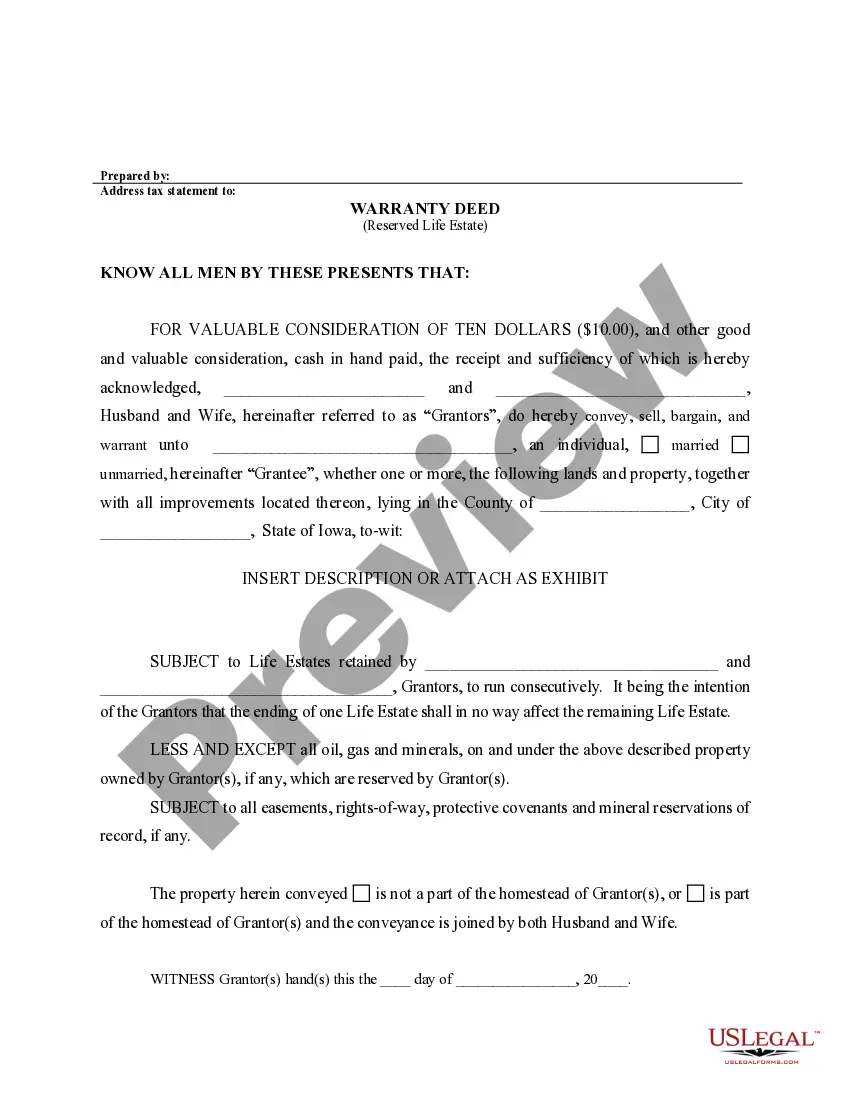

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

A life estate in Iowa with remainder interest is a legal arrangement that grants an individual, known as the life tenant, the right to occupy and use a property for the duration of their life. However, upon the life tenant's death, the property ownership transfers to another party, known as the remainder man. This legal concept is commonly used in estate planning to ensure the orderly transfer of property interests. In Iowa, there are different types of life estates with remainder interest, including: 1. Traditional Life Estate with Remainder Interest: This type of life estate grants the life tenant the right to use and enjoy the property during their lifetime. Upon their death, the property automatically transfers to the designated remainder man, as determined by the original owner or granter. The remainder man is typically identified in the original deed or will. 2. Life Estate with Remainder Interest Subject to a Condition: This variation of life estate in Iowa specifies that the remainder interest is subject to a particular condition or event. For example, the remainder man may only receive the property if they reach a certain age, marry, or fulfill another specified condition. If the condition is not met, the property may go to an alternate remainder man or follow a different distribution plan. 3. Life Estate with Remainder Interest in Multiple Successive Interests: This type of life estate designates multiple remainder men who will successively inherit the property. Each remainder man is entitled to occupy and use the property in sequential order, following the death of the prior life tenant. This arrangement ensures a predetermined chain of property transmission. 4. Life Estate with Remainder Interest for Charitable Purposes: Some individuals choose to establish a life estate in Iowa with remainder interest for charitable purposes. In such cases, the life tenant retains the right to occupy and use the property during their lifetime, and upon their death, the property transfers to a designated charity or charitable organization as the remainder man. This arrangement allows individuals to support causes they care about while enjoying the property during their lifetime. It's important to consult with an experienced estate planning attorney or legal professional to ensure the proper establishment and execution of a life estate in Iowa with remainder interest. Legal experts can provide guidance based on an individual's specific circumstances, preferences, and objectives, ensuring a smooth transition of property ownership and interests.