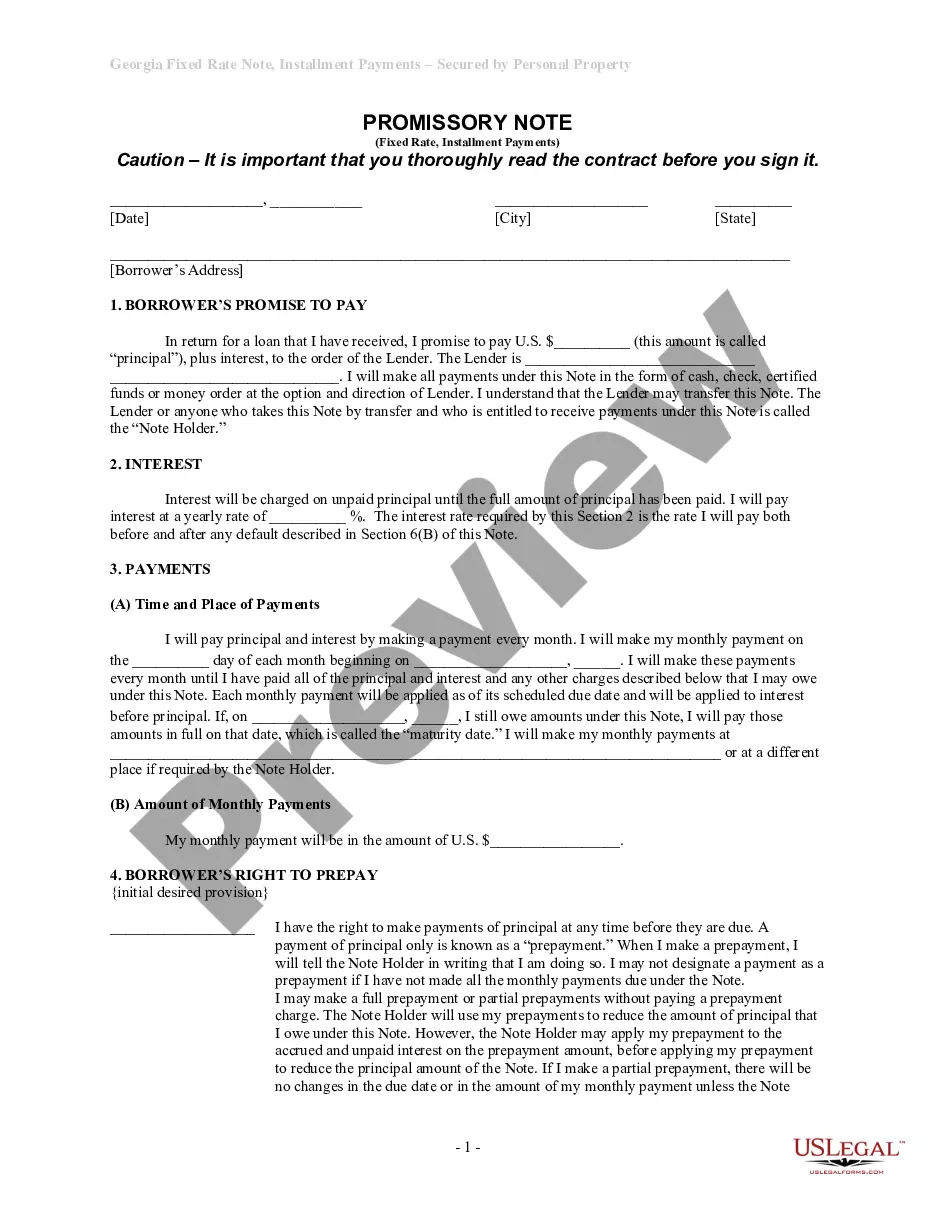

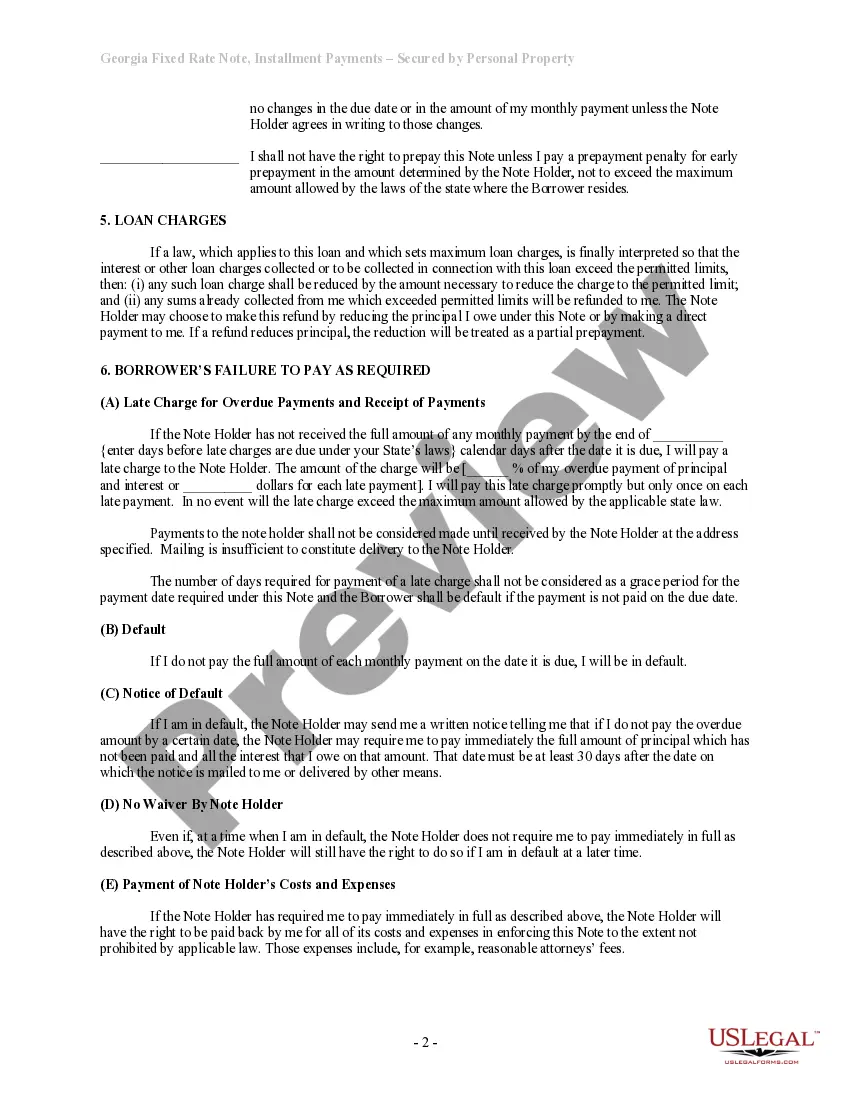

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Secured Personal Property With Real Estate

Description

Form popularity

FAQ

Secure property generally refers to real estate that is protected under a legal agreement or contract. For example, your home can be considered secure when you have a mortgage in place, linking it to your financial obligations. This security helps ensure that both the lender and borrower have clear guidelines on responsibilities and rights.

Secured personal property with real estate refers to assets linked to a valuable item, like a home or a car. For instance, a mortgage on your property is secured by the home itself, while credit card debt is considered unsecured because it isn’t tied to any physical asset. Understanding these differences can help you manage your finances more effectively.

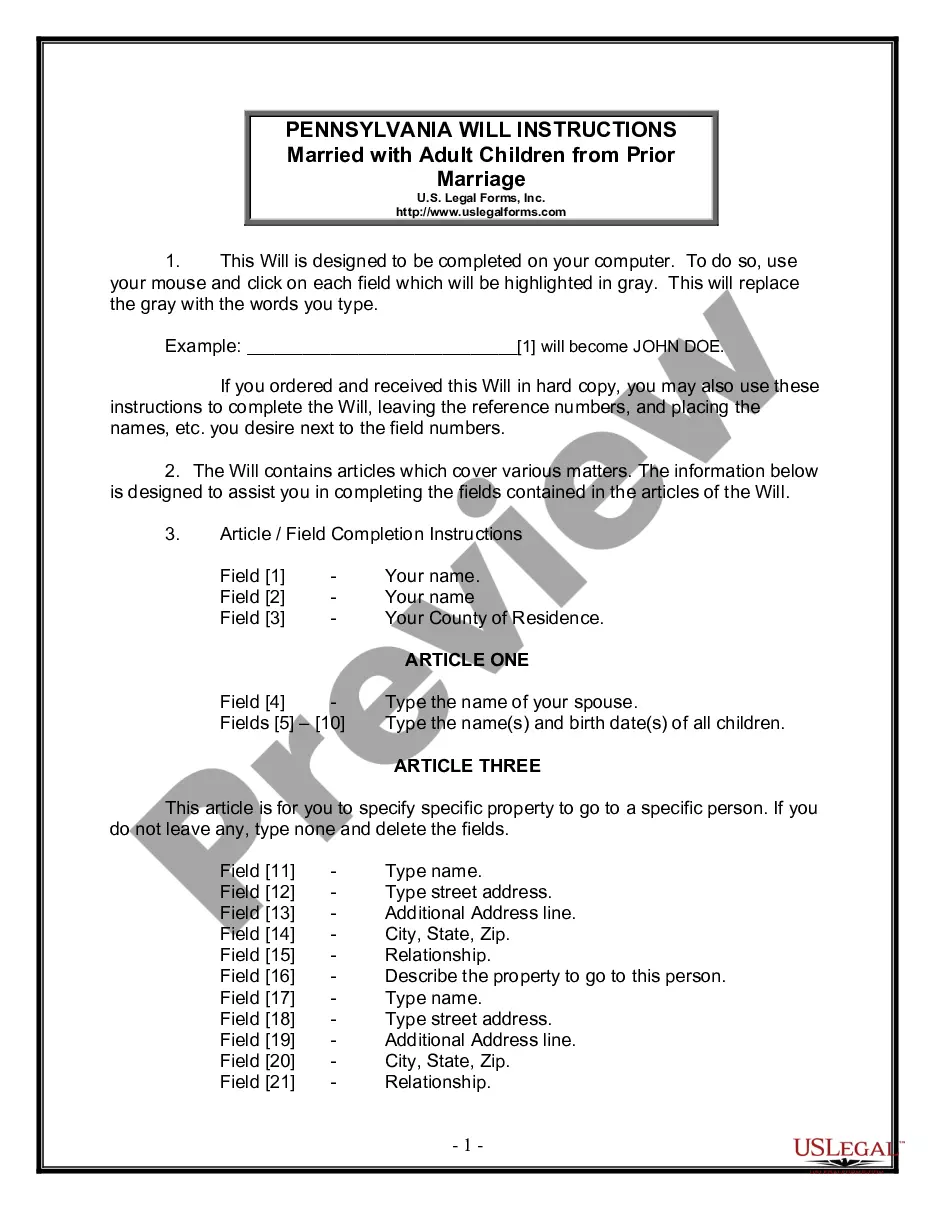

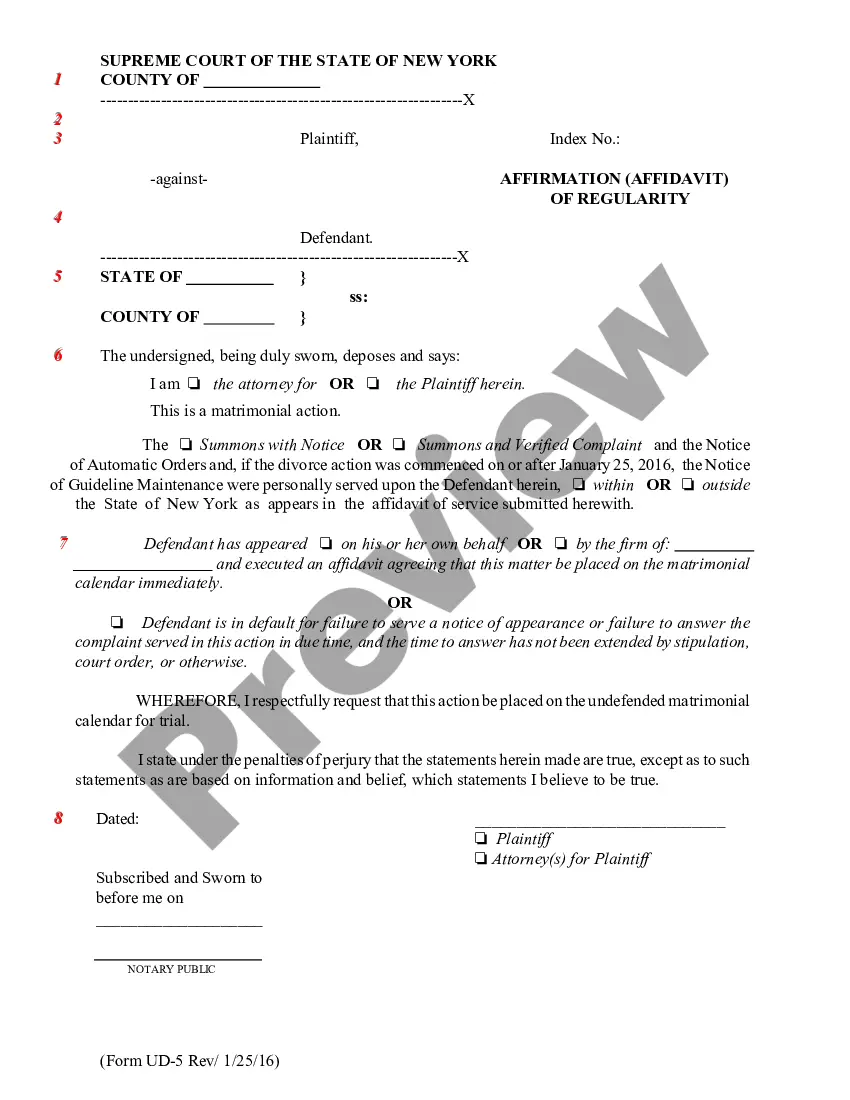

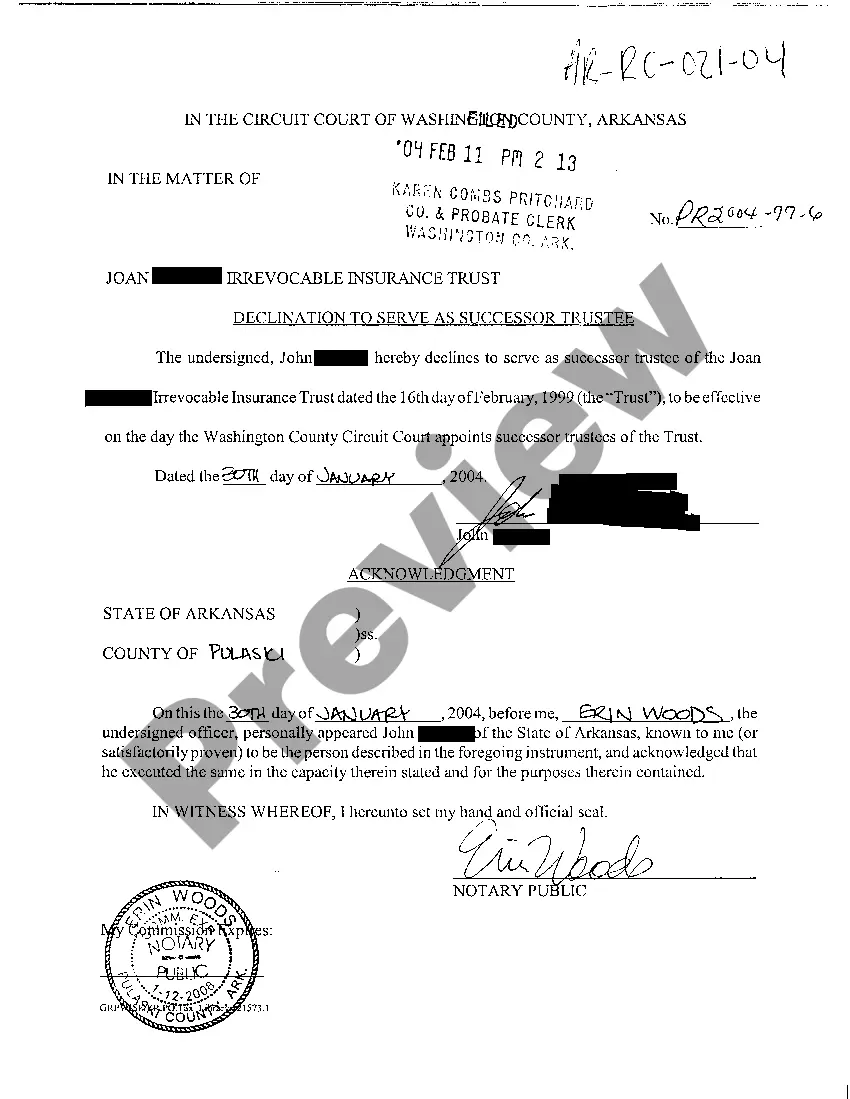

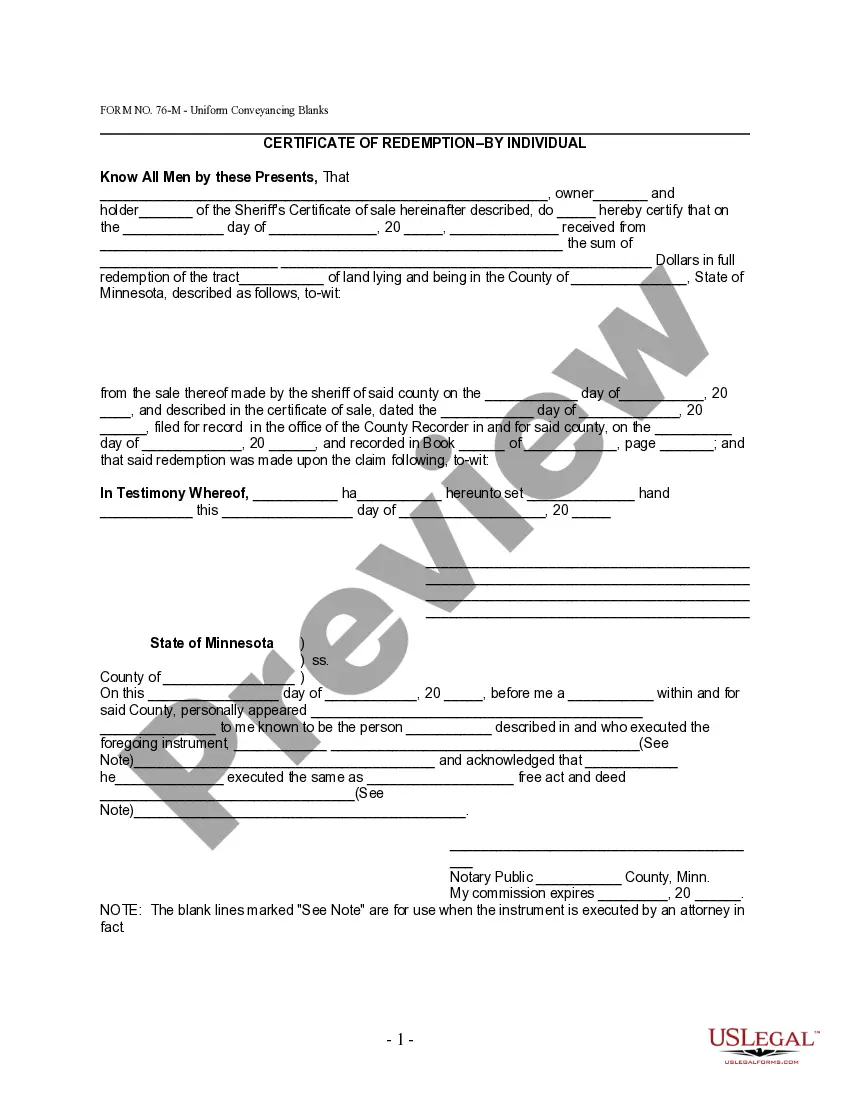

To establish a properly perfected secured creditor, you need a security agreement, proper identification of the collateral, and a filed financing statement. The security agreement details the borrower's pledge of secured personal property with real estate to you. Ensuring the financing statement is filed correctly is crucial, as it publicly notifies others of your interest. Utilize platforms like uslegalforms to help generate the necessary documents and streamline the process.

Interest on securities typically refers to the returns that investors earn from their investment, often seen in bonds or other debt instruments. For example, when you invest in a bond secured by personal property with real estate, you might earn periodic interest until the bond matures. This demonstrates a way to profit from secured investments with underlying real assets.

Ownership interest grants full rights to an asset, including the right to use, sell, or lease it. On the other hand, a security interest in property, such as secured personal property with real estate, only provides a claim against the asset in case of default. Hence, while ownership gives you control, a security interest offers protection for lenders.

A security interest in property refers to a legal claim that a lender has on a borrower's property, allowing the lender to take possession if the borrower defaults. This interest can pertain to various types of assets, including secured personal property with real estate. By establishing a security interest, lenders can protect their financial investments and ensure that they recoup losses.

Personal property in real estate refers to movable items that are not fixed to the land or buildings. These assets can include furniture, appliances, and vehicles. Unlike secured personal property with real estate, which is tied to immovable assets, personal property is generally separate from the real estate itself. Understanding this distinction can help you navigate both real estate transactions and personal asset management.

Secured personal property with real estate refers to assets that are backed by property in a legal agreement. This means that if the borrower defaults, the lender can claim the real estate to satisfy the debt. Common types of secured assets include mortgages, where the real estate itself acts as collateral. Understanding these relationships can help you make informed decisions about property investments.