Owner Occupancy Affidavit Form

Description

How to fill out Owner Occupancy Affidavit Form?

Individuals frequently link legal documents with something complex that only an expert can handle.

In a certain sense, it's accurate, as composing Owner Occupancy Affidavit Form demands significant skill in subject matter, including state and county laws.

However, with the US Legal Forms, everything has become simpler: pre-made legal templates for any personal and business circumstance tailored to state regulations are compiled in a single online catalog and are now accessible to everyone.

Sign up for an account or Log In to advance to the payment page. Make a payment for your subscription using PayPal or your credit card. Select the format for your document and click Download. Print your form or upload it to an online editor for quicker completion. All templates in our catalogue are reusable: once purchased, they remain stored in your profile. You can access them whenever needed via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current forms categorized by state and usage area, making it easy to find the Owner Occupancy Affidavit Form or any specific template in just minutes.

- Formerly registered users with an active subscription need to Log In to their account and click Download to retrieve the form.

- New users to the site must first create an account and subscribe before they are able to save any documentation.

- Here is the step-by-step guide on how to obtain the Owner Occupancy Affidavit Form.

- Verify the page content thoroughly to ensure it meets your requirements.

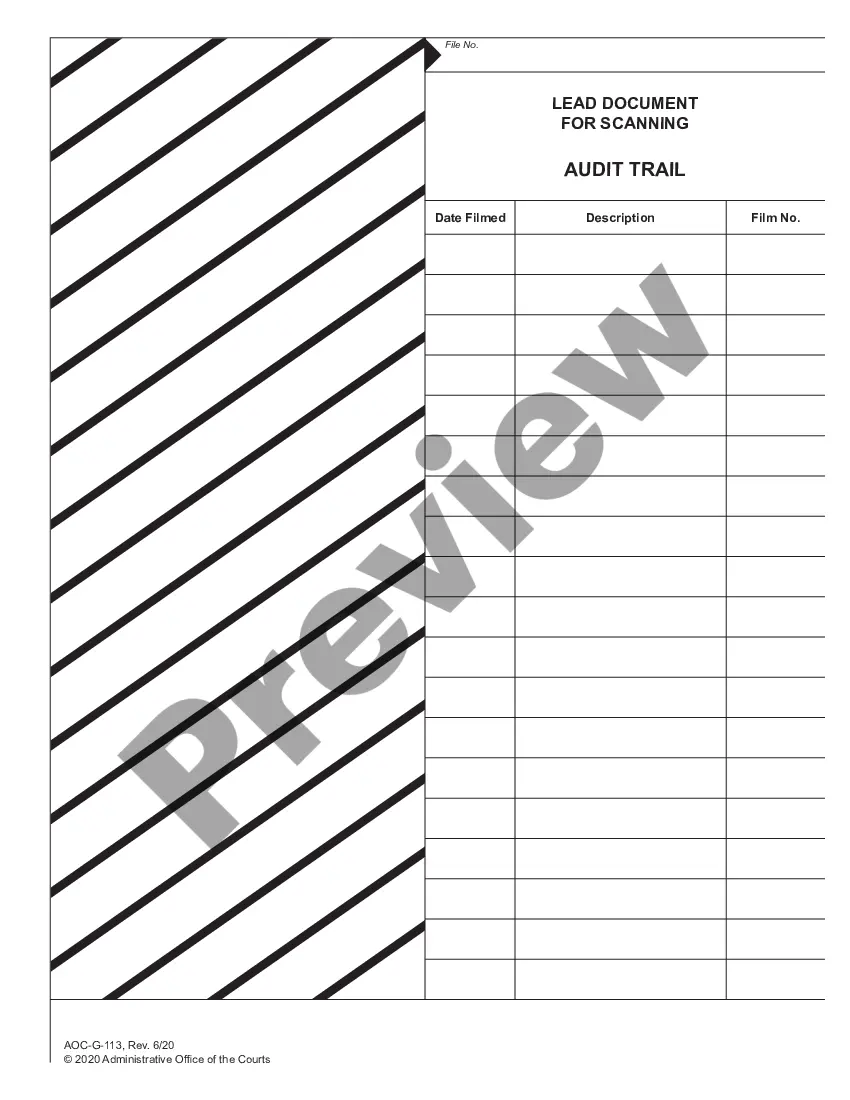

- Review the form description or examine it using the Preview option.

- Search for another sample through the Search field in the header if the previous selection does not meet your needs.

- Click Buy Now once you identify the apt Owner Occupancy Affidavit Form.

- Choose the pricing plan that aligns with your needs and financial plan.

Form popularity

FAQ

Lending companies cannot force a homeowner to live in a home when they have legitimate reasons or even desires to move. However, to get out of the owner-occupancy clause on a primary residence home loan, the owner should be able to prove that they had every intention of occupying the home at the time of purchase.

Changing your home loan from an owner-occupied to an investment loan. If you've decided to use your home as an investment property, you'll need to notify your lender that the property is no longer owner-occupied. That's because a different mortgage product might apply for an investment property.

If you have a residential mortgage, it's against the terms of your loan to rent it out without the lender's permission. That amounts to mortgage fraud. The consequences can be serious. If your lender finds out it could demand that you repay the mortgage immediately or it'll repossess the property.

The Occupancy Affidavit is one type of document that can be used to show that a home was (or is) the primary place of residence for a specified time period. It is a document that is attached to an application, such as a Senior Exemption.

No. A second home does not qualify as owner-occupied. If an owner decides later to make their second home their primary residence, then they could potentially refinance it at that point as their primary residence.