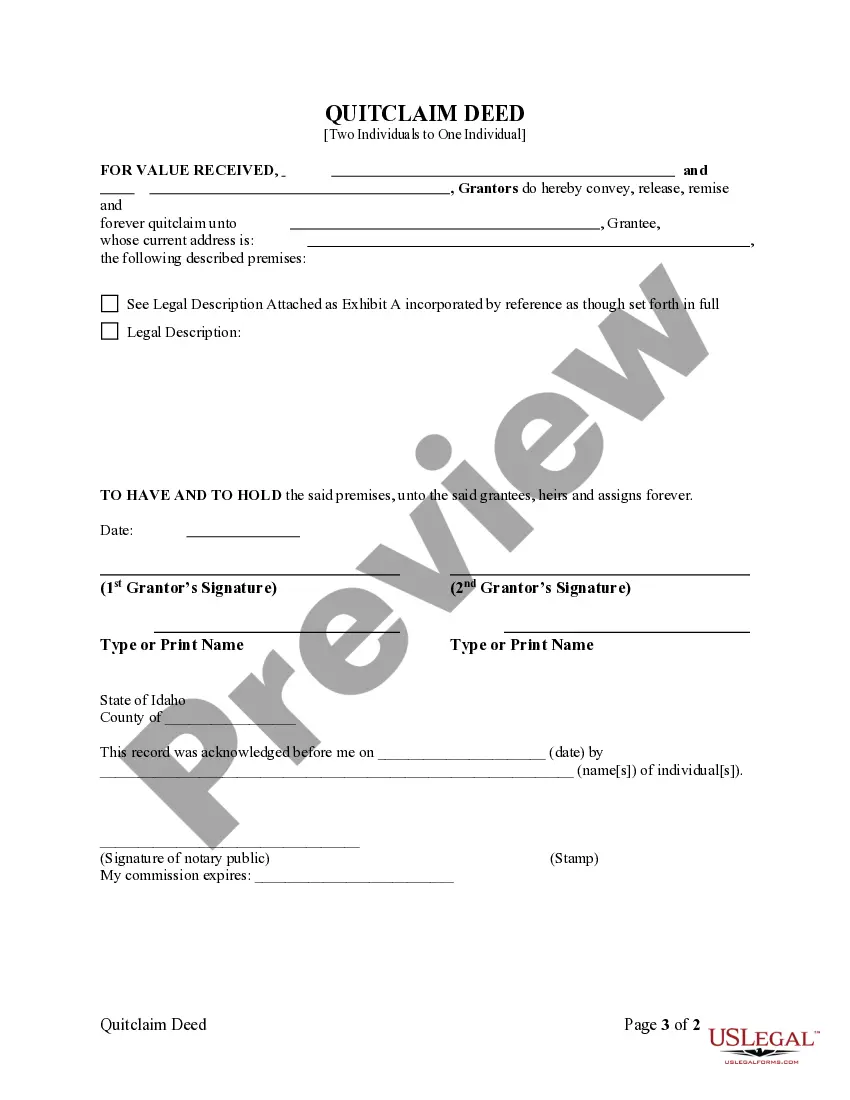

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Quitclaim Deed Idaho With A Mortgage

Description

How to fill out Quitclaim Deed Idaho With A Mortgage?

How to discover expert legal documents that adhere to your state regulations and create the Quitclaim Deed Idaho With A Mortgage without seeking the help of an attorney.

Numerous online services provide templates to address various legal scenarios and requirements. However, it might require time to identify which of the accessible samples meet both practical and legal standards for you.

US Legal Forms is a trustworthy resource that aids you in finding official documents created in line with the latest updates to state laws and helps you economize on legal services.

If you do not have an account with US Legal Forms, follow the instructions below: Review the web page you've accessed and check if the form meets your requirements. To do this, leverage the form description and preview options if available. Search for an alternative sample in the header for your state if needed. Click the Buy Now button when you find the appropriate document. Select the most suitable pricing plan, then Log In or establish an account. Choose the payment method (via credit card or PayPal). Change the file format for your Quitclaim Deed Idaho With A Mortgage and click Download. The acquired documents remain in your possession: you can always access them in the My documents tab of your profile. Register with our platform and prepare legal paperwork independently like a skilled legal practitioner!

- US Legal Forms is not just a typical online directory.

- It's a database of over 85,000 verified templates for diverse business and personal situations.

- All documents are organized by region and state to streamline your search process and reduce inconvenience.

- Moreover, it features powerful tools for PDF modification and eSignature, enabling users with a Premium subscription to effortlessly complete their paperwork online.

- It requires minimal time and effort to acquire the necessary documents.

- If you already possess an account, Log In and confirm your subscription is active.

- Download the Quitclaim Deed Idaho With A Mortgage using the corresponding button next to the file name.

Form popularity

FAQ

People often use a quitclaim deed to transfer property between family members, during divorce proceedings, or to clear up title issues. This deed is straightforward and can effectively address ownership questions without involving lengthy legal processes. If your situation involves a quitclaim deed Idaho with a mortgage, consider utilizing platforms like US Legal Forms to simplify the documentation process. They provide templates and resources to help you navigate your legal needs efficiently.

Once a spouse signs a quitclaim deed in Idaho, they typically relinquish their rights to that property. However, if you have any questions about your rights after signing a quitclaim deed Idaho with a mortgage, it's essential to seek legal advice. Understanding the implications of the deed can help protect your interests. Always make sure both parties fully understand what they are signing.

In divorce cases, quitclaim deeds are commonly used to transfer property interests between spouses. The spouse who is relinquishing their claim to the property will sign the quitclaim deed, effectively removing their name from the title. For those navigating quitclaim deed Idaho with a mortgage during a divorce, it's essential to address how the mortgage will be handled as well. By consulting a real estate attorney, you can ensure a smoother transition.

A quitclaim deed in Idaho allows one party to transfer any interest they have in a property to another party. This type of deed does not guarantee that the property title is clear; it simply transfers whatever interest the grantor has. If you are dealing with a quitclaim deed Idaho with a mortgage, it's crucial to ensure that all parties understand their obligations regarding the mortgage. Therefore, it's advisable to consult a legal expert when executing a quitclaim deed.

Quitclaim deeds primarily benefit individuals looking to transfer property without the need for extensive verification processes. This is especially useful in family situations, where trust levels are high, such as transferring property between relatives. However, it is critical to understand the risks involved, particularly if the property has a mortgage, as the new owner takes on existing debts. Utilizing a service like US Legal Forms can provide additional guidance for those navigating quitclaim deeds in Idaho.

Some common problems associated with quitclaim deeds include the lack of warranties or guarantees related to the title. This means the buyer assumes all risks and potential title issues, which can be significant, especially if there are existing liens or claims against the property. Additionally, transferring property through a quitclaim deed may lead to complications if there is a mortgage still attached to the property. Being informed about these problems is essential for anyone using a quitclaim deed in Idaho with a mortgage.

Yes, in Idaho, a quitclaim deed must be notarized to be legally effective. Notarization serves to authenticate the identities of the parties involved, preventing potential fraud. It is also important that the deed is properly recorded in the county where the property is located. For those using a quitclaim deed in Idaho with a mortgage, adhering to these notarization requirements is crucial.

Several factors could potentially void a quitclaim deed, including fraud or coercion at the time of signing. If the grantor did not have the legal authority to transfer the property, that could also invalidate the deed. Additionally, if the deed fails to meet state requirements, such as proper notarization or witnesses in Idaho, it might not hold up. Being aware of these factors is vital when engaging with a quitclaim deed in Idaho with a mortgage.

In Texas, reversing a quitclaim deed is not straightforward. Typically, once a quitclaim deed is signed, it transfers ownership, and the original owner loses their rights. To reclaim the property, the previous owner must file a lawsuit or negotiate a new deed, adding complexity to the situation. Therefore, when dealing with property and a quitclaim deed in Idaho with a mortgage, it is crucial to understand the implications before making a transfer.