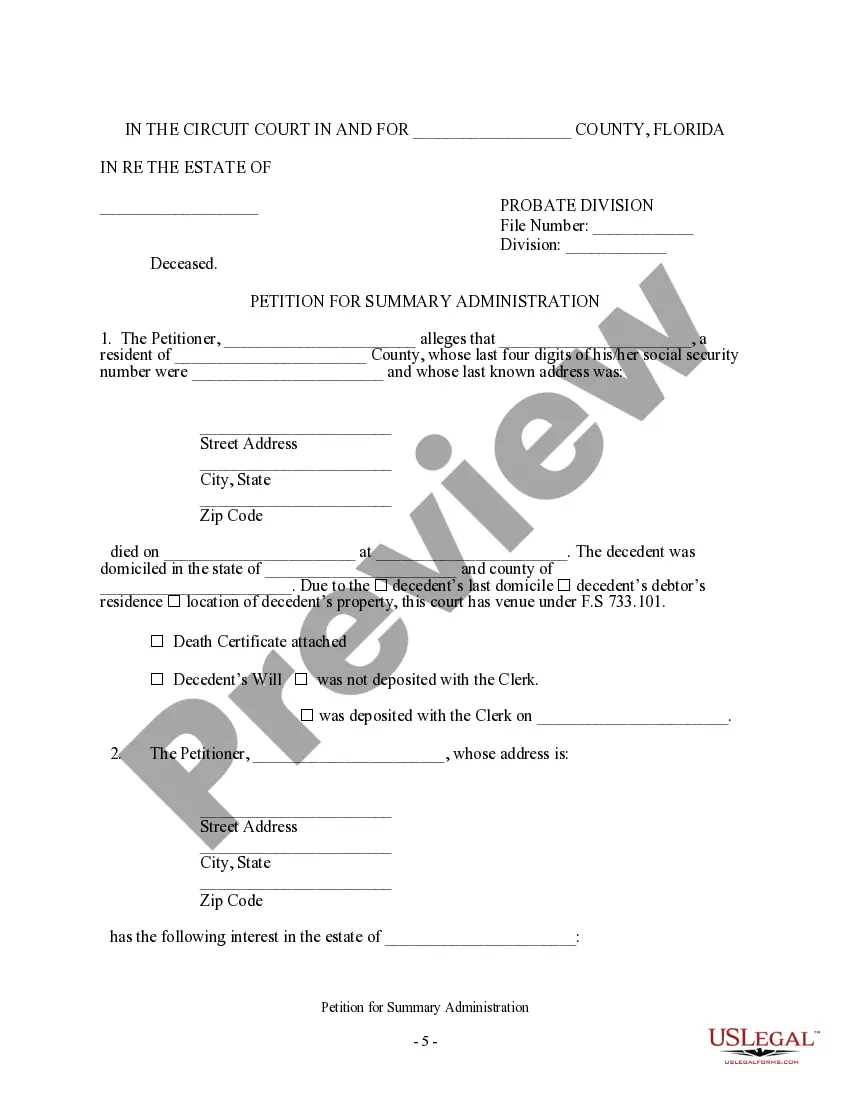

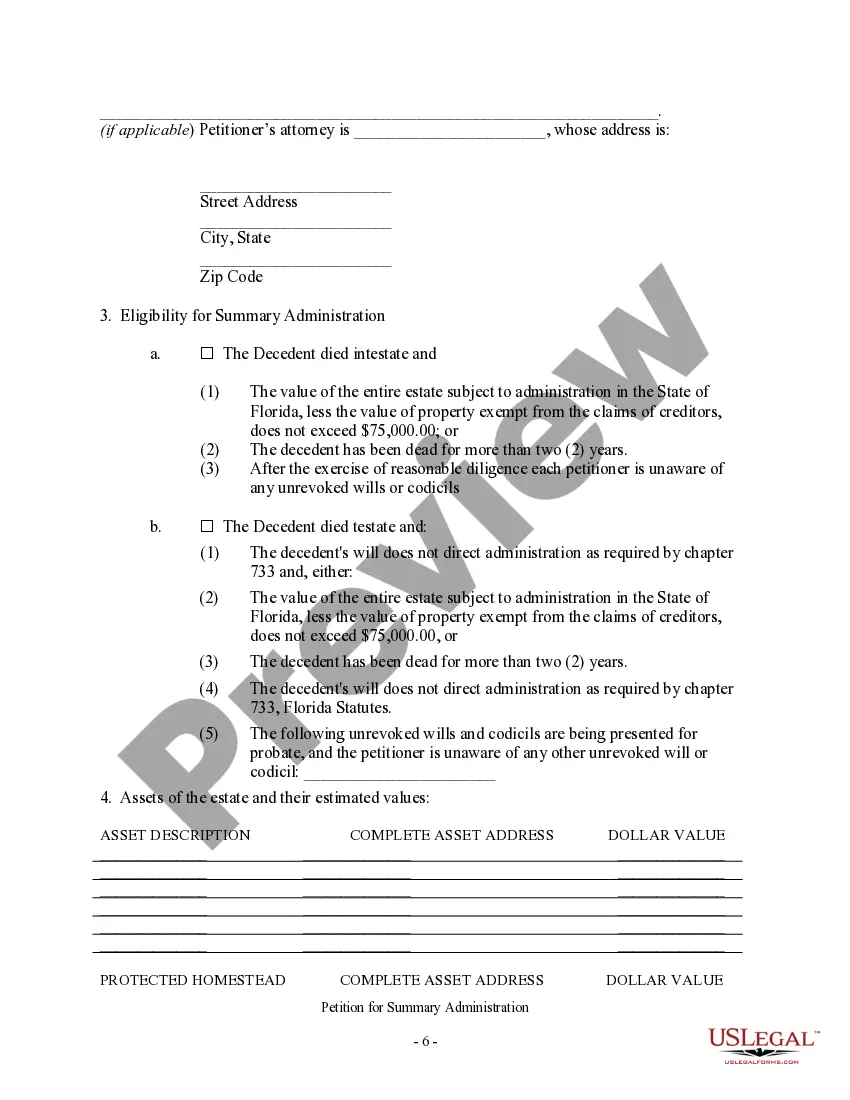

A Summary of Administration Florida form for ancillary is an important legal document used in the state of Florida to summarize the administration process of an estate, particularly when the deceased person had property or assets in Florida. This form is typically utilized in situations where the decedent's primary estate administration is conducted in another state, but ancillary administration is required in Florida. The Summary of Administration Florida form for ancillary serves as a condensed overview of the primary estate administration, ensuring compliance with Florida law. It outlines key details and facilitates the transfer of assets to the beneficiaries or heirs in Florida. This form aids in streamlining the administration process by summarizing important information from the primary estate administration, reducing the need for duplication of paperwork. Keywords: Summary of Administration, Florida form, ancillary administration, estate, assets, beneficiaries, heirs, primary estate administration, legal document, transfer of assets, Florida law, paperwork. Different types of Summary of Administration Florida forms for ancillary can include: 1. Summary of Administration Florida Form for Ancillary Probate: This form is used specifically for ancillary probate cases when an estate needs to be administered in Florida alongside the primary probate process conducted in another state. 2. Summary of Administration Florida Form for Ancillary Administration without Probate: This form is utilized when the primary administration process in another state does not involve a full probate, but ancillary administration is still required in Florida to address assets or property held by the decedent within the state. 3. Summary of Administration Florida Form for Ancillary Summary Administration: In cases where the estate's total value qualifies for a summary administration under Florida law, this form is utilized to summarize the primary administration process and request a simplified summary ancillary administration in Florida. Keywords: Ancillary probate, ancillary administration without probate, summary administration, simplified summary ancillary administration.

Summary Of Administration Florida Form For Ancillary

Description

How to fill out Summary Of Administration Florida Form For Ancillary?

Handling legal paperwork and procedures might be a time-consuming addition to the day. Summary Of Administration Florida Form For Ancillary and forms like it usually require you to search for them and understand the way to complete them appropriately. As a result, whether you are taking care of economic, legal, or individual matters, using a comprehensive and convenient web library of forms at your fingertips will greatly assist.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and a variety of resources to assist you to complete your paperwork effortlessly. Check out the library of relevant documents open to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your papers management processes using a high quality services that lets you prepare any form within a few minutes with no extra or hidden fees. Simply log in to the profile, locate Summary Of Administration Florida Form For Ancillary and acquire it right away from the My Forms tab. You may also gain access to formerly downloaded forms.

Would it be your first time making use of US Legal Forms? Register and set up an account in a few minutes and you’ll get access to the form library and Summary Of Administration Florida Form For Ancillary. Then, adhere to the steps below to complete your form:

- Be sure you have discovered the right form using the Review option and looking at the form description.

- Pick Buy Now when ready, and choose the monthly subscription plan that meets your needs.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise assisting consumers deal with their legal paperwork. Discover the form you need right now and enhance any operation without having to break a sweat.

Form popularity

FAQ

To dissolve your corporation in Alaska, you must file a Certificate of Election to Dissolve, before or at the same time as, the Articles of Dissolution form. File in duplicate with the Alaska Division of Corporations, Business, and Professional Licensing by mail, fax or in person.

File Articles of Dissolution with the state ?An LLC in Alaska must file completed Articles of Dissolution with the Division of Corporations, Business, and Professional Licensing. Meanwhile, a corporation must file a Certificate of Election to Dissolve either before or along with the Articles of Dissolution.

How to Reinstate an Alaska LLC file an initial report. file a biennial report for six months after the due date. appoint and maintain a registered agent. file paperwork after changing your registered agent. pay any fees required by law. truthfully represent facts about your Alaska LLC on your formation documents.

Online renewal is available the first 9 months of a lapsed (expired) business license; after which you can only apply for renewal hardcopy (via in-person, fax, or U.S. Mail) by submitting Business License: RENEWAL Application (form 08-4617) along with the appropriate fees.

Alaska LLC Formation Filing Fee: $250 The main cost of starting an Alaska LLC is the $250 fee to file the Alaska Articles of Organization with the Division of Corporations. Filing this document officially forms your LLC, and you can file online, by mail, or in person.

Involuntary Dissolution is the result of an administrative action taken by the filing office or tax administrator in a state. The company is generally notified of the impending dissolution and after a specified period of time is marked inactive on the filing offices records.

How do you dissolve an Alaska limited liability company? To dissolve your LLC in Alaska, you must provide the completed Articles of Dissolution Limited Liability Company form, in duplicate, to the Division of Corporations, Business, and Professional Licensing by mail, fax or in person.

You may reinstate within two years following the date of dissolution. You can file with the Alaska Division of Corporations, Business, and Professional Licensing in person, by fax, or by mail. If you fax your request, a Credit Card Payment Form is required.