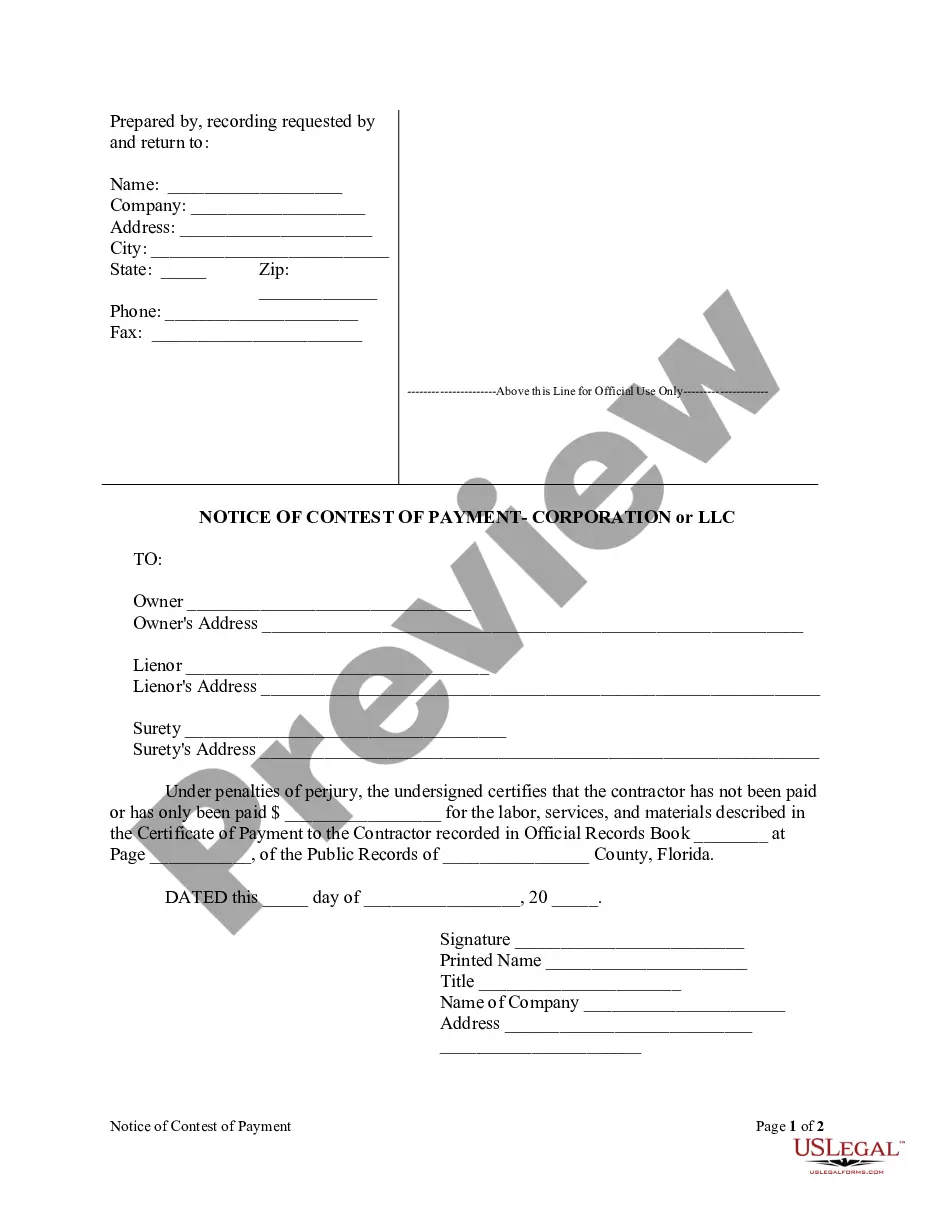

This is the Notice to Owner required to be given by liens of corporate or limited liability entities not in privity with the owner.

Sun biz Florida is the official online portal for the Division of Corporations in Florida. It provides a platform for businesses, including Limited Liability Companies (LCS), to file various documents required for compliance with state laws. One crucial filing for LCS in Florida is the annual report. This report must be submitted each year to maintain an active status and to update the Division of Corporations on the company's current information. The Sun biz Florida annual report for LLC in Florida is a comprehensive form that requires detailed information about the company. The report can be filed online through the Sun biz website. LLC owners should be aware of the following key points when preparing the report: 1. Entity Type: When filing the annual report, it is essential to specify the entity type as "Limited Liability Company" correctly. 2. Business Identifier Number (BIN): The BIN is a unique identification number assigned to each active LLC in Florida. It should be included on the annual report to ensure accuracy and proper documentation. 3. Principal Place of Business: The physical address where the LLC conducts its primary operations should be provided. If there is a change in the address, this must be updated in the annual report. 4. Manager/Member Information: The report requires the identification of LLC managers or members, along with their names, titles, and addresses. This section ensures that the Division of Corporations has updated and accurate information regarding the company's key individuals. 5. Registered Agent and Registered Office: The annual report mandates the disclosure of the registered agent's contact information, including their name, address, and email, residing in the state of Florida. The registered office address is also required, which serves as the official communication address for the company. 6. Business Activities: LCS must provide a brief description of the nature of their business activities. This helps the Division of Corporations understand the scope of the company's operations and its compliance with specific regulations. It is vital to file the annual report by the designated due date to avoid late fees and potential administrative dissolution of the LLC. The due date for filing varies depending on the LCS formation or fiscal year, generally falling on May 1 each year. However, it is recommended to check the Sun biz website for the most up-to-date information. Other types of annual reports for LCS in Florida may include Dissolution Annual Reports, which are filed when an LLC decides to cease its operations and wind up its affairs. Additionally, LCS that are Foreign Entities, operating outside of Florida, may be required to file different variations of the annual report, such as Foreign Annual Reports or Amended Foreign Annual Reports to maintain compliance with the state's laws and regulations. In summary, the Sun biz Florida annual report for LLC in Florida is a mandatory filing that ensures proper documentation and updated company information. LLC owners must accurately provide details such as entity type, BIN, principal place of business, manager/member information, registered agent/office details, and a description of business activities. Filing the report on time is crucial to avoid penalties and potential dissolution.