Florida Mortgage Deed Form

Description

How to fill out Florida Mortgage Deed Form?

There's no longer a necessity to invest hours searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our platform provides over 85,000 templates for various business and personal legal situations categorized by state and area of use.

Utilize the search bar above to find another template if the current one does not meet your needs. Select Buy Now next to the template title upon locating the right one. Choose the preferred subscription plan and register for an account or Log In/">Log In. Complete your subscription payment via credit card or PayPal to proceed. Select the file format for your Florida Mortgage Deed Form and download it to your device. Print your form to fill it out by hand or upload the sample if you prefer to complete it in an online editor. Preparing legal documents under federal and state regulations is quick and simple with our platform. Experience US Legal Forms now to keep your paperwork organized!

- All forms are expertly drafted and verified for accuracy, so you can trust in acquiring an up-to-date Florida Mortgage Deed Form.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In/">Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by accessing the My documents tab in your profile.

- If you haven't utilized our service before, the procedure will require a few additional steps to finalize.

- Here’s how new users can find the Florida Mortgage Deed Form in our catalog.

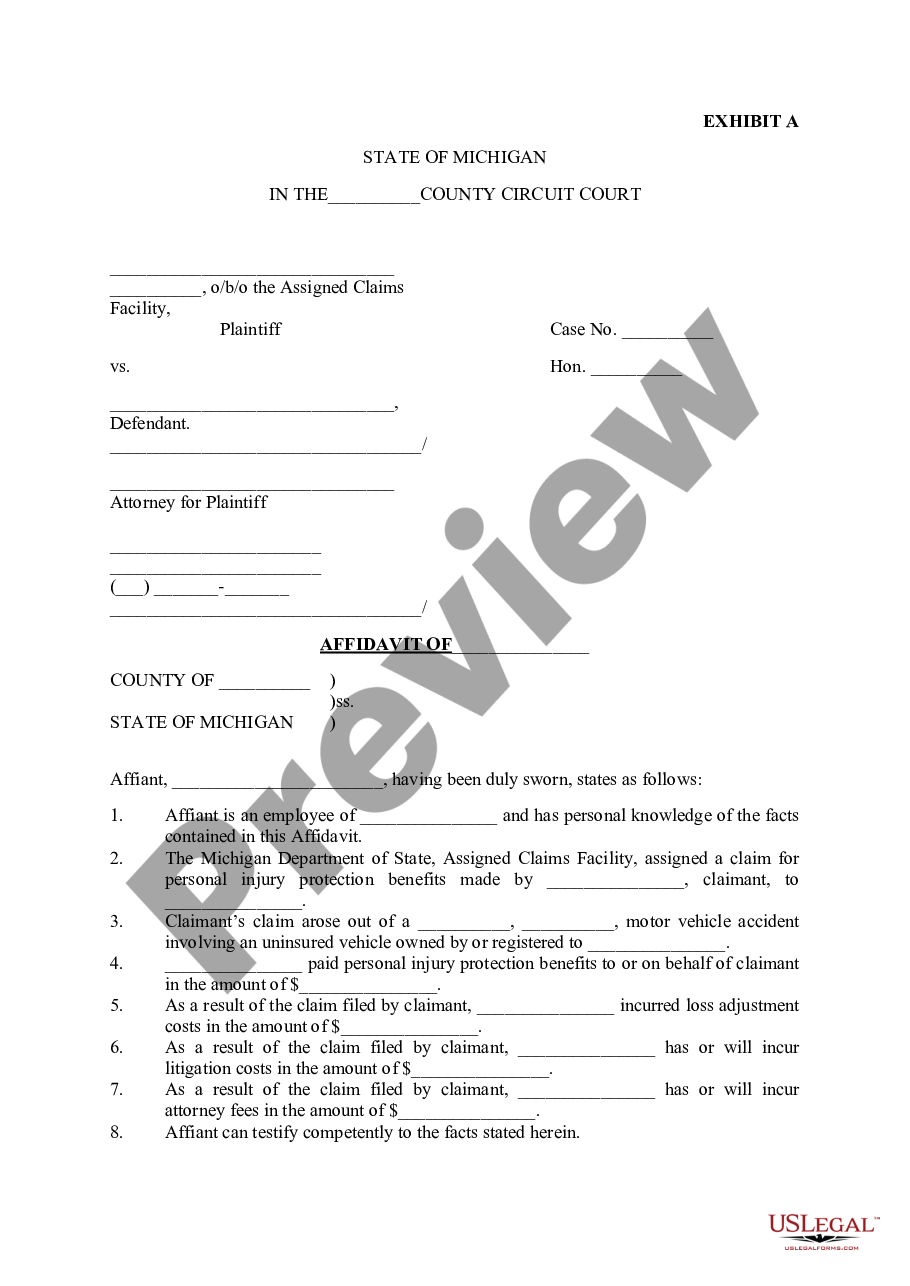

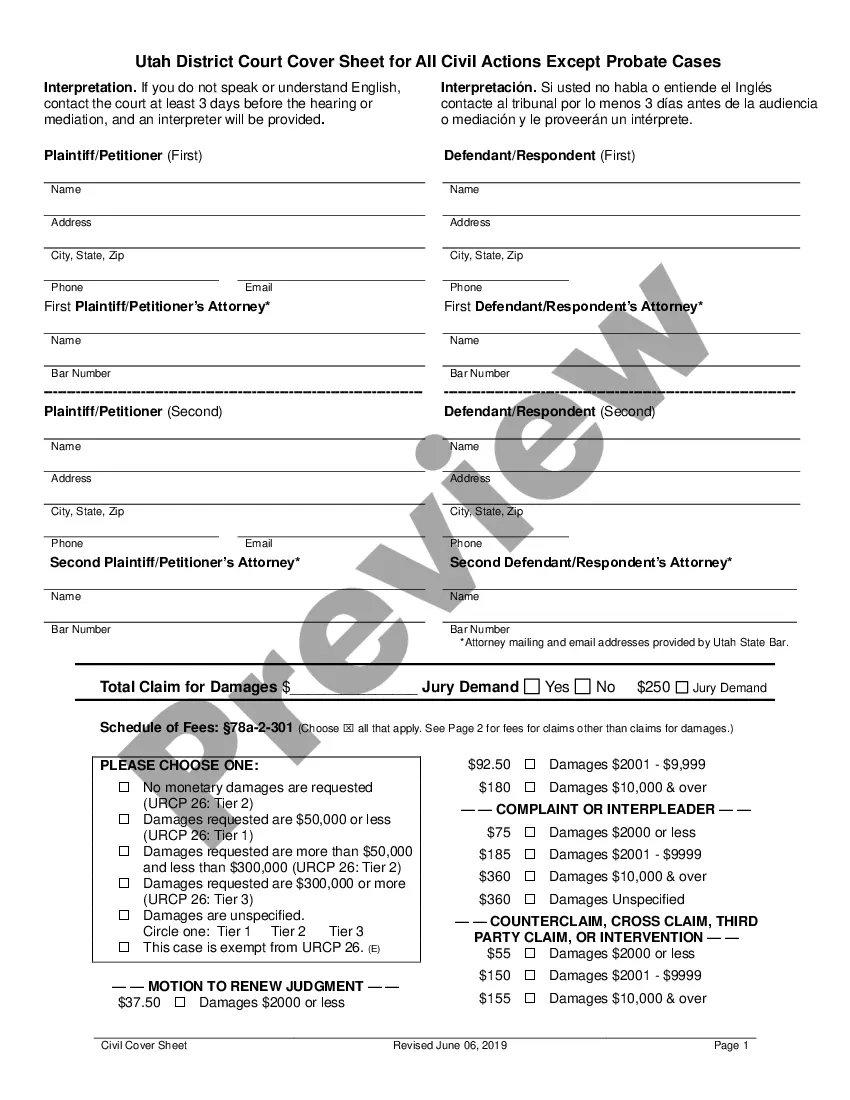

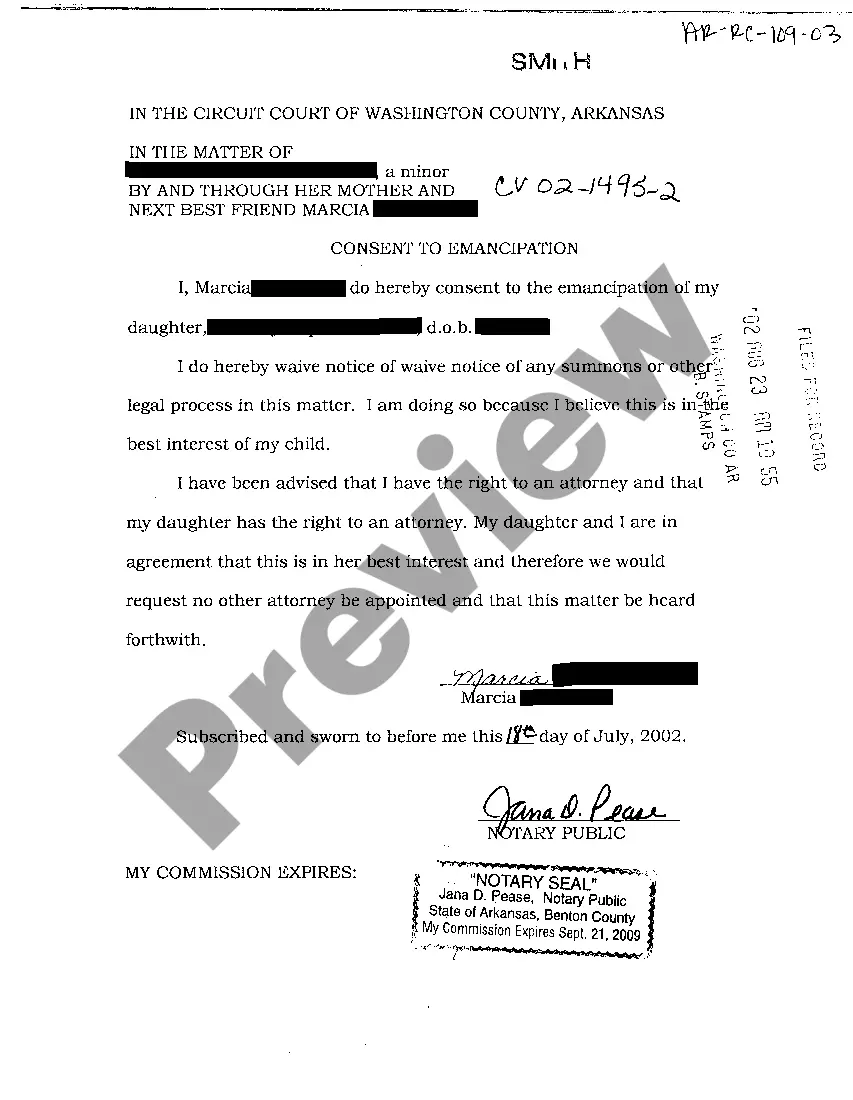

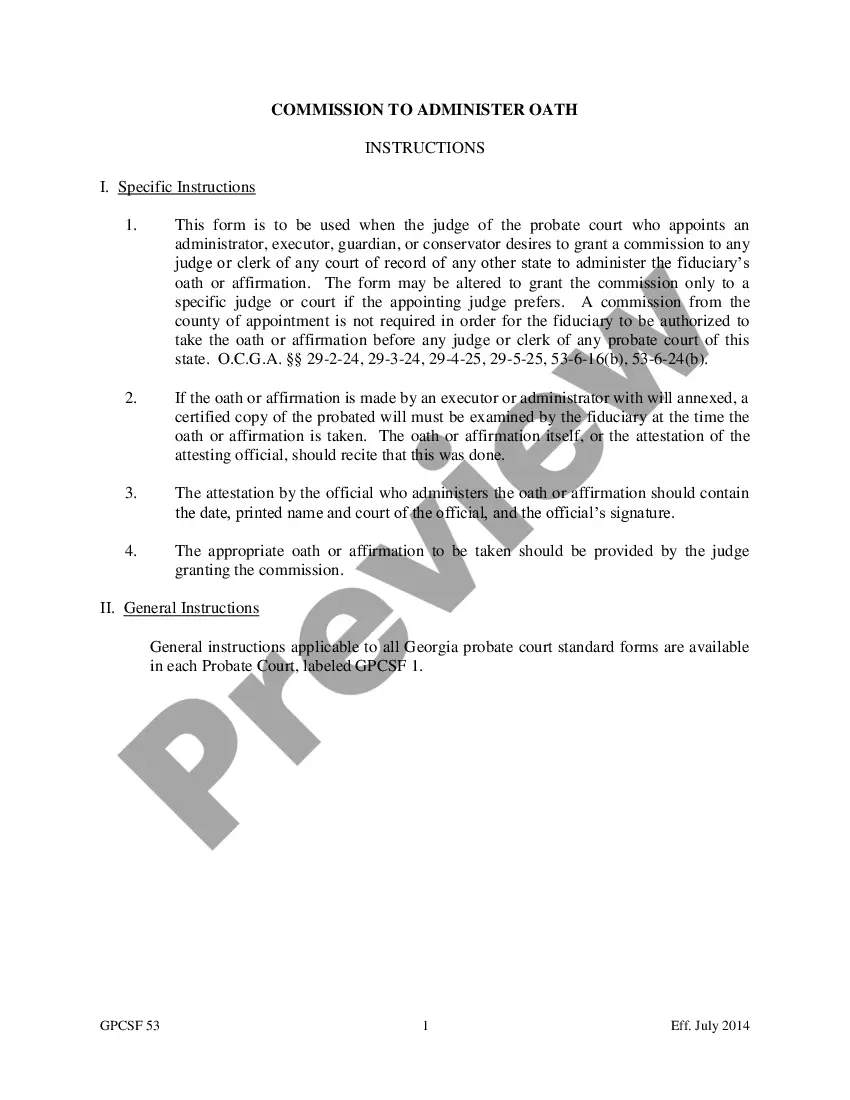

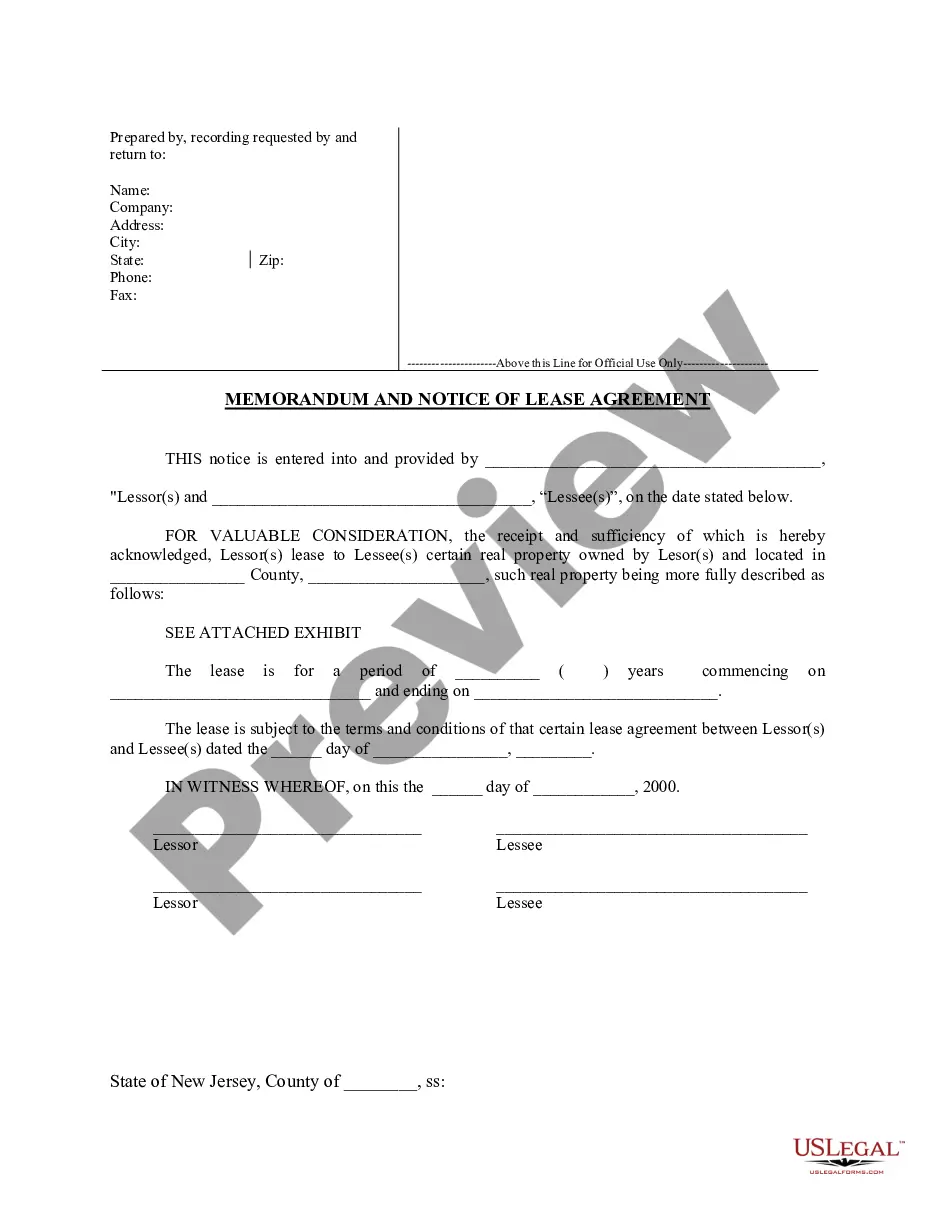

- Examine the page content carefully to confirm it contains the sample you need.

- Employ the form description and preview options if available.

Form popularity

FAQ

For a deed to be valid in Florida, it must be in writing, signed by the grantor, and must include a clear legal description of the property. Additionally, the deed must be acknowledged by a notary public and recorded with the county clerk's office. Ensuring that a Florida mortgage deed form meets these criteria is essential for protecting your rights in property ownership. Using platforms like US Legal Forms can help ensure your deed is correctly prepared and filed.

If your name appears on the deed but not on the mortgage, you may still have ownership rights to the property. However, since you are not responsible for the mortgage, the lender can pursue the borrower for outstanding payments. In certain situations, this could lead to foreclosure despite your ownership on the deed. It's wise to consult with a legal professional if you encounter these circumstances involving your Florida mortgage deed form.

To obtain the deed to your property in Florida, you typically receive it at the closing of the property sale. After closing, the deed is recorded with the county clerk's office, making it public record. It's essential to verify that all documents, including the Florida mortgage deed form, are accurately completed and filed. Utilizing services like US Legal Forms can simplify the process of preparing necessary documents.

The most common type of deed used in Florida is the warranty deed. This form provides a guarantee that the seller holds clear title to the property and has the right to sell it. By utilizing a warranty deed, buyers receive protection against future claims on the property. For specific situations, a Florida mortgage deed form might also be relevant, ensuring clarity in property ownership.

Florida operates as a title state, which means the ownership of real estate is established through legal title rather than the physical transfer of deeds. In this context, understanding the nuances of documents like the Florida mortgage deed form can help you navigate property transactions more effectively.

Obtaining a quitclaim deed in Florida typically requires a few days to several weeks. After you submit the deed to the county clerk for recording, processing times may vary by county. If you want to expedite the process, consider using a Florida mortgage deed form, which provides clarity and legal support for your transaction.

Florida is primarily a mortgage state, meaning it uses mortgages for property financing rather than deeds of trust. In a mortgage, the borrower conveys a lien on the property directly to the lender. This distinction is important when engaging with Florida mortgage deed forms for your real estate needs.

Yes, you can prepare your own quit claim deed in Florida. However, it is recommended to follow the legal requirements closely to ensure the document is valid. Utilizing a Florida mortgage deed form can simplify this process, providing the structure and necessary clauses you need to protect your interests.

Yes, a contract for deed is legal in Florida. It allows the buyer to take possession of the property while making payments over time. However, it is important to ensure that the contract complies with Florida laws related to real estate transactions. You may benefit from using a Florida mortgage deed form for legal clarity.

To create a valid deed in Florida, it must include the names of the parties involved, a clear description of the property, and the signatures of the grantors. Additionally, the Florida mortgage deed form must be notarized and recorded with the county clerk’s office. Ensuring these elements are in place is crucial for the deed's legality and effectiveness.