Florida Real Estate Closings For Sale Sarasota

Description

Form popularity

FAQ

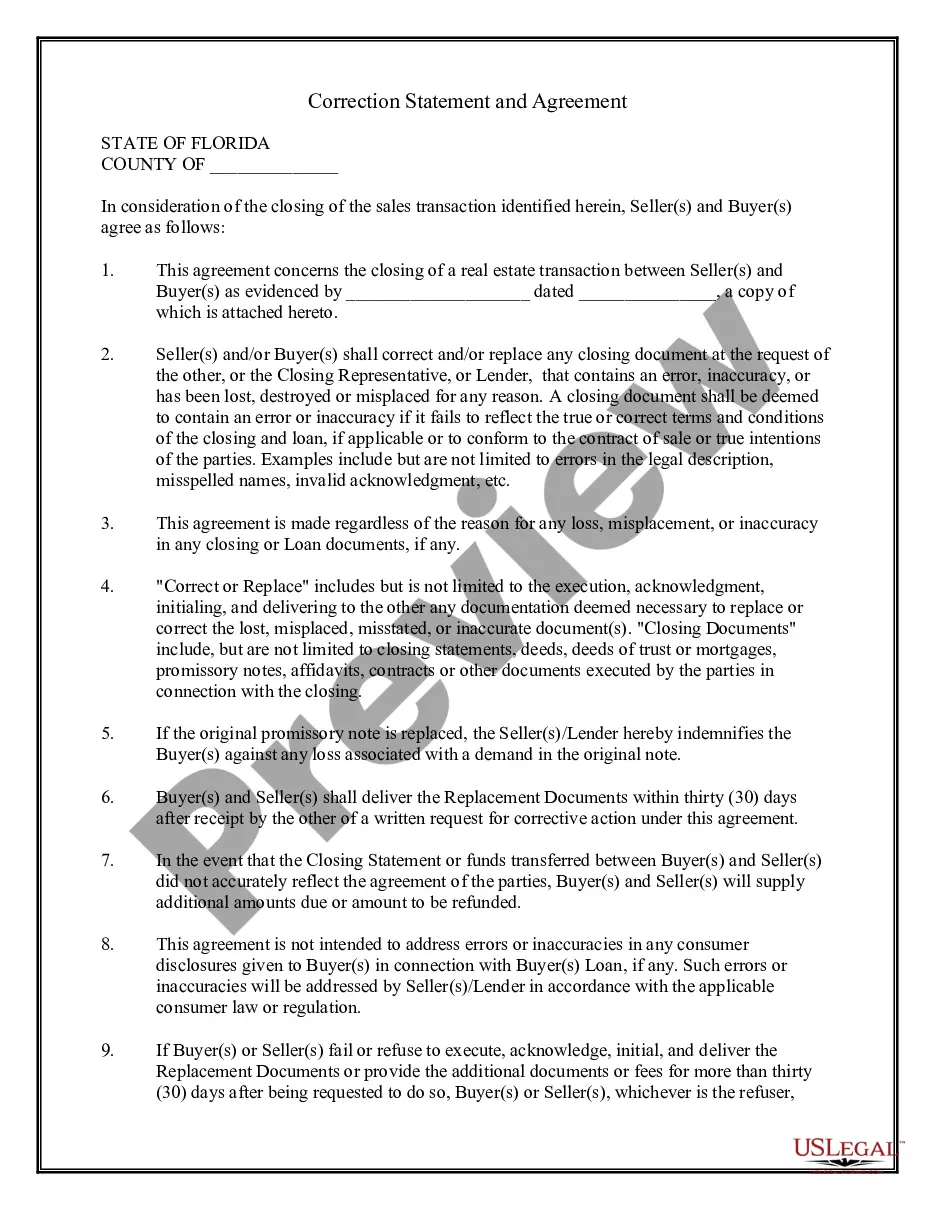

In Florida, real estate closings are typically conducted by a title company or an attorney. During this process, all parties involved review documents, settle any outstanding payments, and transfer the property title. It is essential to understand that Florida real estate closings for sale Sarasota can vary slightly in procedure based on local regulations. Using a reliable platform like US Legal Forms can help you navigate the complexities and ensure a smooth closing experience.

While hiring a lawyer for a real estate closing in Florida is not required, it can be advantageous. A knowledgeable attorney can help you navigate the legal documents and protect your interests during Florida real estate closings for sale Sarasota. Many buyers choose to have legal representation to ensure the process goes smoothly and to address any potential issues that may arise.

Real estate closings can be obtained through various methods, including working with a real estate agent, a title company, or an attorney. It’s beneficial to have professional assistance to navigate the complexities of Florida real estate closings for sale Sarasota. Additionally, USLegalForms provides templates and tools that can simplify the closing process, ensuring all documentation is handled correctly.

Closings in Florida are typically handled by a title company or an attorney, facilitating the legal transfer of property ownership. Both parties attend the closing meeting, where they review and sign the required documents. This process ensures that Florida real estate closings for sale Sarasota are smooth and legally compliant, providing peace of mind to both buyers and sellers.

In Florida, real estate closings are typically handled by title companies, attorneys, or real estate professionals. Each of these parties plays a crucial role in ensuring that the transaction is smooth and compliant with local laws. If you're looking at Florida real estate closings for sale in Sarasota, it's essential to choose qualified professionals who understand the local market. Always verify that they have experience with Sarasota properties to facilitate a successful closing.

Deciding whether to buy a house now or wait for a potential recession depends on your personal circumstances and market conditions. While waiting could bring lower prices, it can also mean missing current opportunities that fit your budget and lifestyle. Engage with real estate professionals familiar with Florida real estate closings for sale Sarasota to make an informed choice.

Sarasota presents many opportunities for real estate investment due to its robust rental market, scenic locations, and community amenities. Investors often find favorable returns through various property types, making it a strategic choice for investment. Look for insights from specialists in Florida real estate closings for sale Sarasota to maximize your investment.

The Florida real estate market is experiencing some cooling trends, yet demand remains high in many regions, including Sarasota. While some buyers may hesitate, opportunities still exist for those looking to invest. Stay updated on market shifts by consulting licensed professionals in Florida real estate closings for sale Sarasota.

Now can be a good time to buy in Sarasota, Florida, especially if you find a property that meets your needs. The market offers various options, and interest rates may be favorable. Keep an eye on local listings to identify opportunities through Florida real estate closings for sale Sarasota.

Yes, Sarasota is an excellent place to buy a house. The area boasts beautiful beaches, vibrant cultural scenes, and a variety of amenities that appeal to residents and investors alike. With a growing demand for housing, Sarasota's real estate landscape makes it a promising choice for Florida real estate closings for sale Sarasota.