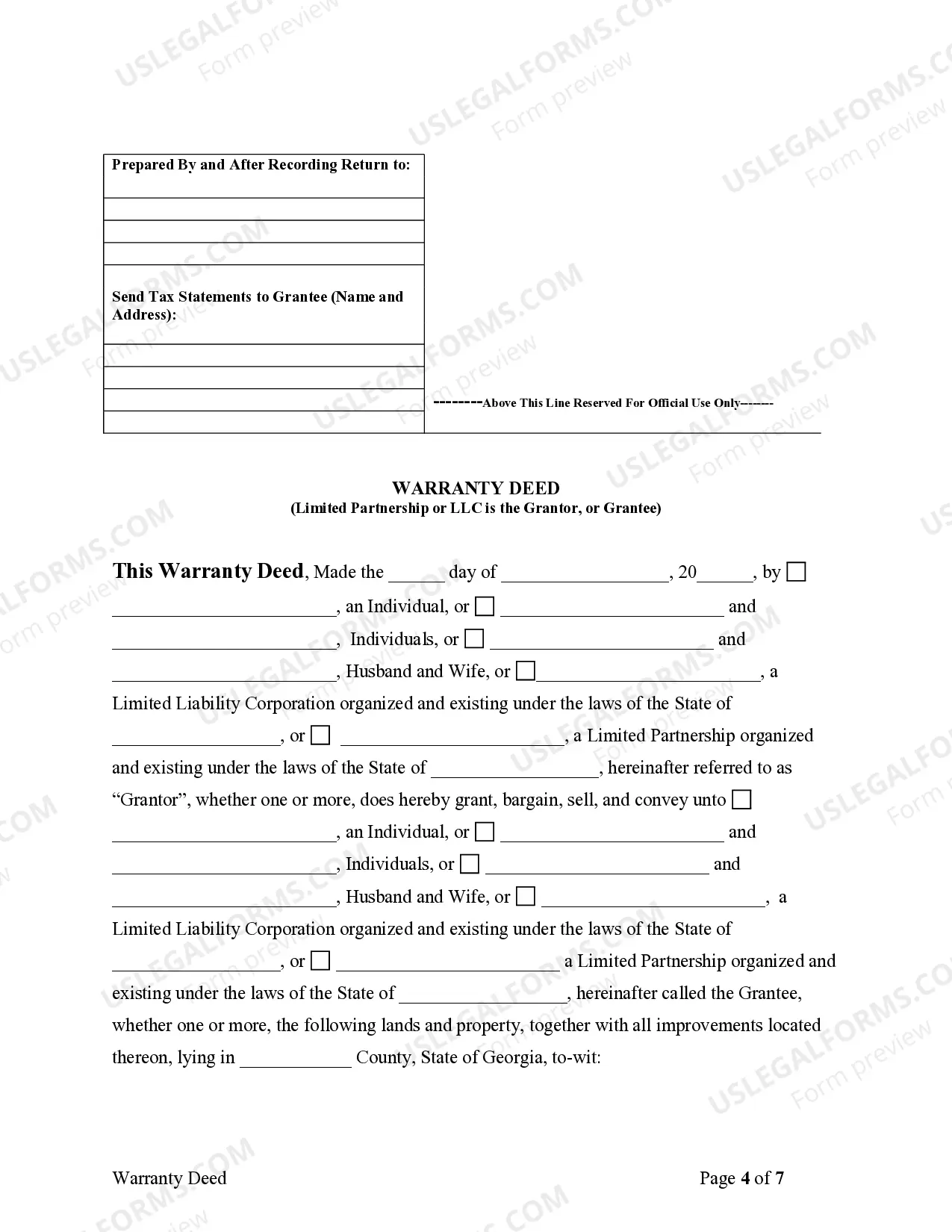

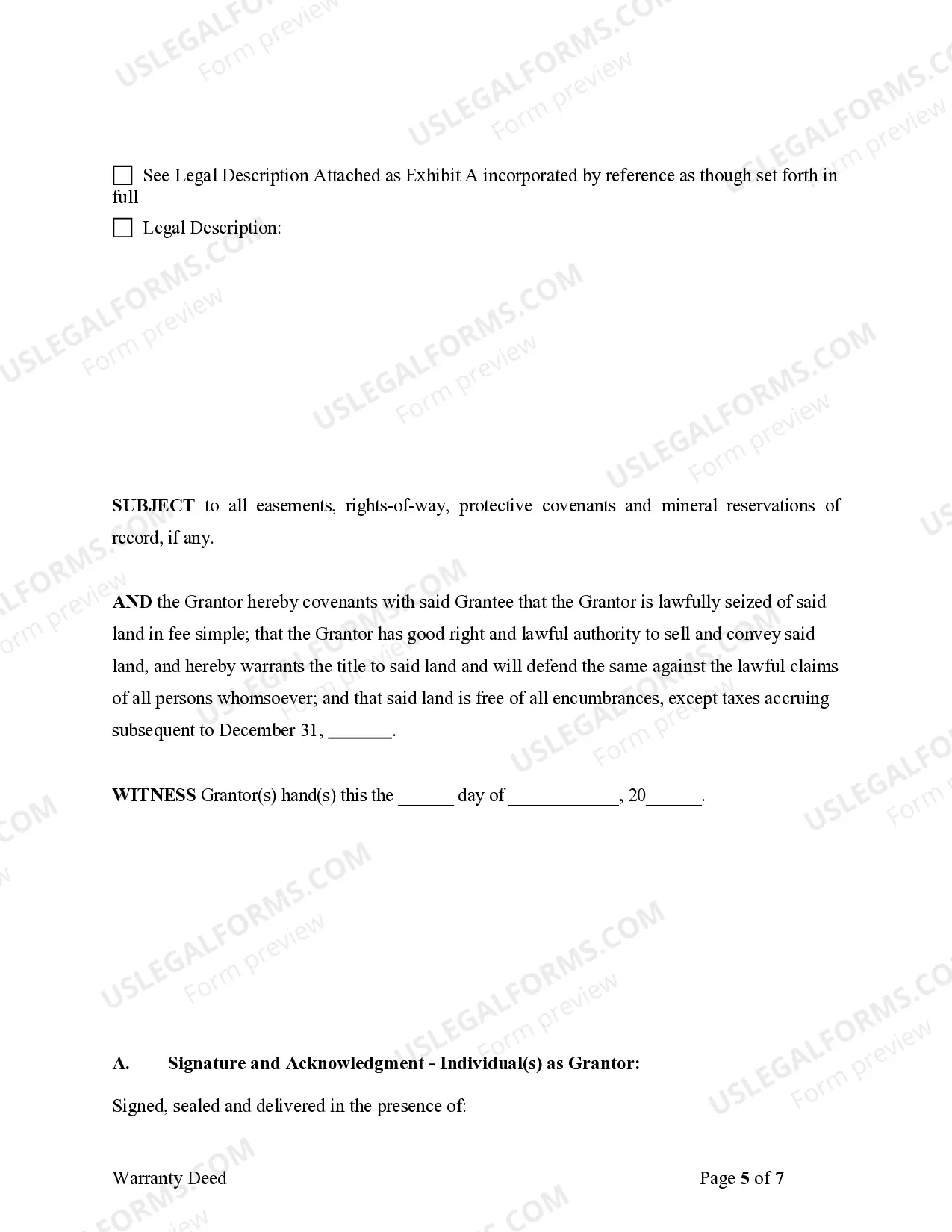

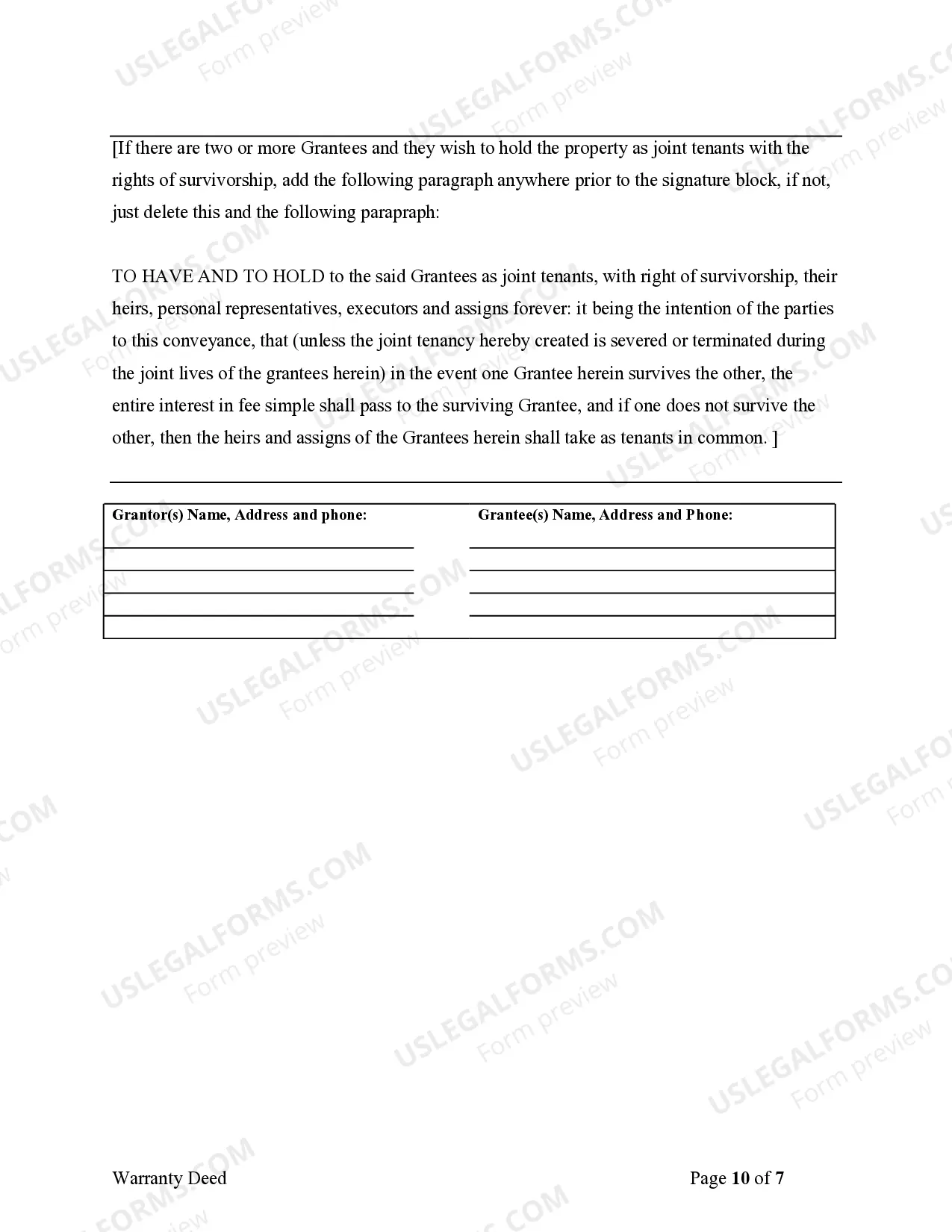

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Georgia Limited Llc Foreign Qualification

Category:

State:

Georgia

Control #:

GA-SDEED-7

Format:

Word;

Rich Text

Instant download

Description Warranty Deed Limited

Free preview What Is A Limited Warranty Deed In Georgia