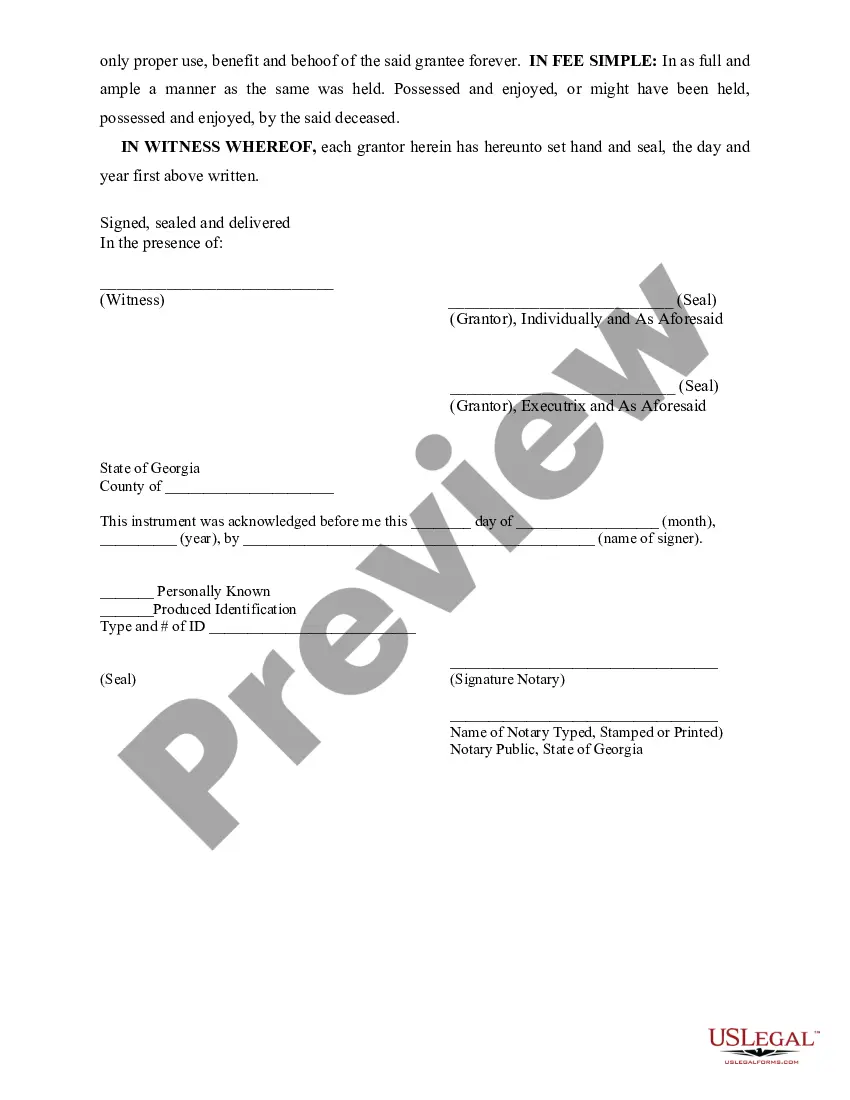

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Executor's Deed, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-A2005

Executor's Deed Form Georgia

Description

How to fill out Executor's Deed Form Georgia?

What is the most reliable source to obtain the Executor's Deed Form Georgia and other current versions of legal forms.

US Legal Forms is the solution! It is the best collection of legal documents for any situation. Each template is expertly crafted and verified for adherence to federal and local regulations. They are categorized by field and state of application, making it easy to find the one you require.

US Legal Forms is a fantastic choice for anyone needing to process legal documents. Premium users have even more benefits as they can complete and sign previously stored documents electronically at any time using the integrated PDF editing tool. Check it out today!

- Advanced users of the site just need to Log In to the system, confirm the validity of their subscription, and click the Download button next to the Executor's Deed Form Georgia to acquire it.

- Once saved, the template will be available for future access under the My documents section of your profile.

- If you do not yet have an account with our library, here are the steps you should follow to create one.

- Form compliance verification. Before you acquire any template, you must verify whether it meets your usage requirements and your state or county's guidelines. Review the form description and utilize the Preview option if provided.

Form popularity

FAQ

To transfer a property deed after death in Georgia, the executor must first obtain the executor's deed form Georgia. This form must be completed and signed, outlining the details of the property and the decedent's wishes. After completing the form, you must file it with the county clerk's office to officially transfer ownership.

Executors in Georgia can receive fees based on a percentage of the estate's value, typically ranging from 2% to 5%. The exact amount can vary depending on the size and complexity of the estate. By utilizing the executor's deed form Georgia, executors can ensure they follow legal guidelines, helping them understand their compensation better.

In Georgia, executor fees are considered taxable income. If you receive payment for your work as an executor, you must report that income on your tax return. It is essential to understand how the executor's deed form Georgia fits into this situation, as it may require careful accounting of any fees received during the process.

An executor's deed in Georgia is a formal document used by an executor to convey real estate owned by a deceased person. It provides legal assurance that the executor has the authority to transfer property as per the will. To ensure all requirements are met and to simplify the transfer, using an executor's deed form Georgia is an excellent choice.

An administrator's deed is a legal document used to transfer property from an estate when there is no will, or the executor is not appointed. This deed grants an administrator the authority to sell or distribute properties according to Georgia's intestacy laws. For proper documentation, an executor's deed form Georgia can facilitate this process effectively.

An executor cannot arbitrarily override a beneficiary's rights or decisions without legal justification. The executor must adhere to the terms outlined in the will and act in the best interests of the estate and its beneficiaries. If disputes arise, consulting resources like the executor's deed form Georgia can provide clarity on the executor's authority.

In Georgia, an executor typically has nine months to one year to settle an estate, though the timeline can vary based on the complexity of the estate. Factors such as the need for property sales, creditor claims, and tax obligations can extend this time frame. To manage the process efficiently, using the executor's deed form Georgia can help facilitate timely property transfers.

Yes, Georgia recognizes transfers on death (TOD) deeds, which allow property owners to transfer real estate upon death without going through probate. The TOD deed must be properly executed and recorded before the property owner’s death. For assistance with the required paperwork, consider using the executor's deed form Georgia for clarity and compliance.

A deed of assent in Georgia is a legal document that allows an executor to transfer property to the beneficiaries named in a will. This type of deed is essential when settling an estate, as it formalizes the transfer of ownership. For accurate execution, using an executor's deed form Georgia can help simplify the documentation required.

Yes, an executor can sell property in Georgia, provided they have the authority granted in the will or through court approval. The executor must follow legal procedures, including notifying beneficiaries and obtaining appraisals if necessary. Utilizing an executor's deed form Georgia streamlines this process, ensuring proper documentation of the sale.