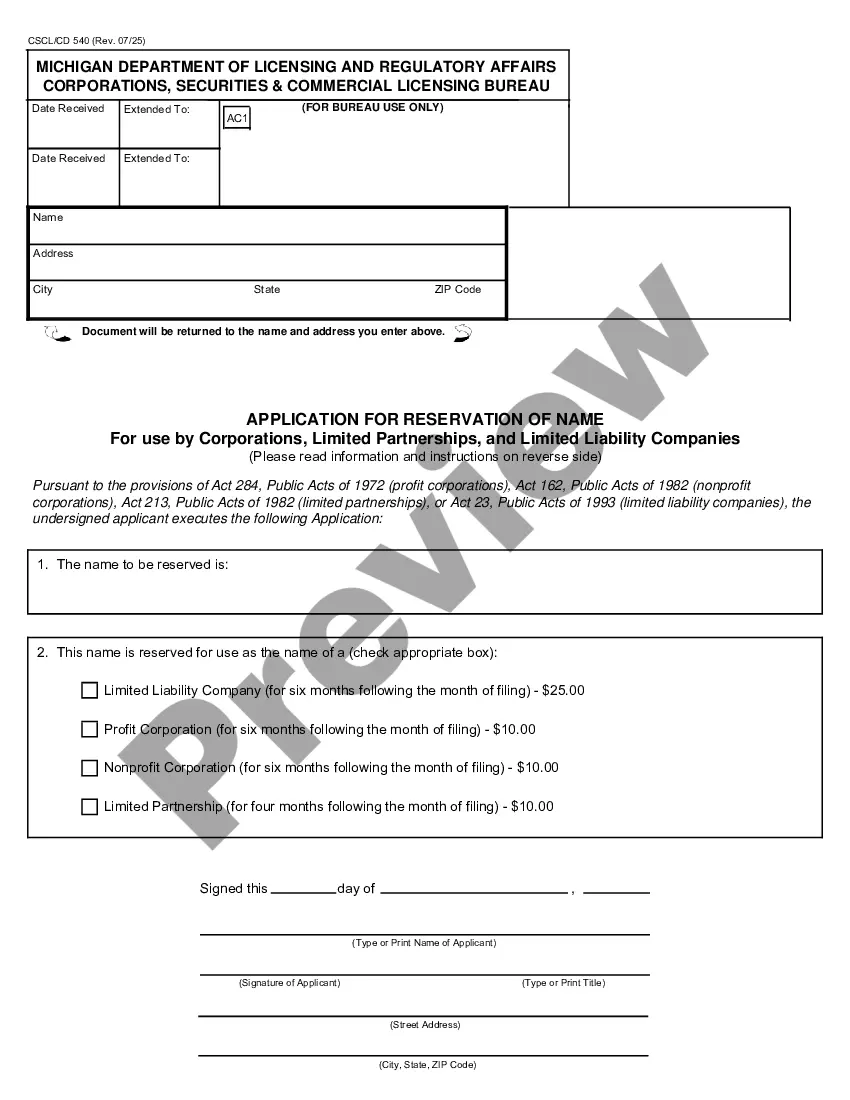

This is a Name Change package for a family for the state of Georgia. This package contains (1) State Specific Information on change of name, (2) Steps to Change your Name, (3) Forms required to file with the appropriate court. Your satisfaction is guaranteed!

Name Change Instructions Form For Pan Card

Description

Form popularity

FAQ

If your PAN and Aadhaar are not linked, you may face difficulties in filing your income tax return. Begin by accessing the official tax portal and look for the option to link your PAN and Aadhaar. If there are discrepancies, using the name change instructions form for PAN card can help resolve any issues quickly. Take these steps to maintain compliance with Indian tax regulations.

Resolving a PAN and Aadhaar name mismatch involves a few simple steps. Start by gathering the required documents and filling out the name change instructions form for PAN card accurately. Submit the form along with necessary documents at the designated authority, ensuring all information is consistent across both documents. Completing this process promptly will minimize any potential issues with your tax liabilities.

The CSF (Correction Slip Format) form for a PAN card is used to request updates or corrections to your PAN details. If you encounter discrepancies, such as a name mismatch, you must fill out this form along with a name change instructions form for PAN card. This initial form will provide guidance on how to correct your information efficiently. Ensure all necessary documents accompany your application for a smoother process.

Merging your Aadhaar and PAN card is a crucial step for tax compliance in India. First, visit the official tax portal or Aadhaar website and locate the option to link these documents. You may need to provide a name change instructions form for PAN card if there are discrepancies. Following these steps ensures your identification records are synchronized correctly.

Linking your PAN and Aadhaar incorrectly can lead to complications in your tax filings. If you realize there's a mistake, immediately fill out the relevant name change instructions form for PAN card. This form will allow you to rectify the details by guiding you through the correction process with clear instructions. Ensuring accurate linkage is vital for smooth financial transactions.

If your PAN card and Aadhaar card have different names, you must correct this disparity to ensure compliance with Indian tax laws. Start by submitting a name change instructions form for PAN card on the official PAN website. After submitting the form, follow the necessary steps, including providing supporting documents. Doing so will help you avoid penalties and ensure your records are updated.

The consent message in a PAN card indicates that the applicant agrees to the terms and conditions concerning the issuance and use of the PAN. This consent assures the authorities that the information provided is accurate. If you're updating your name, ensure the new name aligns with the consent message on your PAN card, and consider using the name change instructions form for pan card to clarify any required changes.

The PAN cancellation form 49A is used to formally request the cancellation of an existing PAN card. This may be necessary if you have multiple PAN cards or need to correct information. If your goal involves changing details on a PAN card, the name change instructions form for pan card will be more relevant in this situation.

To change your name on a PAN card, you need to fill out Form 49A, providing the new name and relevant documents. Submitting this form along with the necessary proofs is important for processing your request. Using the name change instructions form for pan card can help simplify this step, making it easier to complete your application correctly.

Item 14 in Form 49A pertains to the applicant's full name as it should appear on the PAN card. This section is vital for ensuring that your PAN card accurately reflects your identity, especially if you're changing your name. The name change instructions form for pan card offers guidelines to fill this item accurately if you're updating your name.