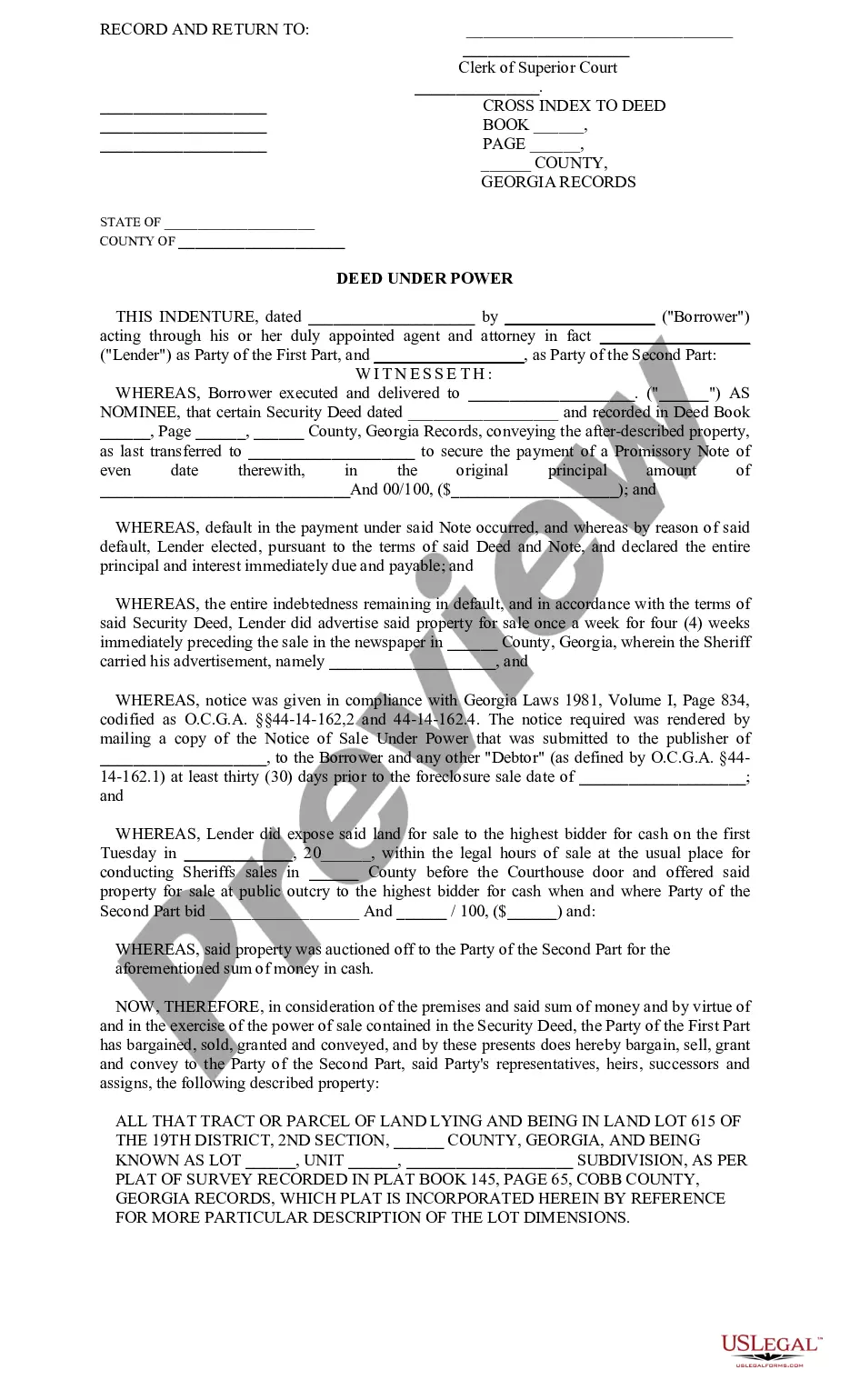

Deed Under Power Foreclosure

Description

How to fill out Deed Under Power Foreclosure?

There’s no longer a necessity to squander hours searching for legal documents to satisfy your local state regulations.

US Legal Forms has compiled all of them in one location and optimized their availability.

Our site offers over 85,000 templates for any business and personal legal situations organized by state and area of application.

Utilize the search bar above to find another template if the previous one did not meet your needs. Click Buy Now next to the template name once you locate the appropriate one. Select the most fitting subscription plan and create an account or Log In. Process your subscription payment with a card or via PayPal to proceed. Choose the file format for your Deed Under Power Foreclosure and download it to your device. Print your form for manual completion or upload the template if you prefer utilizing an online editor. Preparing official paperwork under federal and state regulations is quick and simple with our library. Experience US Legal Forms today to keep your documentation organized!

- All forms are accurately drafted and validated, ensuring you receive an up-to-date Deed Under Power Foreclosure.

- If you are acquainted with our platform and already possess an account, confirm that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all stored documents whenever necessary by accessing the My documents tab in your profile.

- If you've never utilized our platform previously, the process will require a few additional steps.

- Here's how new users can discover the Deed Under Power Foreclosure in our inventory.

- Examine the page content closely to ensure it includes the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

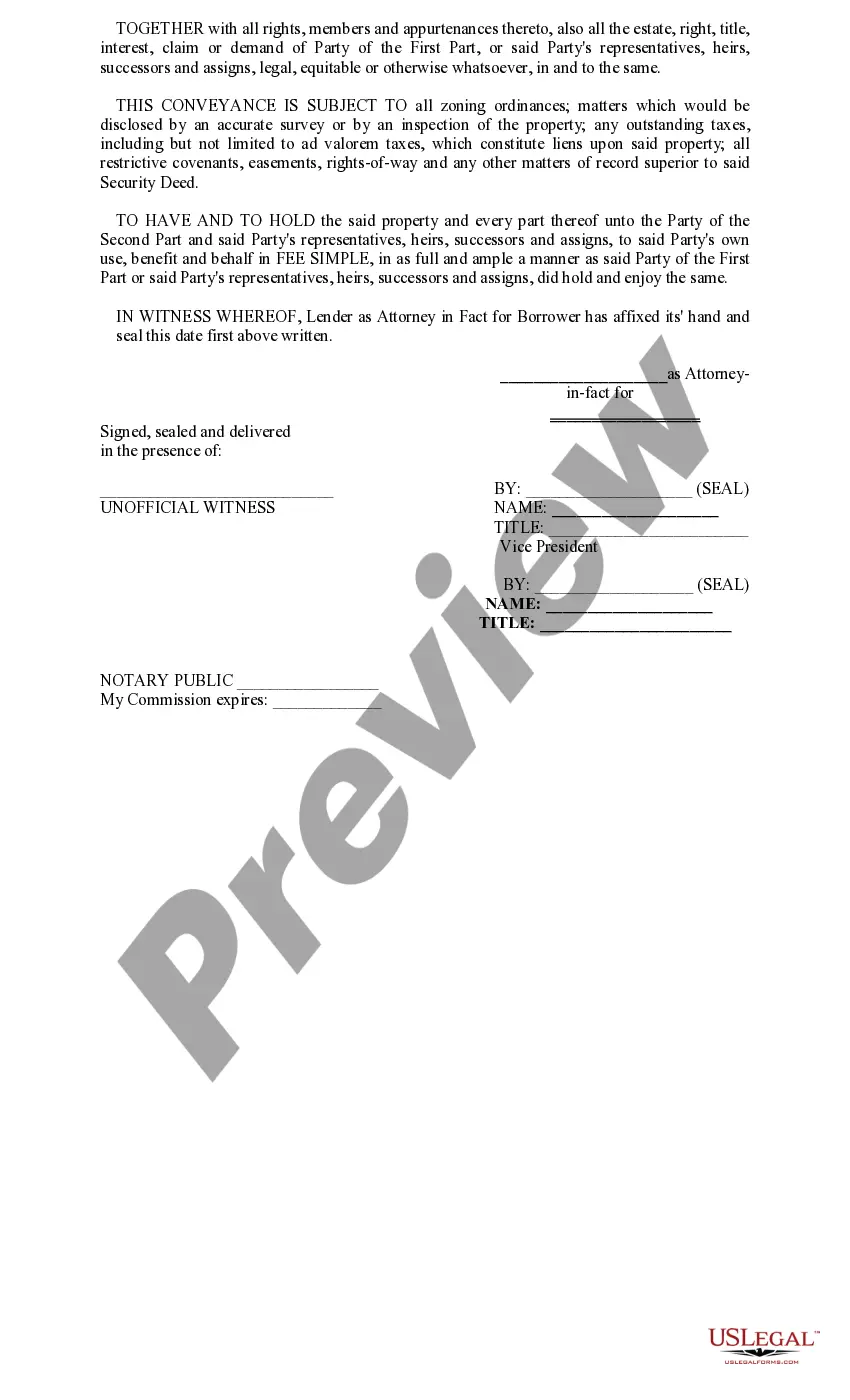

A deed in lieu of foreclosure allows a homeowner to transfer the property title to the lender instead of going through the foreclosure process. This option can help the homeowner avoid some of the negative impacts of foreclosure. When considering a deed under power foreclosure, it's essential to weigh the benefits against the potential consequences on credit. US Legal Forms offers resources that can guide you through this process effectively.

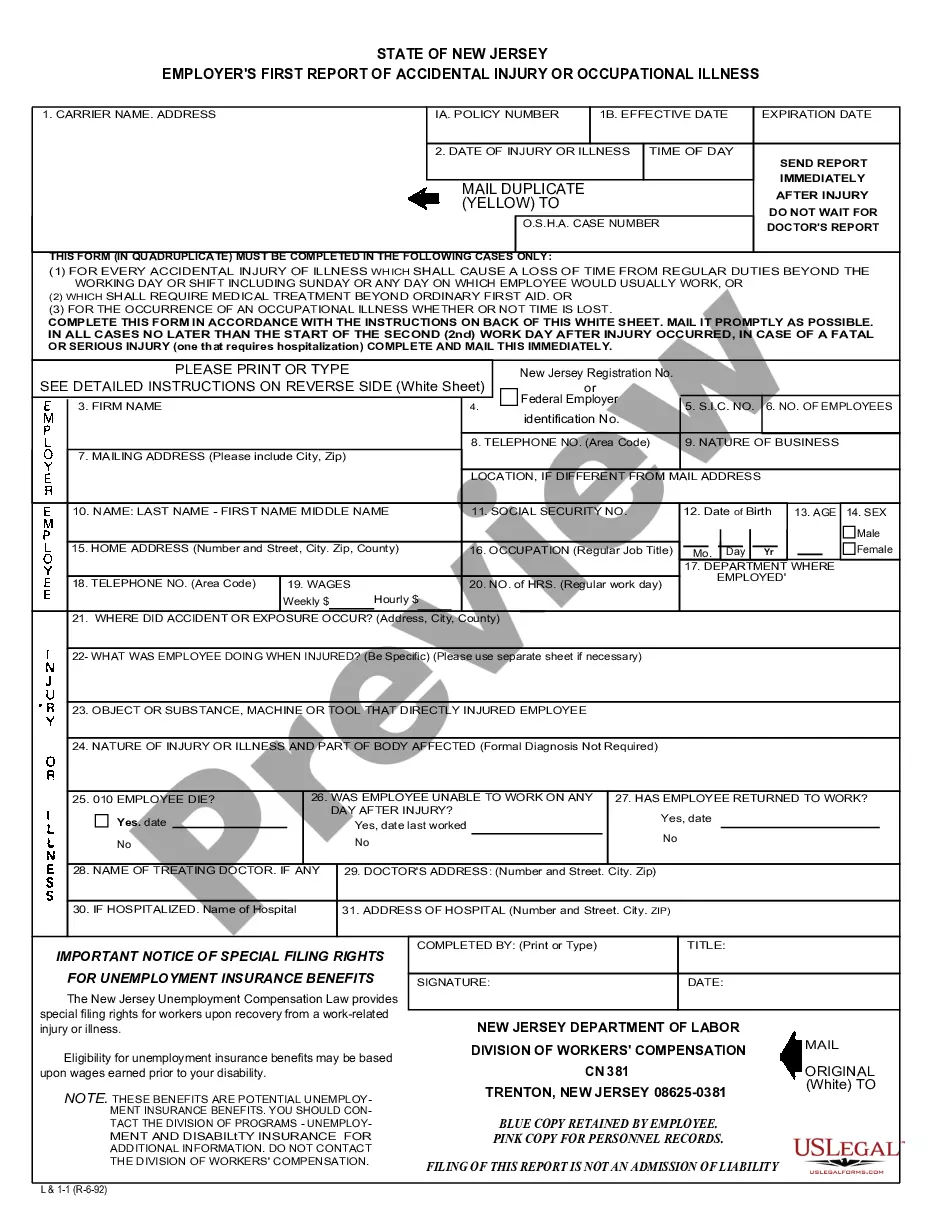

States like New Jersey and New York tend to have the longest foreclosure processes, often exceeding a year or more. Factors such as judicial requirements and borrower protections contribute to these prolonged timelines. In contrast, states with non-judicial foreclosures may experience quicker processes. If you are facing a deed under power foreclosure, knowing your state's laws can provide essential insights for your next steps.

In the Philippines, the timeframe for foreclosure can vary but generally takes around several months to a year. Initially, after a borrower defaults, lenders provide notifications and assist in resolving the debt. If no resolution is reached, the lender may start the legal action to initiate a deed under power foreclosure. Understanding this timeline can help borrowers engage with their lenders and explore alternatives.

To initiate a deed under power foreclosure, certain requirements must be met. Primarily, the homeowner must have defaulted on their mortgage payments, typically after missing three to six payments. Additionally, lenders must provide proper notification to the borrower before proceeding with the foreclosure process. Familiarizing yourself with these requirements can help you prepare and respond effectively.

The foreclosure process in the US generally begins with a borrower defaulting on their mortgage payments. After several missed payments, the lender may initiate a deed under power foreclosure. This process involves notifying the borrower, conducting a public auction of the property, and ultimately transferring ownership to the lender if no buyers emerge. Understanding the process is vital, as knowing your rights can help you navigate this challenging situation.

After a foreclosure auction, obtaining the deed under power foreclosure involves several essential steps. First, you need to confirm who won the auction and ensure that the sale is finalized. Next, the new owner must receive the deed, which often requires filing with the county recorder's office. If you have questions about this process, the US Legal Forms platform can provide detailed legal documents and guidance to help you navigate the steps effectively.

The most likely disadvantage for a lender accepting a deed in lieu of foreclosure is the possibility of unfavorable market conditions impacting property sales. If the real estate market is down, the lender might incur significant losses when trying to sell the property. Additionally, the lender must navigate any liens or claims against the property that could complicate or delay the sale process.

The disadvantages of a deed include potential loss of equity for the borrower and challenges in clearing title to the property. If not processed correctly, the borrower may still face outstanding debts linked to the property. Moreover, the property's future resale value might be affected, as buyers could be wary of properties tied to a deed under power foreclosure.

A deed in lieu of foreclosure presents several disadvantages, including possible tax implications for the borrower. When homeowners transfer property in this manner, they might still be responsible for any remaining debts. Furthermore, lenders may hesitate to accept a deed if the property has liens or disputes that complicate ownership transfer.