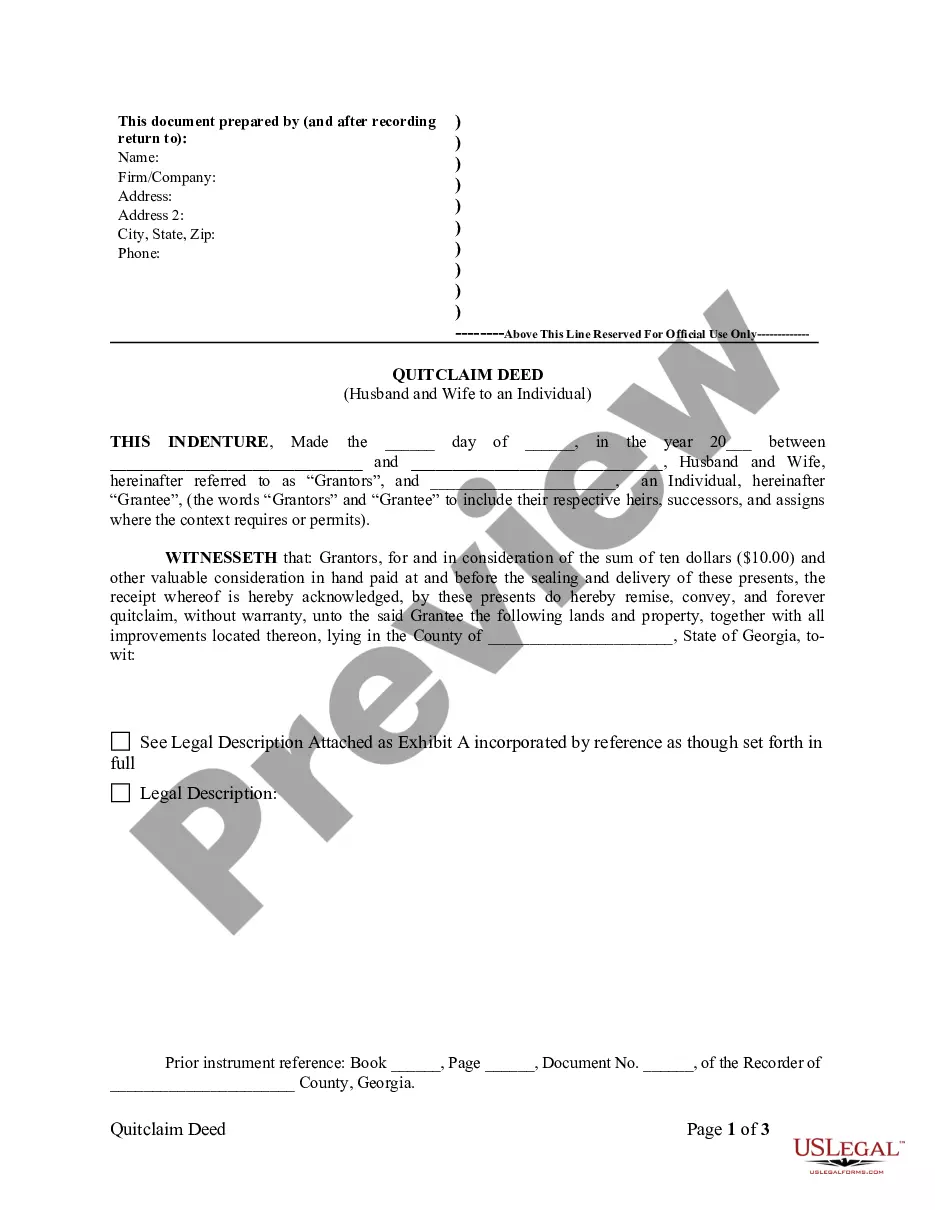

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Quitclaim Deed Wife With Mortgage Owed

Description

How to fill out Quitclaim Deed Wife With Mortgage Owed?

No matter if you deal with documentation frequently or need to submit a legal document from time to time, it is essential to have a resource where all samples are interconnected and current.

One task you need to accomplish with a Quitclaim Deed Wife With Mortgage Owed is to confirm that it is the latest version, as it determines whether it can be submitted.

If you want to streamline your search for the most recent document examples, look for them on US Legal Forms.

Utilize the search menu to locate the specific form you need.

- US Legal Forms is a repository of legal templates that includes nearly every document sample you could need.

- Search for the forms you require, evaluate their applicability immediately, and discover more about their use.

- With US Legal Forms, you gain access to approximately 85,000 form templates across a broad array of fields.

- Find the Quitclaim Deed Wife With Mortgage Owed samples in just a few clicks and save them anytime to your account.

- Having a US Legal Forms account will enable you to access all the samples you need with greater ease and less hassle.

- Simply click Log In in the site header and navigate to the My documents section with all the necessary forms at your fingertips, eliminating the need to spend time searching for the ideal template or verifying its relevance.

- To obtain a form without an account, adhere to these steps.

Form popularity

FAQ

If your name is not on a deed but you are married in Georgia, you may still have rights to the property under state law. Georgia follows the principle of equitable distribution, which may affect how assets are divided during a divorce. Additionally, the concept of marital ownership can grant you rights to the property, even if your name does not appear on the deed. Engaging a legal professional can help clarify your rights and guide you through any necessary steps.

A spouse's rights to a property after signing a quitclaim deed in Georgia largely depend on the circumstances surrounding the deed's signing. If the deed indicates a transfer of property ownership, the spouse may relinquish certain rights, especially if there is a mortgage owed on the property. It's essential to review the terms of the deed and seek legal counsel to understand how it impacts property rights. Resources like US Legal Forms can assist in clarifying these nuances.

In Georgia, signing a quitclaim deed typically transfers your interest in the property to another party. However, this does not eliminate the rights of a spouse regarding property acquired during the marriage. If a quitclaim deed is signed, the spouse may lose their financial interest in that property, especially if there is a mortgage owed. For clarity and security, it is advisable to consult a legal expert, particularly when dealing with a quitclaim deed and mortgage issues.

A Quitclaim deed primarily benefits individuals seeking to transfer property rights quickly and easily, often among family members. It can simplify the process of transferring ownership when a spouse, like in a situation involving a quitclaim deed wife with mortgage owed, is added to the title without the complexities of a sale. However, this method does not guarantee clear title, so it's important for recipients to understand their rights and responsibilities before proceeding. Services like US Legal Forms can offer guidance on the implications of using a Quitclaim deed.

Yes, you can add your wife to the property deed without including her on the mortgage. This means she will have ownership rights to the property but will not be responsible for repaying the mortgage. It's important to communicate with your lender about this arrangement, as they may have policies regarding title changes. Consulting resources like US Legal Forms can help you navigate the legal aspects of a Quitclaim deed wife with mortgage owed.

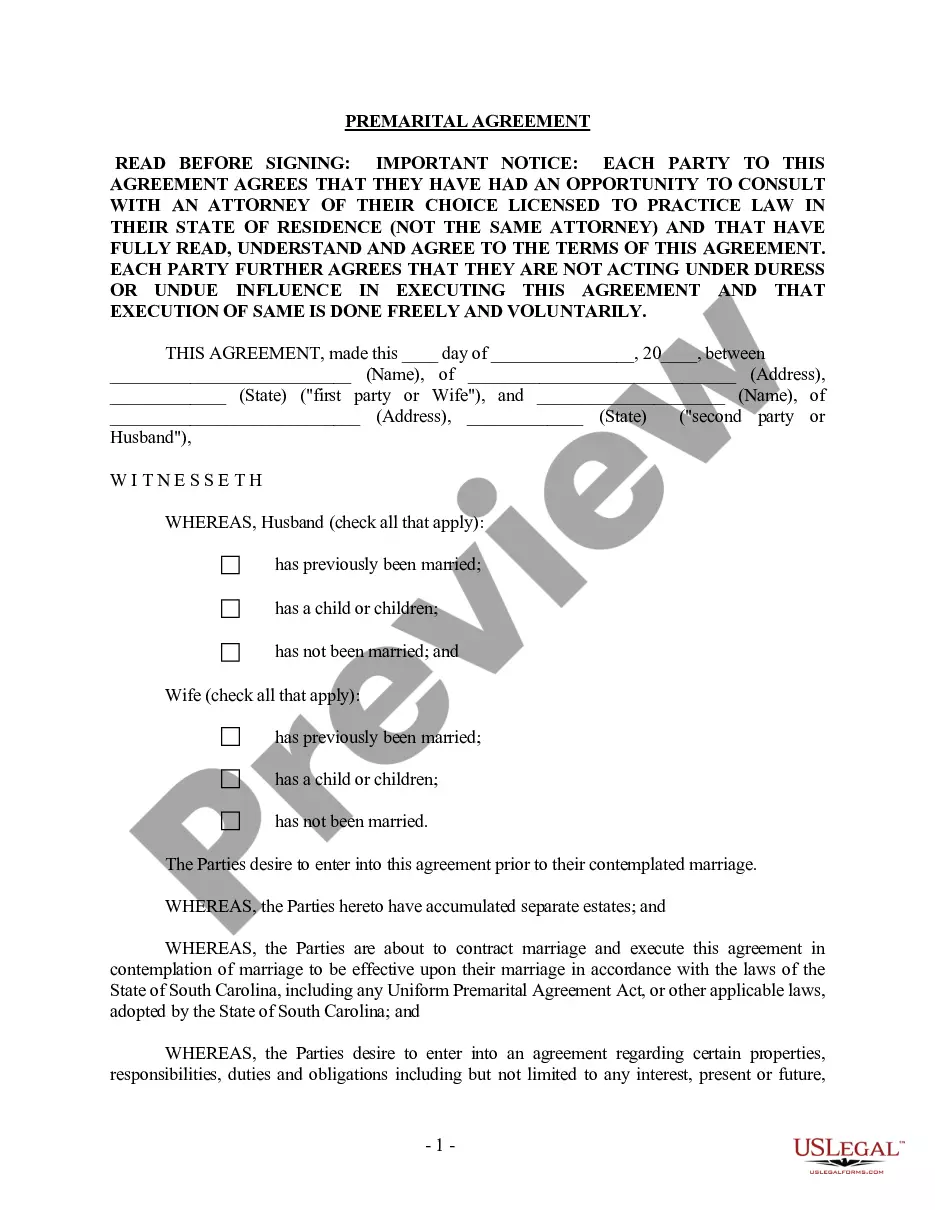

In South Carolina, you can add your spouse to a property deed by executing a Quit Claim Deed. This involves drafting the deed with both names, detailing the property information, and signing it in front of a notary. Once completed, you will need to file this deed with your local county clerk's office to make it official. Tools and templates from platforms like US Legal Forms can simplify this procedure, ensuring you handle the documentation accurately.

To fill out a Quit Claim Deed, start by entering the names of the current owners and the person you want to add to the home title. Make sure to describe the property accurately, including its address and any legal description. After that, both parties need to sign the deed in front of a notary to make it legally binding. Using services like US Legal Forms can help streamline this process and ensure that you meet all necessary legal requirements.

In California, once a spouse signs a quitclaim deed, they typically relinquish any rights to the property transferred under that deed. However, if the deed was signed under duress or without a full understanding, it may be contestable in court. Specifically regarding a quitclaim deed wife with mortgage owed, it is advisable to consult with a legal professional to ensure proper understanding of rights and implications during these transactions.

A quitclaim deed is most commonly used to transfer an interest in a property without making any warranties about the title. It is often utilized in situations like divorce, where one spouse, like a wife, needs to transfer her interest in a property where a mortgage is owed. This type of deed facilitates a straightforward transfer and can help streamline the process when dealing with a quitclaim deed wife with mortgage owed.

The warranty deed is the most commonly used deed that provides the most protections to buyers. Unlike quitclaim deeds, which merely convey interest without guarantees, warranty deeds offer assurances against issues that may arise with the property title. This is particularly important when considering a quitclaim deed wife with mortgage owed, as it’s crucial to ensure clear title and right of ownership to avoid future disputes.