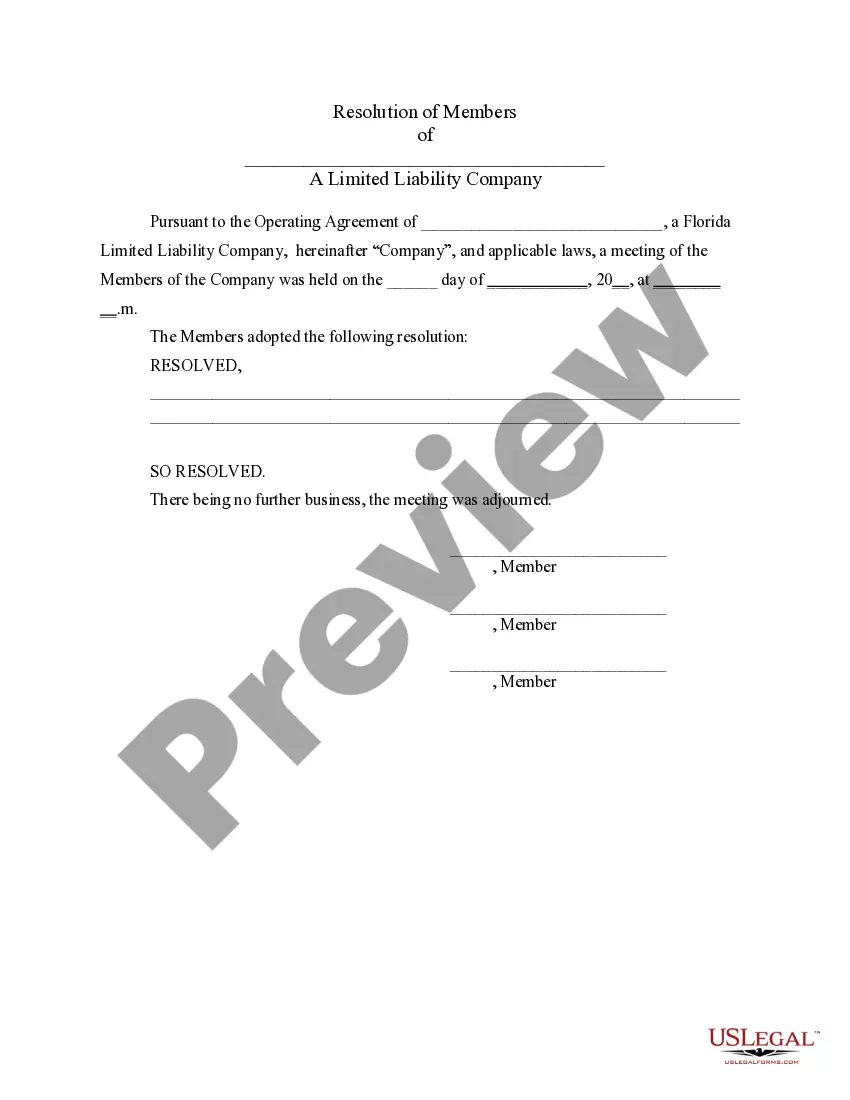

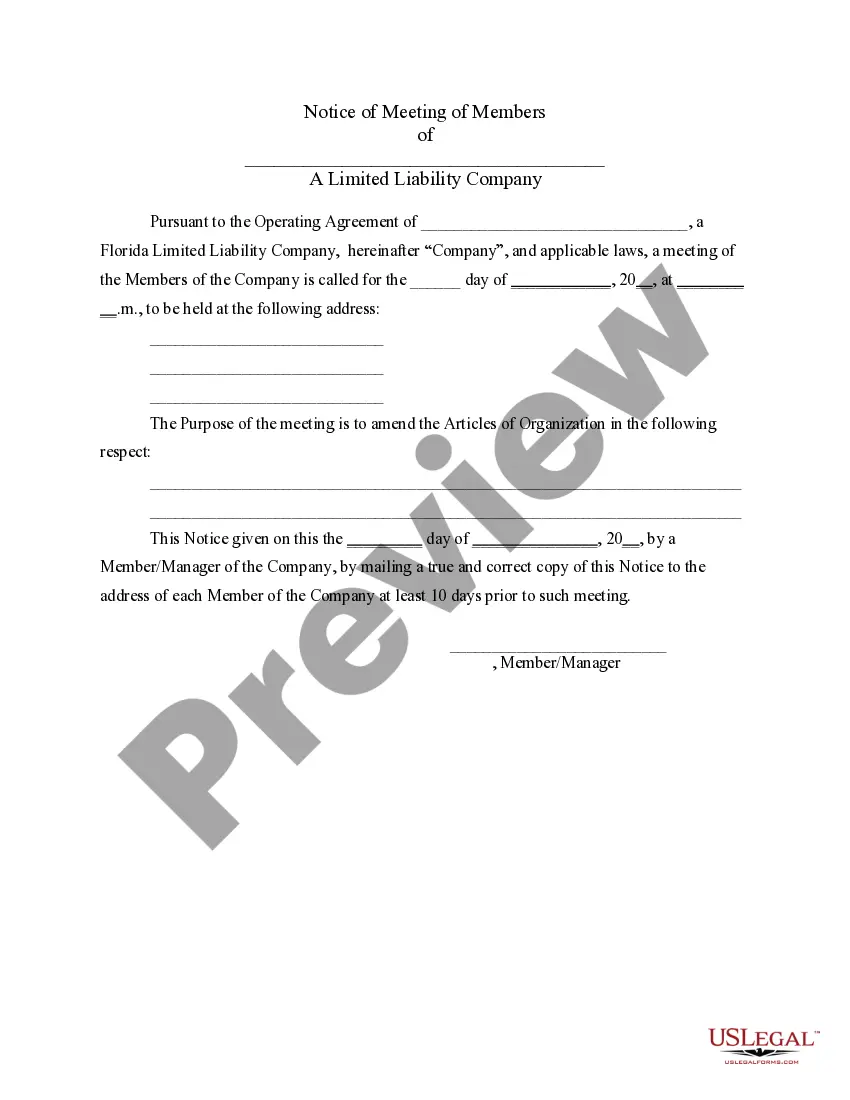

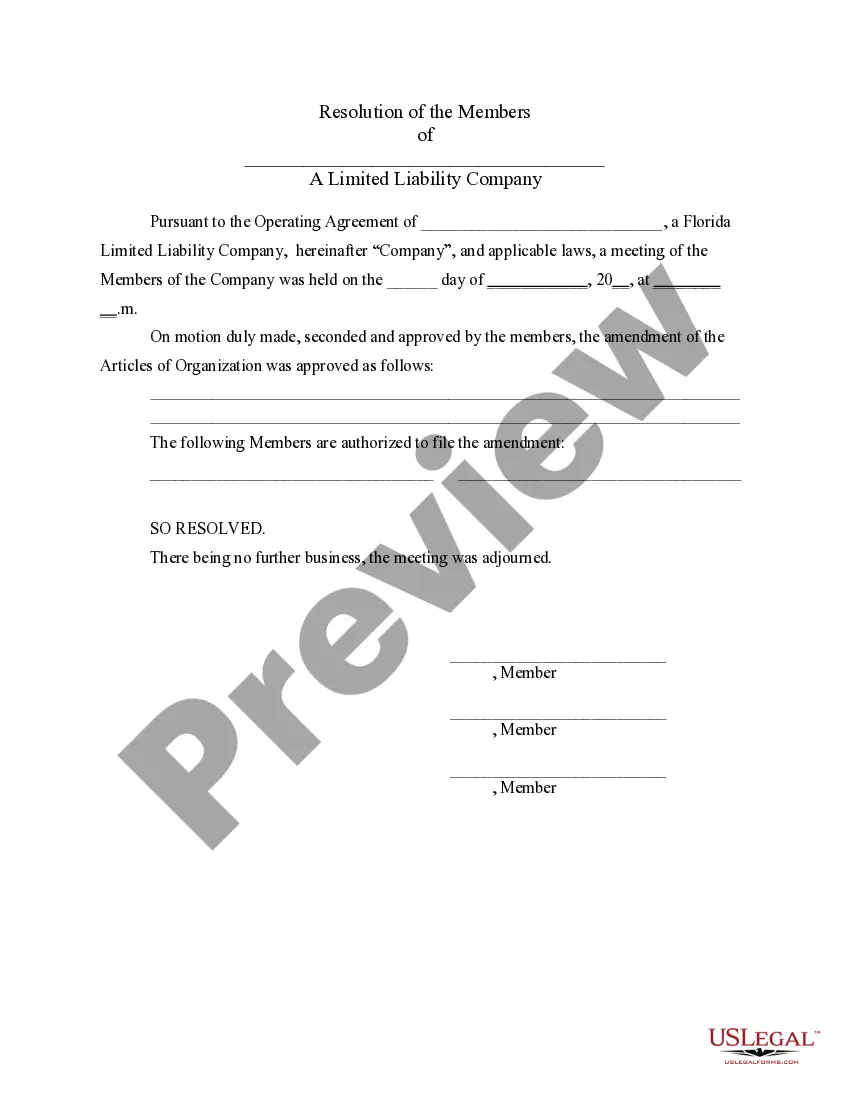

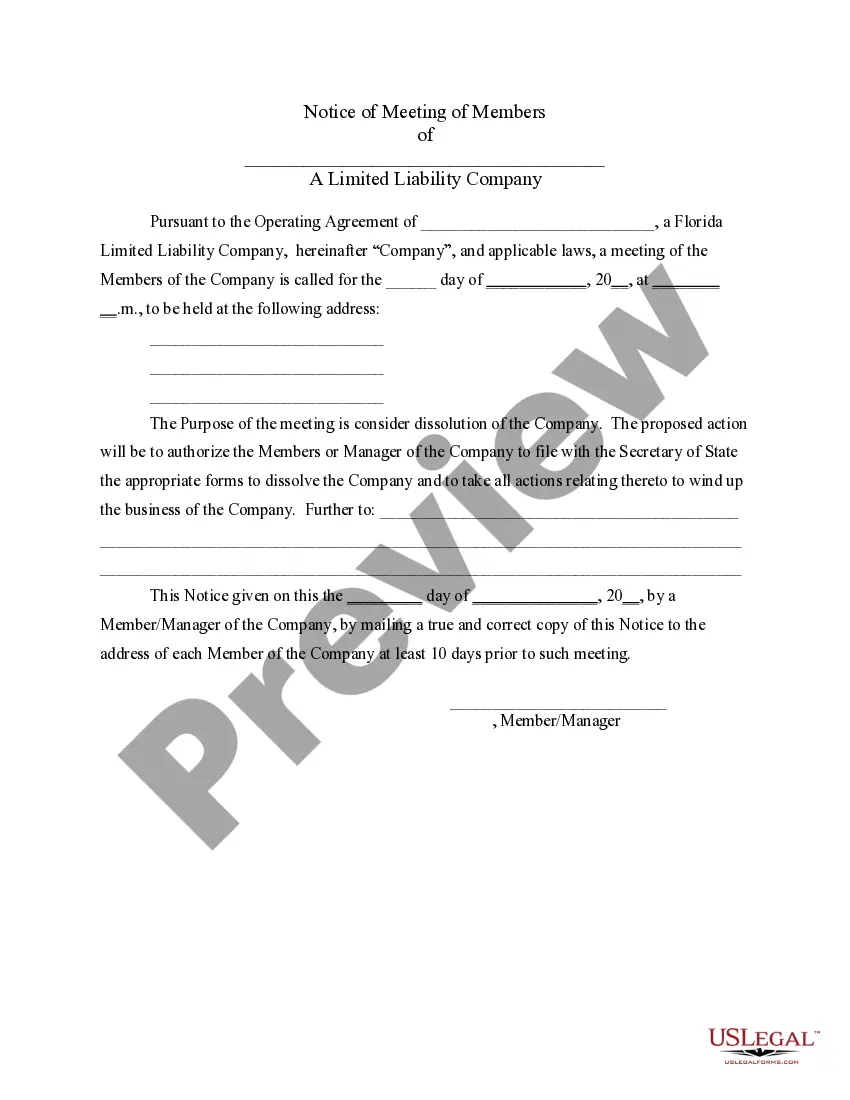

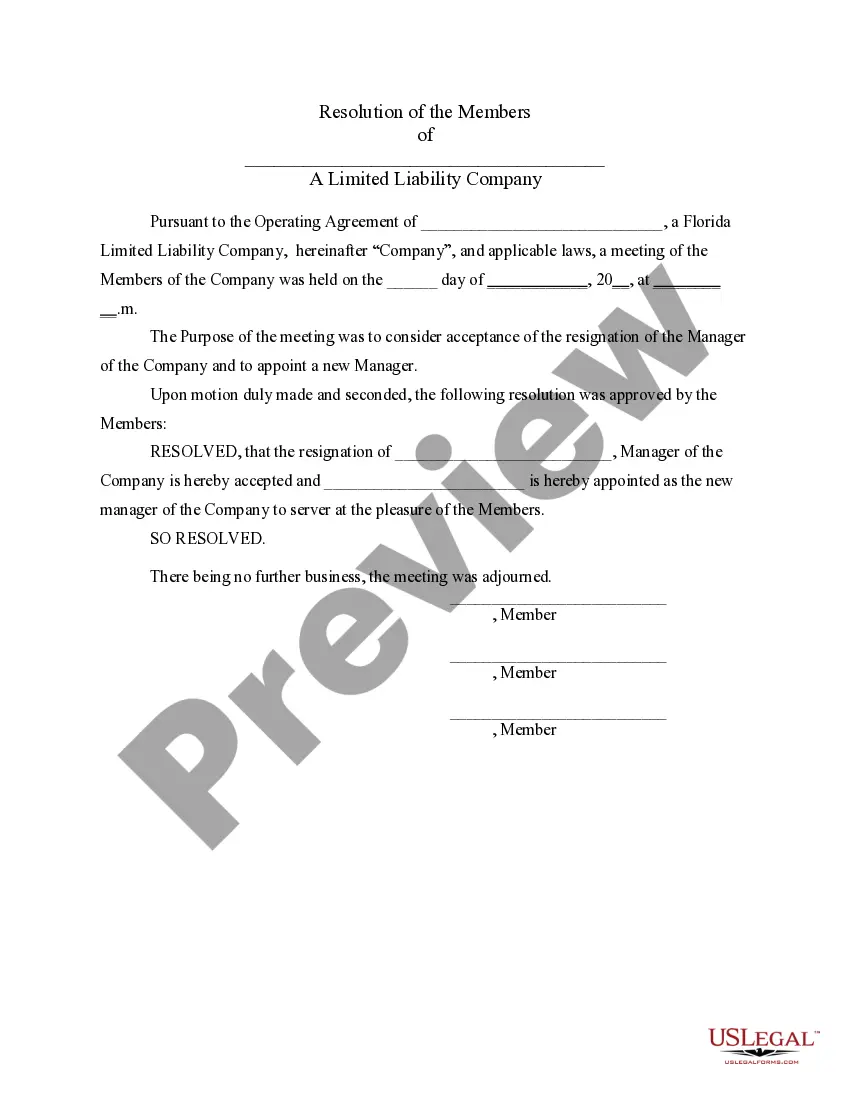

Florida Double LLC with No Assets: A Comprehensive Description If you are considering establishing a limited liability company (LLC) in Florida with no assets, it's crucial to understand the implications and specifics of such an entity. In this detailed description, we will explore what a Florida double LLC with no assets entails, its purpose, benefits, legal requirements, and the different types of double LCS that exist, if applicable. Florida Double LLC with No Assets Definition: A Florida double LLC with no assets is a legal entity that enables entrepreneurs, investors, or individuals to create multiple LCS under a single umbrella, with each subsidiary LLC having its own specific purpose. The primary objective of forming such an LLC is to segregate liabilities and protect the assets of each subsidiary LLC from any legal claims or obligations. Benefits of a Florida Double LLC with No Assets: 1. Limited Liability: By establishing a double LLC structure, the liabilities of each subsidiary LLC are isolated from one another. This means that if one LLC faces legal issues or incurs debts, the assets of other LCS within the structure are shielded from such claims. 2. Enhanced Asset Protection: Florida offers favorable asset protection laws, making a double LLC an effective strategy for safeguarding personal and business assets, as the structure prevents creditors from reaching your other LCS' assets. 3. Easy Setup and Maintenance: Setting up a double LLC in Florida is relatively straightforward. The administrative and maintenance requirements are similar to those of a regular LLC, making it a manageable structure for small businesses or individuals. Types of Florida Double LLC with No Assets: While there is no specific designation for different types of Florida double LCS with no assets, the structure can be customized to meet various needs. Some common examples include: 1. Subsidiary LCS for Real Estate Investments: Creating separate subsidiary LCS for each real estate property or investment can protect each property from lawsuits or financial issues pertaining to the others. 2. Business Ventures: Entrepreneurs involved in various small-scale businesses or startups can establish multiple LCS to protect each business from the liabilities of others. 3. Professional Practices: Professionals like doctors, lawyers, or accountants having multiple practices in distinct areas can benefit from this structure. Each practice can operate as a separate subsidiary LLC, isolating the liabilities of one practice from another. Legal Requirements and Considerations: To establish a Florida double LLC with no assets, certain legal requirements must be fulfilled: 1. Name: Each subsidiary LLC within the structure must have a unique name, complying with Florida's business entity naming rules and regulations. 2. Articles of Organization: Each subsidiary LLC must file Articles of Organization with the Florida Division of Corporations, including the necessary information and paying the required fees. 3. Operating Agreement: Drafting an operating agreement for each subsidiary LLC is crucial, outlining the management structure, profit distribution, and the relationship between LCS within the double LLC structure. 4. Registered Agent: Each subsidiary LLC must appoint a registered agent in Florida, responsible for receiving legal documents and official correspondence on behalf of the LLC. In summary, a Florida double LLC with no assets is an effective legal structure allowing individuals or businesses to create multiple LCS, with each subsidiary LLC protected from the liabilities and claims of others. The structure provides enhanced asset protection, limited liability, and flexibility for various purposes, including real estate investments, diverse business ventures, or professional practices.

Florida Double Llc With No Assets

Description

How to fill out Florida Double Llc With No Assets?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of handling bureaucracy. Choosing the right legal documents needs accuracy and attention to detail, which is the reason it is important to take samples of Florida Double Llc With No Assets only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details concerning the document’s use and relevance for the situation and in your state or county.

Take the listed steps to finish your Florida Double Llc With No Assets:

- Make use of the library navigation or search field to find your sample.

- View the form’s information to ascertain if it matches the requirements of your state and region.

- View the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Resume the search and locate the right document if the Florida Double Llc With No Assets does not fit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Florida Double Llc With No Assets.

- When you have the form on your device, you may change it using the editor or print it and finish it manually.

Remove the headache that accompanies your legal documentation. Explore the comprehensive US Legal Forms catalog where you can find legal templates, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

In most cases in Oklahoma, the duration of a POA is determined by the terms outlined in the actual document. This means that the POA could be set to expire on a specific date, when a certain event occurs, or when the principal becomes incapacitated or passes away.

YES! If you filed the document or a copy of the document assigning Powers of Attorney to another person or entity with a County or Court Clerk, you must also file the document REVOKING the Powers with that same County or Court Clerk's Office.

Last year, on November 1, 2021, the new Oklahoma Uniform Durable Power of Attorney Act took effect, which inadvertently repealed the Oklahoma statutory provisions that authorized executing a durable power of attorney for the purpose of making healthcare decisions.

What Are the Legal Requirements of a Financial POA in Oklahoma? Mental Capacity for Creating a POA. ... Notarization Requirement. ... Create the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact.

A Power of Attorney can be overridden by a court-appointed guardian or conservator and the grantor if they maintain decision-making capacity. In addition, a person with the overriding power of attorney can make decisions and take actions that may supersede those of the existing agent designated by the principal.

An Oklahoma minor child (parental) power of attorney form is a legal document that a parent may use to appoint another person to care for their child(ren). This paperwork will go into effect when the parent(s) are not unavailable and expect the agent to care for the concerned child(ren).

A power of attorney in fact for the conveyance of real estate or any interest therein, or for the execution or release of any mortgage therefor, shall be executed, acknowledged and recorded in the manner required by this chapter for the execution, acknowledgment and recording of deeds and mortgages, and shall be ...