Landlord Rent Paid For The Office Journal Entry

State:

Florida

Control #:

FL-1071LT

Format:

Word;

Rich Text

Instant download

Description

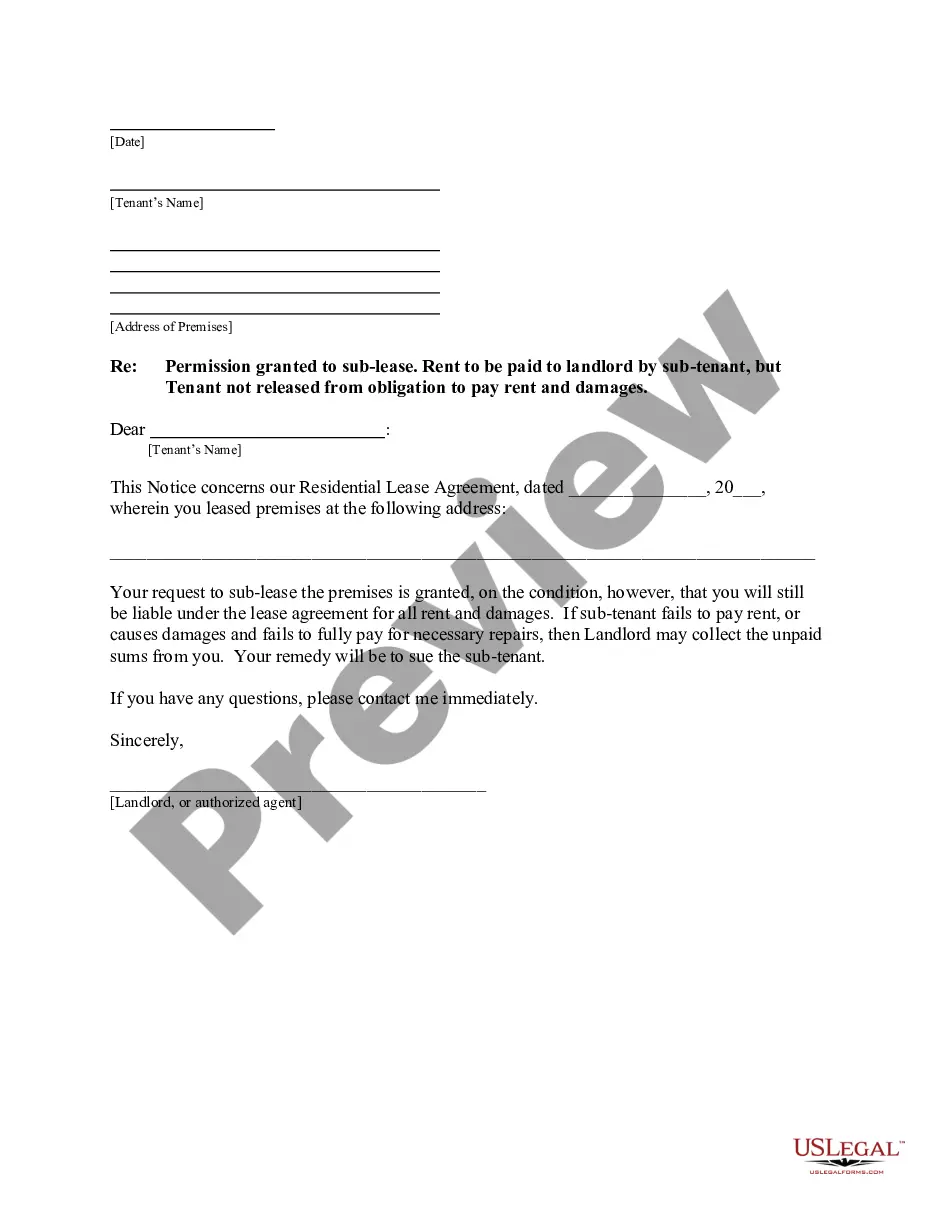

This is a letter from Landlord to Tenant that the Sublease has been granted. Rent will be paid by sub-tenant, but Tenant remains liable for rent and damages.

Free preview