Hawaii General Excise Tax For Contractors

Description

How to fill out Hawaii Statutory Form Of Power Of Attorney For Property And Finances Or Financial?

Whether you handle documentation on a consistent basis or you need to present a legal paper sporadically, it is crucial to have a resource where all the samples are relevant and current.

The first action you should take with a Hawaii General Excise Tax For Contractors is to ensure that it is indeed its latest version, as it determines whether it can be submitted.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

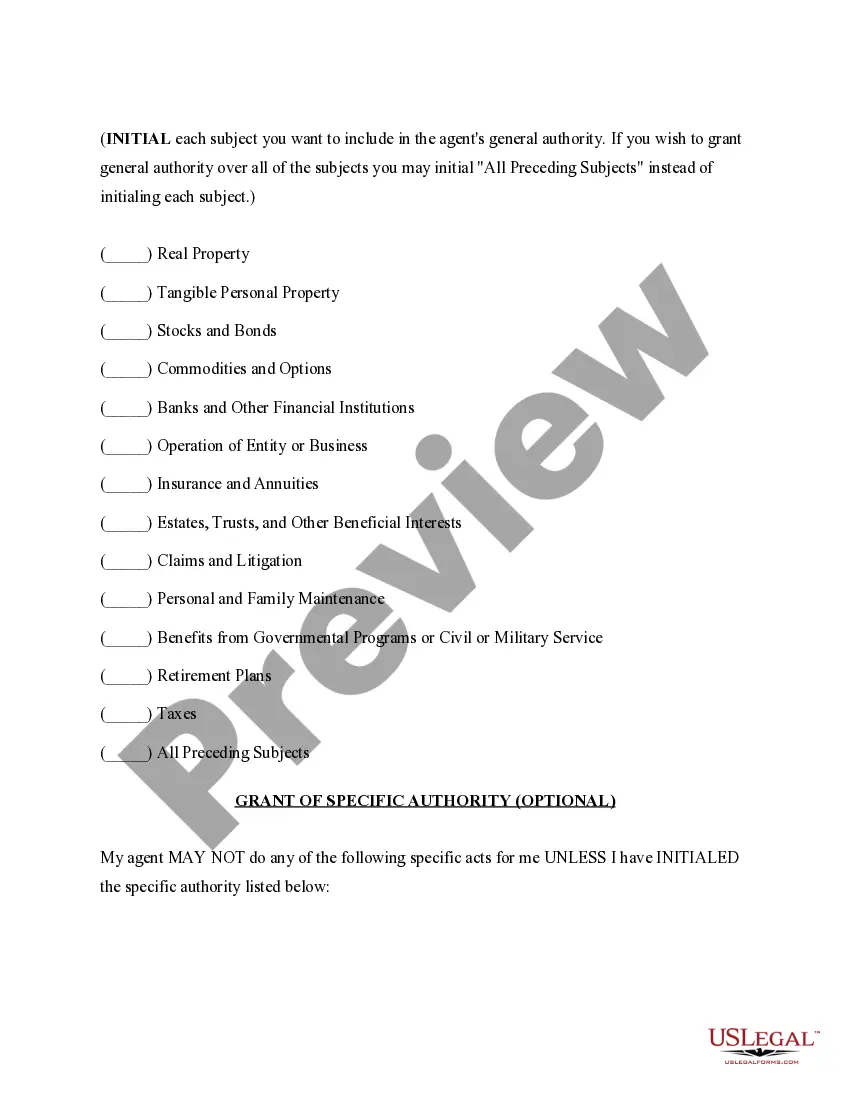

Utilize the search menu to locate the form you need. Review the preview and description of the Hawaii General Excise Tax For Contractors to ensure it is indeed the one you seek. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing account. Enter your credit card information or PayPal account to finalize the purchase. Select the file format for download and confirm it. Eliminate the confusion associated with handling legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes virtually every document example you might seek.

- Search for the templates you require, verify their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various professional fields.

- Find the Hawaii General Excise Tax For Contractors templates in just a few clicks and save them at any time in your account.

- A US Legal Forms account will enable you to access all necessary samples with greater convenience and less trouble.

- You simply need to click Log In on the website header and navigate to the My documents section where all the forms you require will be available without any delays in searching for the right template or checking its usefulness.

- To acquire a form without an account, follow these instructions.

Form popularity

FAQ

Your application may be submitted online through our website at hitax.hawaii.gov or through the Hawaii Business Express website at hbe.ehawaii.gov, by mail, or in person at any district tax office. You may also file your application with one of the Department of Commerce and Consumer Affairs' Business Action Centers.

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

Unlike sales tax, which is paid by consumers, the GET is levied on businesses' gross income from wholesale goods, services, and rents. Any business, whether it's a small business, self-employed, independent contractor, or freelancer, must obtain a general excise license and pay the tax.

Paying Taxes as an Independent Contractor You'll need to file a tax return with the IRS if your net earnings from self-employment are $400 or more. Along with your Form 1040, you'll file a Schedule C to calculate your net income or loss for your business.