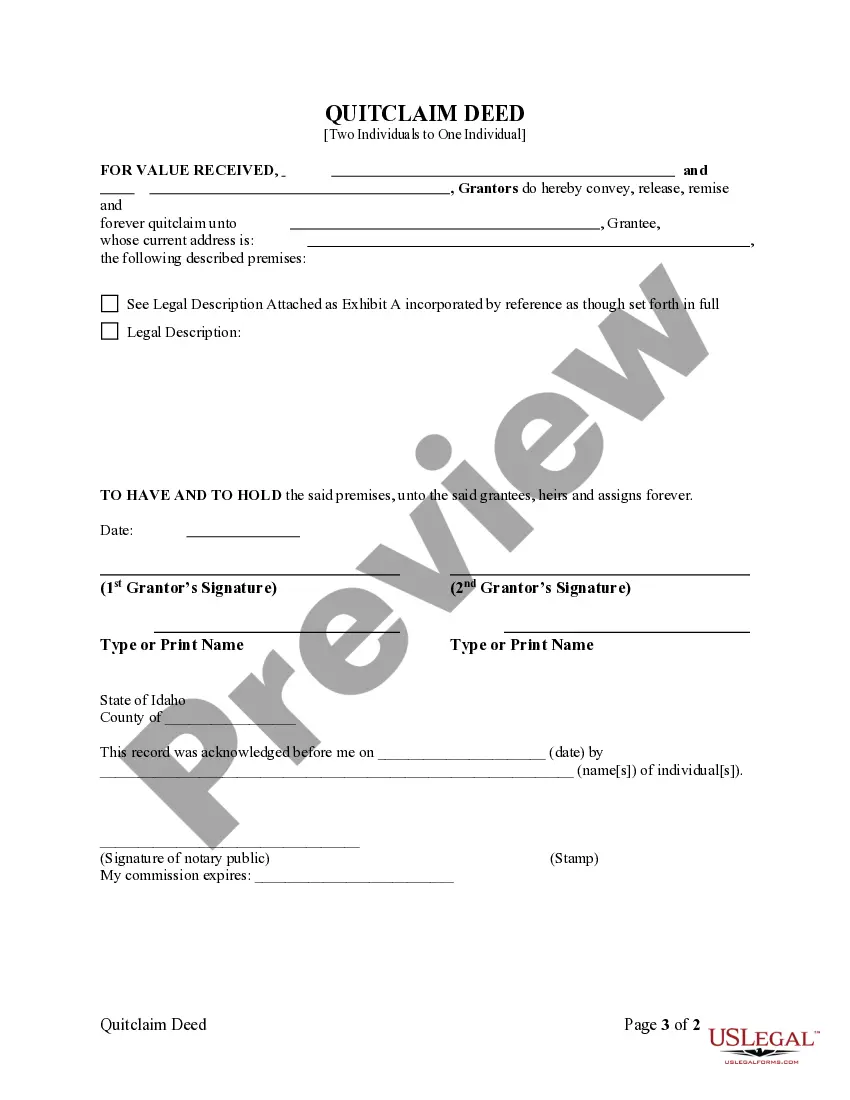

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Quitclaim Deed Idaho With Mortgage Owed

Description

How to fill out Quitclaim Deed Idaho With Mortgage Owed?

Properly prepared official documentation is one of the essential assurances for preventing problems and legal disputes, but acquiring it without the assistance of an attorney may require time.

Whether you are looking to swiftly locate a current Quitclaim Deed Idaho With Mortgage Owed or any other templates related to employment, family, or business circumstances, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Furthermore, you can retrieve the Quitclaim Deed Idaho With Mortgage Owed anytime afterward, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official paperwork. Try US Legal Forms today!

- Ensure that the form fits your circumstances and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Press Buy Now when you identify the suitable template.

- Choose the pricing option, Log Into your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Quitclaim Deed Idaho With Mortgage Owed.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The choice of deed for transferring property often depends on specific circumstances. A quitclaim deed is frequently used, especially when transferring property between family members, due to its simplicity and lack of warranties. However, if the property has financial obligations, such as a mortgage owed, a warranty deed might offer better protection for the grantee. For comprehensive solutions, consider using USLegalForms to access various deeds and guidance tailored to your needs, particularly for quitclaim deed Idaho with mortgage owed.

A quitclaim deed allows the transfer of property ownership without warranty, which means the grantor provides no guarantees about the title. When a mortgage is in place, it's vital to understand that the debt remains tied to the property, even if ownership changes. Consequently, the new owner assumes responsibility for the mortgage owed. If you're navigating this process in Idaho, using tools like USLegalForms can simplify your deed preparation, ensuring compliance with state requirements.

To fill out a Quit Claim Deed in Idaho, you will first need to locate the correct form for your situation. Be sure to include the legal description of the property and the names of both the grantor and grantee. It's important to understand that when adding someone to the title while a mortgage is owed, you may affect the liability for that debt, so consult with a real estate attorney if necessary. Additionally, visiting platforms like US Legal Forms can provide you with reliable resources and guidance to complete the Quitclaim deed Idaho with mortgage owed accurately.

Typically, signing a quitclaim deed may affect a spouse's claim to the property, but it does not automatically eliminate their rights. If the property was acquired during the marriage, California community property laws may still apply, granting the non-signing spouse certain rights. It's essential to comprehend the implications of a quitclaim deed, especially when any mortgage is owed. A legal expert can guide you through these complex issues, ensuring you understand your entitlements.

In California, if you are married but not listed on a property deed, you may still have legal rights to that property. Community property laws generally ensure that both spouses have an interest in property acquired during the marriage. However, when dealing with a quitclaim deed, especially if there’s a mortgage involved, it is crucial to understand how these rights apply. Consulting platforms like USLegalForms can provide clarity and resources for your specific situation.

Yes, a quitclaim deed can be contested in California under specific circumstances. For example, if the grantor did not have the legal capacity to transfer the property or if there was fraud involved, a court may invalidate the deed. It is also important to note that any existing liens or mortgages may still apply, even if the deed is challenged. Seeking legal advice can help navigate these complex situations, especially for quitclaim deeds in Idaho with mortgage owed.

In Idaho, a quitclaim deed allows a property owner to transfer their rights to another party without guaranteeing clear title. This type of deed is often used between family members or friends. Importantly, if there is a mortgage owed on the property, that obligation does not disappear with the transfer. Therefore, understanding how a quitclaim deed works in relation to any existing mortgage is vital.

A quitclaim deed transfers whatever interest the grantor has in a property. In California, if the grantor holds ownership, the deed will convey that ownership to the grantee. However, if a mortgage is owed, it is crucial to understand that the mortgage remains with the property, and the grantee assumes the risk. Therefore, consult with a legal expert if you're considering a quitclaim deed in Idaho with mortgage owed.

In divorce situations, a quitclaim deed is often the preferred choice to transfer property between spouses. This deed enables one spouse to relinquish their claims to the property effectively, simplifying the division of assets. It’s particularly useful when handling real estate associated with a quitclaim deed in Idaho with mortgage owed, as it provides clarity in ownership. For individuals navigating this complex process, platforms like US Legal Forms can offer valuable templates and guidance.

If your name is not on a deed but you are married in Idaho, you may have certain rights to property under Idaho's community property laws. This means that you might be entitled to half of the marital property acquired during the marriage. Even if your name is not directly on the title, understanding your rights in relation to a quitclaim deed in Idaho with mortgage owed is important. Always consider seeking legal advice to clarify your situation.