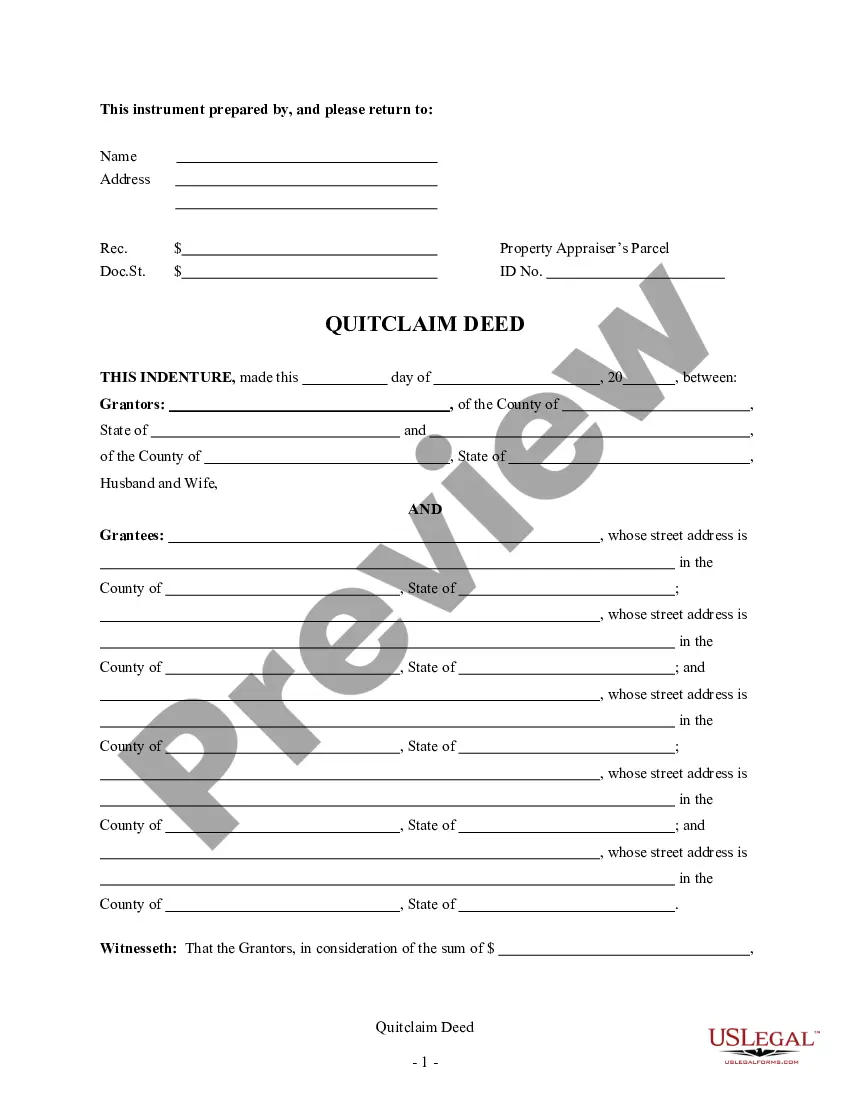

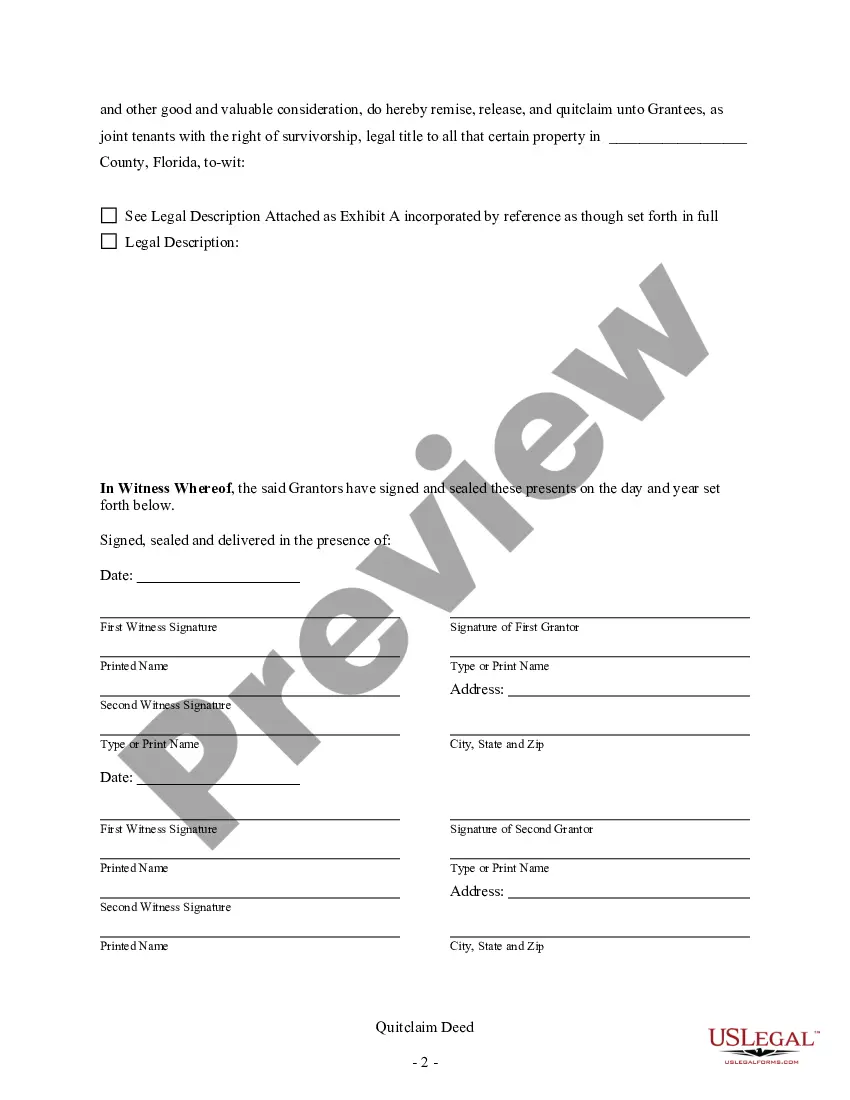

This form is a Quitclaim Deed where the Grantors are Husband and Wife, or two Individuals, and the Grantees are Five Individuals. Grantors convey and quitclaim the described property to Grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Florida Deed Husband With Life Estate Form

Description

How to fill out Florida Deed Husband With Life Estate Form?

Bureaucracy demands exactness and correctness.

Unless you regularly handle completing forms like Florida Deed Husband With Life Estate Form, it may lead to some misunderstanding.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any frustrations of resending a document or starting the same task from the beginning.

Acquiring the correct and updated samples for your documentation is achieved within minutes with an account at US Legal Forms. Eliminate the bureaucracy worries and simplify your paperwork.

- Find the template using the search bar.

- Ensure the Florida Deed Husband With Life Estate Form you've located is suited for your state or region.

- Access the preview or examine the description detailing the use of the template.

- When the result aligns with your search, click the Buy Now button.

- Select the appropriate choice among the proposed subscription options.

- Sign in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal payment method.

- Download the form in the format of your preference.

Form popularity

FAQ

Yes, you can sell a property with a life estate in Florida, but the life tenant retains the right to live in the property until their death. The sale often requires the cooperation of the life tenant, and the use of the Florida deed husband with life estate form can help clarify the sale terms. Consulting a professional can ensure compliance with all legal requirements.

In Florida, the life tenant is generally responsible for paying property taxes on the life estate. This individual benefits from the property during their lifetime, so they must also meet tax obligations. However, both the life tenant and the remaindermen should review their responsibilities outlined in the Florida deed husband with life estate form to avoid conflicts.

To terminate a life estate in Florida, both the life tenant and the remaindermen must agree to end it. This typically involves signing the Florida deed husband with life estate form to relinquish the life estate rights. If you need further assistance, consulting a legal expert can help you navigate the process smoothly.

Yes, you can sell a house while in probate in Florida, but it usually requires court approval. The process may involve filing specific documents and obtaining permission from the probate court. Utilizing resources like the Florida deed husband with life estate form can streamline this process and clarify any rights involved.

Yes, you can homestead a life estate in Florida. If you meet the eligibility requirements, your life estate may qualify for homestead protection. This protection can provide you with tax benefits and help safeguard your property from creditors, making it a valuable option for homeowners.

Yes, a life estate can be changed in Florida, but it typically requires the consent of both the life tenant and the remaindermen. The Florida deed husband with life estate form can be utilized to make such changes, ensuring that all parties agree to the new terms. It's important to consult a legal professional to understand the implications of these changes.

Adding someone to a deed in Florida can have various tax implications, including potential transfer taxes and changes in property taxes. Depending on the circumstances, it may also affect the capital gains tax when selling the property. It is wise to seek guidance on the Florida deed husband with life estate form to understand how these changes may impact your tax situation before proceeding.

After the death of a spouse in Florida, changing the deed typically involves transferring ownership according to the deceased's wishes or the existing property arrangement. This process might require updating the deed with the Florida deed husband with life estate form if applicable. Additionally, you may need to file a death certificate and other relevant documents with the county clerk's office to reflect this change.

In Florida, you do not necessarily need a lawyer to add a name to a deed; however, consulting one can help avoid potential issues. The process can be complex, so having expert advice can ensure that all legal requirements are met. Many people use a Florida deed husband with life estate form as a guide, but personal circumstances might warrant professional assistance.

To add your spouse to your house deed in Florida, you can complete a new deed that lists both your names. This often involves getting a Florida deed husband with life estate form, which outlines the ownership structure clearly. After preparing the deed, you will need to sign it in front of a notary and file it with your local property records office to make it official.