Divorce Decree For Mortgage

Category:

State:

Iowa

Control #:

IA-809D

Format:

Word;

Rich Text

Instant download

Description

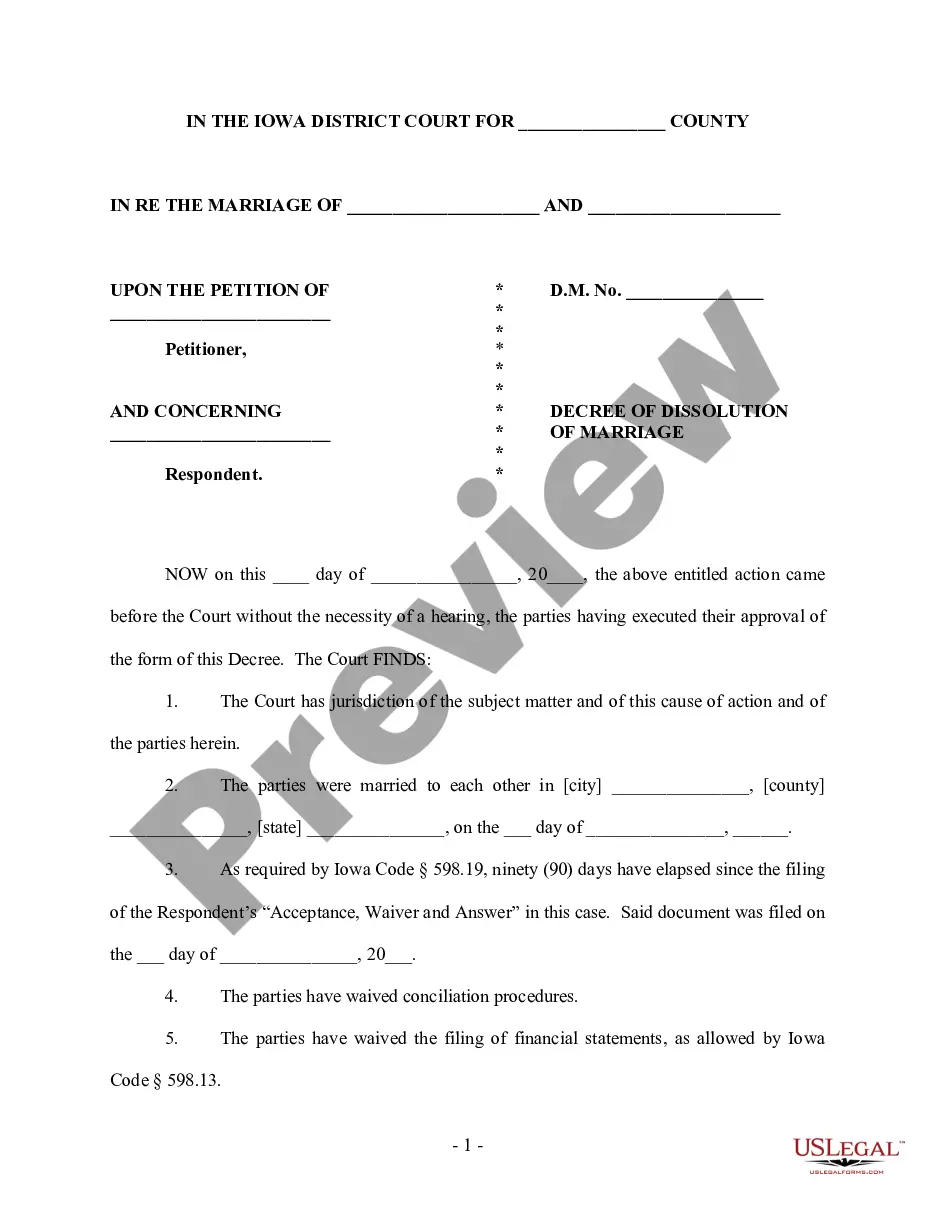

A Decree of Dissolution is the last form filed with the Court. It is signed by the judge and states that the marriage between the two parties has officially been dissolved.

Free preview