Articles Of Llc Sample Withdrawal

State:

Hawaii

Control #:

HI-LLC-TL

Format:

Word;

Rich Text

Instant download

Description Hawaii Llc Filing

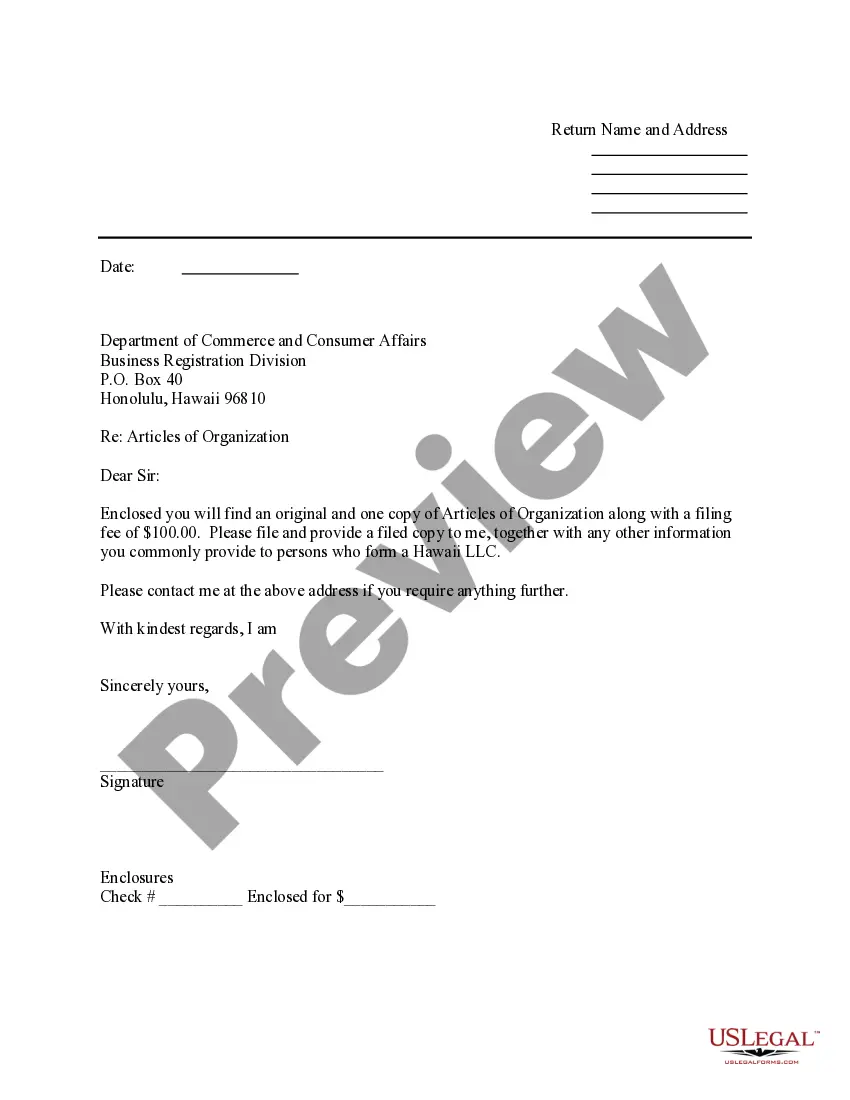

This is a sample cover letter for use with filing LLC Articles of Organization or Certificate of Formation with the Secretary of State.