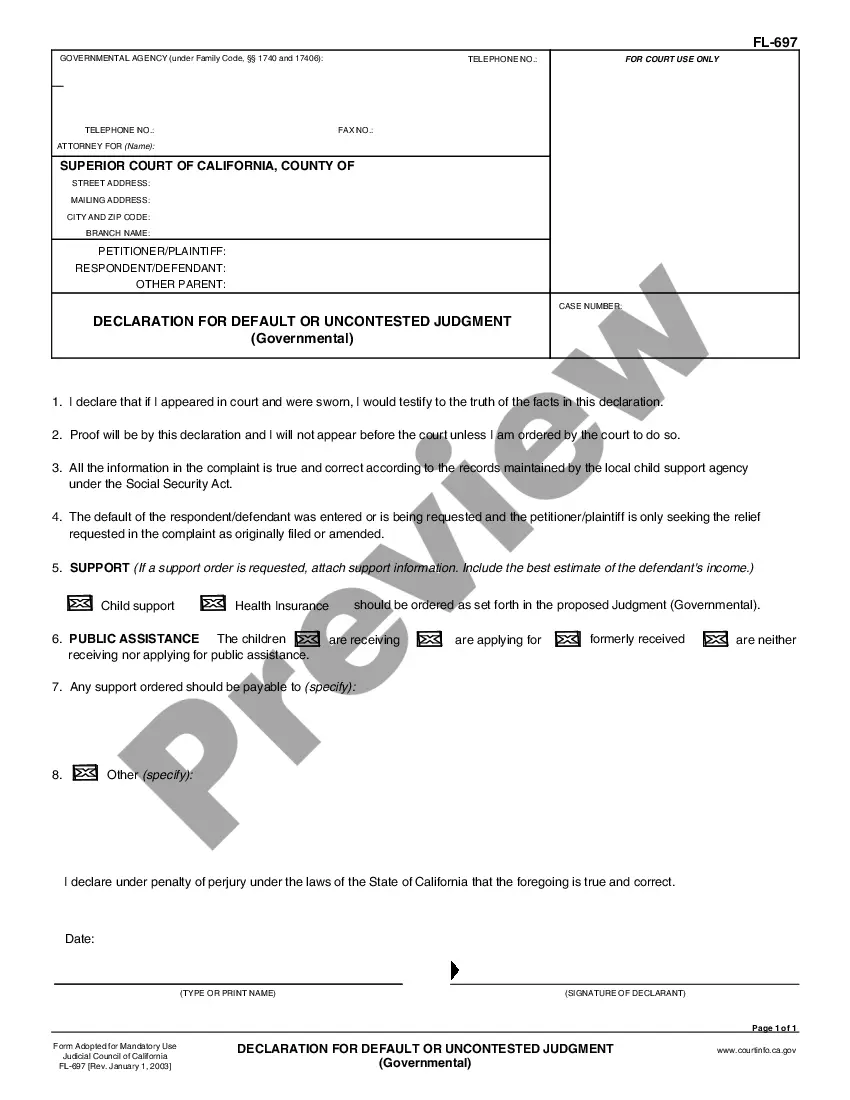

Heloc Payment Example Format

Description heloc explained

How to fill out Heloc Payment Example Format?

It’s obvious that you can’t become a legal expert immediately, nor can you learn how to quickly prepare Heloc Payment Example Format without the need of a specialized set of skills. Creating legal forms is a time-consuming venture requiring a specific training and skills. So why not leave the preparation of the Heloc Payment Example Format to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court documents to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the document you need in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Heloc Payment Example Format is what you’re looking for.

- Start your search over if you need any other template.

- Register for a free account and choose a subscription option to purchase the form.

- Choose Buy now. As soon as the payment is complete, you can get the Heloc Payment Example Format, complete it, print it, and send or mail it to the designated people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The advance health care directive provides a clear statement of your wishes about prolonging your life or withholding or withdrawing treatment. You can also choose to request relief from pain even if doing so hastens death.

The specific rules and restrictions vary by state; however, in Arkansas, your Power of Attorney must be acknowledged by a notary public or signed by two witnesses. At least one witness to this PoA must be someone who is not a relative, spouse, adoptee, heir, or any other beneficiary.

An Arkansas advance directive allows a person to articulate their preferences for medical treatment and choose someone to make health care decisions on their behalf. The form is used as a guide for a hospital on how to treat someone in the chance they should become permanently incapacitated with no possible cure.

What is an Arkansas Medical Power of Attorney? An Arkansas Medical Power of Attorney is a legal document that grants a selected person permission to make healthcare decisions on your behalf, such as accepting or refusing a specific medical treatment, if you cannot do so.

This legal document authorizes someone chosen by an individual (called an 'agent') to make decisions on their behalf if they are no longer able to speak for themselves. The agent makes decisions on behalf of the patient which is aligned with their known or stated preferences for ongoing medical care.

Advance directives are legal documents that provide instructions for medical care and only go into effect if you cannot communicate your own wishes. The two most common advance directives for health care are the living will and the durable power of attorney for health care.

Advance directives generally fall into three categories: living will, power of attorney and health care proxy. LIVING WILL: This is a written document that specifies what types of medical treatment are desired. A living will can be very specific or very general.