Tenancy In Common Mortgage

Category:

State:

Colorado

Control #:

CO-SDEED-1

Format:

Word;

Rich Text

Instant download

Description Warranty Deed Joint Form Fill

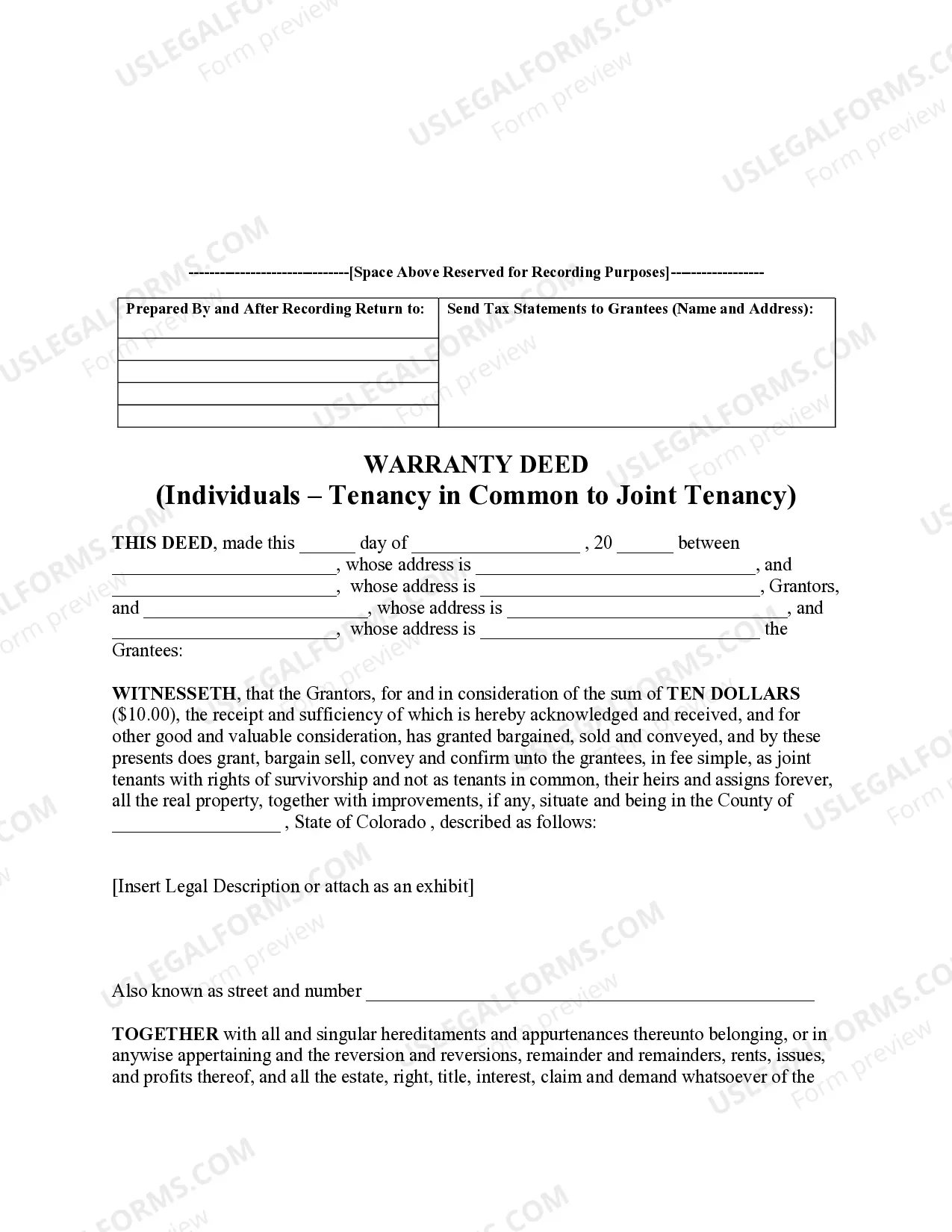

This form is a Warranty Deed where the grantors are two individuals and the grantees are two individuals holding title as joint tenants.

Free preview Tenancy Common