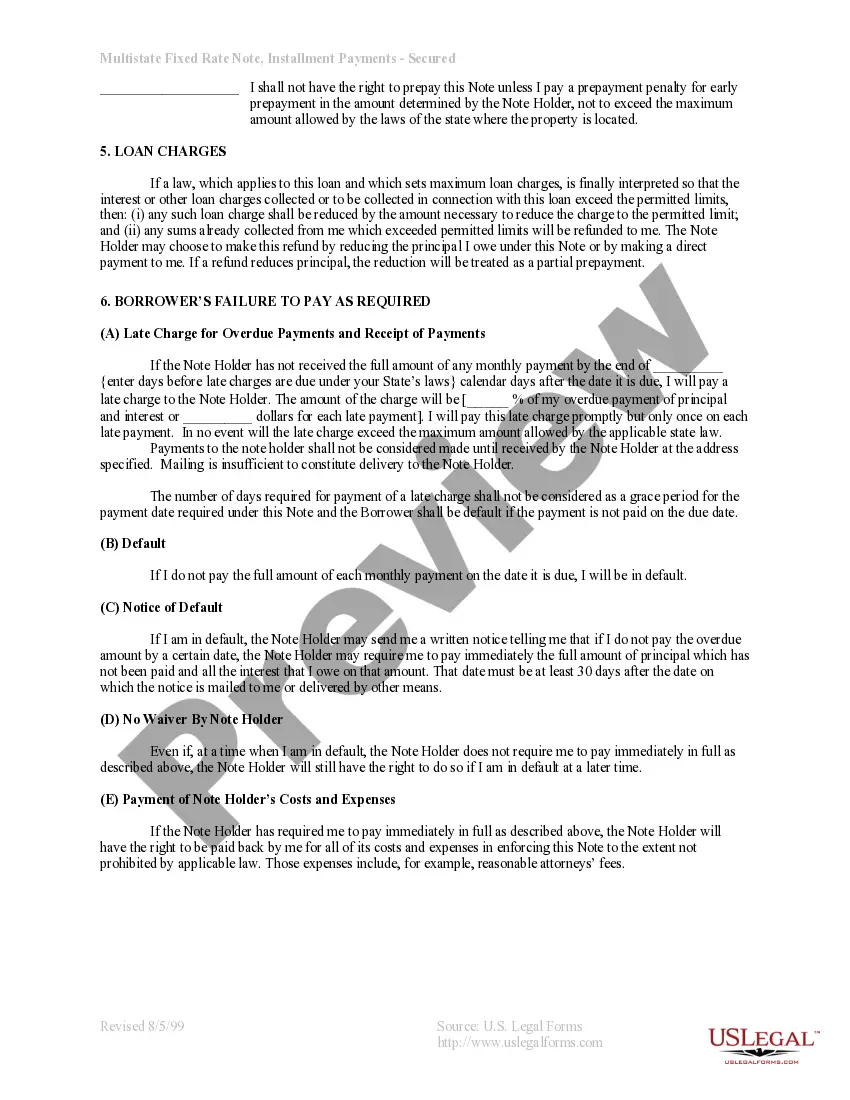

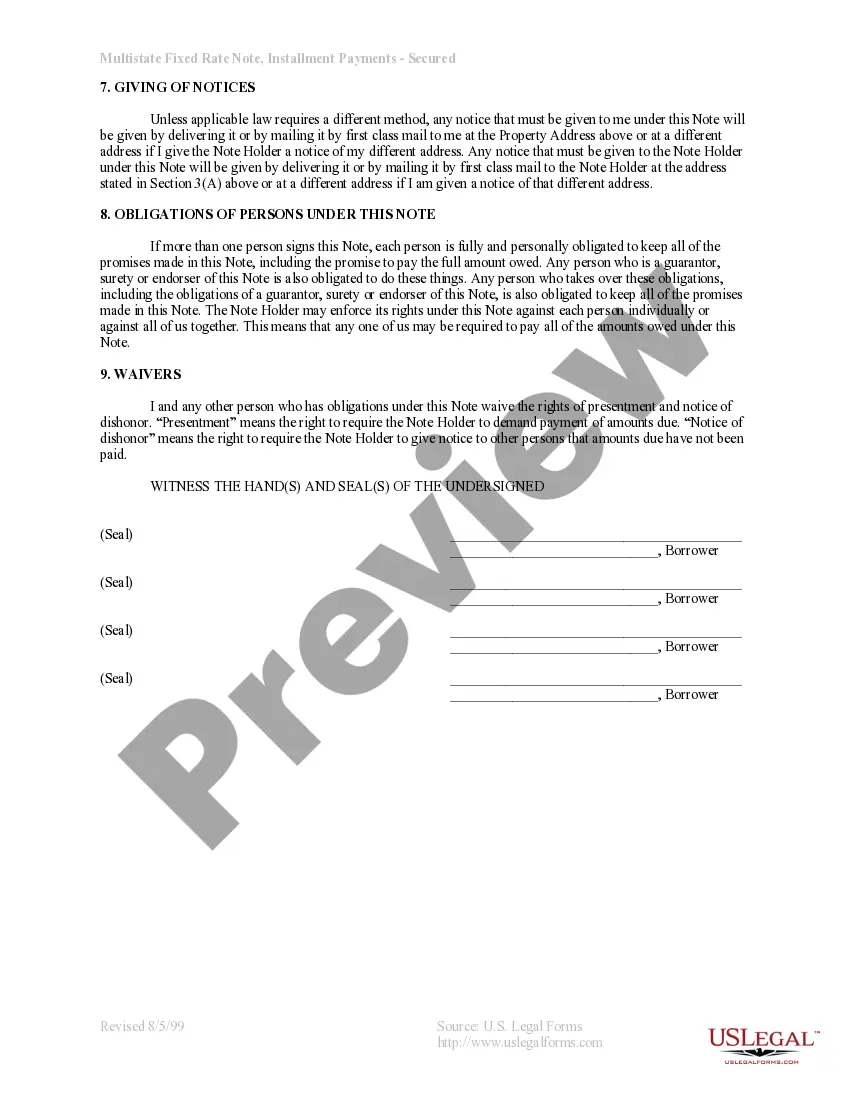

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Georgia Promissory Note With Chattel Mortgage

Description

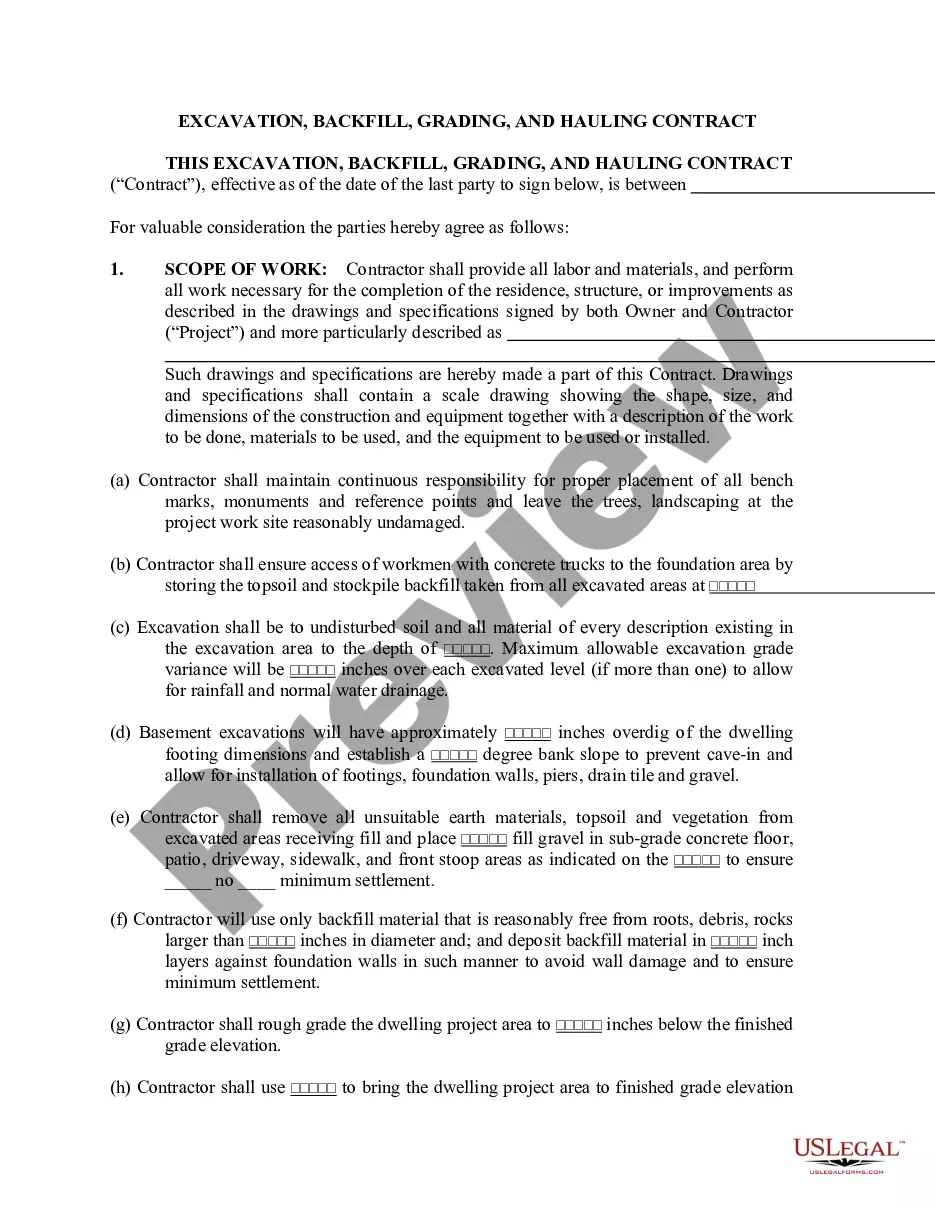

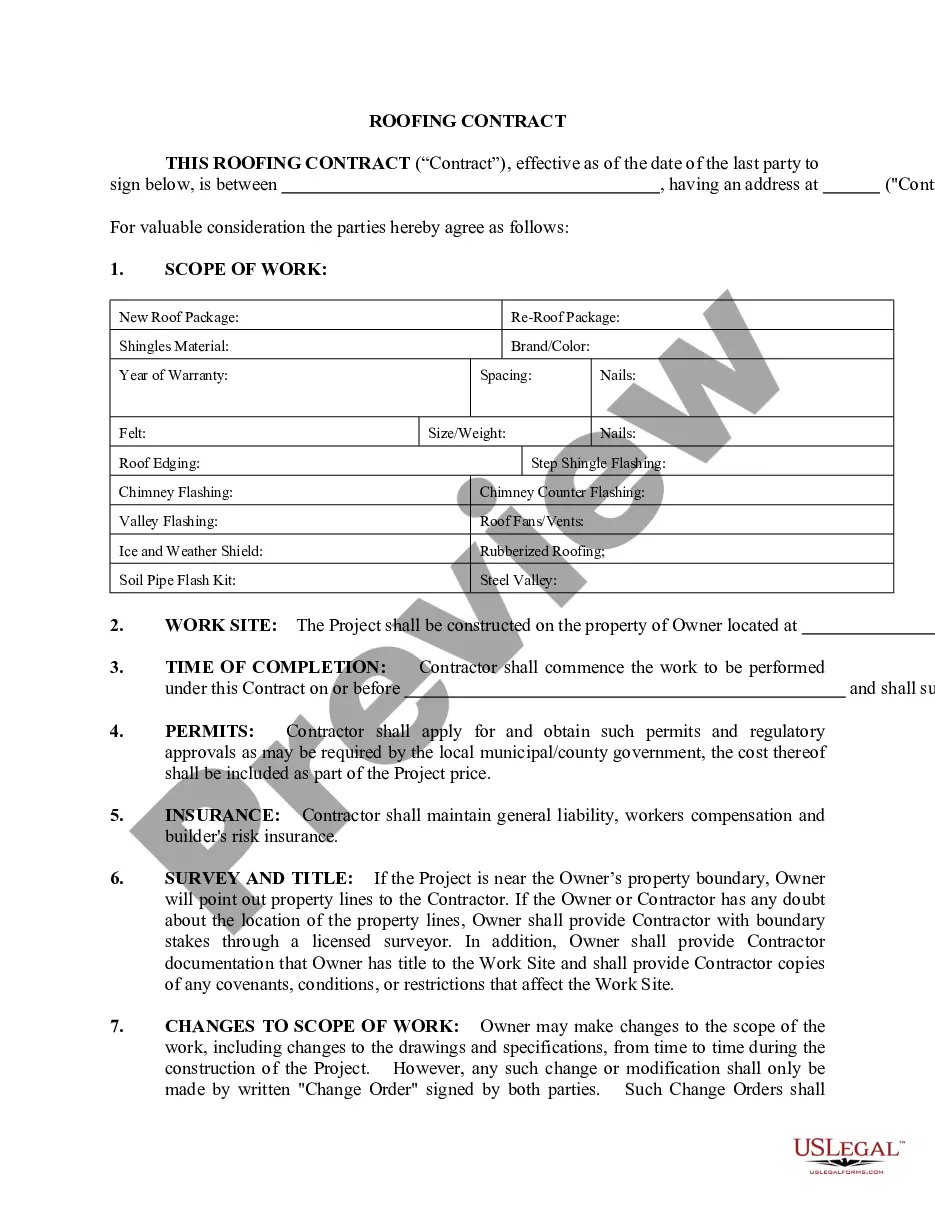

How to fill out Georgia Promissory Note With Chattel Mortgage?

What is the most dependable service to acquire the Georgia Promissory Note With Chattel Mortgage and other recent iterations of legal documents.

US Legal Forms is the solution! It boasts the broadest assortment of legal papers for any situation.

If you don't yet have an account with us, follow these steps to create one: Form compliance evaluation. Prior to obtaining any template, assess if it meets your usage criteria and your state or county's regulations. Review the form overview and utilize the Preview option if it exists. Alternative template search. If there are any discrepancies, employ the search bar in the page header to locate another document. Click Buy Now to select the suitable option. Registration and subscription purchase. Choose the most fitting pricing plan, Log In or establish your account, and complete the payment for your subscription via PayPal or credit card. Downloading the document. Choose the format in which you wish to save the Georgia Promissory Note With Chattel Mortgage (PDF or DOCX) and click Download to obtain it. US Legal Forms is an excellent resource for anyone needing to handle legal documentation. Premium subscribers can even benefit more as they can complete and sign previously saved documents electronically at any time using the integrated PDF editing feature. Give it a try today!

- Each template is skillfully crafted and validated for conformity with national and local laws.

- Documents are organized by field and state of usage, making it simple to find the one you require.

- Regular users of the platform just need to Log In to the system, verify that their subscription is active, and click the Download button next to the Georgia Promissory Note With Chattel Mortgage to access it.

- Once saved, the template is accessible for future use in the My documents section of your profile.

Form popularity

FAQ

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A Georgia promissory note must be signed and dated by the borrower and a witness. It should also be notarized.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.