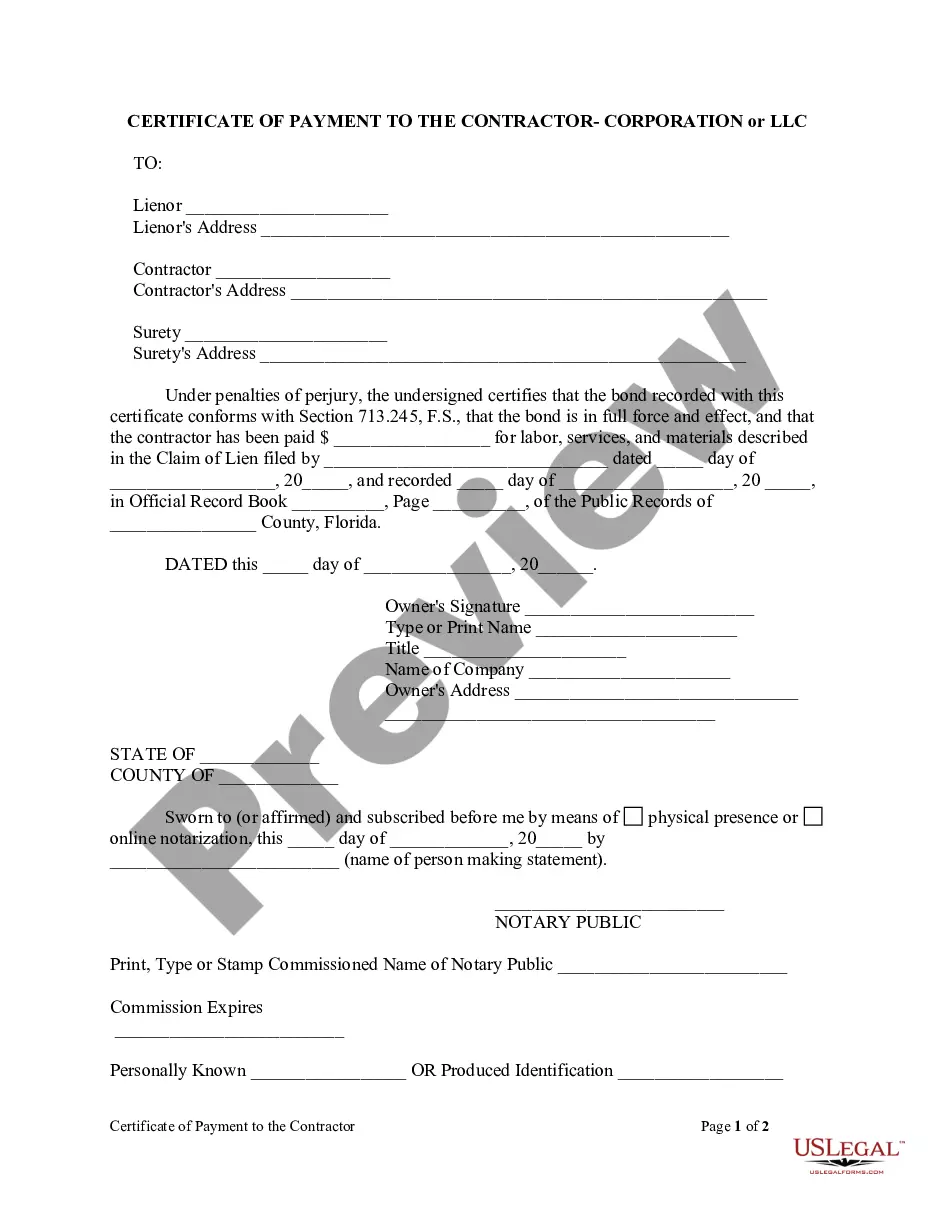

Within 90 days after a claim of lien is recorded for labor, services, or materials for which the contractor has been paid, the corporate or LLC owner or contractor may record a notice of bond as specified in s. 713.23(2), together with a copy of the bond and a sworn statement of Certificate Of Payment To Contractor Form. 713.245 Conditional payment bond.

Down Payment With Construction Loan

Description

How to fill out Down Payment With Construction Loan?

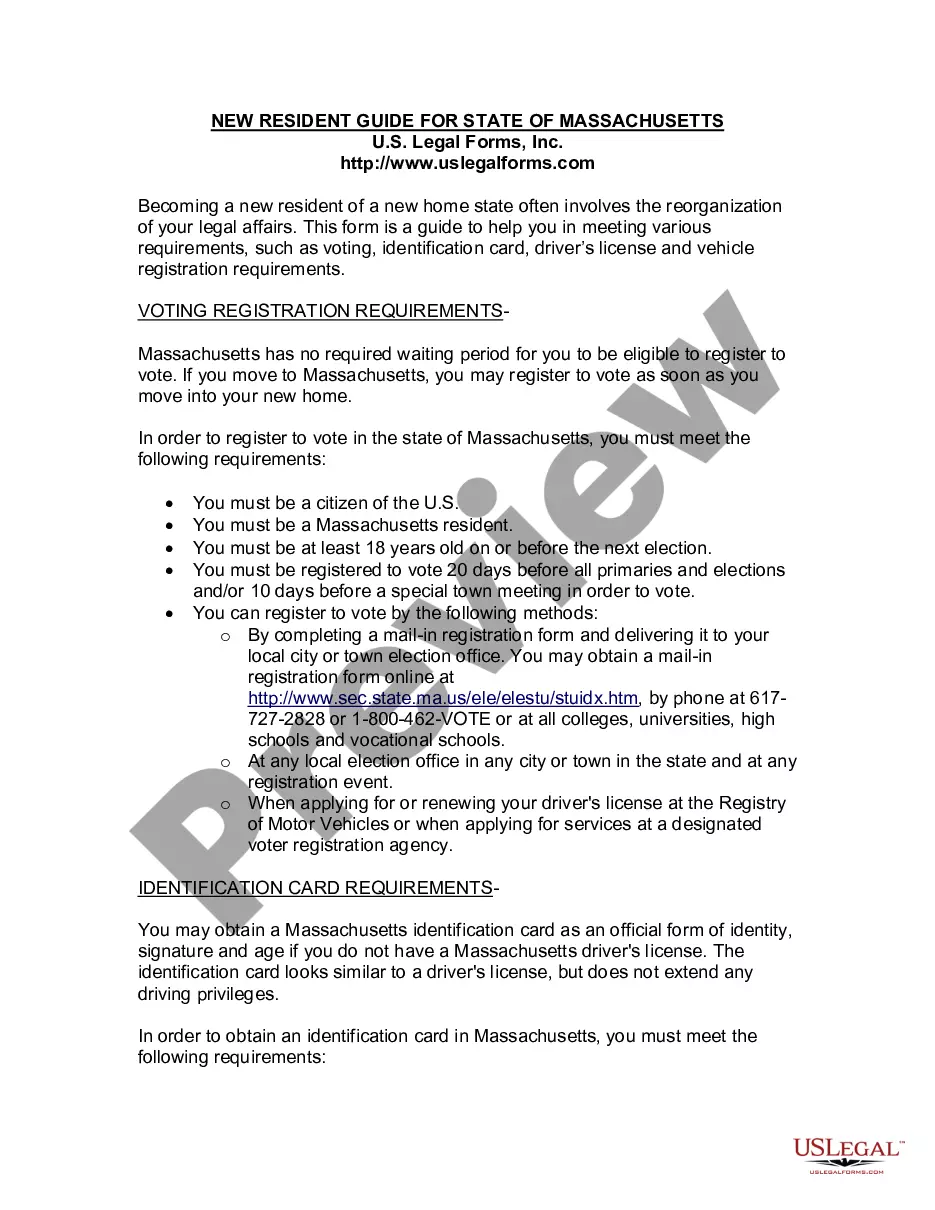

There's no longer a necessity to invest hours searching for legal documents to meet your local state requirements.

US Legal Forms has compiled all of them in a single location, making them easily accessible.

Our site provides over 85k forms for various business and personal legal situations organized by state and area of usage.

Use the Search field above to find another sample if the current one does not suit your needs. Click Buy Now next to the template title when you identify the appropriate one. Select the most suitable pricing plan and either register for an account or Log In. Complete your subscription payment with a credit card or via PayPal to continue. Choose the file format for your Down Payment With Construction Loan and download it to your device. Print your form to fill it out manually or upload the template if you prefer to utilize an online editor. Completing legal documentation in accordance with federal and state regulations is quick and simple with our library. Try US Legal Forms today to maintain your documentation organized!

- All forms are properly drafted and verified for authenticity, allowing you to be assured of acquiring a current Down Payment With Construction Loan.

- If you are acquainted with our service and already possess an account, make sure your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

- If you have not previously used our service, you will require a few extra steps to finalize the process.

- Here’s how new users can discover the Down Payment With Construction Loan in our catalog.

- Examine the page content painstakingly to confirm it contains the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

Qualifying for a construction loanIt's harder to get approved for a construction loan than for a typical purchase mortgage, Moralez and Thomas say. That's because the bank is taking extra risk during the building phase, since there isn't an asset to secure the mortgage. Typical down payments are around 20%.

If you can't easily cover the mortgage with your salary, you'll need to save up enough money to cover the mortgage for several years. It's also a good idea to have six to 12 months' worth of living expenses in an emergency fund.

Conforming conventional loans, as well as FHA loans, do not allow homebuyers to use personal loans as down payments. Even if you find a lender and type of loan that doesn't explicitly forbid it, using a personal loan as a down payment may still not be an option.

Pros. A 20% down payment is widely considered the ideal down payment amount for most loan types and lenders. If you're able to put 20% down on your home, you'll reap a few key benefits.

Typically, you will be required to pay 5%-10% of the base price as the deposit. When making a cash purchase, that amount will be even higher. If you are selecting options and upgrades for your new home, you will usually be asked to put down 25% to 50% of the upgrades value as the builder deposit.