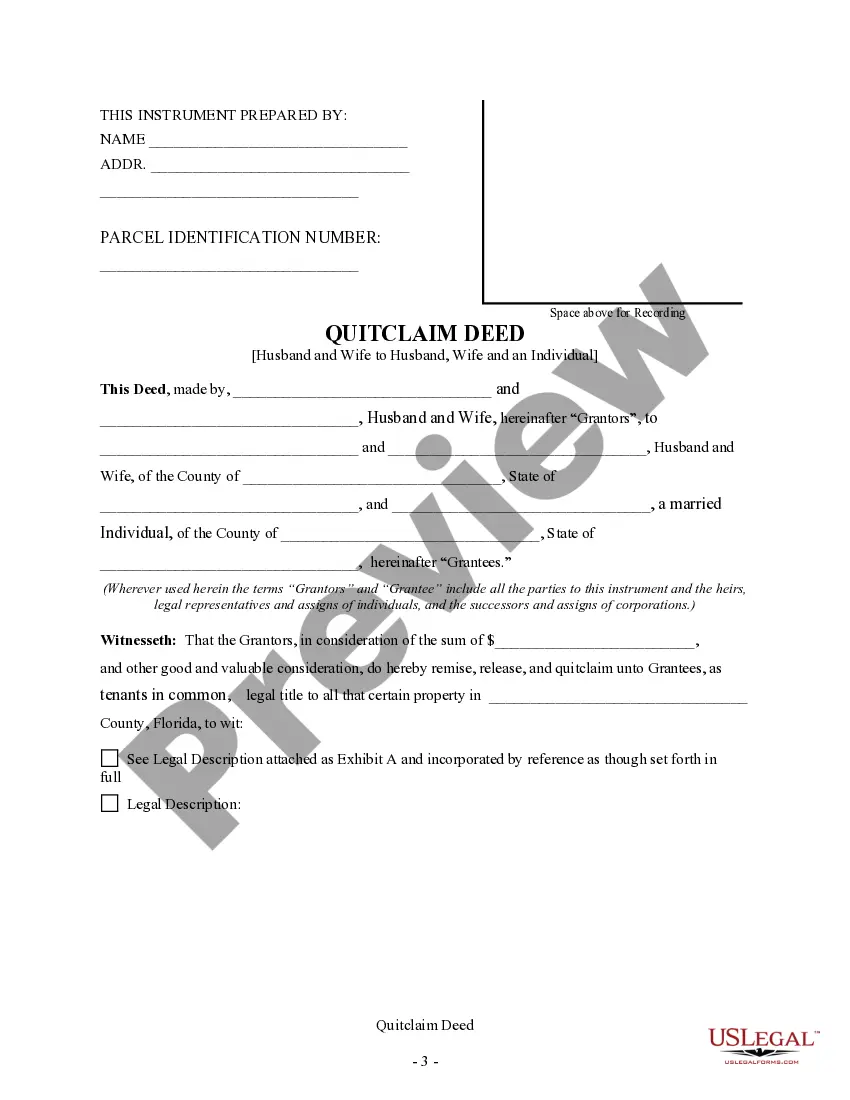

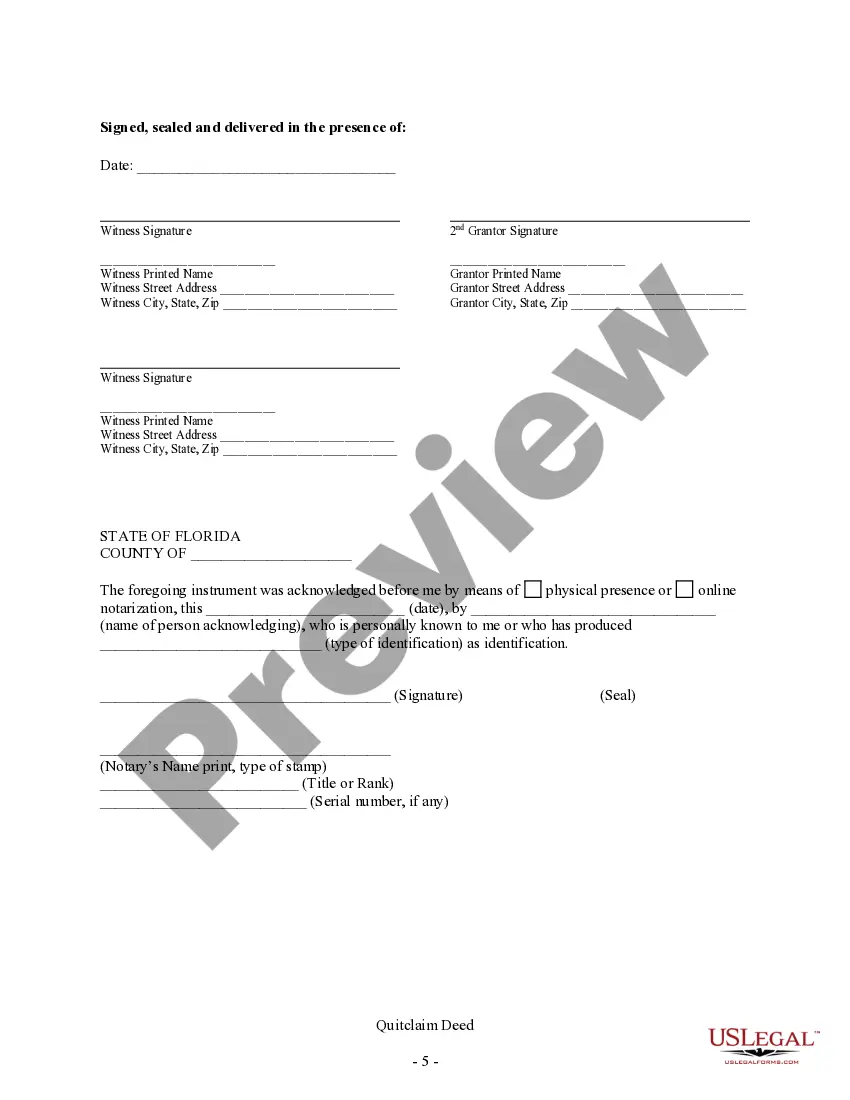

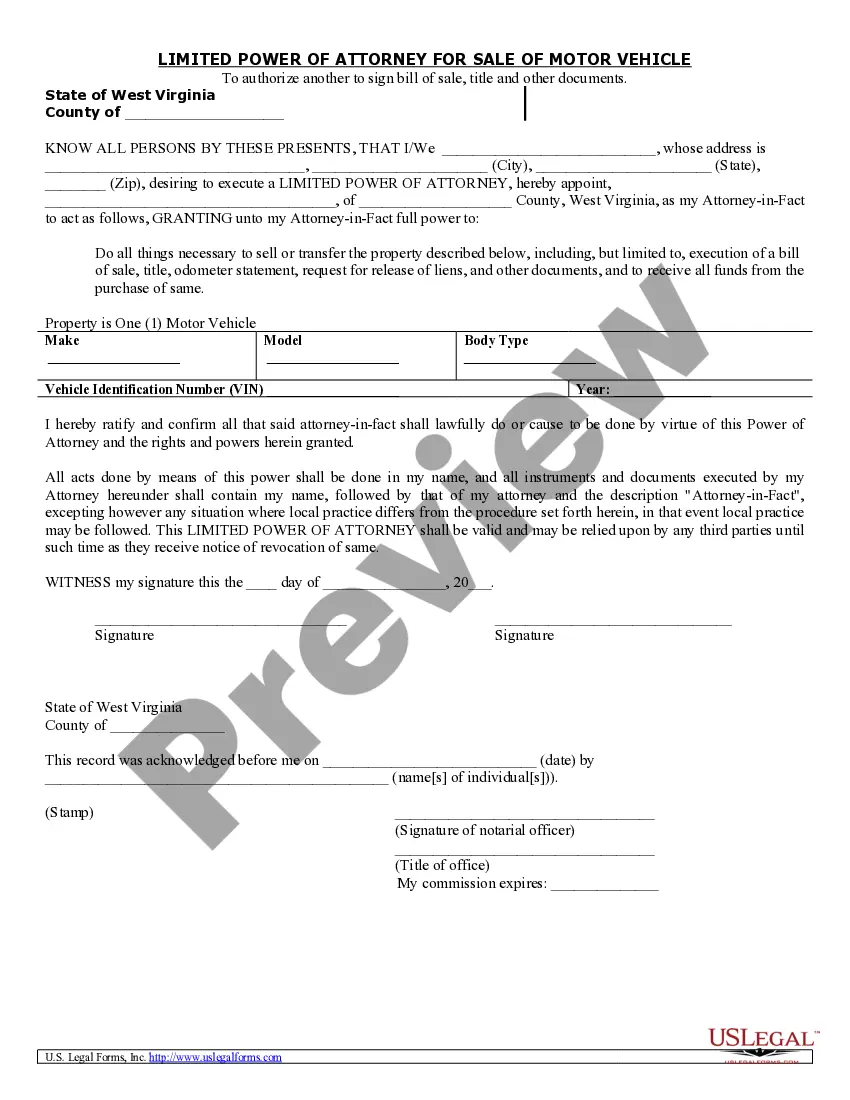

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantees are husband, wife and an individual. Grantors convey and quitclaim the described property to Grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Florida Quitclaim Deed Form With Mortgage

Description

How to fill out Florida Quitclaim Deed Form With Mortgage?

Individuals typically link legal documentation with something intricate that only an expert can manage.

In a certain sense, this is accurate, as creating a Florida Quitclaim Deed Form With Mortgage necessitates considerable expertise in subject matter guidelines, including both state and county laws.

However, with US Legal Forms, everything has become simpler: pre-made legal templates for any life and business circumstance related to state regulations are compiled in a single online repository and are now accessible to everyone.

All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them whenever necessary through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- Scrutinize the page content thoroughly to ensure it meets your requirements.

- Review the form description or inspect it through the Preview option.

- Seek another sample using the Search bar above if the previous one does not meet your expectations.

- Click Buy Now when you discover the appropriate Florida Quitclaim Deed Form With Mortgage.

- Choose a subscription plan that suits your requirements and budget.

- Sign up for an account or Log In/">Log In to progress to the payment page.

- Complete your payment via PayPal or using your credit card.

- Select the format for your file and click Download.

- Print your document or upload it to an online editor for expedited completion.

Form popularity

FAQ

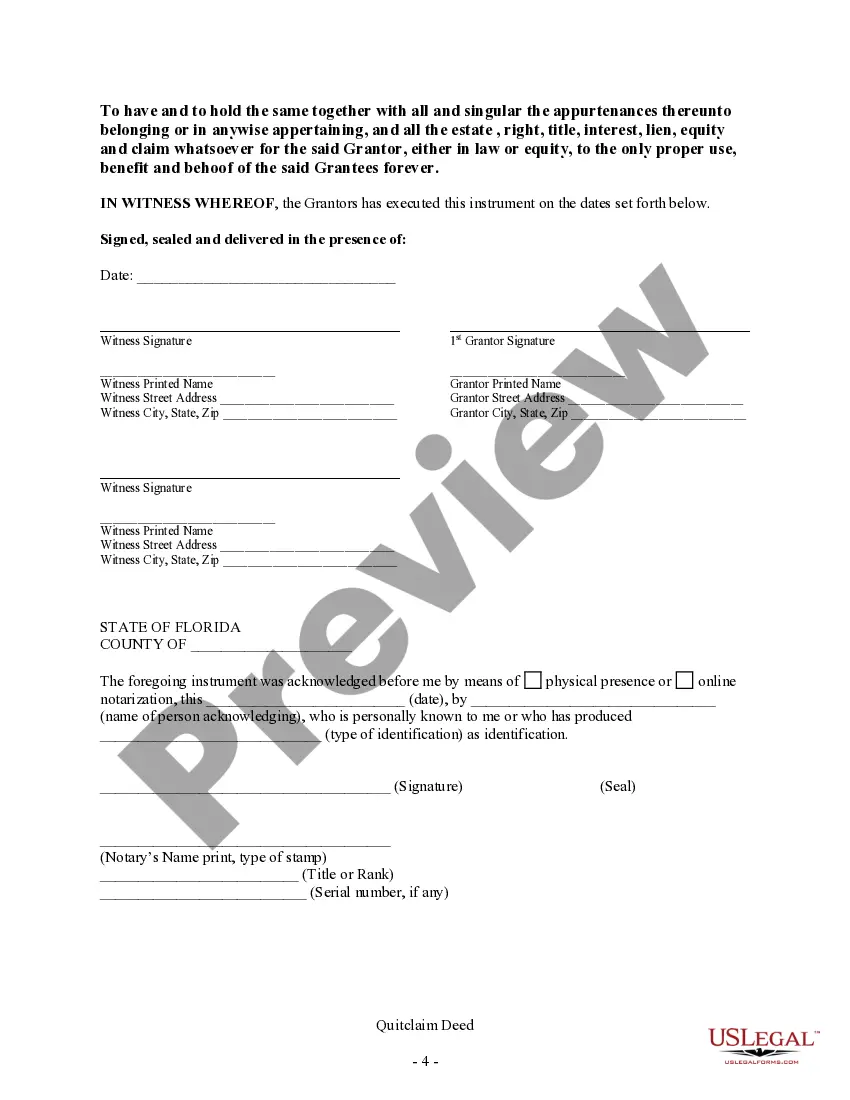

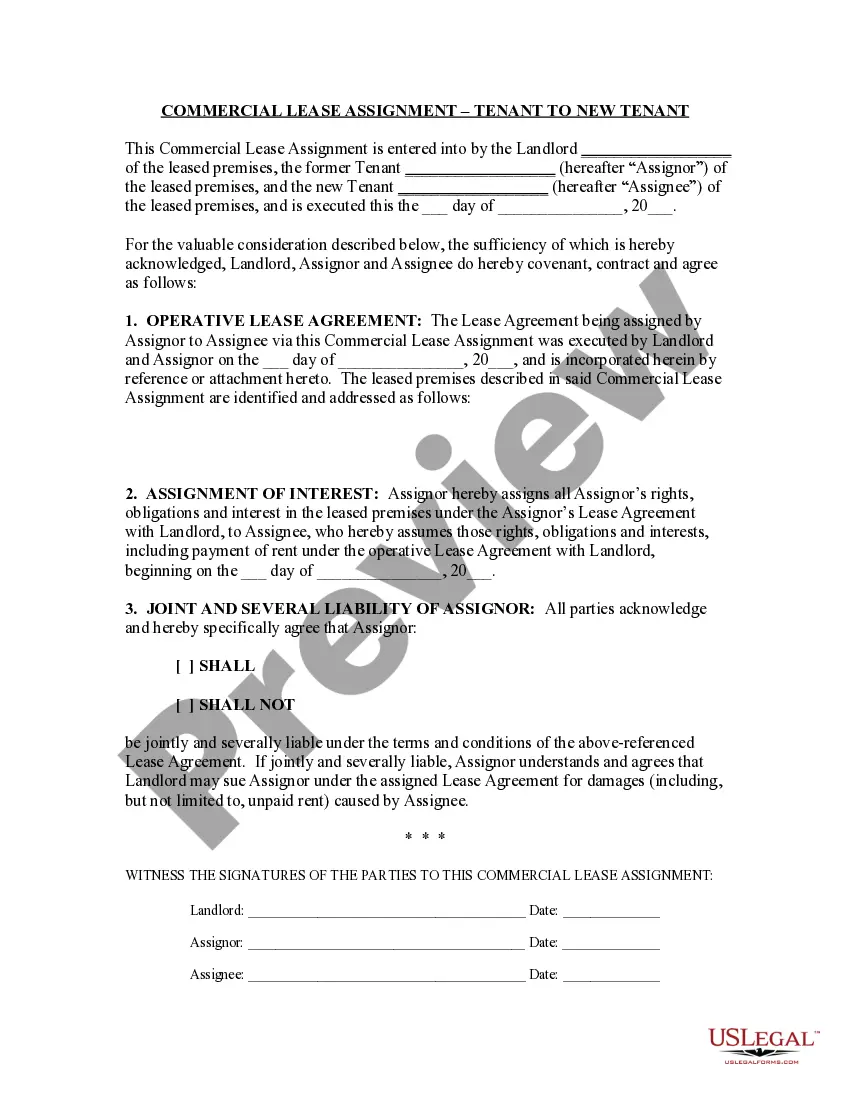

A deed in Florida must meet specific requirements to be considered valid, including clear identification of the parties, a description of the property, and proper execution. Additionally, it may require notarization and recording to protect against disputes. Using a Florida quitclaim deed form with mortgage adds an extra layer of assurance for both parties. It's advisable to follow these guidelines to safeguard your ownership rights.

Florida operates as a mortgage state, meaning the mortgage serves as the primary tool for securing loans against real estate. Despite this, both deeds and mortgages play crucial roles in property transactions. A Florida quitclaim deed form with mortgage can often be used together to facilitate the transfer of property ownership and financing arrangements. Understanding this framework ensures a smoother property transaction experience.

If your name is on the deed but not on the mortgage in Florida, you retain ownership of the property, but you are not responsible for the mortgage debt. This situation can lead to complexities, particularly in cases of foreclosure. Using a Florida quitclaim deed form with mortgage may help clarify ownership rights and financial responsibilities. Consulting with a legal professional can provide clarity and direction.

Florida law views an agreement for deed as more of a sales contract than a traditional mortgage. However, it can carry similar responsibilities. When using a Florida quitclaim deed form with mortgage in this context, it’s essential to clarify the nature of the agreement to avoid misunderstandings. Understanding these distinctions helps protect your investment and rights.

In Florida, a contract for deed is legal, but it comes with specific legal implications. It functions similarly to a mortgage, allowing the buyer to occupy the property while making payments. This type of arrangement may involve a Florida quitclaim deed form with mortgage to ensure all parties are protected. It's vital to consult legal advice to understand obligations and rights in such agreements.

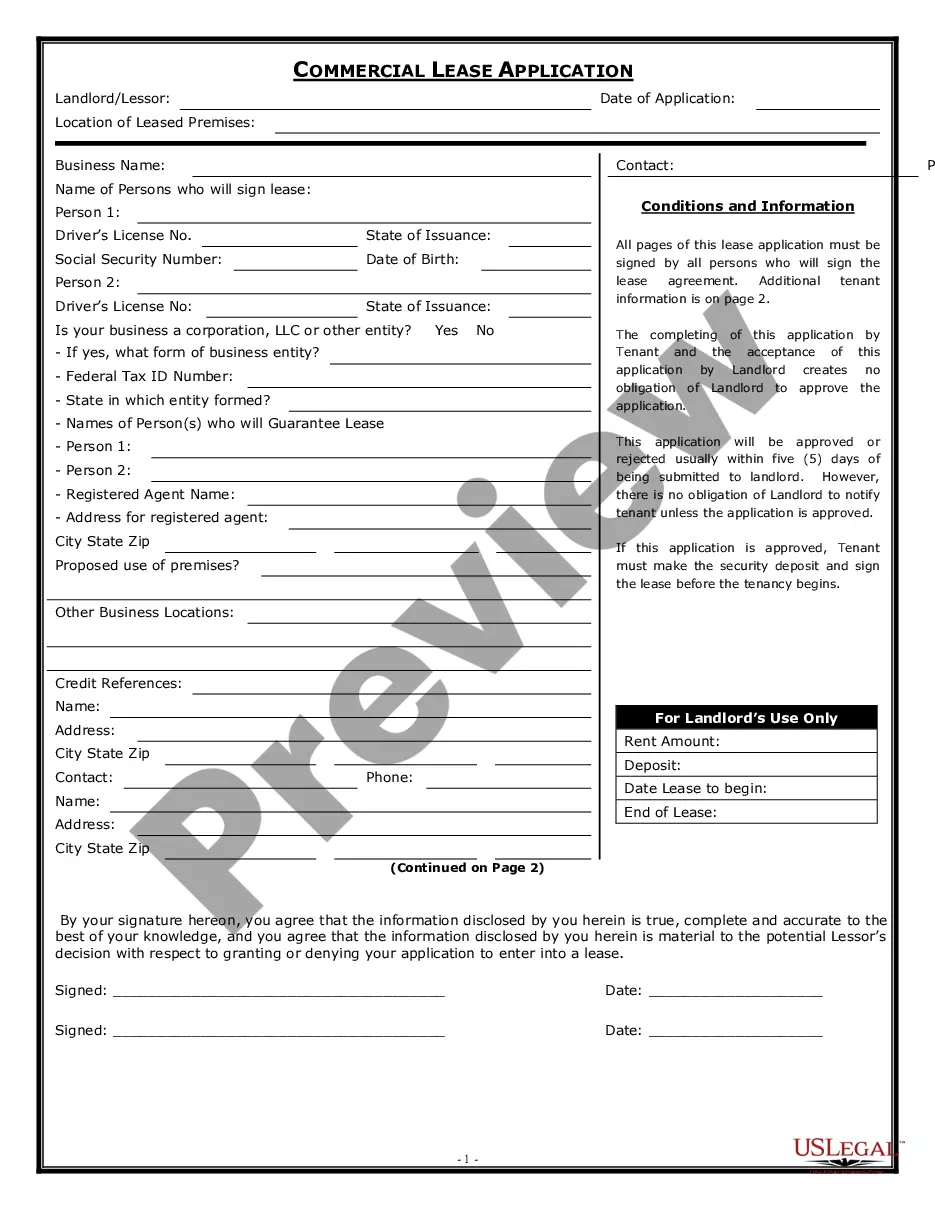

To properly fill out a quit claim deed in Florida, begin by entering the required parties' names and the property's legal description. It is important to state that it is a quit claim deed clearly. After completing the form, both the grantor and a notary need to sign it. Finally, submit the document to your local county office to ensure that the Florida quitclaim deed form with mortgage is officially recorded.

Filling out the quitclaim deed form involves a few key steps. First, enter the full names and addresses of both the grantor and grantee. Next, provide a clear description of the property, including its address or legal description. Don't forget to sign and date the form, then have it notarized. You can find templates and additional guidance on filling out the Florida quitclaim deed form with mortgage on the US Legal Forms platform.

To fill out a Florida quit claim deed, start by gathering all relevant information, including the names of the grantor and grantee, the property's legal description, and any applicable consideration amount. Ensure you follow the correct format required by Florida law, and sign the document in front of a notary. Afterward, file the completed Florida quitclaim deed form with mortgage at your local county clerk's office.

The main disadvantage of a quitclaim deed is that it provides no guarantees about the property's title. This means you may inherit existing liens or claims against the property, which can lead to financial loss. Additionally, if the grantor has no legal ownership, you may not receive any property rights. Therefore, it’s crucial to understand these risks when using a Florida quitclaim deed form with mortgage.

Recording a deed in Florida typically takes from a few days to a couple of weeks, depending on the volume of filings at the county office. Once filed, the recording office will provide a confirmation that the deed has been recorded. To ensure a smooth process, using the Florida quitclaim deed form with mortgage available on our site simplifies preparation and submission, helping you track the status more easily.