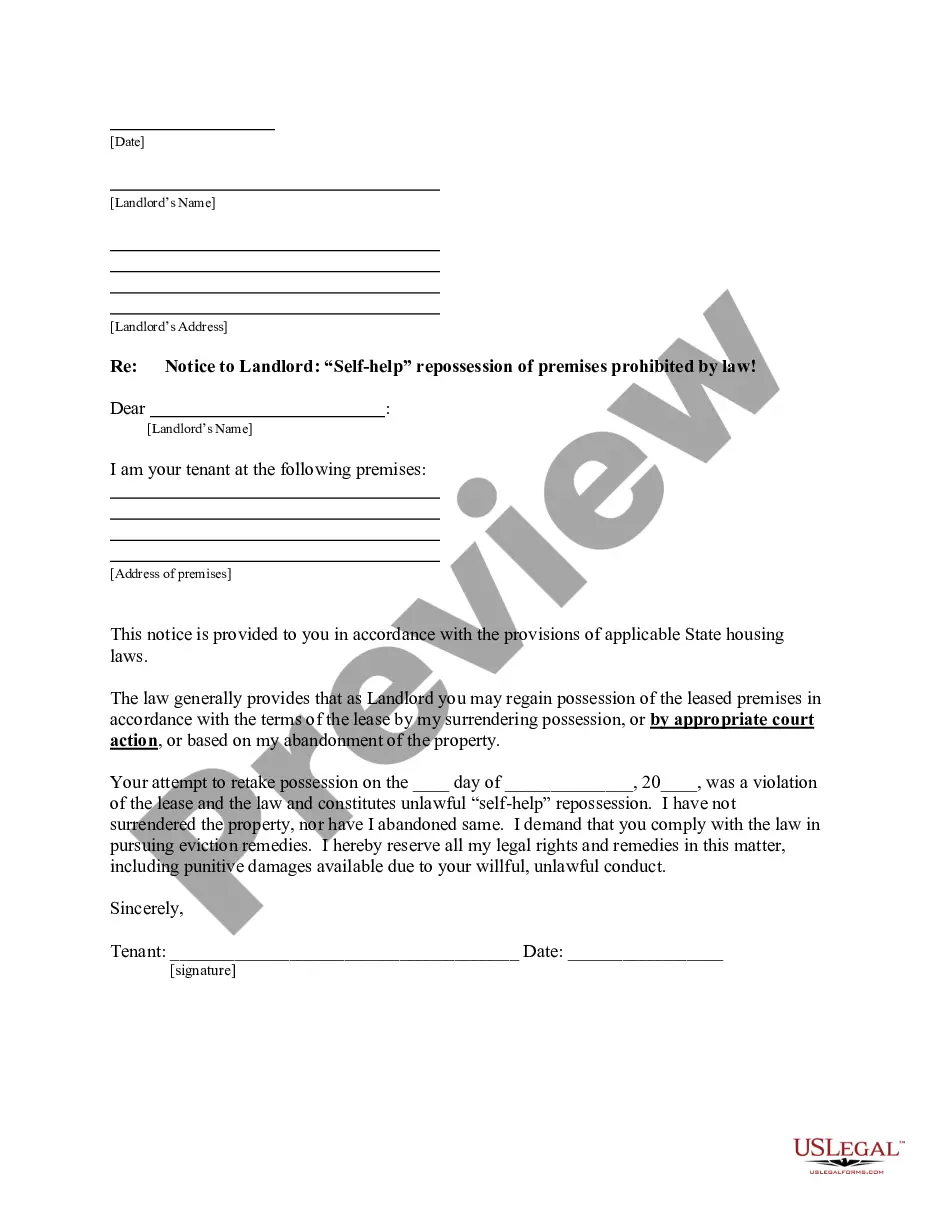

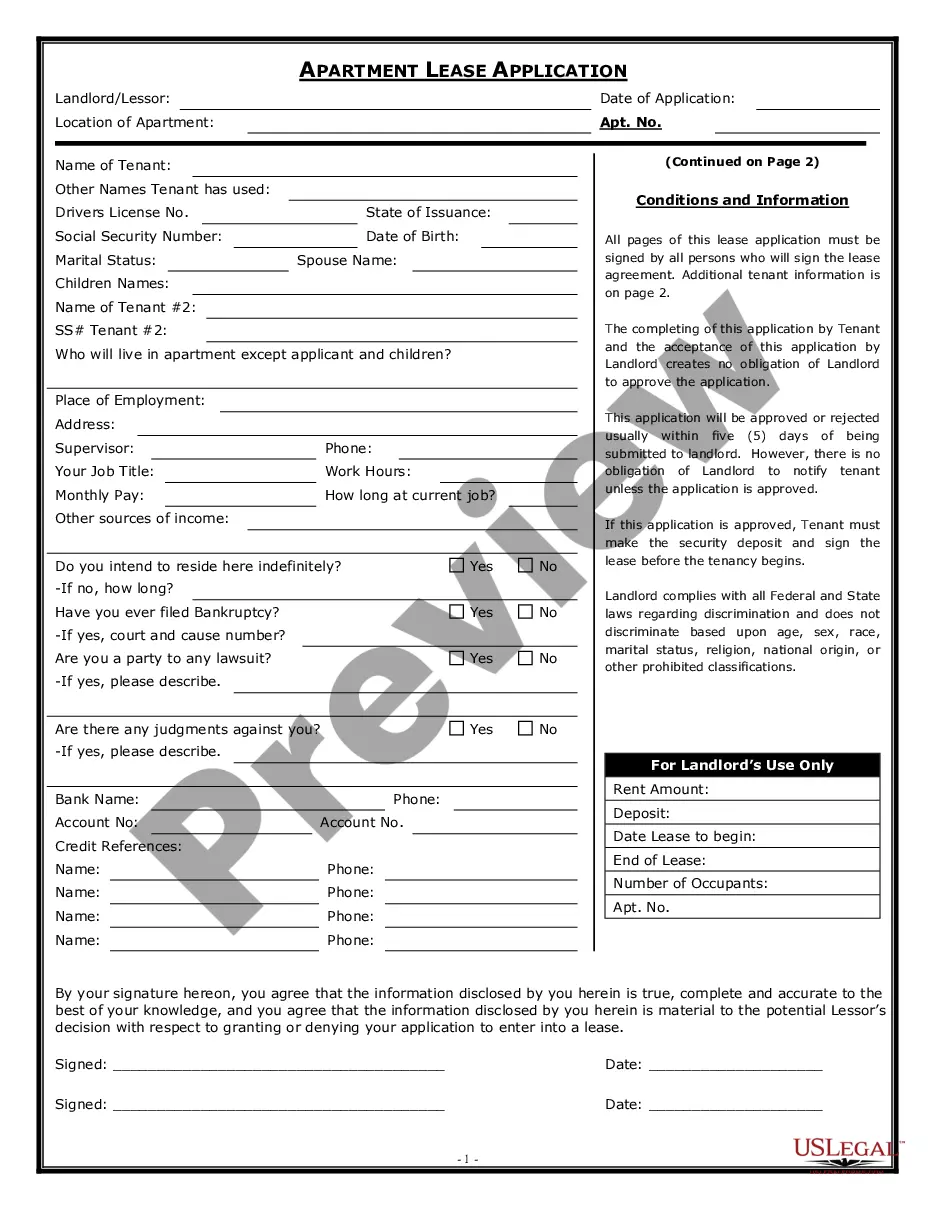

A rent verification letter is a document used to verify the rental expenses of an individual or household applying for food stamp benefits, also known as the Supplemental Nutrition Assistance Program (SNAP). This letter serves as proof of the applicant's rental agreement, monthly rent amount, and other necessary details that are required for determining eligibility for food stamps. The Rent verification letter for food stamps confirms the following information: rental address, lease start and end dates, monthly rent amount, any utilities included in the rent, and the landlord's contact information. This letter helps the SNAP program assess the applicant's housing costs accurately, ensuring that they receive the appropriate amount of assistance. There are various types of Rent verification letters for food stamps that may be required based on individual circumstances: 1. Standard Rent Verification Letter: This letter is used for applicants residing in a standard rented apartment or house. It should include details such as the tenant's name, the landlord's name, rental address, lease terms, monthly rent, and contact information for the landlord or property management. 2. Subsidized Rent Verification Letter: Individuals living in subsidized housing may require this type of letter. It should outline the specifics of the subsidized housing program, including the participant's portion of the rent and any rental assistance received from a government agency or organization. 3. Roommate Rent Verification Letter: In cases where the applicant shares a rental property with roommates, a rent verification letter specifically detailing the portion of rent paid by the applicant is necessary. This letter should state the total rent amount, the applicant's share, and the contact information of both the landlord and roommates. 4. Rent-to-Own Verification Letter: For those participating in a rent-to-own program, a rent verification letter should specify the rental agreement terms, including the monthly rental amount and any portion that will be applied towards eventual homeownership. When obtaining a Rent verification letter for food stamps, it is crucial to ensure that the document is authentic, accurately reflects the rental agreement, and includes all the necessary information.

Rent Verification Letter For Food Stamps

Description landlord letter for food stamps

How to fill out Rent Verification Letter For Food Stamps?

Legal managing might be overwhelming, even for knowledgeable professionals. When you are searching for a Rent Verification Letter For Food Stamps and don’t have the a chance to devote in search of the right and updated version, the procedures might be stress filled. A robust online form library might be a gamechanger for anyone who wants to deal with these situations efficiently. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from personal to organization documents, all-in-one place.

- Make use of innovative tools to finish and manage your Rent Verification Letter For Food Stamps

- Gain access to a useful resource base of articles, tutorials and handbooks and resources related to your situation and needs

Help save effort and time in search of the documents you need, and make use of US Legal Forms’ advanced search and Preview tool to discover Rent Verification Letter For Food Stamps and acquire it. In case you have a monthly subscription, log in in your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved as well as manage your folders as you can see fit.

If it is your first time with US Legal Forms, register a free account and have unlimited access to all benefits of the platform. Listed below are the steps to take after accessing the form you need:

- Verify this is the correct form by previewing it and looking at its description.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Select a subscription plan.

- Pick the file format you need, and Download, complete, eSign, print and send your papers.

Benefit from the US Legal Forms online library, backed with 25 years of experience and reliability. Enhance your everyday papers management in a easy and user-friendly process today.

Form popularity

FAQ

A paper copy of your sales tax permit will arrive at your mailing address within 7-10 business days. Once you receive your mail from the state of Connecticut, you will then be able to access your online account. Your sales permit will arrive in an envelope by itself.

There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

Connecticut Dealer License Application Forms Certificate of Proposed Location Approval. ... Site Drawing (K-93) ... Fingerprint Background Check. ... Trade Name Certificate (If Applicable) ... Driver's License and Personal Information. ... Vehicle Storage Rates (Form K-89) ... Tax Registration and Sales Permit. ... Certificate of Insurance.

Connecticut LLC Cost. Connecticut's state fee for LLC formation is $120. Connecticut LLCs also need to file an annual report every year, which costs $80. Depending on your industry and business needs, you might have additional expenses, such as licensing fees, business insurance, and registered agent fees.

You don't have to file a document to ?form? your Sole Proprietorship with the state. However, there are a few things you may need to (or want to) do in order to operate legally. For example, your business may need a license or permit to operate. And it's best practice to open a separate business bank account.

What is a sales tax permit? A sales tax permit (sometimes called a ?seller's permit? or ?sales tax license?) is a license that allows a business owner to make sales in a certain state or jurisdiction. The Connecticut sales tax permit allows the Department of Revenue to collect sales tax from Connecticut businesses.

A Bill of Sale document is always required along with proof of ownership to process a new vehicle registration. Vehicles that are exempt from emissions testing will require a VIN verification.