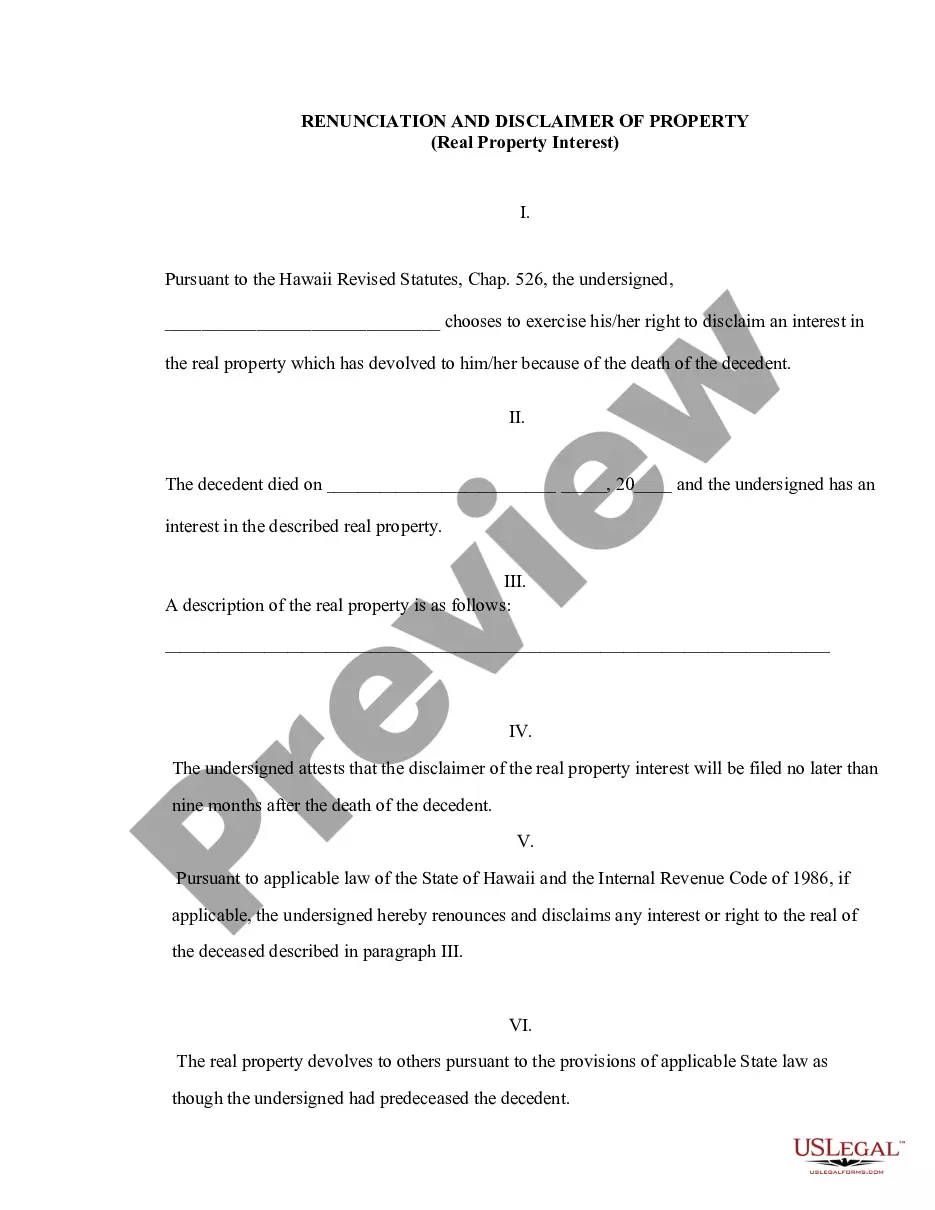

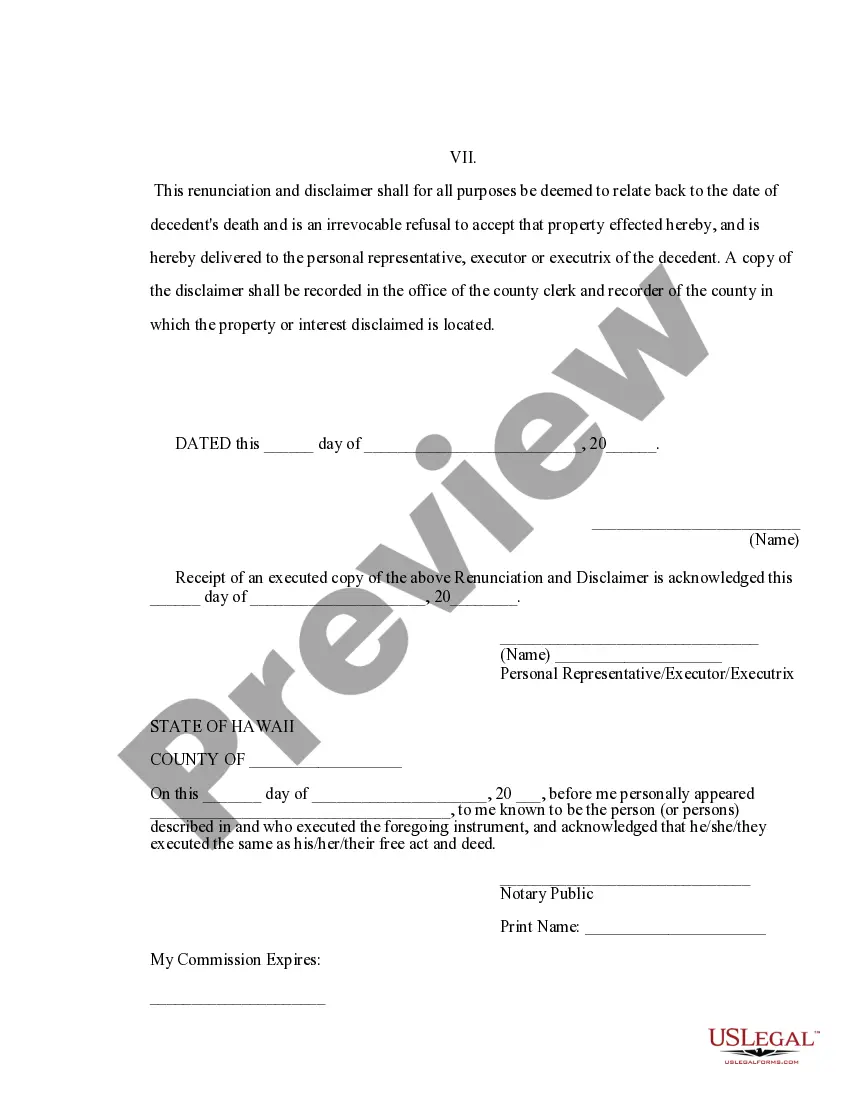

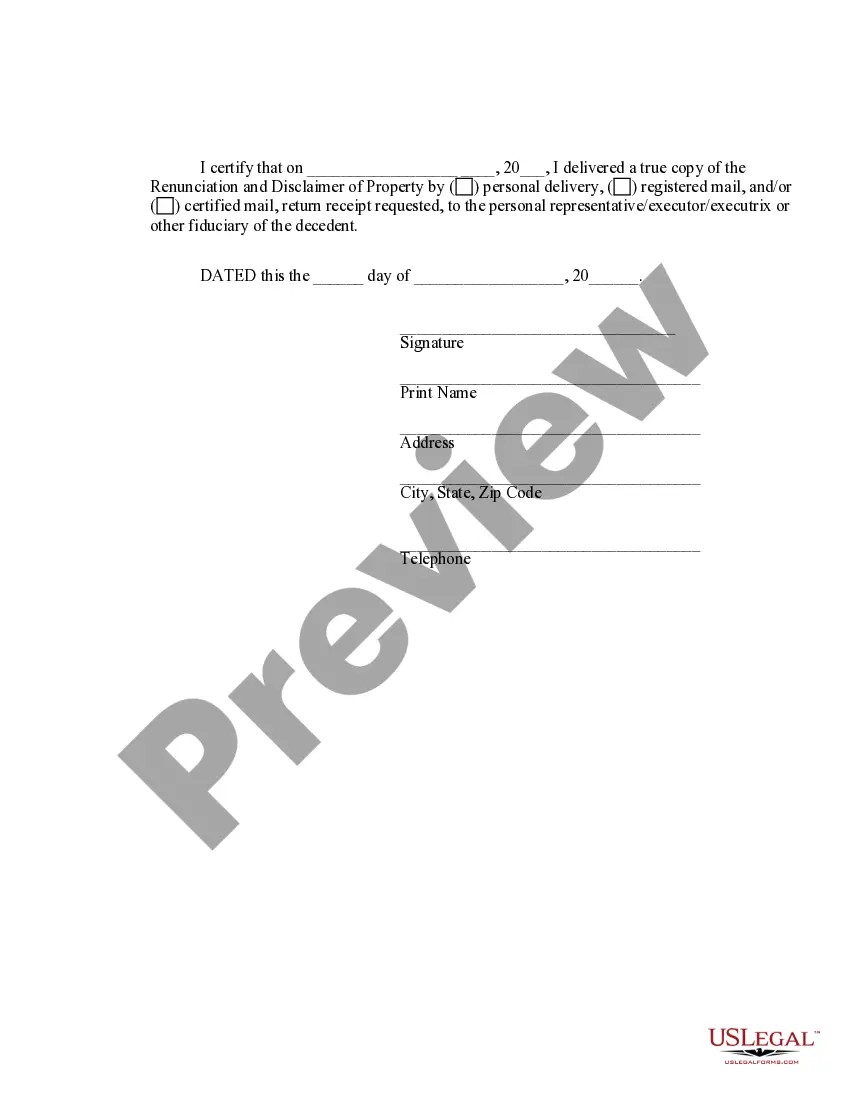

This form is a Renunciation and Disclaimer of a Real Property Interest. The beneficiary acquired a real property interest upon the death of the decedent. However, the beneficiary wishes to disclaim the interest pursuant to the Hawaii Revised Statutes, Chap. 526. The beneficiary also attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Renunciation In Real Estate With Little Money

Description

Form popularity

FAQ

Typically, a form of renunciation should be witnessed by an impartial person, such as a notary public or a qualified attorney. This requirement ensures that the process is legally binding and protects your rights throughout. If you're unsure about the witnessing process, US Legal Forms provides guidance to ensure you comply with all necessary legal standards.

If someone decides they do not want their inheritance, they can choose to renounce it. Doing so means they forfeit their rights to the property, which then may pass to the next beneficiary according to the estate plan or state law. This choice can relieve them of potential obligations or liabilities associated with the property. For assistance in handling such decisions, uslegalforms is an excellent resource.

The act of renunciation involves a conscious decision to give up legal rights or claims to property. This process is critical in scenarios where you wish to transfer ownership or eliminate responsibilities associated with real estate, especially in situations that involve limited financial resources. Platforms like UsLegalForms can assist you in understanding the necessary steps in performing an effective act of renunciation.