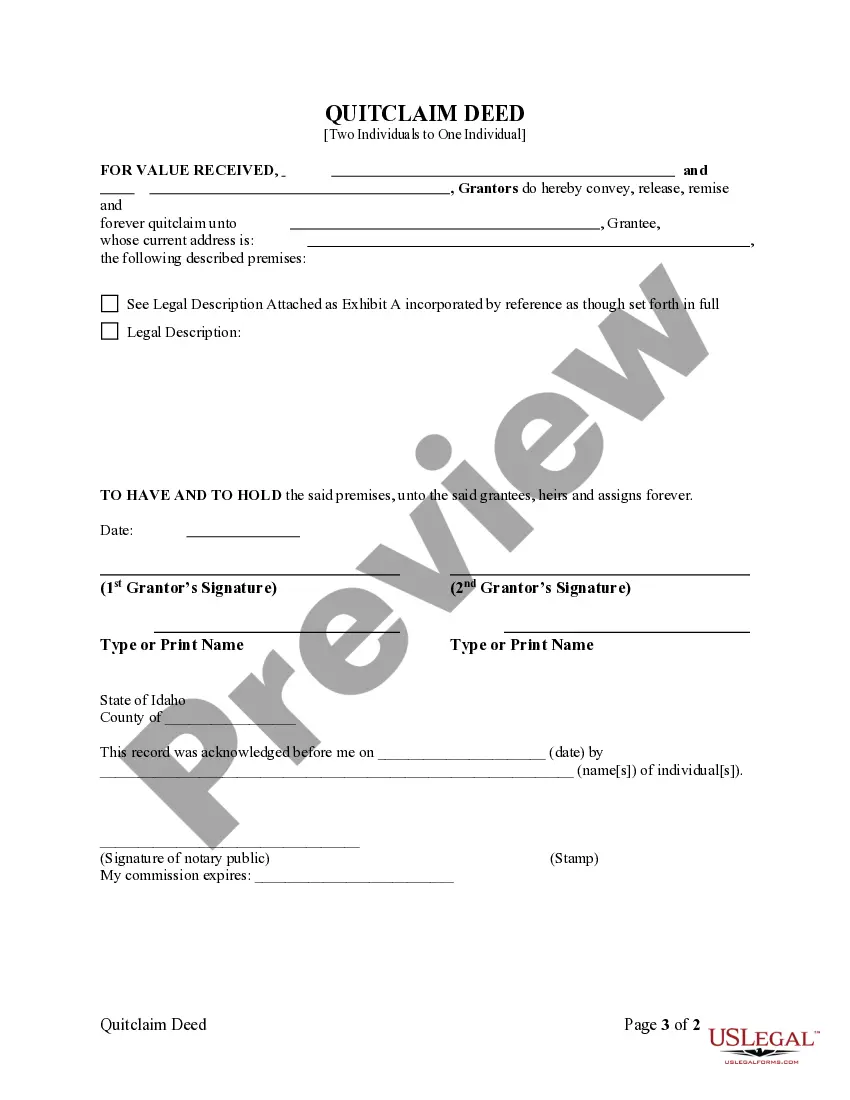

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Quitclaim Deed Idaho Without Consideration

Description

How to fill out Quitclaim Deed Idaho Without Consideration?

How to locate professional legal documents that comply with your state laws and draft the Quitclaim Deed Idaho Without Consideration without consulting an attorney.

Numerous services online offer templates to address various legal scenarios and formalities.

However, it may take a while to identify which of the available samples satisfy both your use case and legal requirements.

Download the Quitclaim Deed Idaho Without Consideration using the related button adjacent to the file name. If you do not have an account with US Legal Forms, then follow the instructions below: Review the webpage you've opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Search for another template in the header that specifies your state if needed. Click the Buy Now button when you locate the suitable document. Select the most appropriate pricing plan, then sign in or create an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Quitclaim Deed Idaho Without Consideration and click Download. The obtained documents remain yours: you can always access them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is a trusted platform that assists you in finding official documents crafted in accordance with the latest state law revisions and economizing on legal services.

- US Legal Forms is not just an ordinary online library.

- It is a repository of over 85,000 verified templates for diverse business and personal situations.

- All documents are organized by category and state to streamline your search process.

- Additionally, it integrates with robust tools for PDF editing and electronic signatures, enabling users with a Premium subscription to efficiently complete their paperwork online.

- It requires minimal effort and time to obtain the desired documents.

- If you already possess an account, Log In and verify your subscription status.

Form popularity

FAQ

If a quitclaim deed is not recorded in California, the transfer of ownership may be challenged, and third parties might not recognize the new ownership. Without proper recording, you could face issues with future transactions or disputes over property rights. For peace of mind, particularly if you’re considering a quitclaim deed in Idaho without consideration, always record the deed to protect your legal interests.

Individuals who wish to transfer property without the complexities of a traditional sale often benefit the most from quitclaim deeds. This includes family members who want to pass down property, as well as parties who need to clear up title issues. If you're leveraging a quitclaim deed in Idaho without consideration, you can simplify the ownership transfer while minimizing legal complications.

Yes, numerous individuals have utilized quitclaim deeds, particularly in informal property transfers. Many people turn to platforms like USLegalForms to acquire the necessary forms and guidance. These resources can help you understand how executing a quitclaim deed in Idaho without consideration impacts your property rights and ownership.

Quitclaim deeds are most often used to transfer ownership of property between family members or acquaintances, typically without a sale. They can simplify the process, especially when there is little or no consideration, making them ideal for situations like estate planning. Therefore, if you're considering a quitclaim deed in Idaho without consideration, it's essential to understand the implications regarding property rights.

A quitclaim deed is most commonly used to transfer property between family members or friends without any monetary exchange. It simplifies the process and provides a way to clear claims on a property. When engaging in such deeds, especially a quitclaim deed Idaho without consideration, ensure all parties understand the implications involved.

In California, signing a quitclaim deed can mean relinquishing rights to the property. However, circumstances such as community property laws may still grant certain rights to a spouse. If you are navigating such issues, consider consulting a legal professional for guidance, particularly in cases involving a quitclaim deed Idaho without consideration.

In Texas, a quitclaim deed cannot be reversed once it is properly executed and recorded. However, the parties involved may choose to create a new deed that reverses the transfer, such as a warranty deed. Always consider your options carefully, especially if the deed involves a quitclaim deed Idaho without consideration.

A quitclaim deed may not be suitable for transferring property that has existing liens, mortgages, or is part of a divorce settlement. Furthermore, if the property is sold to a third party or if ownership dispute exists, alternative deeds are preferable. It’s essential to assess the property situation before choosing a quitclaim deed Idaho without consideration.

A quitclaim deed can become invalid if it lacks necessary signatures, contains incorrect legal descriptions, or does not comply with state laws. Additionally, if the grantor does not actually own the property being transferred, the deed could be deemed ineffective. To avoid issues, always verify the requirements for a quitclaim deed Idaho without consideration.

An invalid deed does not legally transfer ownership of a property. Common reasons for a deed being invalid include lack of proper signatures, failure to meet state requirements, or the presence of fraud. When discussing a quitclaim deed Idaho without consideration, ensure all legal procedures are followed to avoid invalidity.