Hawaii Incorporation Withholding Tax

Category:

State:

Hawaii

Control #:

HI-00INCA

Format:

Word;

Rich Text

Instant download

Description

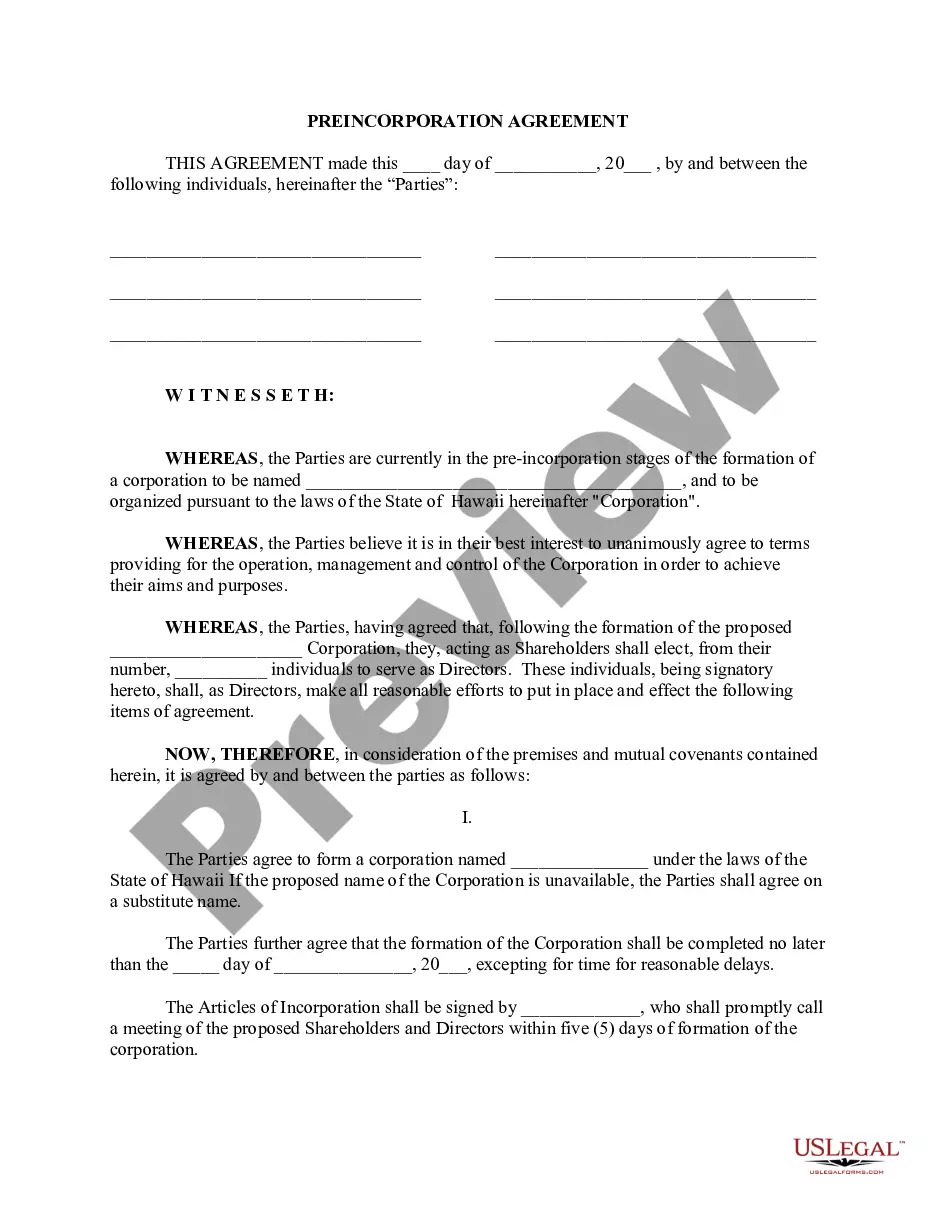

This is a Pre-Incorporation Package with agreement, shareholders agreement (stock restriction) and confidentiality agreement. All forms are included which are needed in order to begin the process of incorporation.

Free preview