Child Support Calculator For Delaware

Description delaware minimum child support amount

How to fill out Child Support Calculator For Delaware?

Maneuvering through the red tape of official paperwork and templates can be challenging, especially if one is not engaged in that field professionally.

Even locating the correct template for a Child Support Calculator for Delaware will require a significant investment of time, as it must be accurate and precise to the very last digit.

However, you will spend considerably less time selecting a suitable template if it originates from a resource you can rely on.

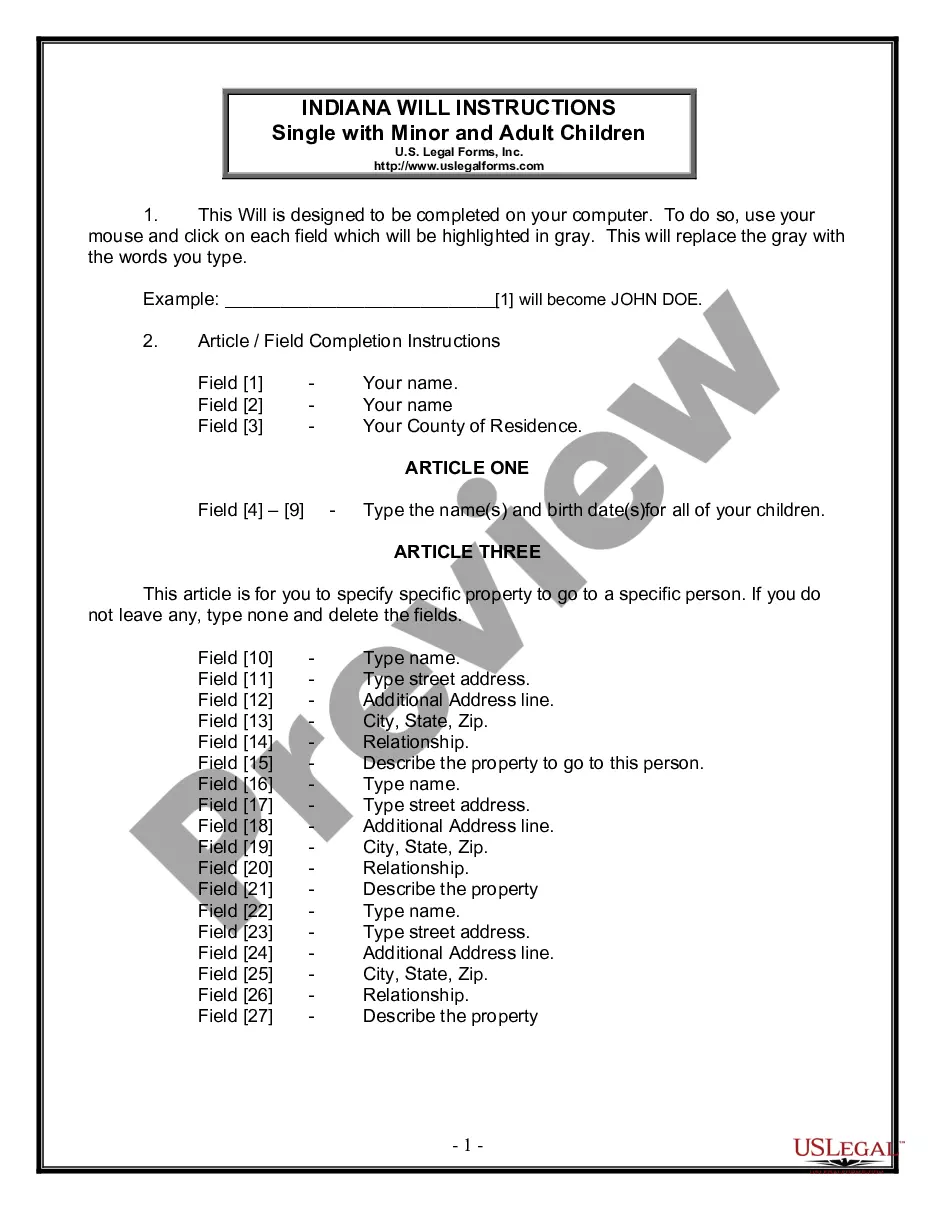

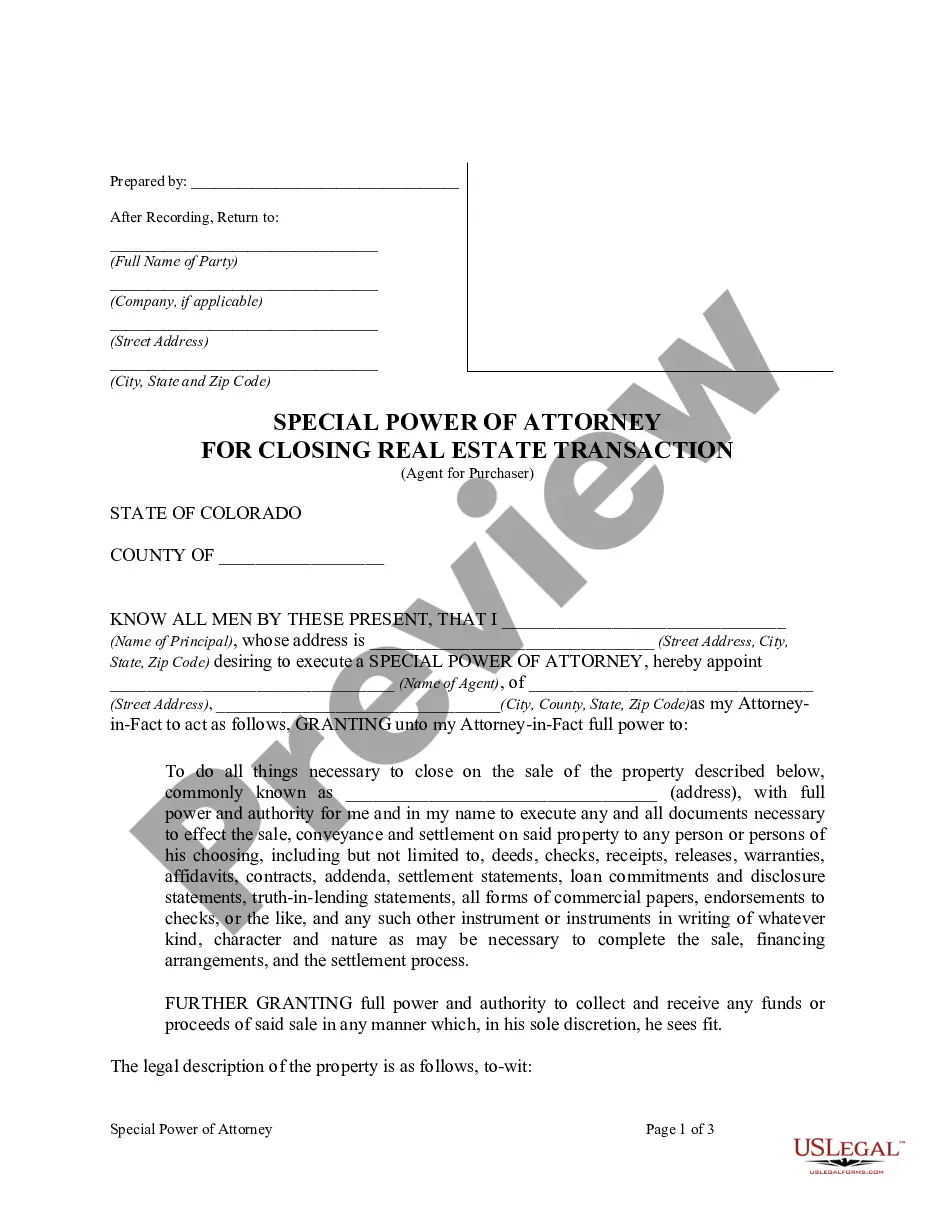

Obtain the correct form in a few straightforward steps: Enter the document title in the search box. Locate the relevant Child Support Calculator for Delaware from the results. Review the outline of the sample or access its preview. If the template aligns with your requirements, click Buy Now. Choose your subscription plan. Provide your email and create a password for your US Legal Forms account. Select either a credit card or PayPal payment method. Download the template file to your device in your preferred format. US Legal Forms will save you considerable time exploring whether the form you encountered online meets your expectations. Establish an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the correct forms online.

- US Legal Forms is a comprehensive source for obtaining the latest versions of documents, verifying their usage, and downloading them for completion.

- It offers a library of over 85,000 forms applicable across various sectors.

- When searching for a Child Support Calculator for Delaware, you won't have to question its accuracy since all forms are authenticated.

- Creating an account at US Legal Forms guarantees you have all the essential documents readily available.

- You can save them in your history or add them to the My documents collection.

- You can retrieve your saved forms from any device by selecting Log In on the library website.

- If you do not possess an account yet, you can always start a new search for the required template.

Form popularity

FAQ

Delaware child support formula and parenting time adjustmentUp to 109 overnights is 0% credit. 110 to 132 overnights is 10% credit. 133 to 150 overnights is 20% credit. 151 to 164 overnights is 30% credit.

In Delaware, child support is calculated based primarily on a parent's net available income. A parent's net available income is determined by taking the parent's monthly gross income and subtracting taxes, other allowable deductions, and a self support allowance.

The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

The three basic principles of the Melson formula are 1) parents are entitled to sufficient income to meet their basic needs; 2) parents shouldn't be permitted to retain more income than required to meet their basic needs; and 3) the child(ren) are entitled to share in any additional income and benefit from a