from selling or refinancing the asset until the debt is resolved. The assignment of lien withdrawal refers to the action of formally removing this claim once obligations are fulfilled.

Filing a lien in Colorado requires completing a lien statement form and recording it with the appropriate county clerk's office. You must provide specific details about the property and the debt. Understanding the assignment of lien withdrawal is essential for future transactions, as it addresses how to manage and remove liens effectively.

To remove a lien from your car title in Missouri, you need to obtain a lien release from the lienholder and submit it to the Department of Revenue. This document serves as proof that the debt has been settled. Engaging in the assignment of lien withdrawal streamlines this process, ensuring clarity on the status of your vehicle title.

To place a lien on a car in Missouri, you must complete the appropriate paperwork and file it with the Missouri Department of Revenue. Typically, you need to provide details about the vehicle and the lienholder. The assignment of lien withdrawal may come into play later if you need to remove the lien after fulfilling financial obligations.

Removing a lien means freeing a property from legal claims that encumber it. This process ensures that the property can be sold or refinanced without any financial obligations attached. The assignment of lien withdrawal is the formal procedure to eliminate these claims, allowing you to regain full control of your asset.