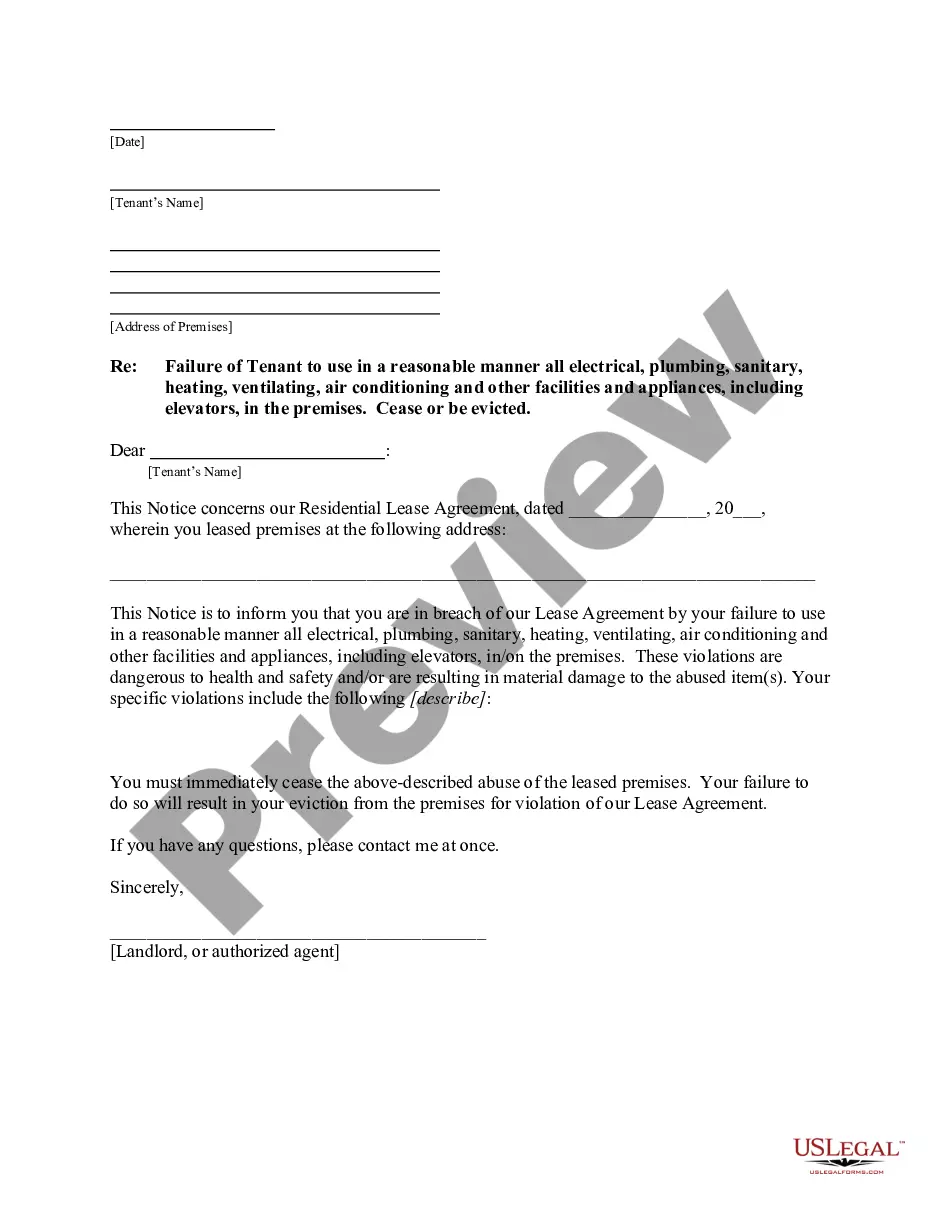

This is a sample letter from a Landlord to the Tenant. This letter relays to the Tenant that he/she is failing to comply with certain areas of the rental agreement, in particular, the reasonable use of all appliances, plumbing fixtures, electrical outlets, etc. He/She must rectify the situation or risk lease termination.

Hawaii Landlord In Form

Description

Form popularity

FAQ

In Hawaii, a guest may be considered a tenant if they stay for a significant period, typically 30 days or more, depending on the lease terms. Such a transition involves certain rights and obligations for both parties. To clarify these specifics and protect your interests, it is wise for both landlords and guests to have clear agreements in writing. US Legal Forms provides customizable templates that help ensure all agreements in Hawaii are legally sound and clear.

A Hawaii landlord cannot engage in illegal eviction practices, such as forcibly removing a tenant or shutting off utilities. Additionally, landlords cannot discriminate based on race, color, national origin, gender, disability, or familial status. It is important for tenants to know their rights and remedies under state law. For detailed information on these regulations, US Legal Forms offers essential resources for landlords and tenants in Hawaii.

In Hawaii, a tenant can refuse entry to a landlord under certain circumstances. A Hawaii landlord must provide reasonable notice, usually 24 hours, before entering the rental property. If the landlord fails to give proper notice or needs to enter for non-emergency reasons, the tenant can legally deny access. To further protect your rights, consider using US Legal Forms to obtain the right documents that outline the responsibilities of a Hawaii landlord.

When writing to your Hawaii landlord, start by clearly stating your name and the property address. Be specific about the issue or request, whether it's a repair, lease question, or payment concern. Maintain a polite tone and provide any relevant details to support your request. If you want to streamline this process, consider using the US Legal Forms platform, which offers templates tailored for communication with Hawaii landlords.

In Hawaii, the General Excise Tax (GET) for rental properties is usually set at 4%. This tax applies to both residential and commercial rental income. However, it’s important to check local rates as they may vary. Consulting uslegalforms can provide the most accurate and up-to-date information for Hawaii landlords regarding GET taxes.

While you do not need a specific landlord license in Hawaii, you must comply with local rental property regulations. Registering your rental property and following tenant laws is essential. Furthermore, if you manage vacation rentals, a permit may be necessary. For guidance, uslegalforms offers resources to help navigate the licensing landscape as a Hawaii landlord.

Owner-occupied properties in Hawaii often receive a special tax rate that is lower than rates applied to rental properties. This incentive is designed to encourage homeownership within the state. It’s crucial for Hawaii landlords to determine how property classifications impact their taxes. For tailored advice, uslegalforms can help landowners understand tax advantages.

Property taxes in Hawaii vary by county, but generally, they are relatively low compared to the national average. The property tax rates can range from about 0.25% to 1.5% of the property's assessed value. As a Hawaii landlord, staying updated on local tax rates is vital to financial planning. Uslegalforms can provide tools to manage property tax obligations effectively.

In Hawaii, a landlord must provide reasonable notice before entering a tenant’s property, typically 24 hours. This notice can be delivered verbally or in writing. However, emergencies do not require prior notice. As a Hawaii landlord, you should consult uslegalforms for the legalities surrounding tenant interactions.

Hawaii does not have a statewide limit on rent increases, but landlords must provide written notice of any rent changes. Local laws may also apply, so it is wise to check city or county regulations. Understanding these specifics can protect you as a tenant living in Hawaii.