Florida Warranty Deed Form Withholding Tax

Description

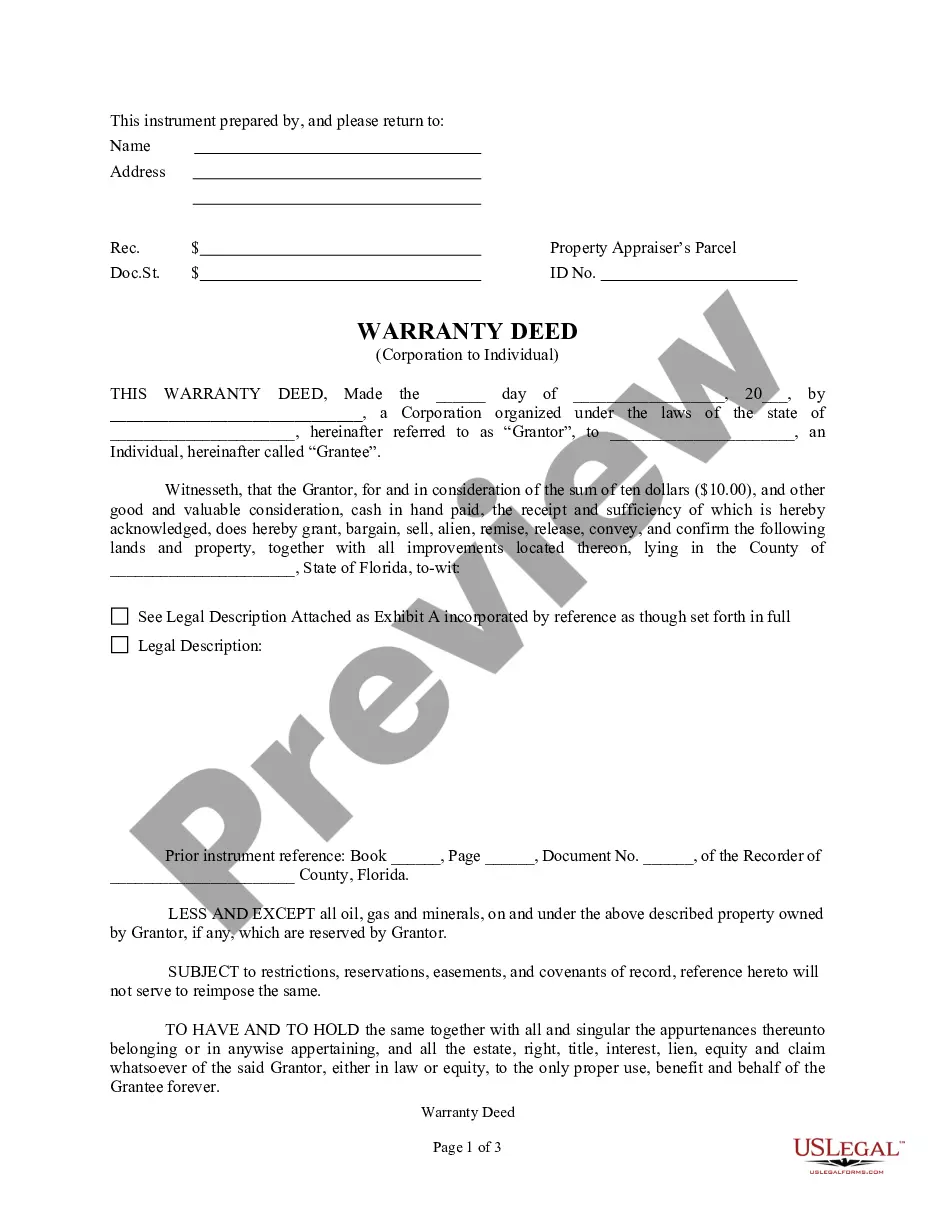

How to fill out Florida Warranty Deed From Corporation To Individual?

It’s well-known that you cannot transform into a legal expert instantly, nor can you quickly learn to draft the Florida Warranty Deed Form Withholding Tax without a specialized skill set. Crafting legal documents is a lengthy process that demands specific training and expertise. So why not entrust the creation of the Florida Warranty Deed Form Withholding Tax to the experts.

With US Legal Forms, one of the largest legal document repositories, you can access anything from court filings to templates for internal communication. We understand how crucial compliance and adherence to federal and state regulations are. That’s why, on our platform, all forms are location-specific and current.

Here’s how you can begin with our website and acquire the document you need in just minutes.

You can regain access to your documents from the My documents tab at any time. If you are an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your paperwork—whether it’s financial and legal or personal—our website has you covered. Try US Legal Forms today!

- Find the form you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if the Florida Warranty Deed Form Withholding Tax is what you are looking for.

- Initiate your search again if you need a different template.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. Once the purchase is complete, you can obtain the Florida Warranty Deed Form Withholding Tax, fill it out, print it, and deliver it or mail it to the specified individuals or entities.

Form popularity

FAQ

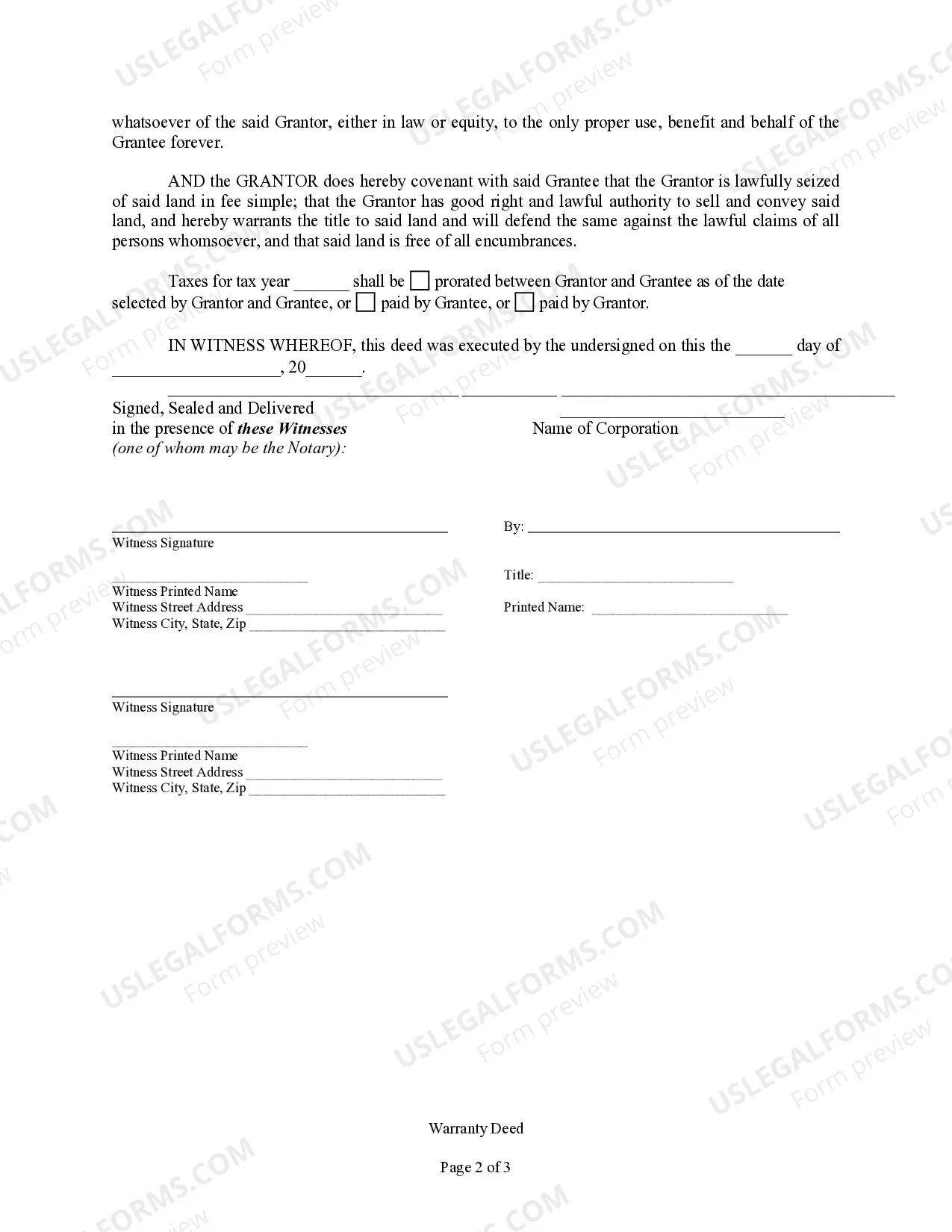

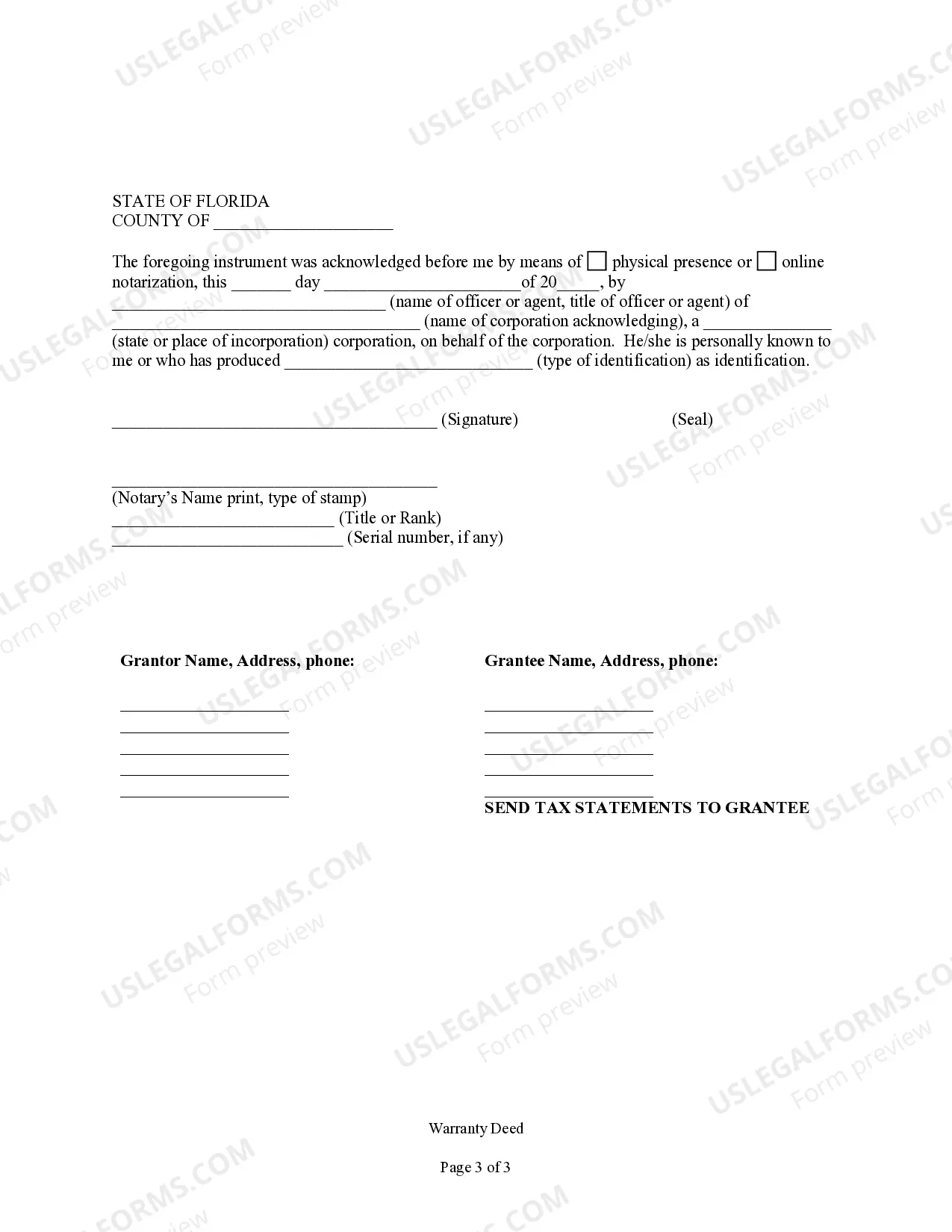

Warranty Deed Rules and Requirements The name and address of the individual who prepared the deed. The name and address of the current owner (also called the grantor) The name and address of the new owner (also called the grantee) Original signature of the grantor (note: the grantee does not need to sign the deed)

Florida does not use a state withholding form because there is no personal income tax in Florida.

Is there a transfer tax on a quitclaim deed in Florida? Yes, the county will charge a transfer tax for a quitclaim deed based on the amount of consideration paid for the property.

Who pays transfer taxes in Florida: The buyer or the seller? In most Florida home sales, the seller is responsible for paying the Doc Stamps. However, responsibility for the transfer taxes can be transferred during closing negotiations. The final payee will be outlined in the contract.

Florida law requires, among other things, that warranty deeds be signed by the grantor (owner) and witnessed by two witnesses. It should be recorded in the county where the property is located.