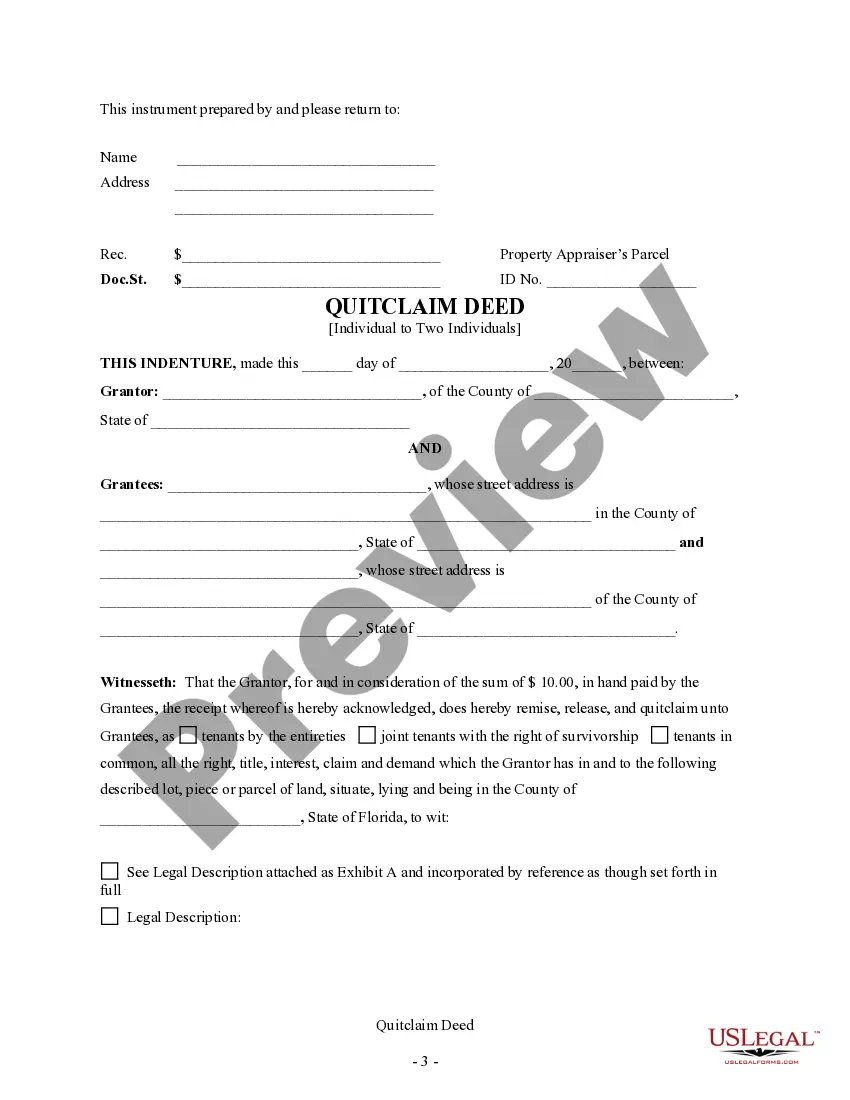

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This form complies with all state statutory laws.

Florida Deed Of Trust

Description

How to fill out Florida Deed Of Trust?

Precisely composed formal documents are among the crucial assurances for steering clear of complications and legal disputes, but obtaining them without the support of an attorney may require time.

Whether you need to swiftly locate an updated Florida Deed Of Trust or any other forms for employment, family, or business purposes, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, all you need to do is Log In/">Log In to your account and click the Download button adjacent to the chosen file. Additionally, you can retrieve the Florida Deed Of Trust at any time, as all documents ever obtained on the platform can be accessed in the My documents section of your profile. Save time and money on preparing official documents. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and locale by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header.

- Press Buy Now once you locate the suitable template.

- Choose the payment plan, sign in to your account or create a new one.

- Select your preferred payment method to buy the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Florida Deed Of Trust.

- Click Download, then print the document to complete it or incorporate it into an online editor.

Form popularity

FAQ

When transferring Florida property from a trust to a beneficiary, the most appropriate instrument is usually a quitclaim deed. This deed allows the trustee to transfer their interest in the property to the beneficiary. It's vital to ensure the proper execution and recording of the quitclaim deed to establish clear title. For assistance in this process, consider resources like US Legal Forms to streamline your paperwork.

Transferring a property deed from a deceased relative in Florida typically requires filing a death certificate and a new deed in the county clerk's office. If the property was held in a Florida deed of trust, you may also need to address any terms specified in the trust. It may be beneficial to work with an attorney to ensure all legal steps are properly followed. This can save you from future complications.

Florida does not currently recognize a beneficiary deed, which is used in some other states to transfer property at death without probate. Instead, Florida has specific mechanisms, such as the Florida deed of trust, that can facilitate property transfer upon death through a trust setup. If planning your estate, consider consulting a professional to find the best strategy for your situation.

To obtain a copy of your deed in Florida, you can visit the county clerk's office where your property is located. They maintain public records, including property deeds, and can assist you in retrieving your Florida deed of trust. Additionally, many counties offer online databases for convenient access to property records. This can save you time and simplify your search.

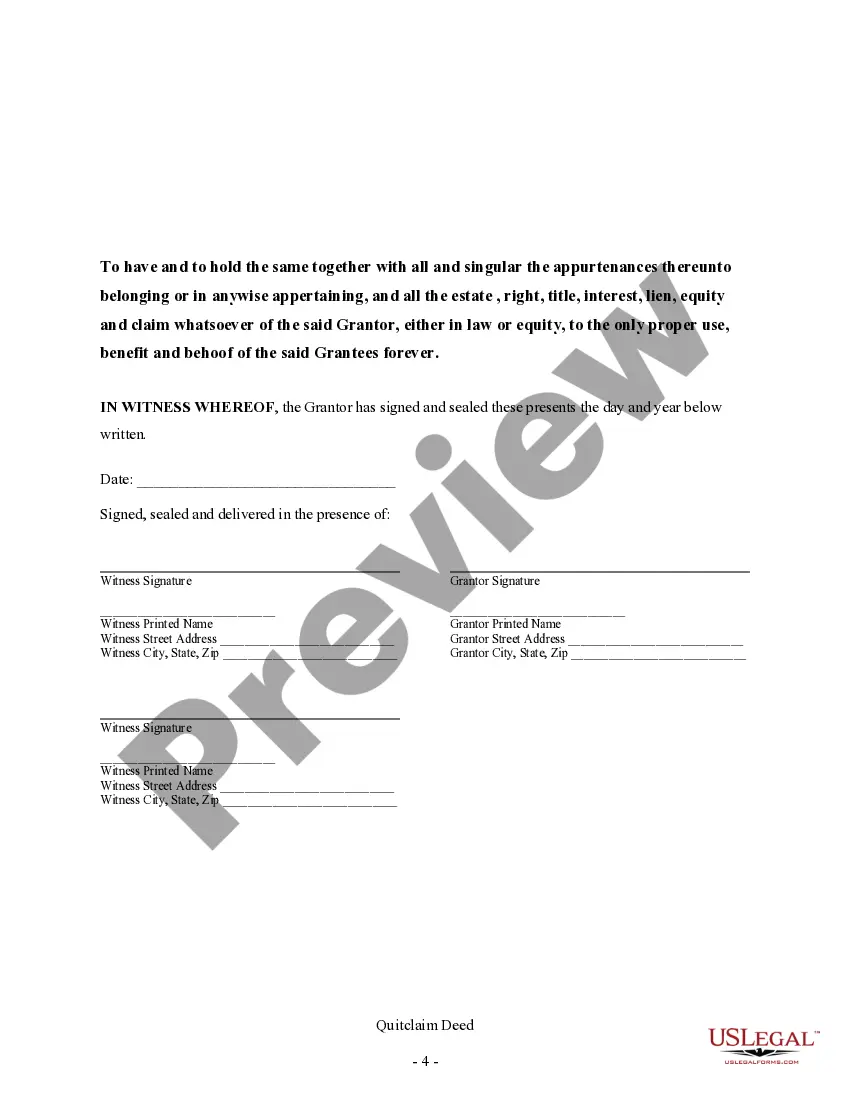

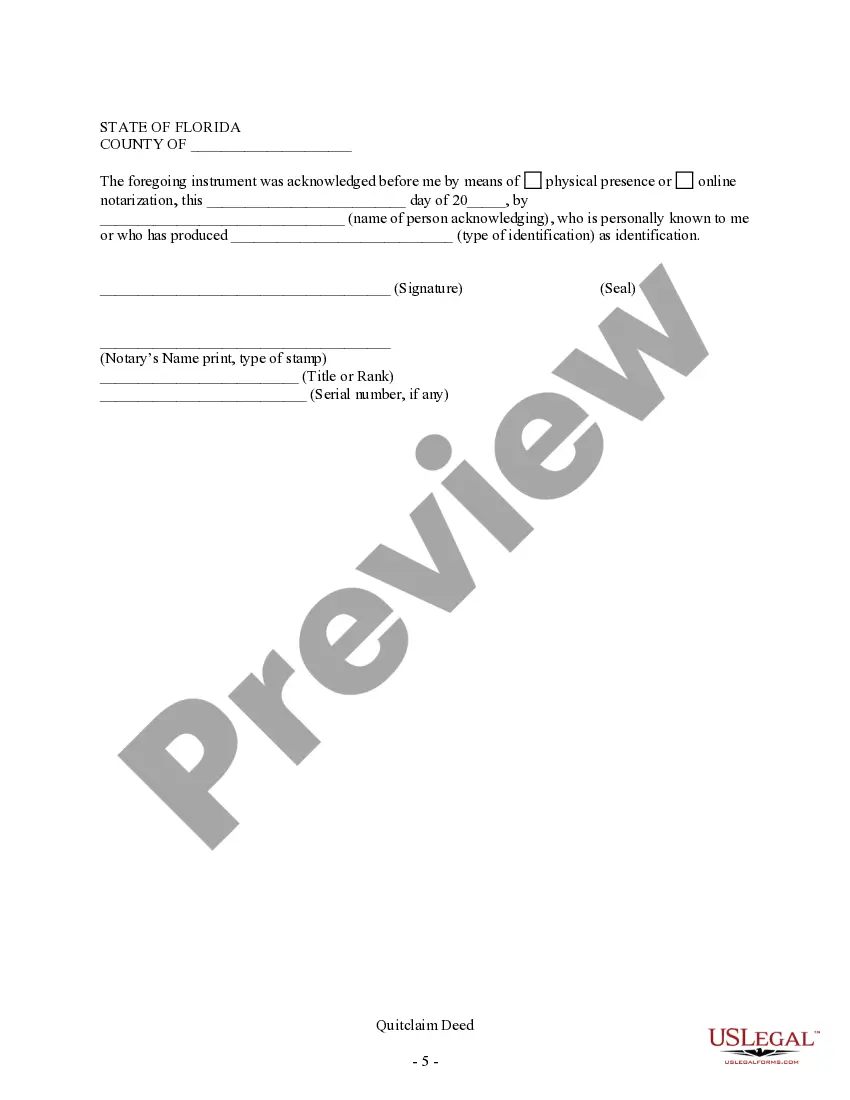

For a deed to be valid in Florida, it must include specific elements: the names of the grantor and grantee, a legal description of the property, and a statement of consideration. Additionally, the deed must be signed by the grantor in the presence of a notary. It's essential to comply with these requirements to ensure your Florida deed of trust holds up in any future legal matters. Using a reliable platform like USLegalForms can help ensure all necessary components are included.

Filing a deed in Florida involves several steps. First, prepare the deed according to state requirements, including necessary information about the parties and property. Then, sign it in front of a notary public. Finally, file the Florida deed of trust with your local county clerk’s office, along with any required fees. This process secures your ownership in public records.

No, you do not need to be an attorney to prepare a deed in Florida. However, it is essential to understand the specific requirements for creating a valid Florida deed of trust. Using online legal services like USLegalForms can guide you through the process and provide templates that meet state requirements, ensuring you avoid costly mistakes. Still, consulting an attorney might be wise for complex transactions.

To transfer a deed to a family member in Florida, you must prepare a new deed that clearly specifies the transfer. Next, you need to sign the deed in front of a notary public to validate it. After signing, file the Florida deed of trust with the local county clerk’s office to complete the transfer and protect your family's ownership rights. This process ensures that your loved ones have a clear claim to the property.

Yes, in Florida, you must record a deed to ensure its legality. Recording a deed establishes public notice of property ownership and protects your rights as a homeowner. If you don’t record the Florida deed of trust, you risk potential issues down the line, like disputes over ownership. It's a crucial step to keep your property records clear and accessible.

The choice between a deed of trust and a mortgage largely depends on your specific situation and goals. A Florida deed of trust can provide additional protections for lenders and may streamline the foreclosure process if necessary. Conversely, mortgages are more widely understood and used in Florida, offering familiarity and simplicity for borrowers.