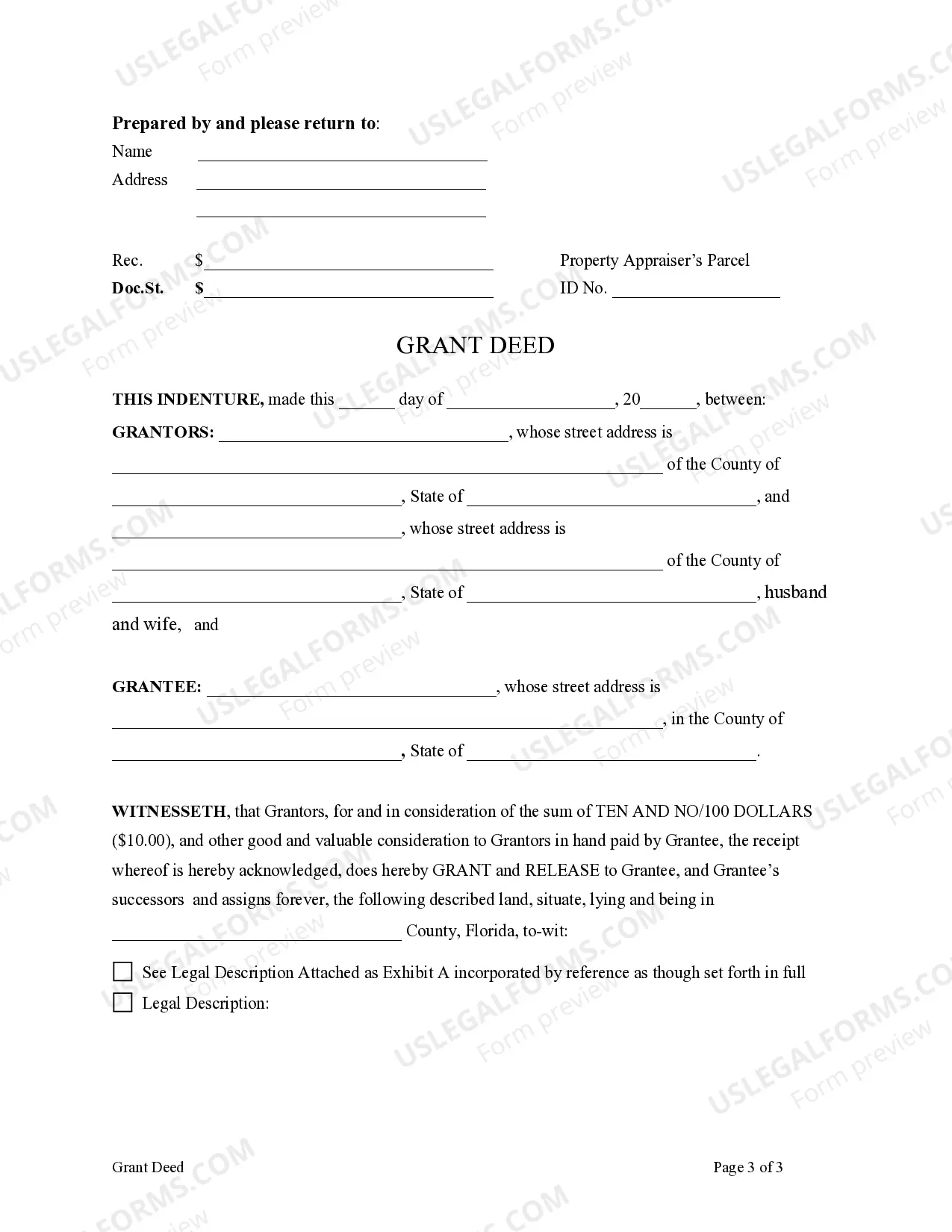

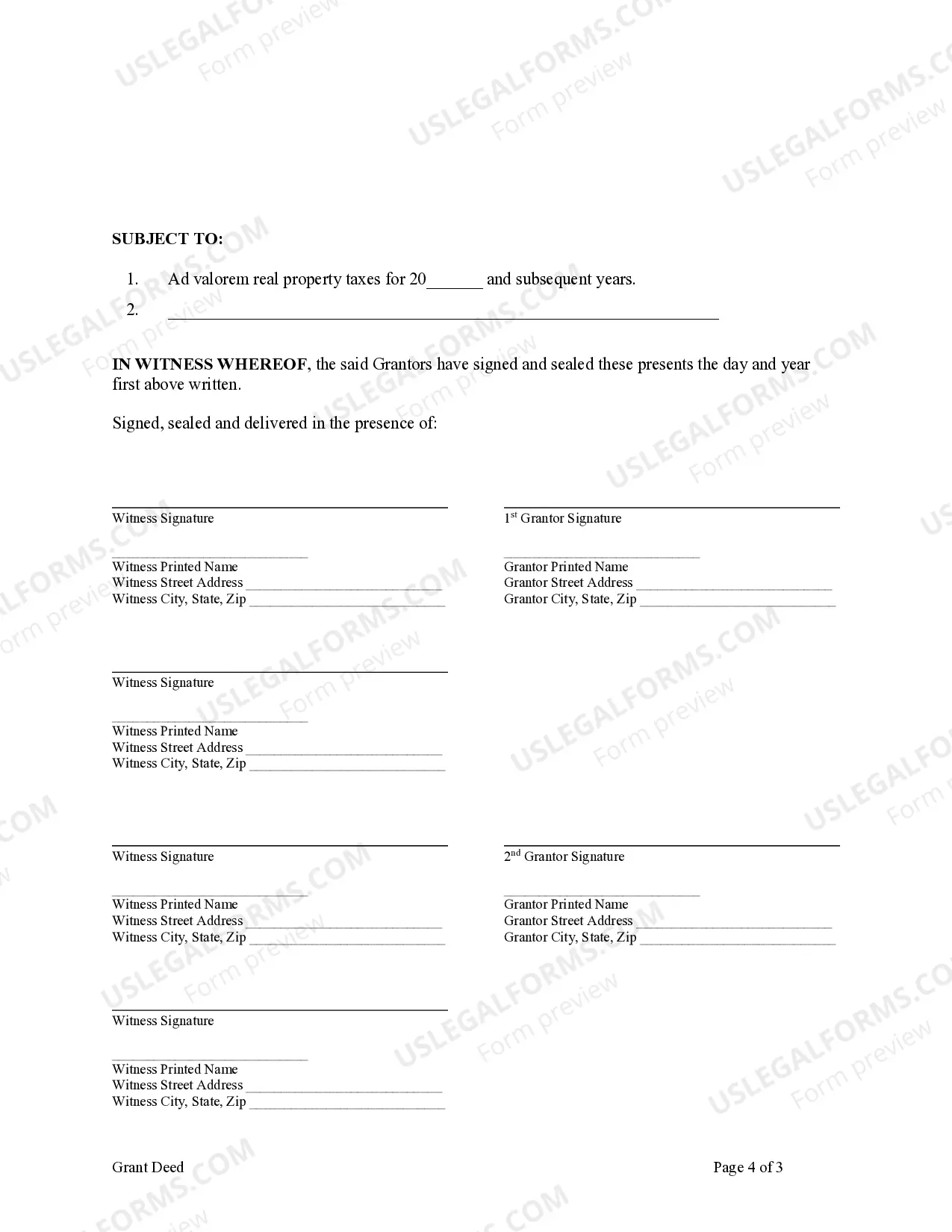

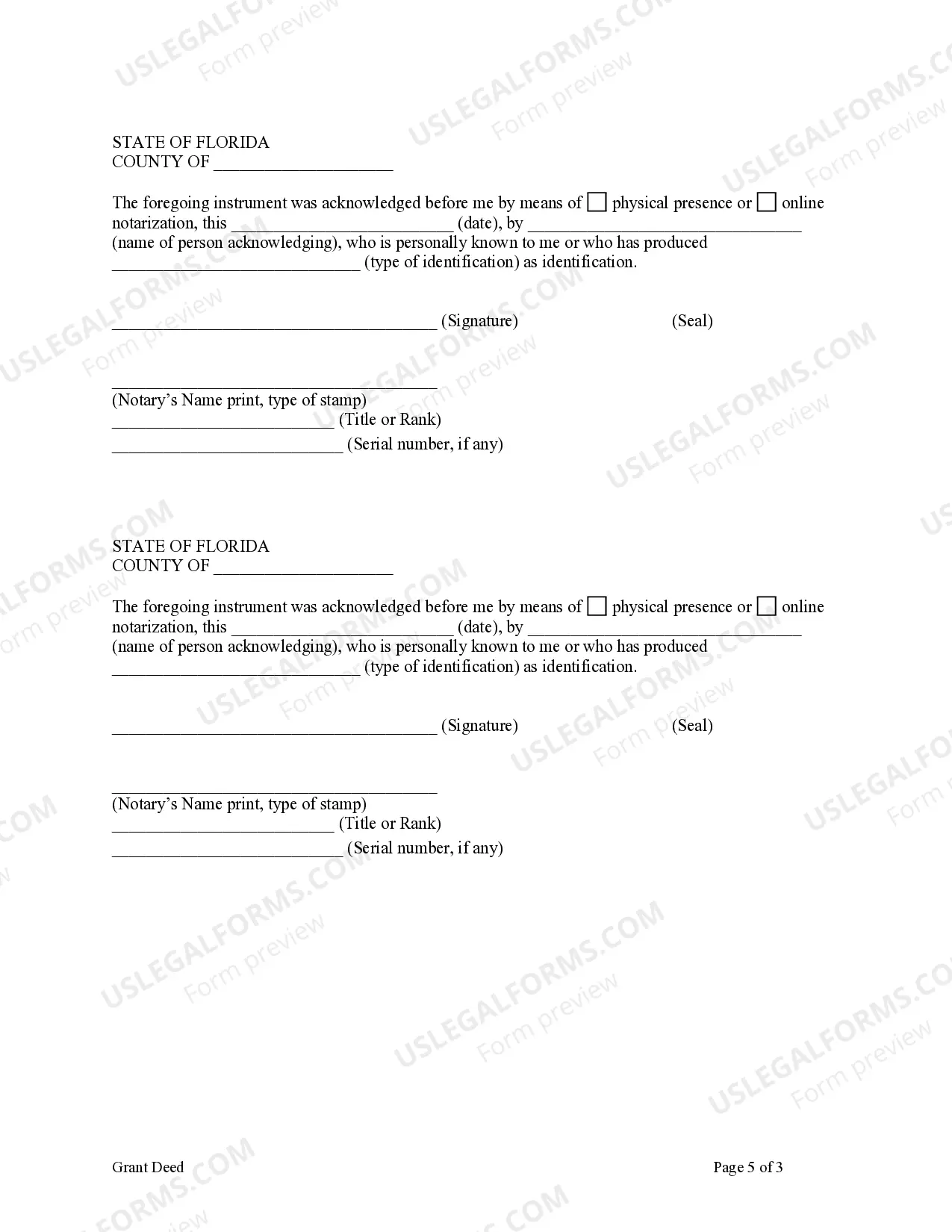

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is an individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

Grant Deed Florida With Mortgage

Description

How to fill out Grant Deed Florida With Mortgage?

Regardless of whether you frequently handle documentation or occasionally need to submit a legal report, it is essential to have a reliable resource where all the samples are pertinent and current.

The first action you should take with a Grant Deed Florida With Mortgage is to ensure that it is the most recent version, as this determines its submitability.

If you wish to make your search for the newest document examples easier, look for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search menu to locate the form you need. Review the Grant Deed Florida With Mortgage preview and details to ensure it is exactly what you're seeking. After verifying the form, simply click Buy Now. Choose a subscription plan that suits your requirements. Create an account or Log In/">Log Into your existing one. Use your credit card information or PayPal account to finalize the transaction. Select the file format for download and confirm it. Eliminate the confusion of dealing with legal documentation. All your templates will be organized and authenticated with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that includes nearly every template you might need.

- Search for the templates you need, evaluate their relevance immediately, and learn more about how to use them.

- With US Legal Forms, you have access to approximately 85,000 document templates across various fields.

- Find the Grant Deed Florida With Mortgage samples in just a few clicks and save them to your profile at any time.

- A US Legal Forms profile allows you to access all the documents you need with added convenience and less hassle.

- Simply click Log In/">Log In in the site header and navigate to My documents section where all your required forms will be available.

- You won't have to spend time searching for the appropriate template or checking its validity.

Form popularity

FAQ

Yes, if your name is on the deed in Florida, you are considered the legal owner of the property. However, this ownership comes with responsibilities, especially if there is a mortgage on the property. It's vital to understand how a grant deed Florida with mortgage affects your rights as an owner. For clarity on ownership issues, uslegalforms can offer valuable insights.

A deed can become invalid in Florida due to several factors, including lack of proper signatures or failure to comply with state requirements. For instance, if a grant deed Florida with mortgage does not include the necessary legal descriptions or is improperly executed, it may be rejected. To ensure your deed's validity, utilize resources from uslegalforms, which can guide you through the necessary steps.

Yes, you can prepare your own deed in Florida, but it requires careful attention to legal requirements. A grant deed Florida with mortgage must include specific information to ensure its validity. While it's possible to DIY, using a platform like uslegalforms can help you navigate the process and avoid potential errors, making for a smoother transaction.

In Florida, your girlfriend cannot automatically claim half of your house just because she has lived there. Ownership rights depend on the title's name, not cohabitation. However, if you've made joint financial commitments regarding the property, disputes could arise later. To secure your interests, consider using a grant deed Florida with mortgage and seek legal assistance.

If your name is on the deed but not on the mortgage in Florida, you hold ownership rights to the property, but you will not be responsible for the mortgage payments. This situation can create complications, especially during refinancing or selling the property. Understanding your rights and obligations in this circumstance is vital. You may want to consult uslegalforms for guidance on resolving any potential issues.

Transferring a property title between family members can be done effectively using a grant deed Florida with mortgage. This method ensures that the new owner receives clear title while maintaining any mortgage obligations. It is essential to consider potential tax implications and consult a legal professional to avoid complications. Using a dedicated platform like uslegalforms can streamline this process.

Yes, in Florida, you receive a deed when you buy a house, commonly in the form of a grant deed. This document serves as proof of ownership and details the specifics of your property. It is essential to ensure that the deed accurately reflects the mortgage arrangement if applicable.

To obtain a copy of your house deed in Florida, you can contact the local county clerk's office or visit their website. Most counties offer online access to property records, which allows you to search and download your grant deed. If you need assistance, consider using platforms like uslegalforms, which can simplify the process.

One disadvantage of a deed can be the potential for title defects that may come to light after the deed is executed. If a property has liens or claims, the buyer may face complications later. When navigating the complexities of grant deed Florida with mortgage, understanding these risks is essential for making informed decisions.

The safest type of deed is often considered to be the quitclaim deed when used properly, mainly in cases between family members. However, it offers minimal protection, so buyers should be cautious. For those seeking a more secure transaction, exploring a warranty deed would be a better choice when dealing with a grant deed Florida with mortgage.