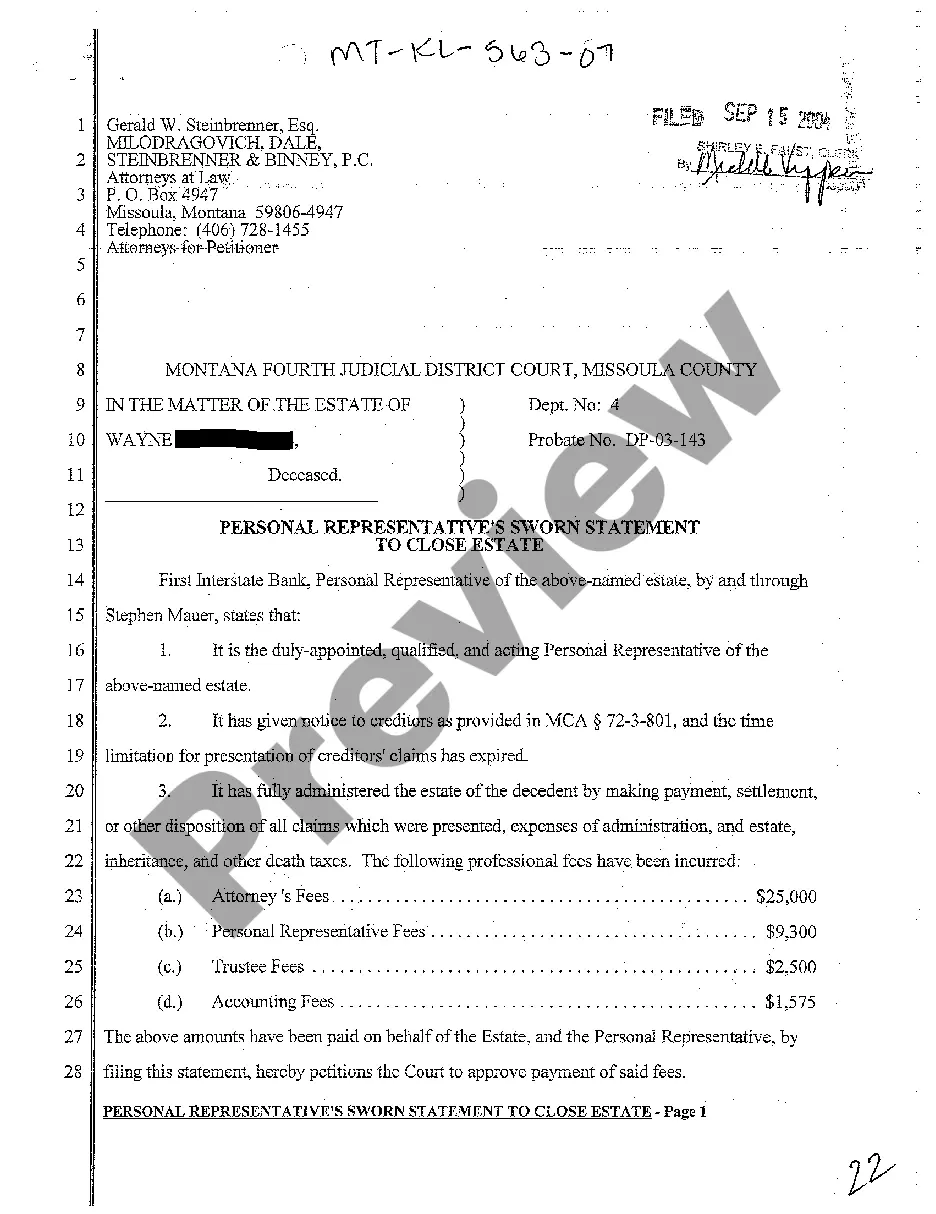

This form is a Personal Representative's Deed of Distribution where the Grantor is an Individual appointed as personal representative of the estate and the Grantee is the beneficiary entitled to receive the property from the estate. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Personal Representative Form After Death

Description

How to fill out Personal Representative Form After Death?

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of creating Personal Representative Form After Death or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific forms diligently prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Personal Representative Form After Death. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and explore the catalog. But before jumping directly to downloading Personal Representative Form After Death, follow these recommendations:

- Check the document preview and descriptions to make sure you are on the the form you are looking for.

- Make sure the form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Personal Representative Form After Death.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and turn document completion into something simple and streamlined!

Form popularity

FAQ

Generally, the person who oversees your estate is known as your ?personal representative.? California law also refers to a personal representative as an ?executor? or ?administrator.? All three terms describe the same function, although there is a legal distinction between their method of appointment.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate.

On the final tax return, the surviving spouse or representative should note that the person has died. The IRS doesn't need a copy of the death certificate or other proof of death. Usually, the representative filing the final tax return is named in the person's will or appointed by a court.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.