Estate Planning Checklist Form With Decimals

Description

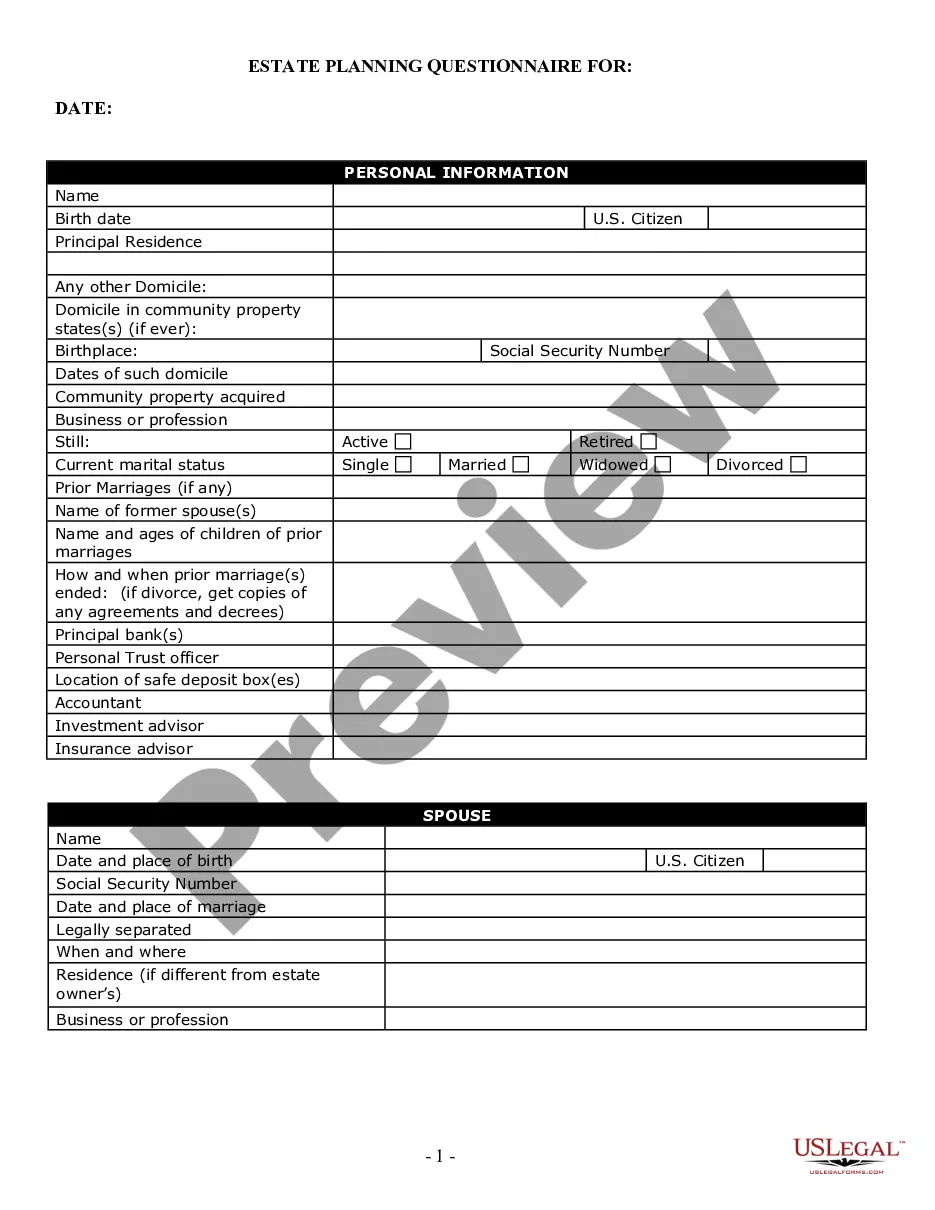

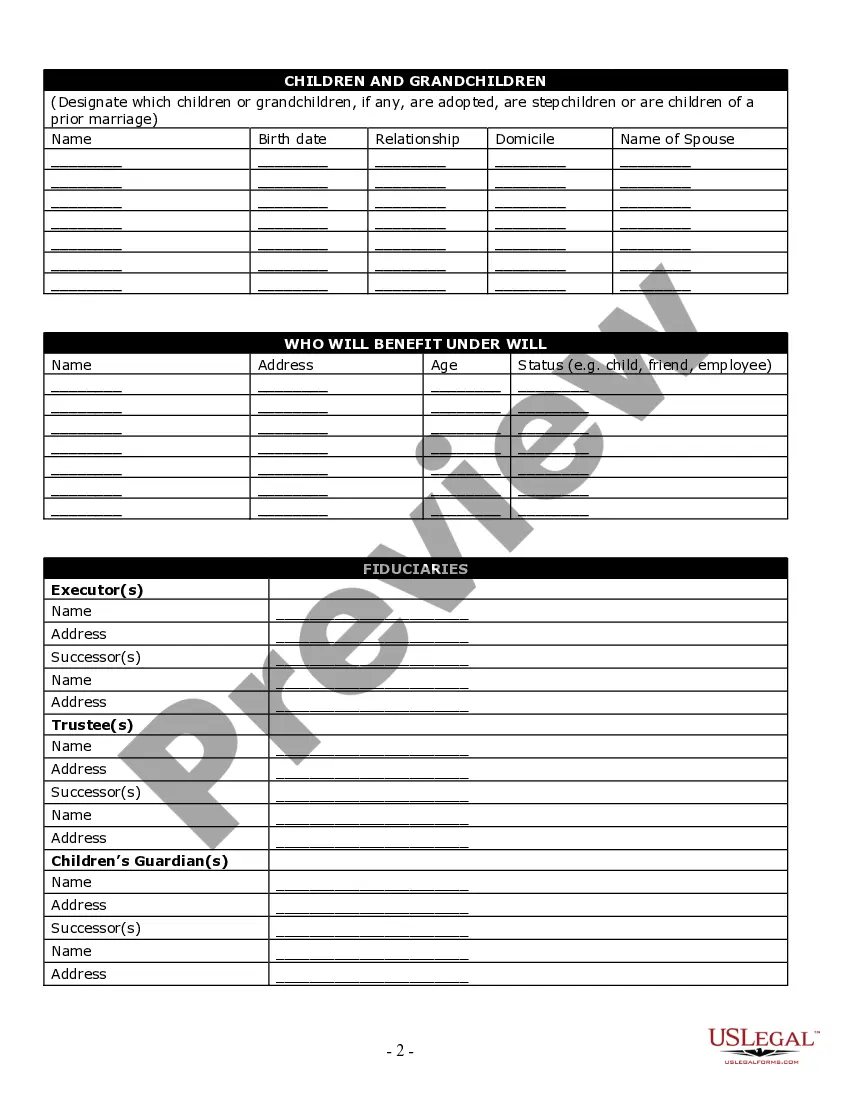

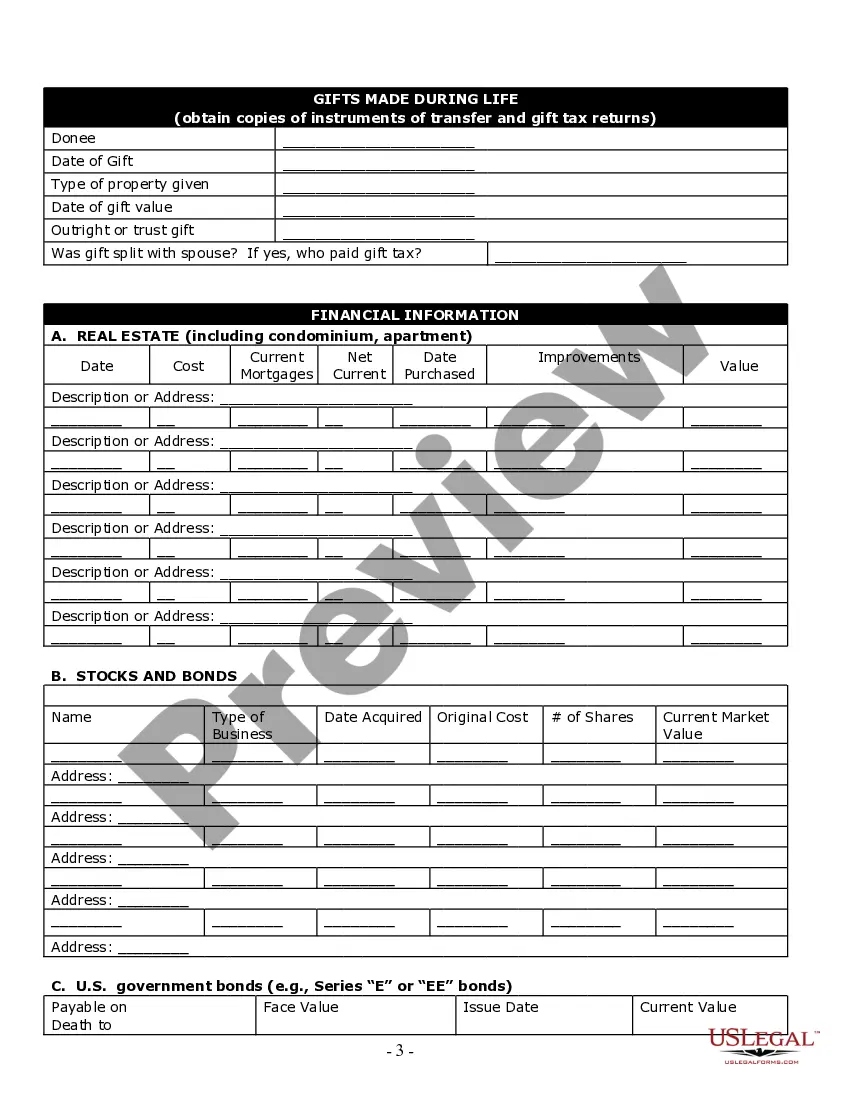

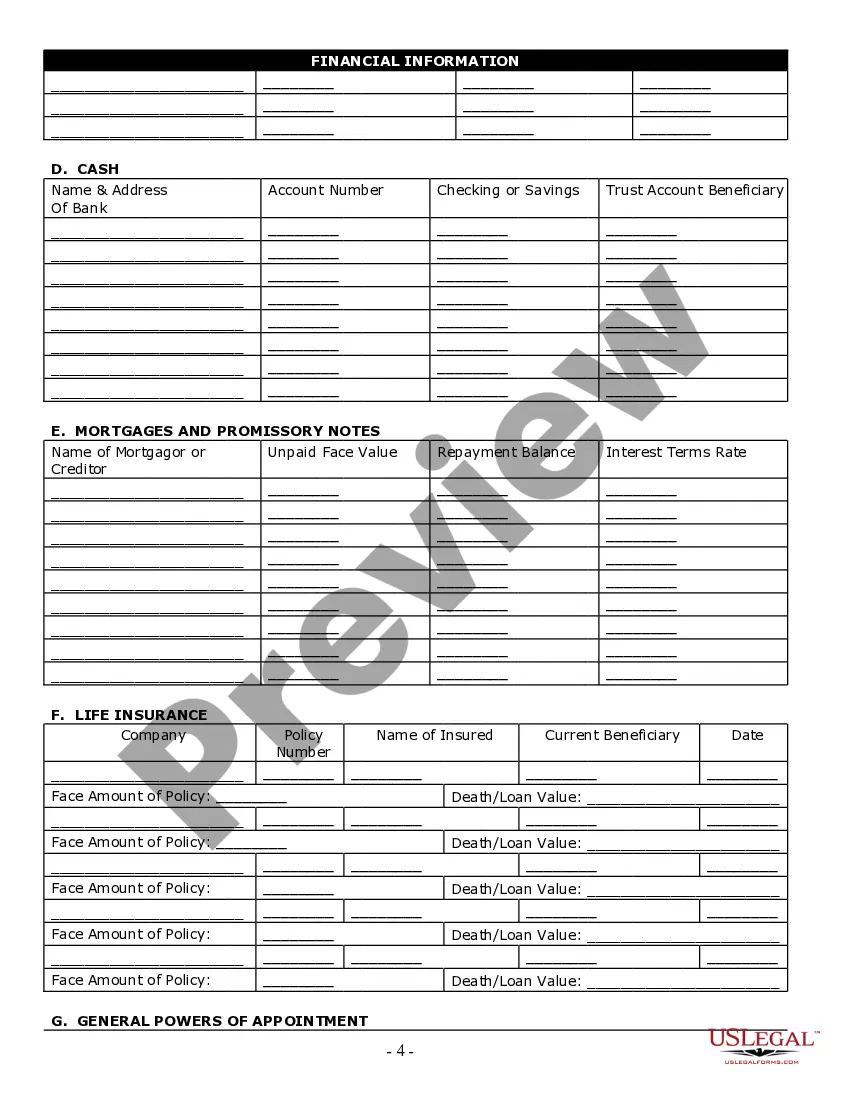

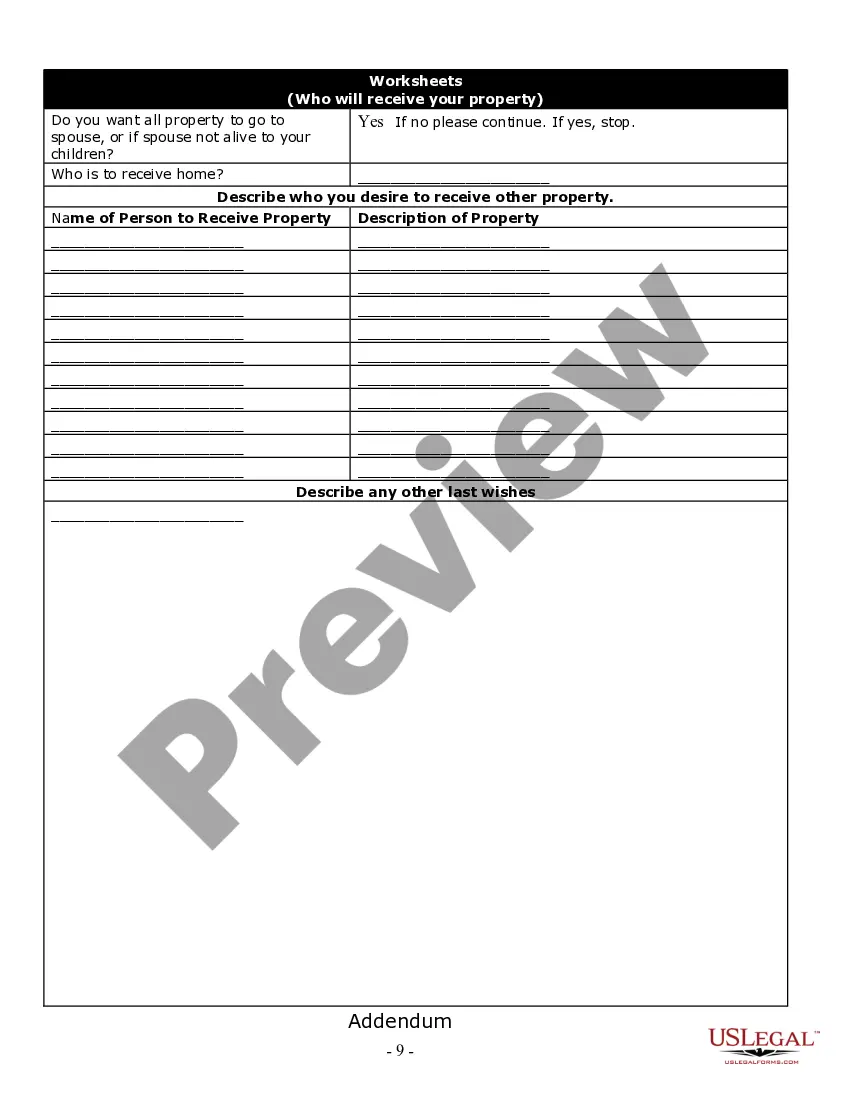

How to fill out Georgia Estate Planning Questionnaire And Worksheets?

No matter if you frequently engage with documents or occasionally need to submit a legal paper, it is imperative to find a source of information where all the samples are pertinent and up to date.

The initial step you must take with an Estate Planning Checklist Form With Decimals is to verify that it is the latest version, as this determines its eligibility for submission.

If you want to simplify your quest for the latest document examples, look for them on US Legal Forms.

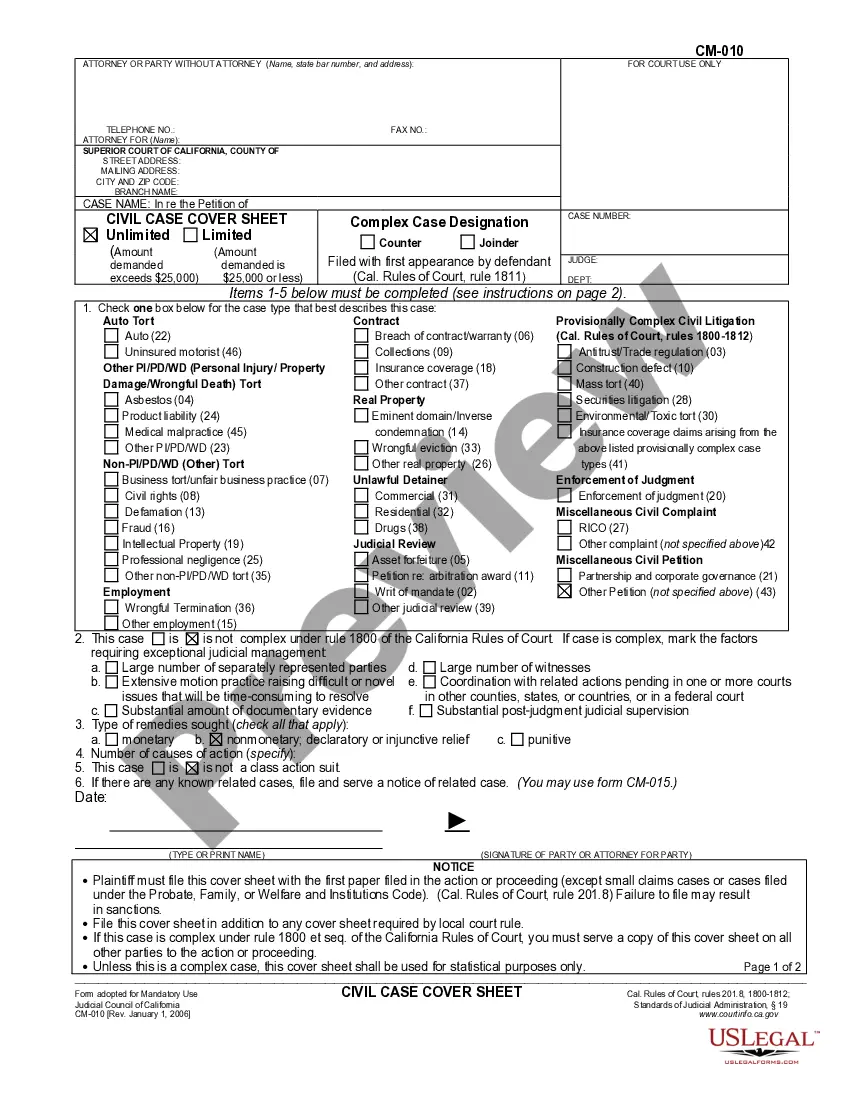

To acquire a form without an account, follow these instructions: Use the search menu to find the necessary form, view the Estate Planning Checklist Form With Decimals preview and description to confirm it is exactly what you need, double-check the form then click Buy Now, choose a subscription plan that suits you, create an account or Log In to your existing account, provide your credit card information or PayPal account details to finalize the purchase, select the document format for download, and confirm it. Eliminate the confusion that comes with handling legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that contains nearly every document example you might need.

- Search for the templates you need, check their relevance immediately, and learn more about how to utilize them.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various fields.

- Obtain the Estate Planning Checklist Form With Decimals examples in just a few clicks and store them at any time in your profile.

- A US Legal Forms profile provides you with access to all the samples you need with added convenience and less effort.

- Simply click Log In in the site header and navigate to the My documents section to have all the forms you need at your fingertips.

- You won't have to spend time either searching for the appropriate template or checking its usability.

Form popularity

FAQ

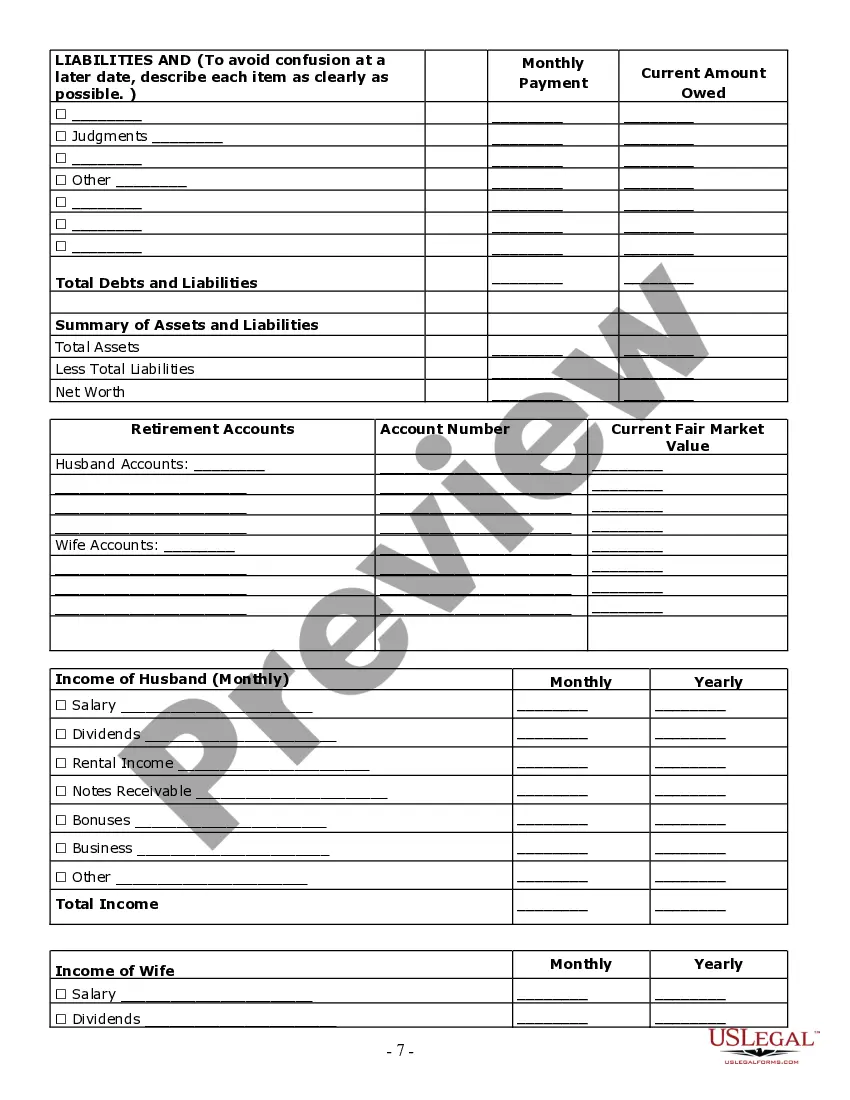

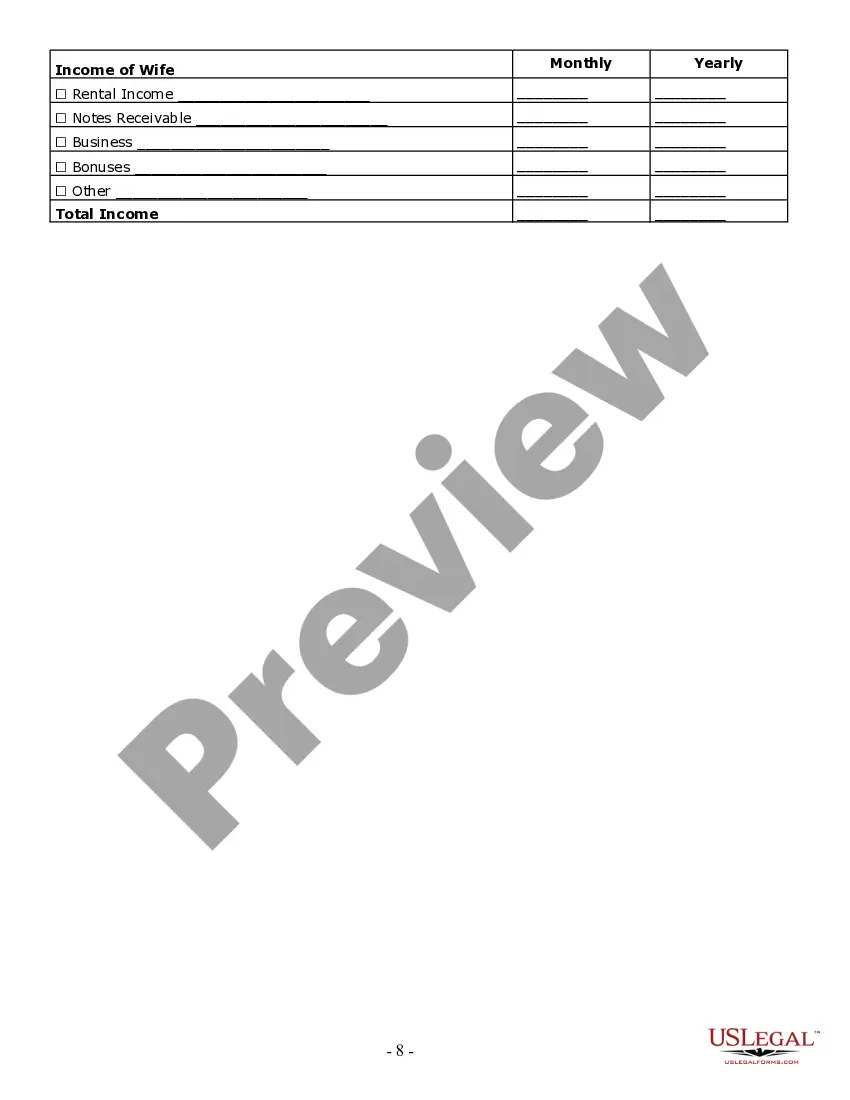

For Form 1041, income typically includes all income received by the estate or trust, such as interest, dividends, rental income, and capital gains. It is also important to report any distributions that beneficiaries may receive during the tax year. Utilizing an estate planning checklist form with decimals can assist you in clearly recording and reporting this income accurately, ensuring compliance with tax obligations.

The formula for calculating estate tax starts with determining the gross estate value, then subtracting allowable deductions, such as debts and marital deductions. The net estate is then applied to the current estate tax rates. Having a comprehensive estate planning checklist form with decimals can help you navigate the complexities of these calculations accurately.

An example of a Deceased Spousal Unused Exclusion (DSUE) is when a spouse passes away without using their full estate tax exemption. If, for instance, they had a $11 million exemption and only utilized $5 million, the remaining $6 million could potentially be transferred to the surviving spouse. This is where an estate planning checklist form with decimals helps ensure you're maximizing your benefits.

Determining the Deceased Spousal Unused Exclusion (DSUe) involves assessing the exclusion amount available from the deceased spouse's estate. You should also consider any adjustments needed based on lifetime gifts and other factors. To simplify this determination, an estate planning checklist form with decimals is beneficial, helping you track and manage these calculations effectively.

The 3 year rule in estate planning refers to a provision where transfers made within three years of a person's death may still be included in their taxable estate. This rule is critical for ensuring that assets are properly accounted for when finalizing estate taxes. A well-structured estate planning checklist form with decimals can help you understand the timings and impacts of such transfers.

To calculate the Deceased Spousal Unused Exclusion (DSUe) amount, start by determining the decedent's estate exclusion amount at the time of their passing. Next, take into account any gift amounts that the deceased made during their lifetime that exceeded the annual exclusion limits. This calculation is essential for proper estate tax planning, and using an estate planning checklist form with decimals can streamline this process.

A comprehensive before death checklist includes organizing financial documents, updating your will, and designating beneficiaries for your accounts. Additionally, consider preparing an Estate planning checklist form with decimals to outline key responsibilities and important contacts like your attorney and financial advisor. Having these details in order facilitates a smoother transition for your loved ones during a difficult time.

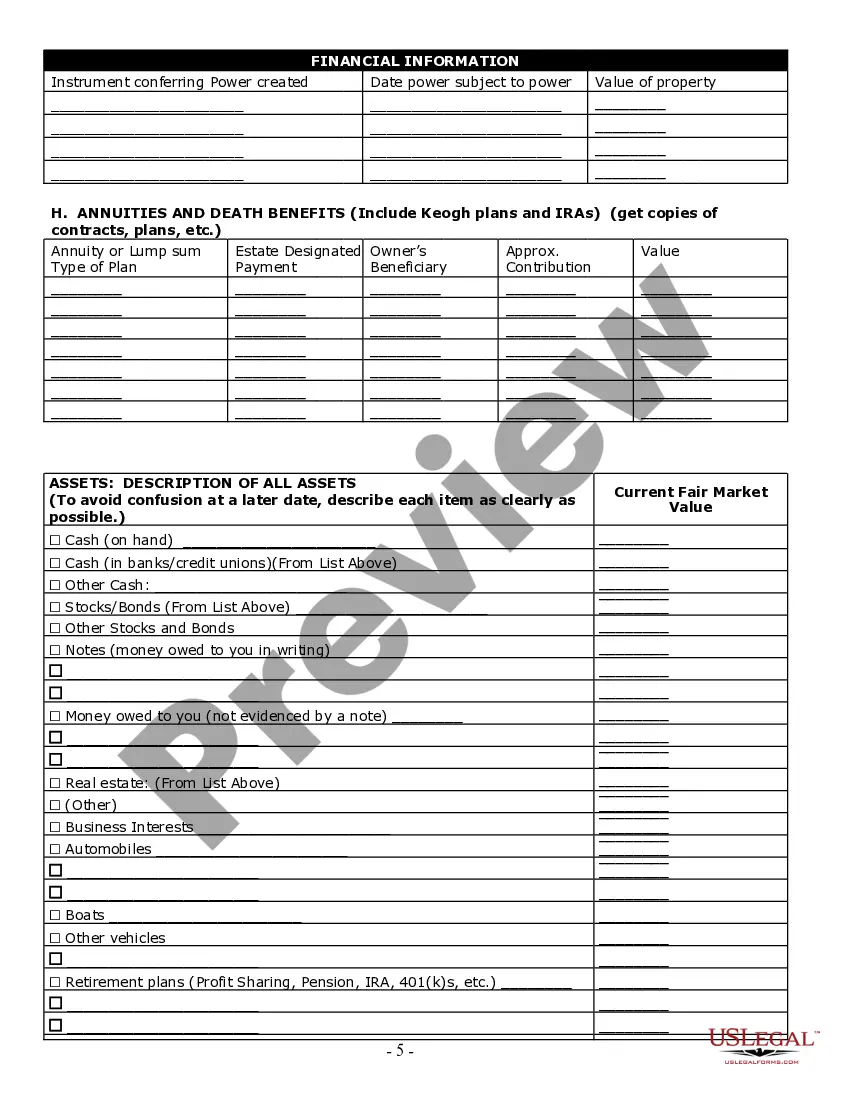

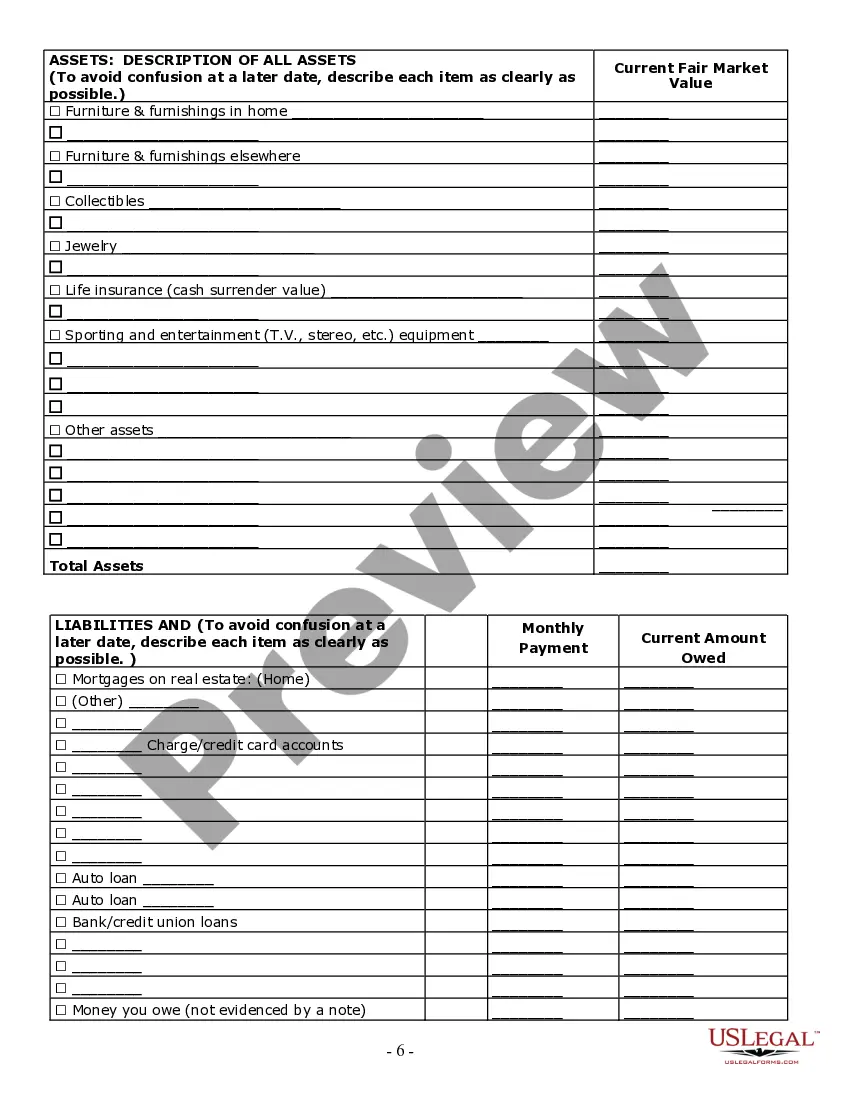

To create a list of assets for your will, start by gathering important documents related to your property, accounts, and possessions. Include items such as real estate, bank accounts, investments, vehicles, and personal valuables. You can use an Estate planning checklist form with decimals to organize this information systematically. This approach helps ensure you do not miss any critical assets when preparing your will.

To create a list of assets for a will template, start by gathering all relevant documents related to your ownership. Include items like real estate, bank accounts, investments, and personal property. Use the Estate planning checklist form with decimals to ensure that you cover all items accurately and comprehensively. This checklist simplifies the process, helping you organize everything in one place, making it easier to manage your estate planning needs.

Filling out Form 706 requires gathering detailed information about the decedent's assets, deductions, and liabilities. You must accurately report the fair market value of the estate and include any applicable deductions such as funeral expenses and debts. Utilizing an estate planning checklist form with decimals can guide you through this process, ensuring that you don’t miss any crucial details and remain compliant with IRS regulations.