Lady Bird Deed Florida Form Printable With Pictures

Description

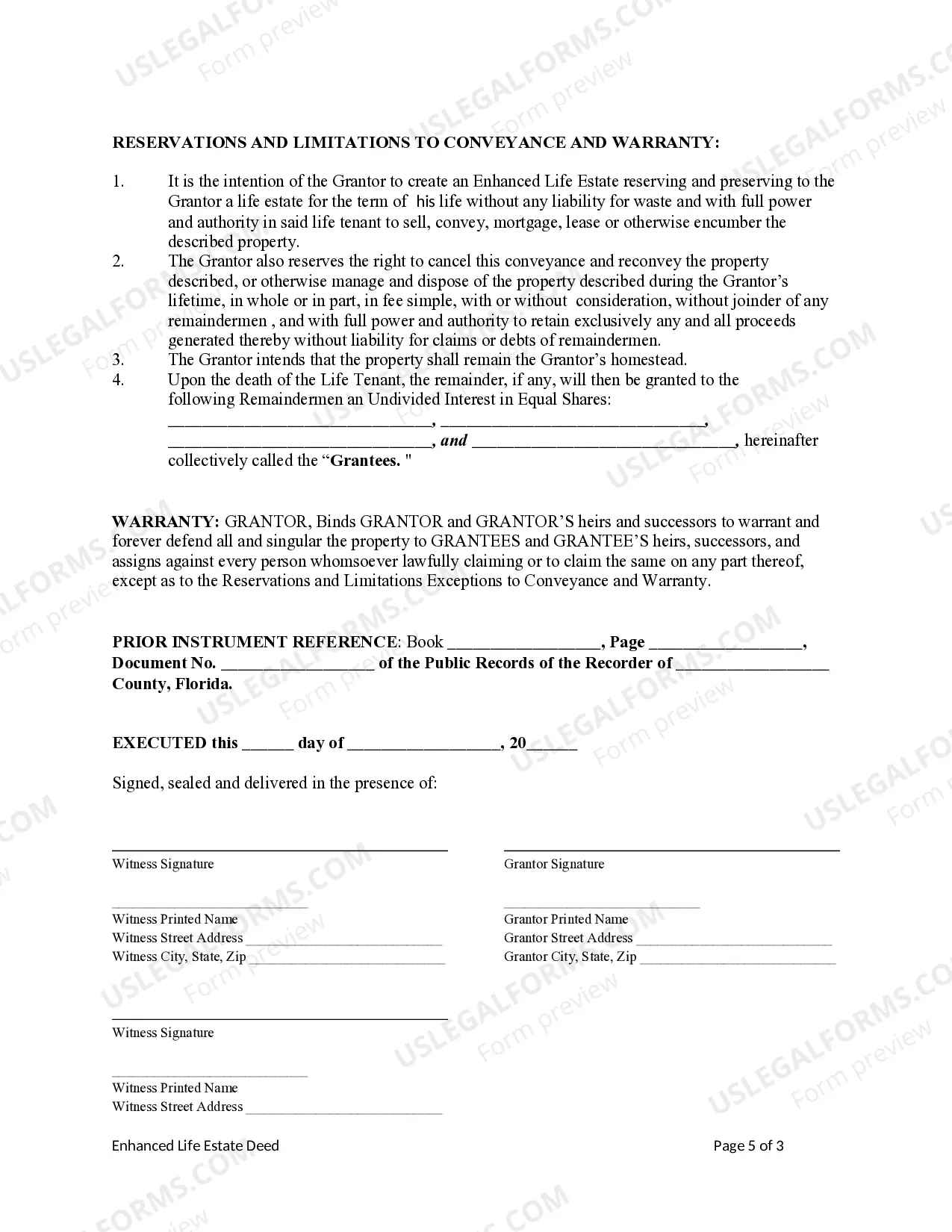

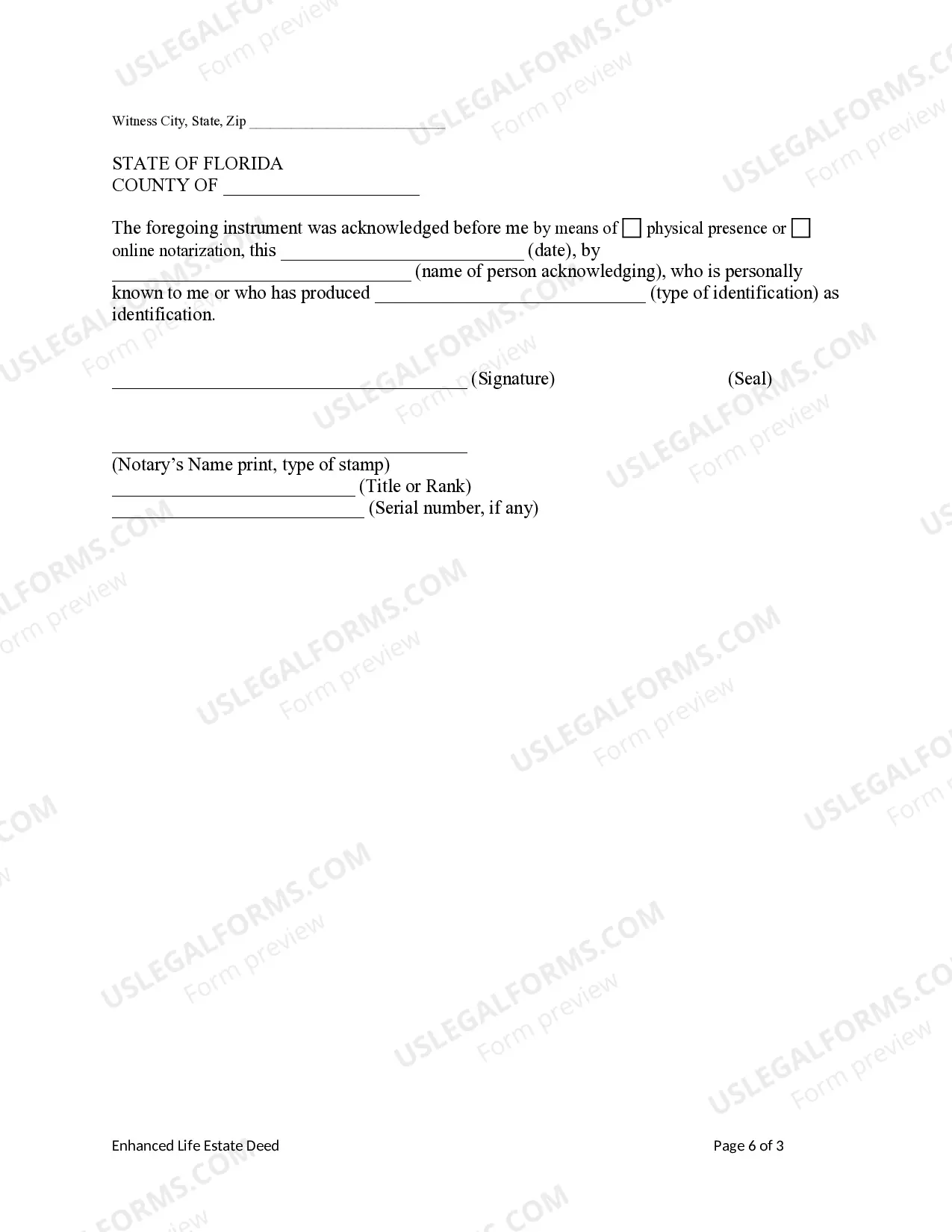

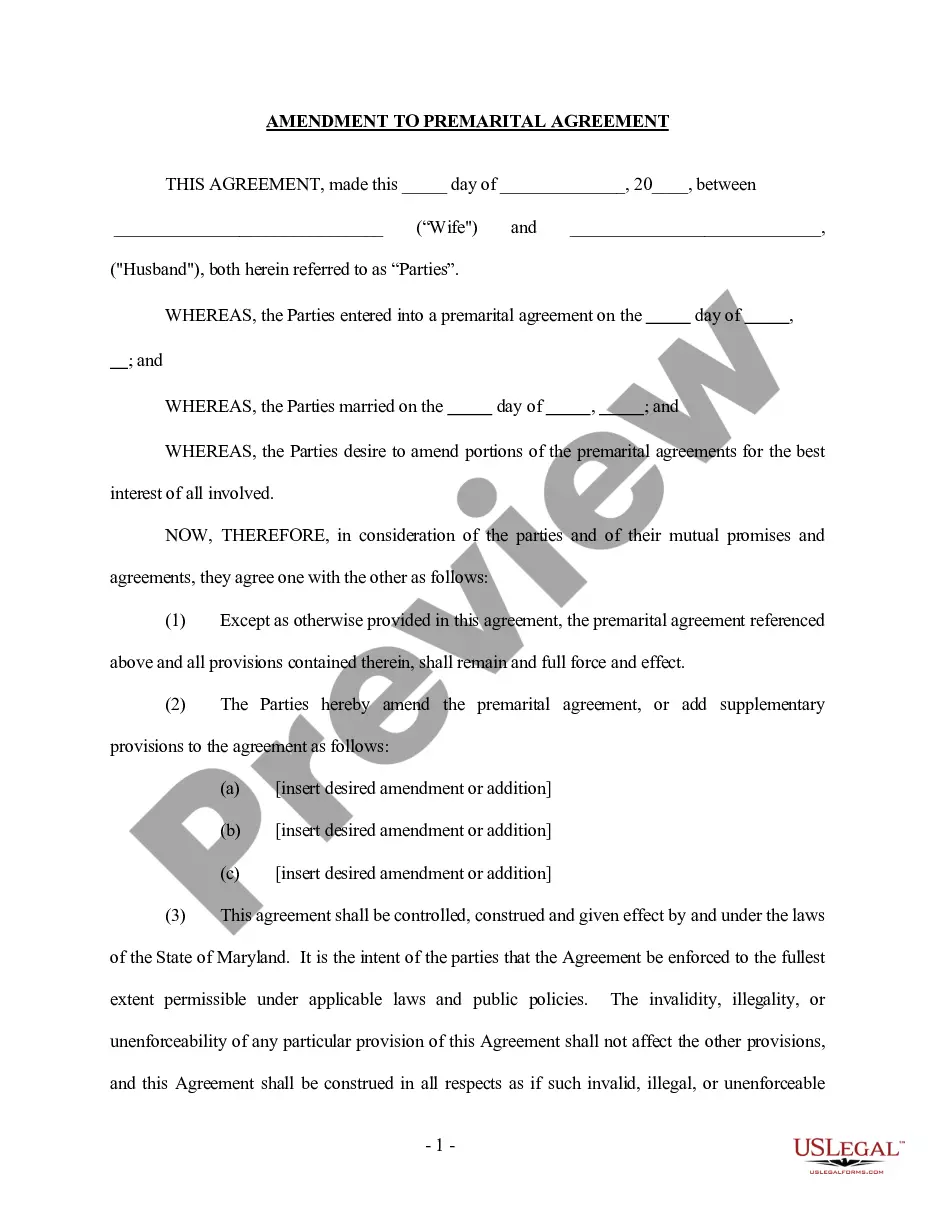

How to fill out Lady Bird Deed Florida Form Printable With Pictures?

Obtaining legal document samples that comply with federal and local laws is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the appropriate Lady Bird Deed Florida Form Printable With Pictures sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are simple to browse with all papers arranged by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Lady Bird Deed Florida Form Printable With Pictures from our website.

Getting a Lady Bird Deed Florida Form Printable With Pictures is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the instructions below:

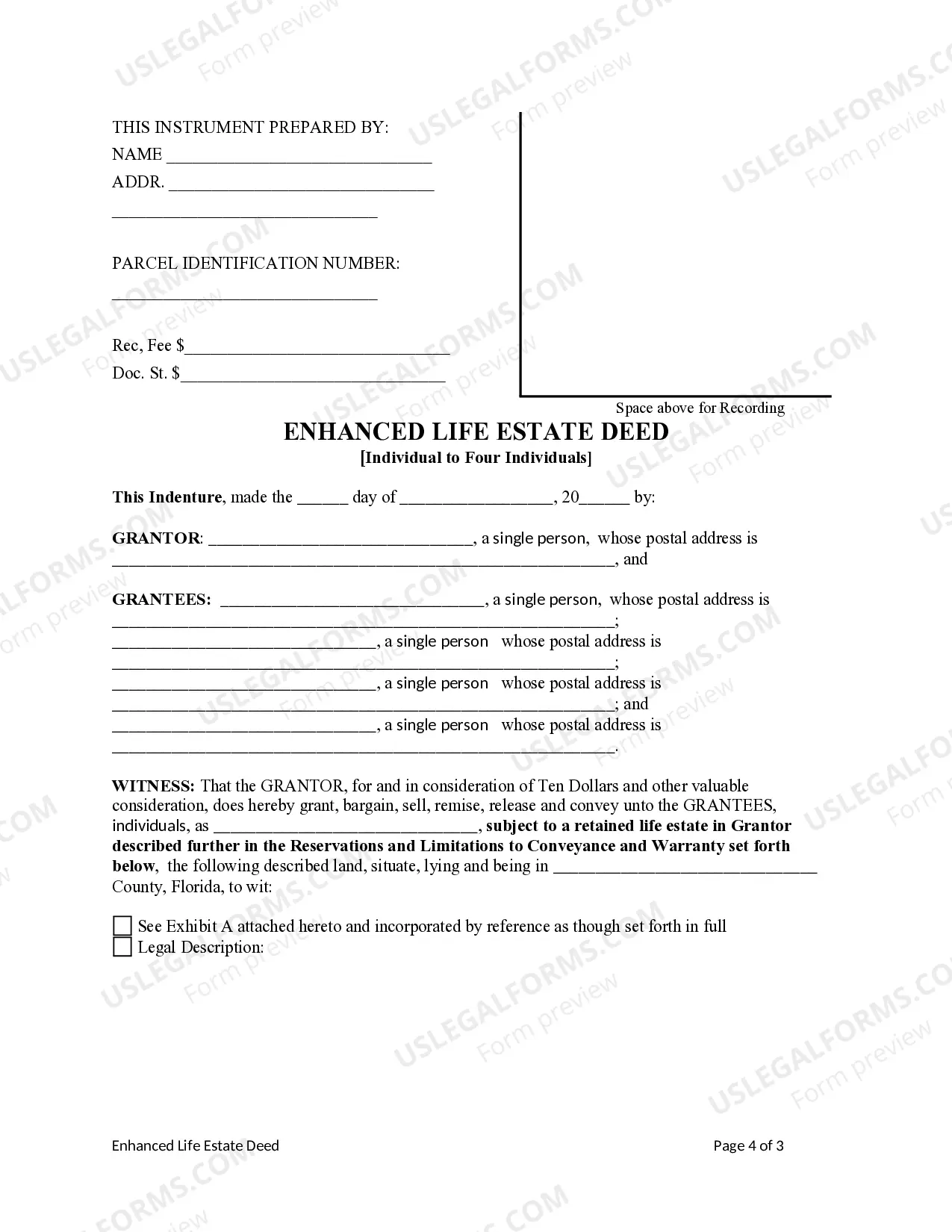

- Analyze the template using the Preview option or through the text description to ensure it meets your requirements.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Lady Bird Deed Florida Form Printable With Pictures and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

You can get an LLC in New Hampshire in 7-10 business days if you file online (or 3-5 weeks if you file by mail).

To revive a New Hampshire LLC, you'll need to file the reinstatement application with the New Hampshire Secretary of State. You'll also have to fix the issues that led to your New Hampshire LLC's dissolution and (in some cases) obtain a Tax Compliance Certificate from the New Hampshire Department of Revenue.

To reinstate your New Hampshire entity within 3 years you first need to obtain tax clearance (corporations) or statement of good standing (LLCs) from the Department of Revenue Administration, and then file it with New Hampshire Department of State together with Reinstatement form and any fees, missing annual reports ...

To dissolve a New Hampshire corporation, you need to file Articles of Dissolution. To dissolve a New Hampshire LLC, you need to request a Certificate of Dissolution from the Department of Revenue Administration. This certificate will state that the LLC has paid all its taxes due.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority.

Due every year by April 1st, your LLC's New Hampshire Annual Report costs $100 to file. If you're late for the filing deadline, the Corporations Division will charge an additional $50 late fee.