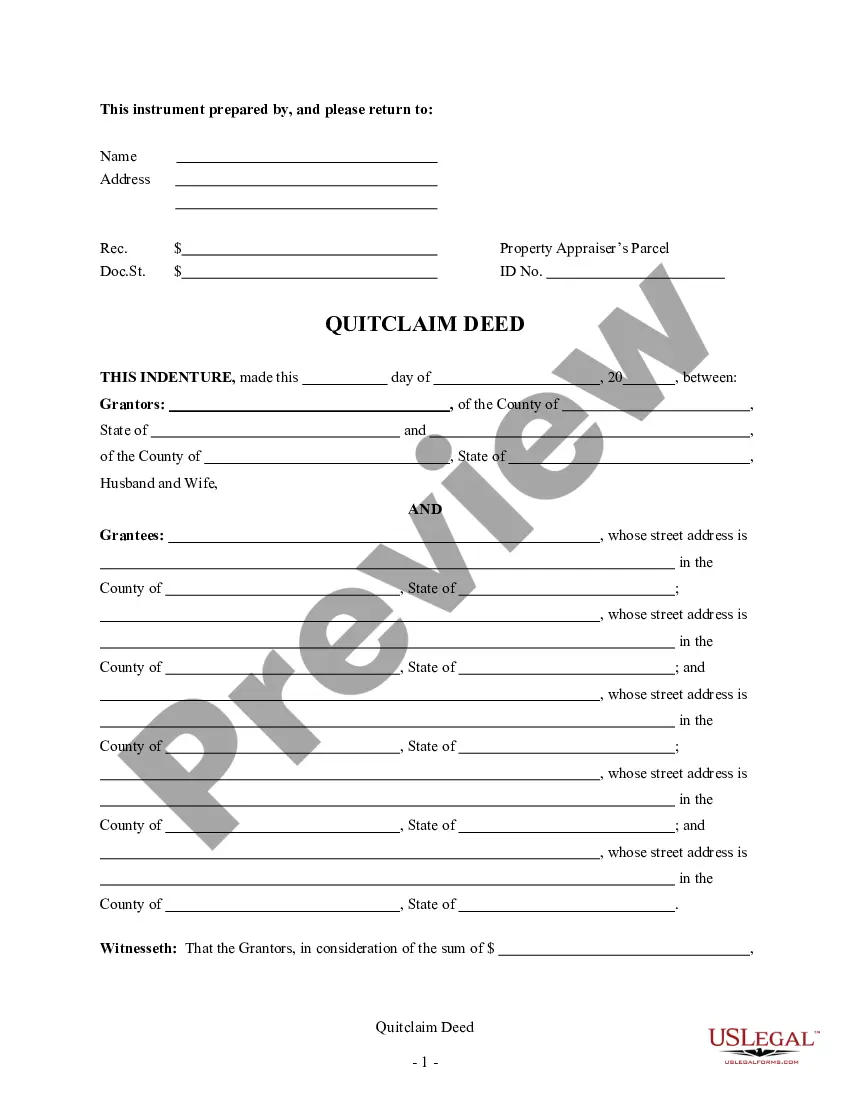

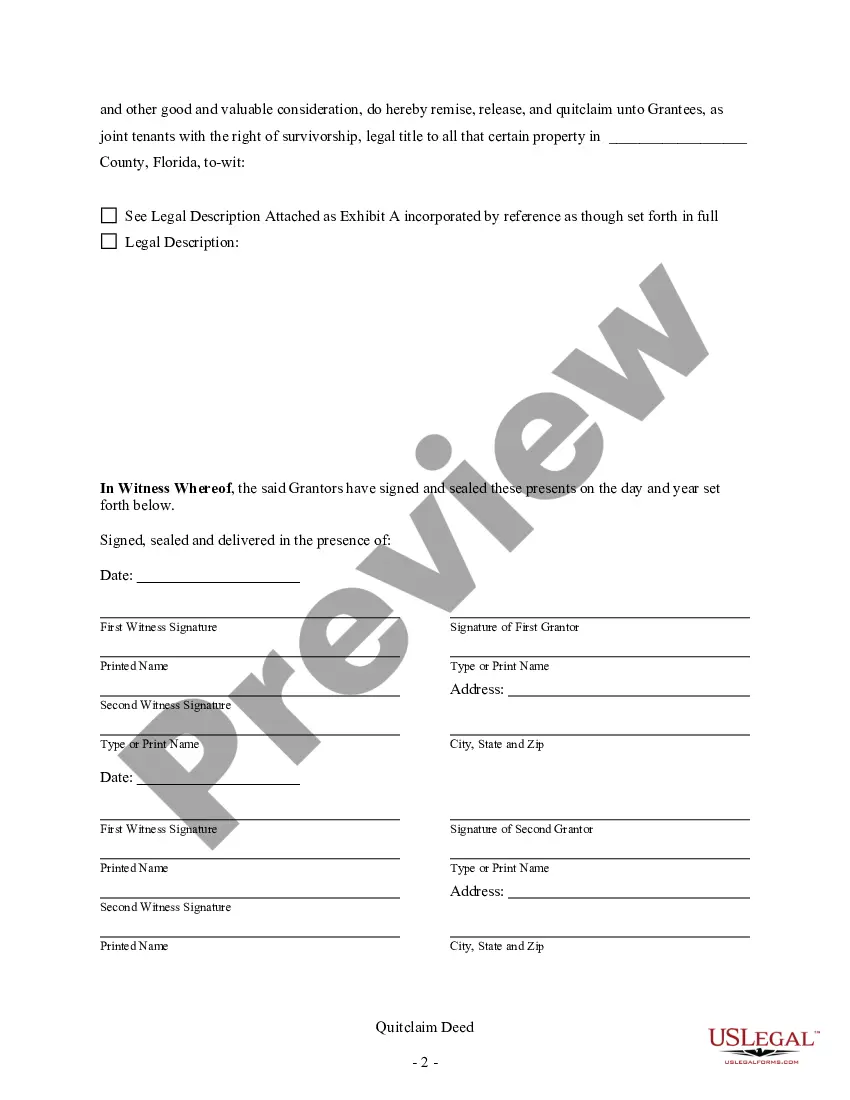

This form is a Quitclaim Deed where the Grantors are Husband and Wife, or two Individuals, and the Grantees are Five Individuals. Grantors convey and quitclaim the described property to Grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Florida Deed Husband With Life Estate

Description

How to fill out Florida Deed Husband With Life Estate?

Steering through the red tape of standard documents and templates can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate template for a Florida Deed Husband With Life Estate will require considerable time, as it must be legitimate and precise to the last detail.

Nevertheless, you will need to invest significantly less time acquiring an appropriate template if it originates from a source you can trust.

Acquire the appropriate form in a few straightforward steps: Enter the name of the document in the search field, locate the correct Florida Deed Husband With Life Estate among the results, review the description of the sample or view its preview, if the template meets your standards, click Buy Now, proceed to select your subscription plan, use your email and create a password to register an account at US Legal Forms, choose a credit card or PayPal payment option, save the template document on your device in your preferred format. US Legal Forms will save you time and effort determining whether the form you found online is suitable for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of seeking the correct forms online.

- US Legal Forms serves as a single destination for discovering the most current samples of documents, understanding their usage, and downloading these samples for completion.

- This is a compilation of over 85K forms applicable in diverse areas.

- When searching for a Florida Deed Husband With Life Estate, you will not have to question its validity as all the forms are confirmed.

- Having an account at US Legal Forms will ensure you have all the essential samples at your fingertips.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by simply clicking Log In/">Log In on the library site.

- If you still don’t possess an account, you can always search anew for the template you require.

Form popularity

FAQ

In Florida, a life estate can qualify for homestead protection as long as the life tenant occupies the property as their primary residence. This protection allows the property to be shielded from certain creditors and may affect how property taxes are assessed. To determine eligibility in your specific situation, consulting resources like US Legal Forms can provide valuable insights and help you with the necessary documentation.

Yes, a life estate can generally be revoked or changed in Florida, but this requires the agreement of all parties involved. If the life tenant wishes to cancel the life estate, they may need to execute a formal deed revocation, especially if they wish to transfer their rights. Engaging with a service like US Legal Forms can help navigate the complexities of this legal process.

In Florida, an individual holding a life estate can sell their interest in the property; however, this does not include the rights of the remaindermen. Selling a life estate means transferring the life tenant's rights to another party, but the new owner will only have the property until the life tenant passes away. It’s advisable to consult an attorney or a professional service like US Legal Forms to understand the implications of such a sale.

In Florida, when a property owner passes away, the ownership of the property typically transfers to the designated beneficiaries. If the deceased had a Florida deed husband with a life estate, the life tenant retains the right to use the property during their lifetime, while the remaindermen receive the property after the life tenant's death. It’s important to review the deed to understand the specifics of ownership transfer.

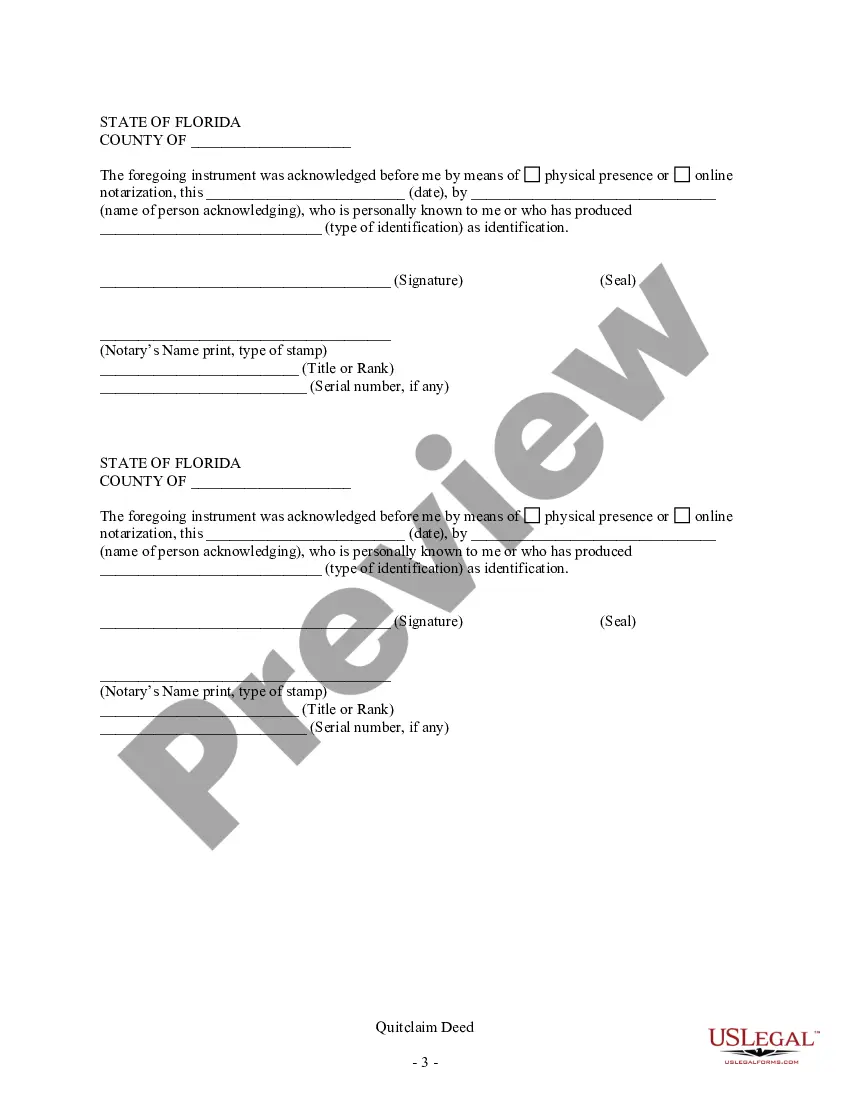

To create a life estate deed in Florida, the deed must be signed by the property owner (grantor) and must include the names of both the life tenant and the remainderman. Additionally, the deed should be notarized and recorded with the local county clerk. Understanding these requirements is essential when preparing a Florida deed husband with life estate, ensuring all legal formalities are properly addressed.

An enhanced life estate deed in Florida, often referred to as a Lady Bird deed, must include the grantor's information, the property description, and the designated remainder beneficiaries. This type of deed allows the grantor to retain full control of the property without losing any rights during their lifetime. It’s a smart option for those considering a Florida deed husband with life estate, as it offers additional flexibility and protection.

Yes, a life estate deed can be contested in Florida under certain circumstances, such as claims of undue influence or lack of legal capacity. Interested parties, including those not named in the deed, may challenge its validity in court. This is where understanding the specifics of a Florida deed husband with life estate can help navigate potential disputes.

In Florida, a life estate deed allows one person to maintain control of a property for their lifetime while transferring ownership to another party after their passing. The person who holds the life estate retains rights to use the property and is responsible for its upkeep. This arrangement can benefit families, particularly those involving a Florida deed husband with life estate, by ensuring property remains within the family.

If your husband dies and the house is solely in his name, ownership will typically transfer to you if you are listed as the beneficiary or co-owner. If no such arrangements exist, the property may go through probate. Understanding your rights can be complex, but resources like US Legal Forms can assist you in navigating the process effectively, especially regarding a Florida deed husband with life estate.

To change the deed on your house after your spouse dies in Florida, gather essential documents like the death certificate and any existing deeds. Create a new deed that removes your spouse’s name and file it with the county clerk. Platforms like US Legal Forms can provide you with templates specifically tailored for situations involving Florida deed husband with life estate.