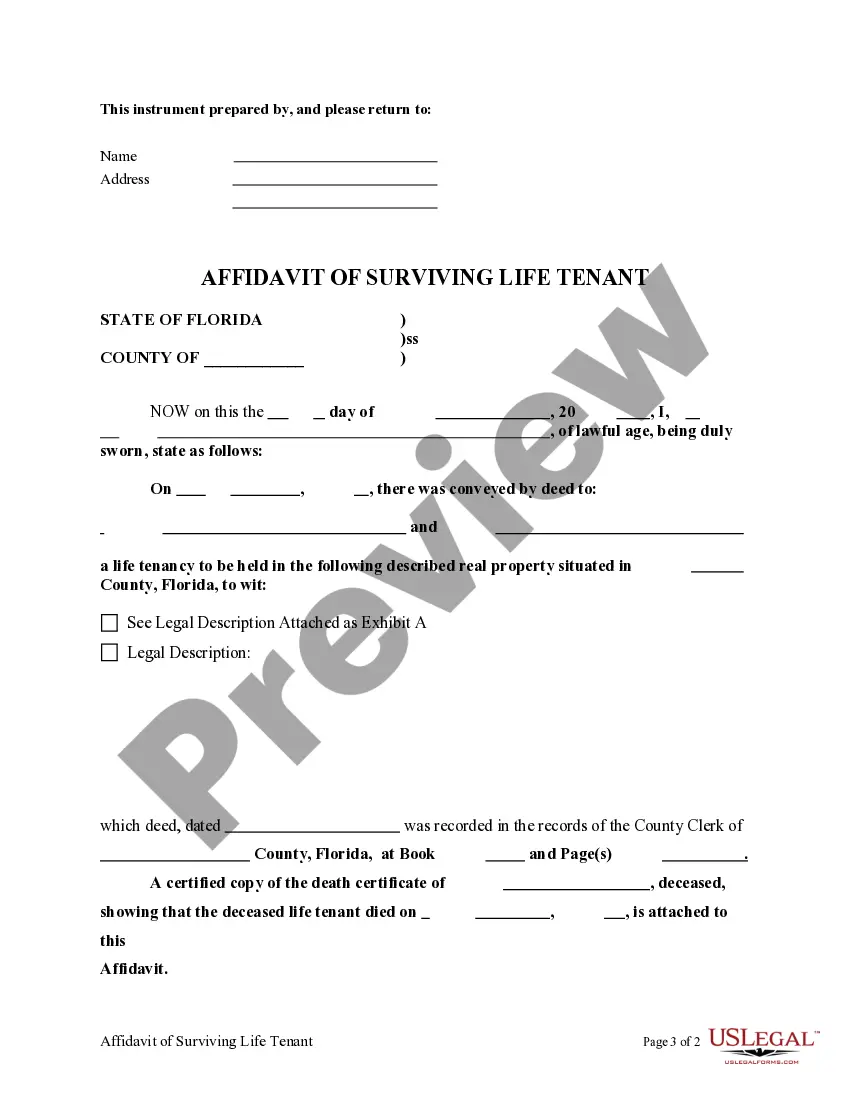

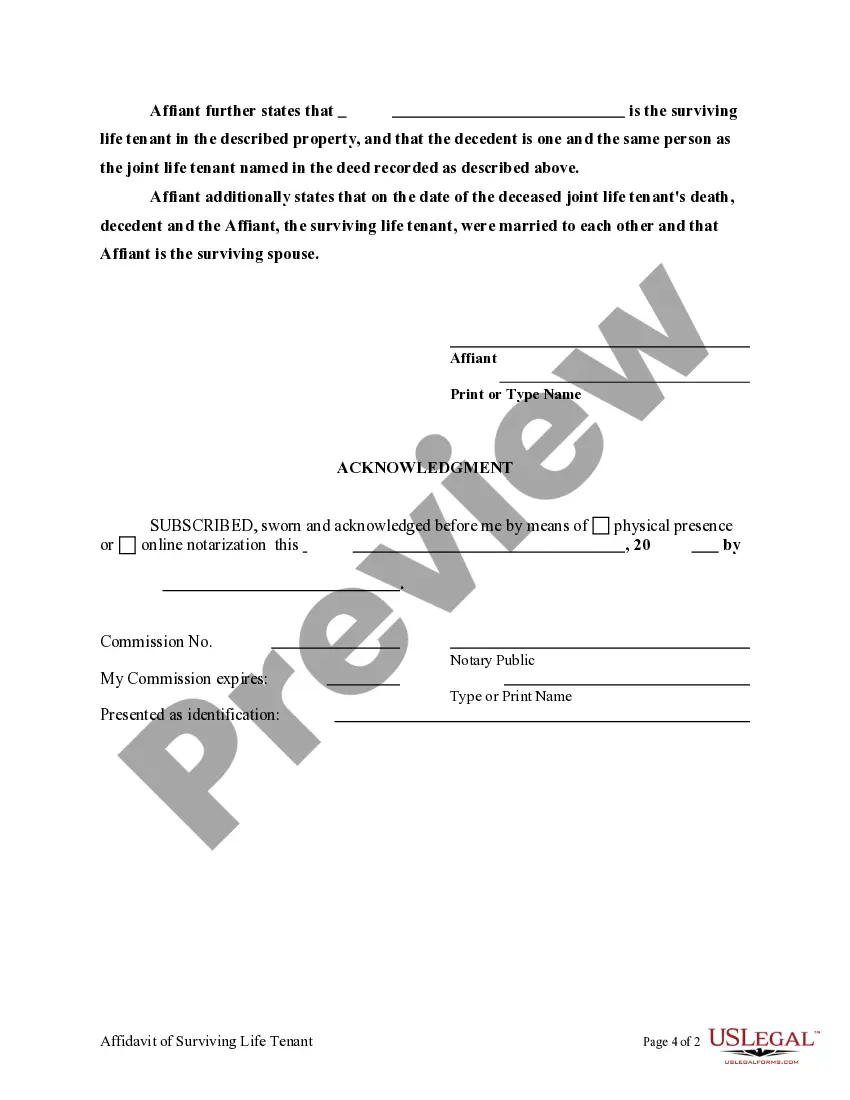

This form is an Affidavit by the Surviving Life Tenant regarding the death of Joint Life Tenant.

Life Tenant In Trust

Category:

State:

Florida

Control #:

FL-AJLT-01

Format:

Word;

Rich Text

Instant download

Description Fl Affidavit Surviving Florida

Free preview Affidavit Life