Deed Of Debt Forgiveness Template

Description

How to fill out Deed Of Debt Forgiveness Template?

Individuals often connect legal documentation with intricate processes that only an expert can handle.

In some respects, this is accurate, as creating a Deed Of Debt Forgiveness Template necessitates considerable knowledge of subject matter, including state and local laws.

Nonetheless, with US Legal Forms, everything has become easier: pre-prepared legal documents for any life and business event specific to state legislation are compiled in a single online directory and are now accessible to everyone.

All templates in our collection are reusable: once acquired, they are saved in your account. You can always access them via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Register right away!

- US Legal Forms provides over 85,000 current documents categorized by state and area of application, making it easy to search for a Deed Of Debt Forgiveness Template or any other specific document within minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to get the form.

- New users on the platform will first need to register an account and subscribe before they can download any files.

- Here is the step-by-step guide on how to obtain the Deed Of Debt Forgiveness Template.

- Carefully review the page content to ensure it meets your requirements.

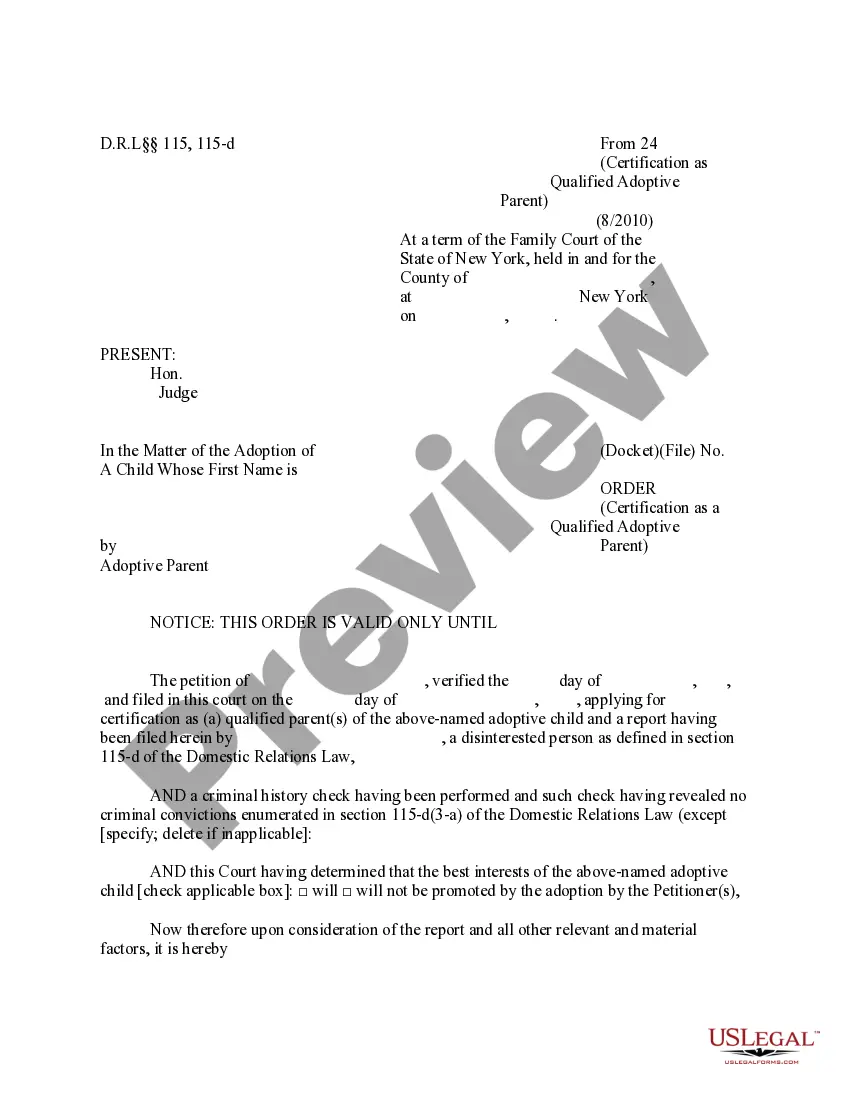

- Read the form description or view it through the Preview option.

- If the previous template does not fit your needs, search for another sample using the Search field above.

- Once you find the appropriate Deed Of Debt Forgiveness Template, click Buy Now.

- Select the pricing plan that fits your needs and budget.

- Create an account or Log In to proceed to the payment page.

- Pay for your subscription using PayPal or a credit card.

- Choose the format for your document and click Download.

- Print your document or upload it to an online editor for easier completion.

Form popularity

FAQ

To record debt forgiveness in accounting, you need to remove the liability from your books and recognize income equal to the amount forgiven. A Deed of Debt Forgiveness template can help formalize this process and provide clarity in your financial records. Make sure to adjust your financial statements accordingly and consult with your accountant for the best practices.

You report debt forgiveness using Form 1099-C, which is issued by the lender to report cancelled debt over a certain amount. If you create a Deed of Debt Forgiveness template, you can present the necessary documentation to support your tax filings. Ensure you keep clear records and understand how this might impact your taxable income.

Debt forgiveness is accounted for as a cancellation of a liability, which typically results in taxable income for the borrower. When you utilize a Deed of Debt Forgiveness template, it clearly outlines the terms of forgiveness, making it easier to document. Always consult a tax professional to understand the tax implications accurately, as forgiveness can affect your financial statements.

An example of a debt forgiveness letter typically includes your name, address, the creditor's name, and a clear statement of forgiveness for the debt. You might say you are forgiving a certain amount due to financial hardship. This letter should be formal and may reference a Deed of debt forgiveness template to ensure all legal bases are covered.

Writing a forgiveness of debt letter involves clearly stating the terms of the debt cancellation. Begin with the creditor's name and contact information, followed by a statement indicating that you are forgiving a specified amount of debt. Utilize a deed of debt forgiveness template to ensure all necessary details are included, such as the date, a description of the debt, and any conditions of forgiveness. This letter should be signed by both parties to solidify the agreement and provide legal protection.

The primary document for debt forgiveness is a deed of debt forgiveness template. This legally binding document outlines the agreement between the lender and the borrower regarding the cancelled debt. It specifies the terms, the amount of debt forgiven, and any conditions attached to the forgiveness. Having such a document protects both parties and helps avoid future misunderstandings or disputes.

Various types of debts can be forgiven, including credit card debt, medical bills, and personal loans. Student loans may also be eligible under specific circumstances, such as income-driven repayment plans. Utilizing a deed of debt forgiveness template can simplify the process, ensuring all parties agree on the terms. However, it’s essential to consult with a financial advisor to understand the implications and eligibility of specific debts for forgiveness.

To record debt forgiveness, both parties should document the agreement formally using a deed of debt forgiveness template. This document serves as a legal record indicating that the lender has agreed to forgive the debt amount. Additionally, the borrower should update their financial records and notify credit reporting agencies, if necessary, to reflect the debt's cancellation. Proper documentation helps avoid future disputes over the forgiven debt.

One of the most common forms of debt relief is debt forgiveness. This involves a lender agreeing to cancel part or all of a borrower's debt. By using a deed of debt forgiveness template, individuals can formalize this arrangement, ensuring clarity and protection for both parties. Many find this option more manageable than bankruptcy, as it allows for a fresh financial start without the severe impacts on credit.

A debt forgiveness agreement is a legal document between the creditor and debtor that outlines the terms of forgiven debt. This agreement provides protection and clarity for both parties involved. It typically includes details regarding the forgiven amount and any future obligations. Using a deed of debt forgiveness template can help you create a comprehensive and effective agreement.