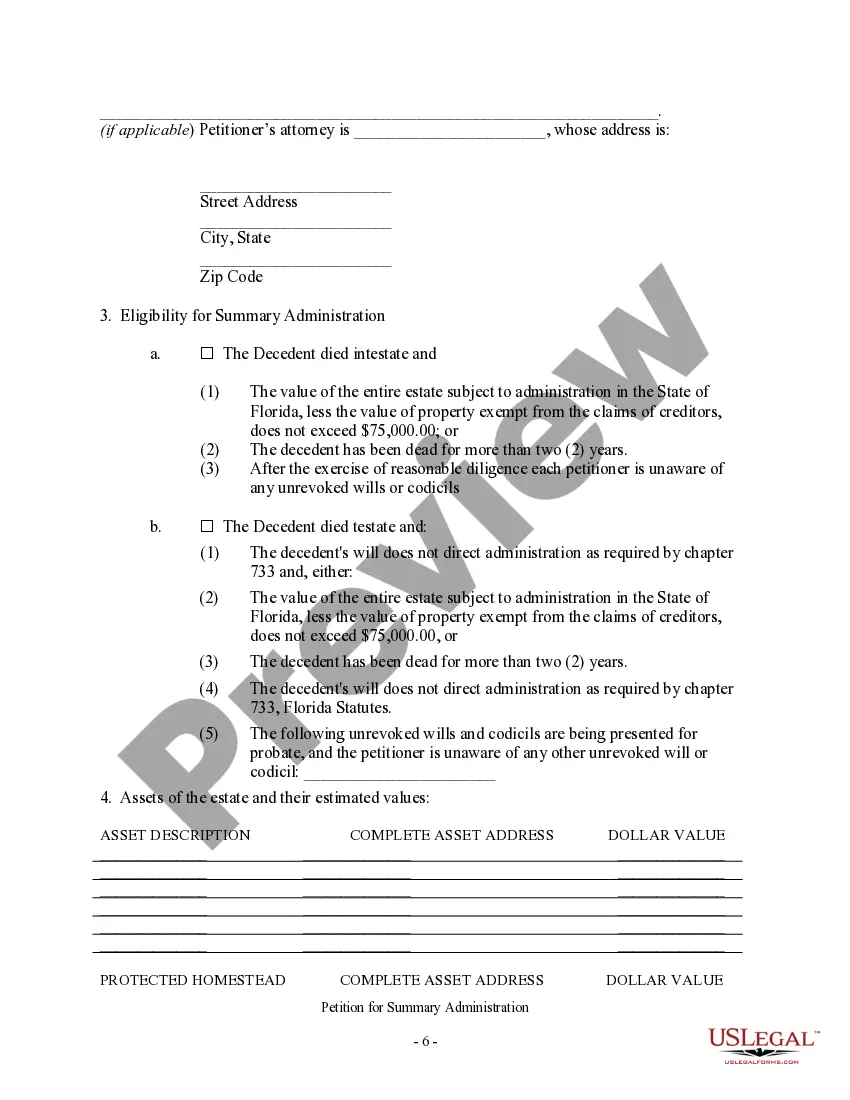

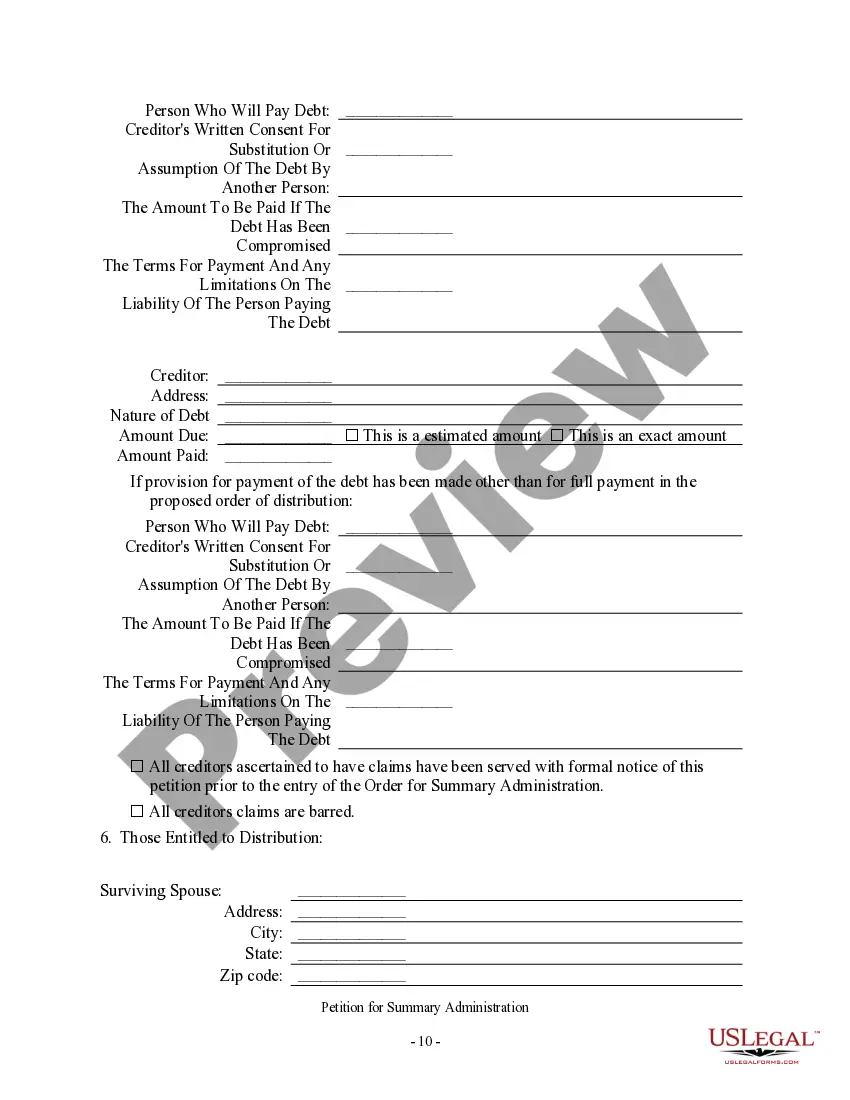

The Summary of Administration Florida Form for probate is a legal document that provides a concise overview of an estate's administration process in the state of Florida. This form is specifically designed to expedite probate proceedings for estates with assets valued below a certain threshold. It helps simplify the process by providing a summary of key details and speeding up the distribution of assets to beneficiaries. Keywords: Summary of Administration, Florida Form, Probate, Estate Administration, Legal Document, Probate Proceedings, Assets Valuation, Beneficiaries, Simplify, Distribution. There are two primary types of Summary of Administration Florida Forms for probate: 1. Summary Administration for Estates with a value less than $75,000: This form is applicable when the total value of an estate's assets, excluding exempt property and homestead, is less than $75,000. It allows for a simplified and quicker probate process, without the need for a personal representative or the appointment of a formal executor. This type of summary administration can be filed when the decedent has been deceased for at least two years or if there is a surviving spouse. 2. Summary Administration for Estates valued over $75,000 but less than $175,000: This type of Summary of Administration Florida Form is utilized when the estate's assets, excluding exempt property and homestead, are valued between $75,000 and $175,000. It is applicable in cases where the decedent has been deceased for at least two years or if there is a surviving spouse. However, a formal Notice to Creditors must be published in a local newspaper to notify potential creditors about the administration of the estate. Both types of Summary Administration Forms aim to streamline the probate process, ensuring a swift distribution of assets to rightful beneficiaries while reducing the associated administrative burden. These forms are crucial for simplifying the legal proceedings and efficiently managing estates within the specified value thresholds in the state of Florida.

Summary Of Administration Florida Form For Probate

Description summary administration form

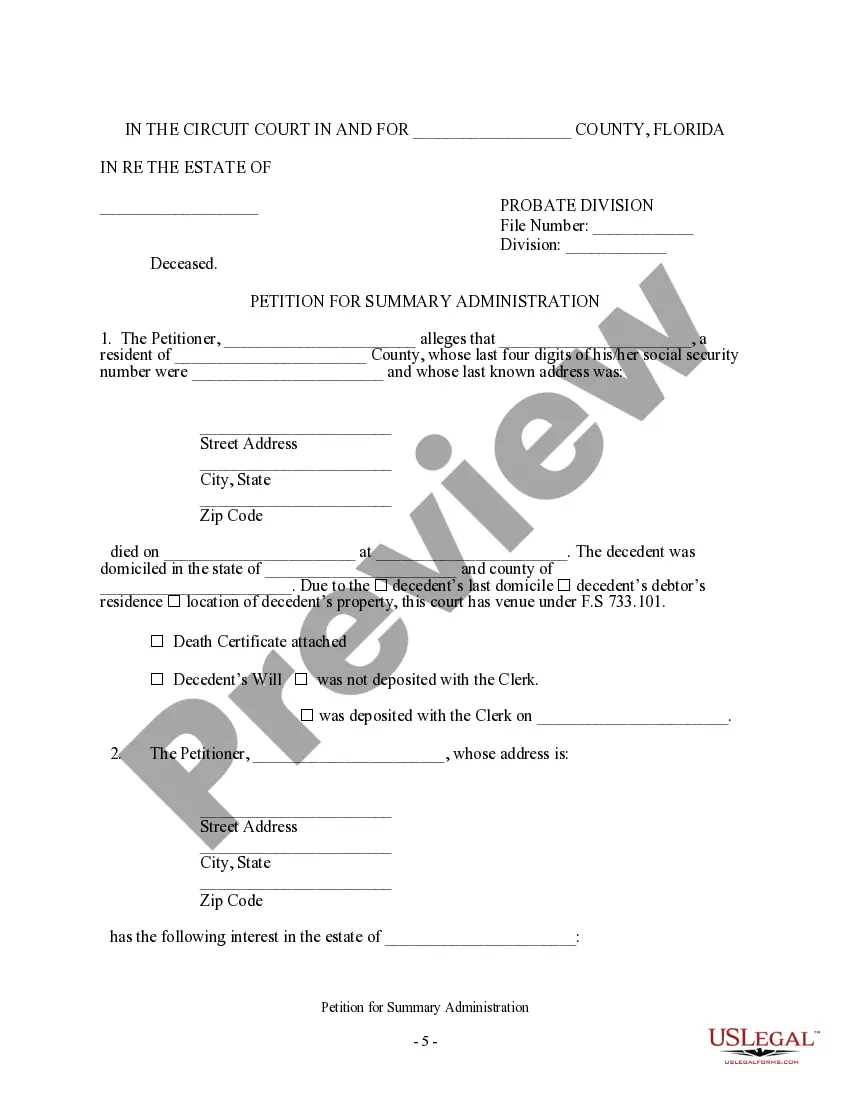

How to fill out Summary Of Administration Florida Form For Probate?

Whether for business purposes or for personal matters, everyone has to manage legal situations at some point in their life. Filling out legal documents needs careful attention, beginning from picking the proper form template. For instance, when you select a wrong edition of a Summary Of Administration Florida Form For Probate, it will be rejected when you send it. It is therefore crucial to get a reliable source of legal documents like US Legal Forms.

If you have to obtain a Summary Of Administration Florida Form For Probate template, stick to these easy steps:

- Get the template you need using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to find the Summary Of Administration Florida Form For Probate sample you need.

- Download the file when it matches your needs.

- If you have a US Legal Forms account, click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the account registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Pick the file format you want and download the Summary Of Administration Florida Form For Probate.

- When it is downloaded, you can fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time looking for the appropriate template across the web. Take advantage of the library’s straightforward navigation to find the correct form for any occasion.

Form popularity

FAQ

Though the affiant is not legally required to have a lawyer, it is wise for the affiant to hire one. It may seem wasteful to hire a lawyer when an estate is small, but many of the same rules that govern the full blown Illinois probate process apply to the affidavit.

How long does it take the court to open the informal probate and appoint a Personal Representative? The court will not sign the Letters or appoint a Personal Representative until a certain amount of time has passed: If the person who died was an Alaska resident: 5 days after the person's death.

What is an Affidavit of Heirship in Illinois? An affidavit of heirship is a written statement establishing the right of inheritance. To be valid, it must be signed under oath and witnessed by a third party.

After Filing the Petition If you are appointed the Personal Representative, the court will send you the Letters Testamentary (or Letters of Administration) once it is signed by the clerk or magistrate. This is the document that you will use to prove that you are authorized to act on behalf of the estate.

Alternatively, the affidavit may be recorded at the same time as a property deed is recorded. Once this is done, the property records will be updated to show the heirs as the new owners of the property. Thereafter, they may transfer or sell the property title if they chose to.

You can only use a small estate affidavit if the estate has no more than $100,000 in it. You cannot use a small estate affidavit to transfer real property, such as a house.

The heirship of a deceased person is determined through a document called an ?Affidavit of Heirship?. This is a form that gives a detailed explanation of the heirs at law of the deceased person at the time of his/her death.

In Illinois a lawyer is required for probate unless the estate is valued at less than $100,000 and does not have real estate; in that case the Illinois Small Estate Affidavit says the estate does not require a lawyer for probate court. This can reduce the time and cost to distribute the deceased's assets.