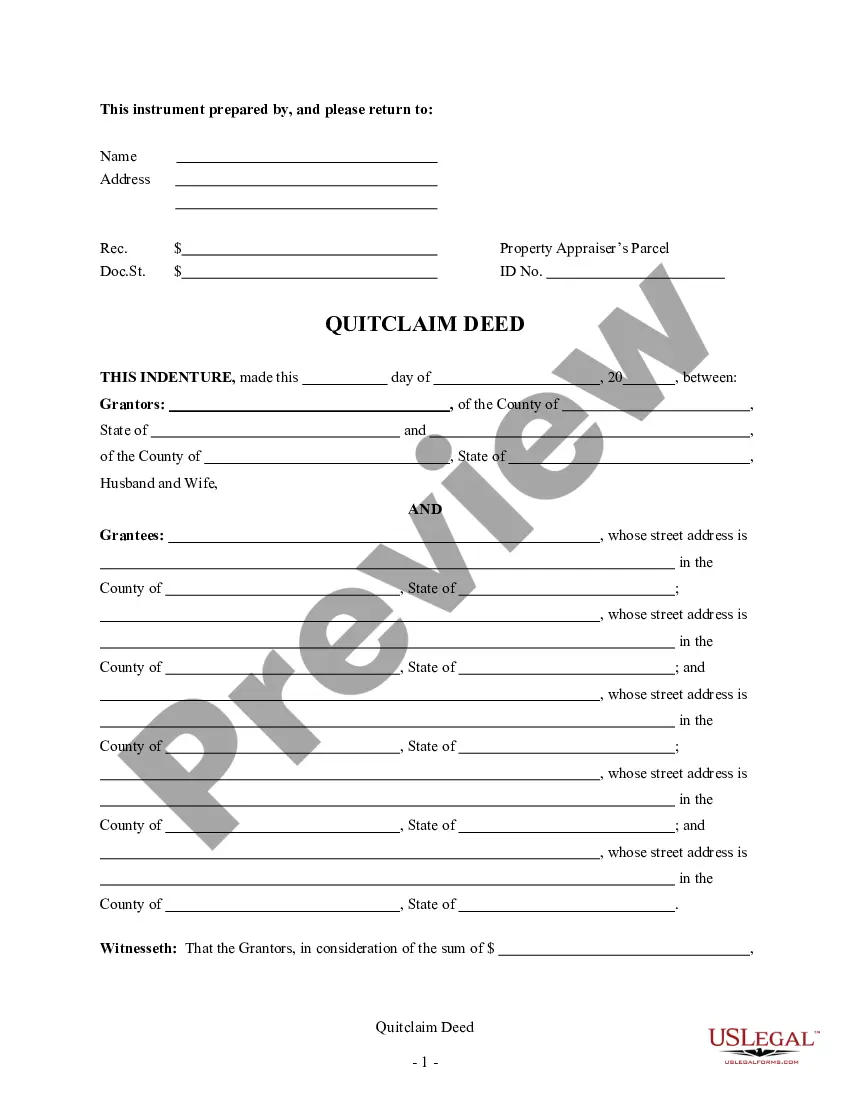

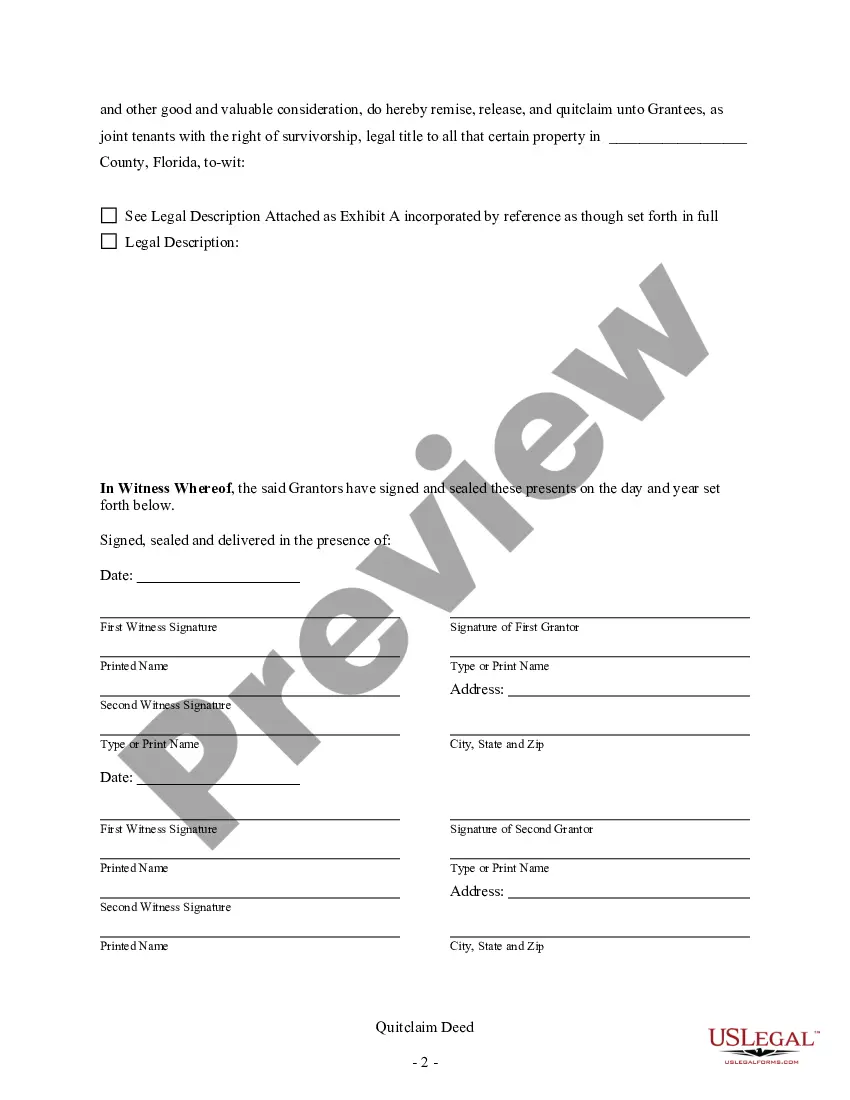

This form is a Quitclaim Deed where the Grantors are Husband and Wife, or two Individuals, and the Grantees are Five Individuals. Grantors convey and quitclaim the described property to Grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Florida Deed Husband With Mortgage

Description

How to fill out Florida Deed Husband With Mortgage?

What is the most trustworthy service to acquire the Florida Deed Husband With Mortgage and other updated versions of legal documents? US Legal Forms is the answer!

It holds the largest assortment of legal documents for any purpose. Each template is skillfully drafted and confirmed for adherence to federal and local regulations.

Form compliance evaluation. Before acquiring any template, ensure it meets your usage requirements and adheres to your state or county regulations. Review the form description and utilize the Preview option if available.Alternative form search. If you find any discrepancies, use the search bar in the header to find another template. Click Buy Now to choose the appropriate one.Account registration and subscription purchase. Choose the best pricing plan, Log In/">Log In or register your account, and finalize your subscription payment through PayPal or credit card.Downloading the documents. Choose the format in which you desire to save the Florida Deed Husband With Mortgage (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent choice for anyone requiring assistance with legal documentation. Premium users can enjoy additional features as they complete and sign previously saved documents electronically whenever they wish using the integrated PDF editing tool. Explore it now!

- They are grouped by area and state of usage, making it easy to find the one you need.

- Experienced users of the platform simply need to Log In/">Log In to the system, verify their subscription status, and click the Download button next to the Florida Deed Husband With Mortgage to retrieve it.

- Once downloaded, the template can be accessed again in the My documents section of your profile.

- If you do not yet have an account with us, follow these steps to create one.

Form popularity

FAQ

A spouse does not have to be on the deed in Florida, but this can affect property rights and inheritance. If the property is owned solely by one spouse, the other may not automatically inherit it unless specified in a will. It is valuable to consider the implications of the Florida deed husband with mortgage when deciding on how property title is handled.

Yes, a married man can buy a house without his wife's name on the mortgage or deed in Florida. However, this may affect marital property rights. It is wise to consider how a Florida deed husband with mortgage interactions will influence future claims, especially in cases of marital separation or property disputes.

You can leave your spouse off the title of a property in Florida, but doing so can lead to complications down the line. If your spouse contributes to the mortgage or home expenses, they may still claim an interest in the property despite not being on the title. It’s advisable to consult a legal professional to ensure clarity in relationships concerning a Florida deed husband with mortgage.

If a spouse's name is not on the deed, that spouse may not have a legal claim to the property in Florida during divorce or bankruptcy. This can be significant because the non-titled spouse may have limited rights regarding the property's division. Therefore, knowing the implications of a Florida deed husband with mortgage can guide decisions on property ownership and rights.

Florida law does not require both spouses to be on the deed of a property. However, having both names on the deed can simplify inheritance and property rights for the surviving spouse. Therefore, if you hold a mortgage, consider how the title is structured concerning the Florida deed husband with mortgage to avoid potential disputes later.

In Florida, property acquired during the marriage is considered marital property, regardless of the title. This means that, in the event of divorce, your husband may be entitled to a portion, possibly half, of the house's equity, even if the deed is solely in your name. It's essential to plan with the Florida deed husband with mortgage situation in mind to protect your assets appropriately.

In Florida, when one spouse passes away, the surviving spouse often has rights to the deceased spouse's property, depending on how the property is titled. If the property is held as a joint tenancy, the surviving spouse automatically inherits the property. However, complexities may arise if there is a will or if the property is solely in the deceased spouse's name. Understanding Florida deed laws related to a husband with a mortgage can clarify these situations.

To add a spouse to a deed in Florida, you will need to prepare a new deed that includes your spouse's name. This process usually requires both parties to sign the new deed in front of a notary. After signing, you must record the new deed with the county property appraiser's office. If there's a mortgage involved, like a Florida deed husband with mortgage, ensure that your lender is informed to avoid potential issues.

Adding someone to a deed in Florida can have various consequences, which may include changes in property ownership rights and potential impacts on your mortgage. The person added will gain an ownership interest, which could complicate future transactions involving the property. Additionally, it's essential to understand that this action can have implications for estate planning and taxes. Platforms like uslegalforms are excellent resources for understanding these consequences and providing guidance.

While you are not required to hire a lawyer to add a name to a deed in Florida, it can be beneficial to consult one, especially if the property is under a mortgage. A lawyer can help ensure that the process adheres to Florida laws and guidelines. If you prefer a more straightforward approach, consider using platforms like uslegalforms that provide reliable resources and templates for creating and filing deeds. This way, you can proceed with confidence.