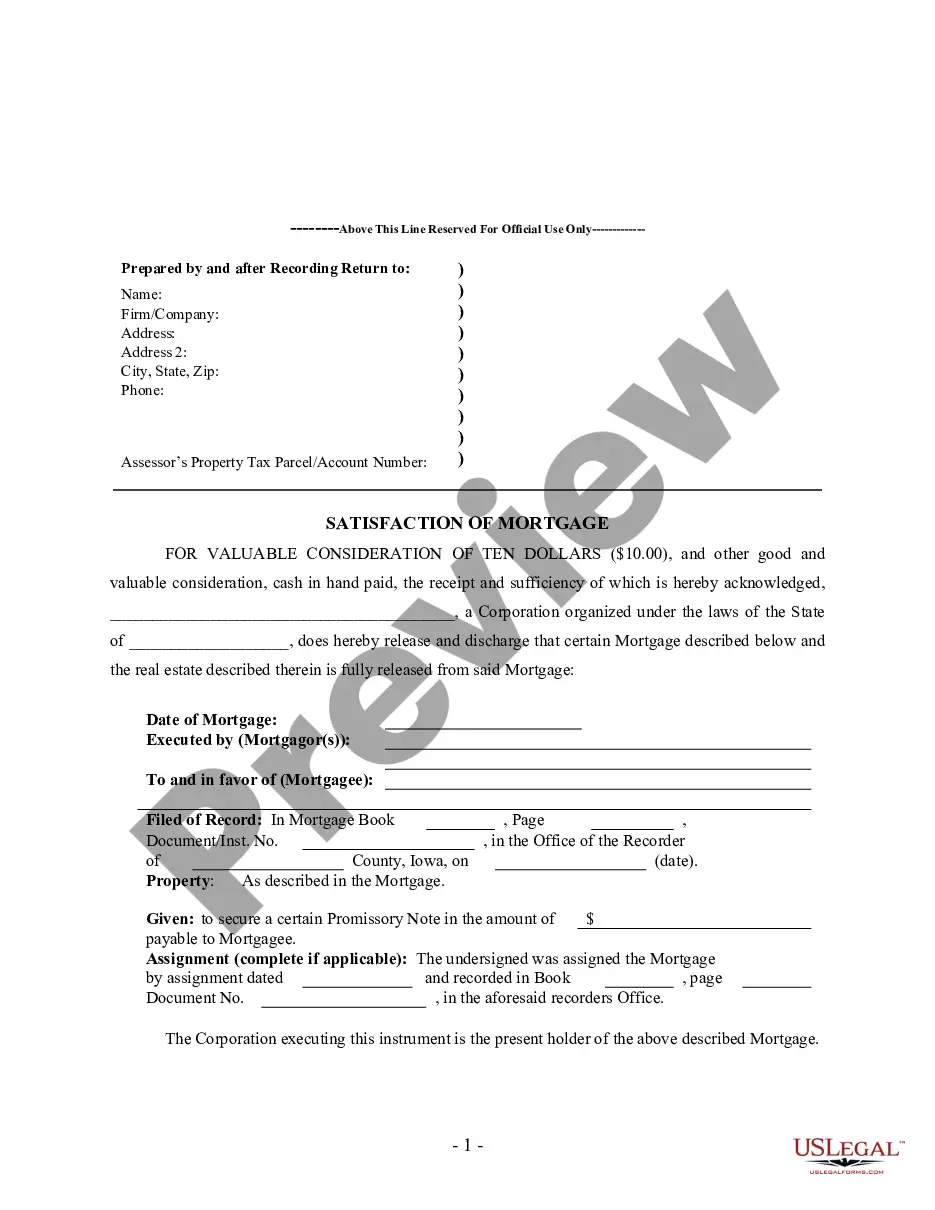

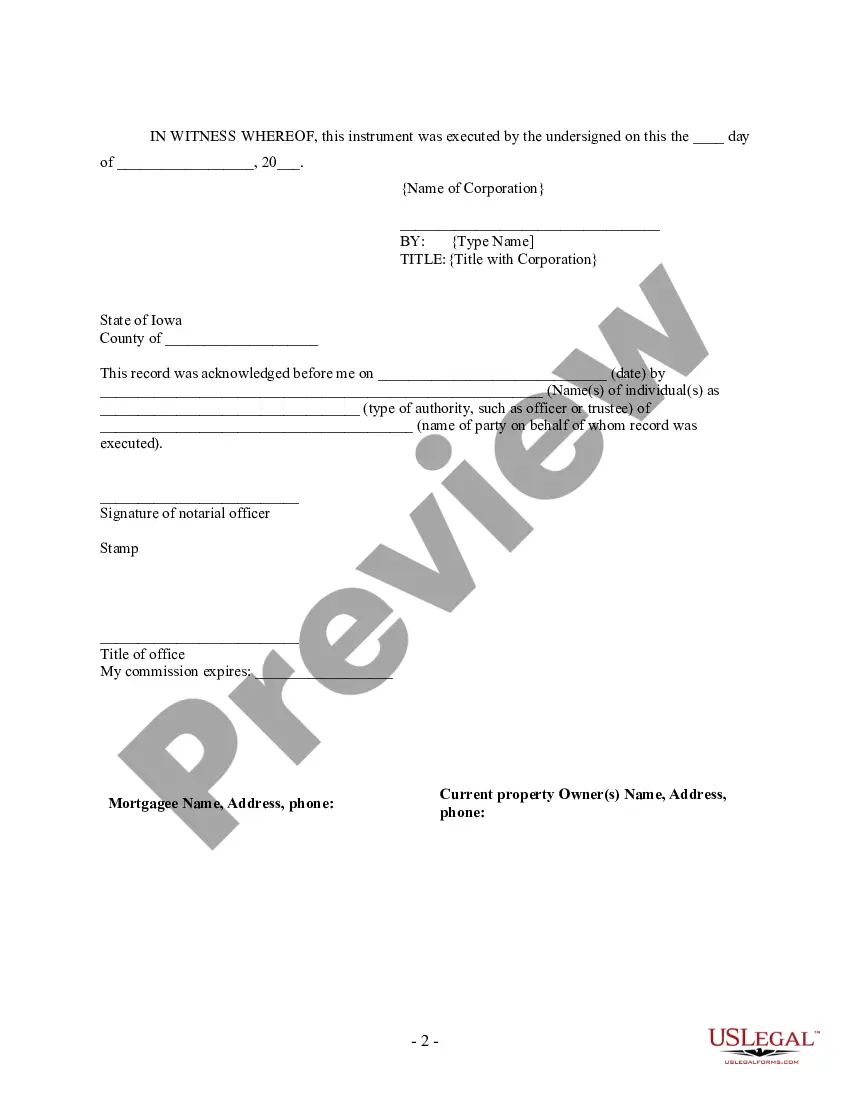

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Iowa by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Blank Iowa Release Of Mortgage Form With Decimals

Description Iowa Printable Satisfaction Of Mortgage Form

How to fill out Satisfaction And Release Of Promissory Note?

There's no more reason to waste time searching for legal paperwork to meet your local state requirements. US Legal Forms has collected all of them in one place and facilitated their accessibility. Our website provides more than 85k templates for any business and individual legal cases grouped by state and area of use All forms are appropriately drafted and verified for validity, so you can be certain in obtaining an up-to-date Blank Iowa Release Of Mortgage Form With Decimals.

If you are familiar with our platform and already have an account, you need to make sure your subscription is valid before obtaining any templates. Log in to your account, pick the document, and click Download. You can also return to all saved paperwork whenever needed by opening the My Forms tab in your profile.

If you've never used our platform before, the process will take some more actions to complete. Here's how new users can locate the Blank Iowa Release Of Mortgage Form With Decimals in our catalog:

- Read the page content carefully to make sure it has the sample you require.

- To do so, use the form description and preview options if any.

- Utilize the Seach field above to browser for another sample if the previous one didn't suit you.

- Click Buy Now next to the template title once you find the correct one.

- Opt for the best suitable pricing plan and register for an account or sign in.

- Make payment for your subscription with a credit card or via PayPal to proceed.

- Opt for the file format for your Blank Iowa Release Of Mortgage Form With Decimals and download it to your device.

- Print your form to fill it out in writing or upload the sample if you prefer to do it in an online editor.

Preparing formal paperwork under federal and state laws and regulations is quick and simple with our library. Try US Legal Forms right now to keep your documentation in order!