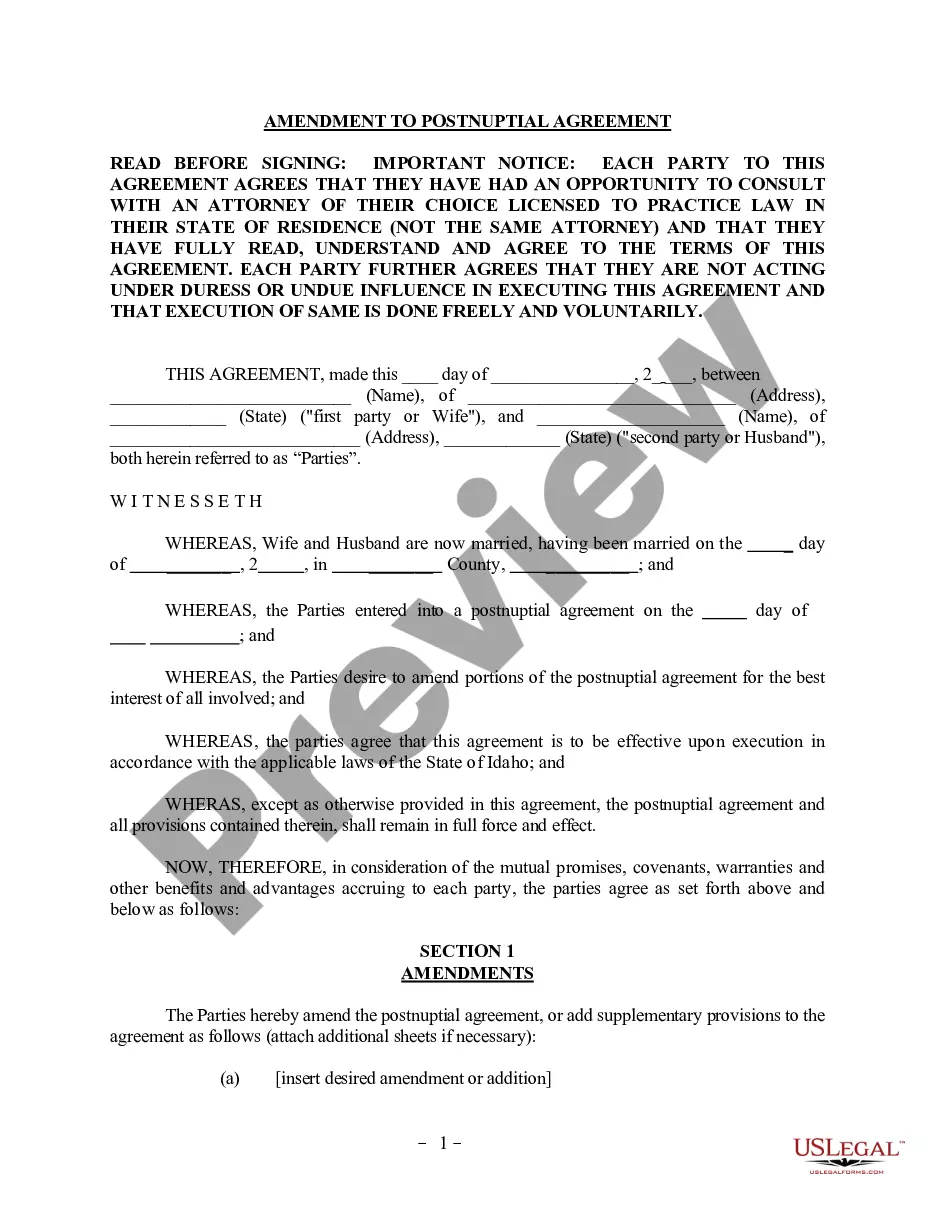

Amendment To Postnuptial Agreement Idaho Withholding

Description

How to fill out Amendment To Postnuptial Agreement Idaho Withholding?

What is the most reliable service to obtain the Amendment To Postnuptial Agreement Idaho Withholding and other current versions of legal documents.

US Legal Forms is the answer! It's the largest compilation of legal forms for every situation.

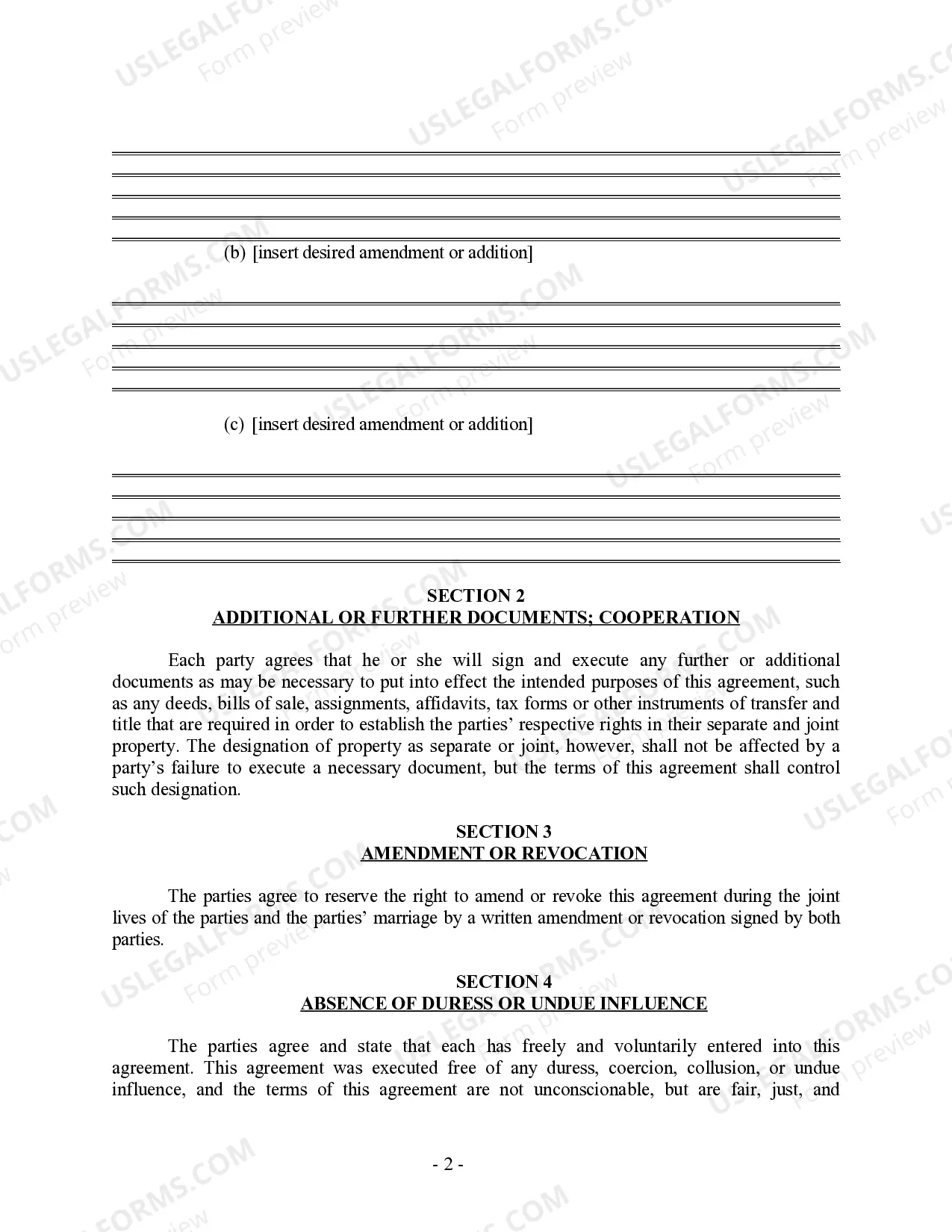

If you don't already have an account in our database, here are the steps you must follow to create one: Verify form compliance. Before obtaining any template, ensure it meets your usage criteria and adheres to the regulations of your state or county. Review the form details and utilize the Preview option if available. Search for alternative documents. If there are any discrepancies, use the search feature in the page header to find another sample. Click Buy Now to select the correct one. Register and acquire a subscription. Choose the most suitable pricing option, Log Into or create your account, and make your payment via PayPal or credit card. Download the documents. Choose the format in which you wish to save the Amendment To Postnuptial Agreement Idaho Withholding (PDF or DOCX) and click Download to receive it. US Legal Forms is an excellent resource for anyone dealing with legal documents. Premium users can enjoy even more benefits as they can fill out and approve previously saved documents electronically anytime using the integrated PDF editing tool. Check it out now!

- Each template is expertly created and verified for adherence to federal and local laws.

- They are categorized by area and state of application, making it simple to find what you require.

- Experienced users of the site only need to Log In to the platform, confirm that their subscription is active, and click the Download button next to the Amendment To Postnuptial Agreement Idaho Withholding to obtain it.

- Once downloaded, the template can be accessed for further use in the My documents section of your account.

Form popularity

FAQ

If your federal return was amended, attach a copy of Form 1040X. Mail your amended return, any supporting documentation and any payment due to: Idaho State Tax Commission, PO Box 56, Boise ID 83756-0056.

Steps to take NOW:Use the withholding estimator at IRS.gov to estimate your federal withholding. Update the federal Form W-4 with that information.Use page 2 of the Form ID W-4 to estimate your Idaho withholding. Fill out Form ID W-4 with that information.Give both W-4 forms to your employer.

You must have a federal Employer Identification Number (EIN) before you apply for an Idaho withholding account. Apply for an EIN with the IRS. After you have your EIN, visit our Idaho Business Registration Information guide. Follow the instructions to register for an Idaho withholding account.

Use this form to report the Idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your W-2, 1099 forms, or both containing Idaho withholding. See our Instructions for Form 967. Sign the return if you're filing on paper.

State Only Return Requirements Idaho state returns can be filed with the federal return or sent state-only through the Federal/State Electronic Filing Program. Amended Returns Idaho will accept electronically filed amended returns.